What is a Pip in Forex?

New to Forex? Then you’ve probably been told that there are some important terms often used by forex traders. Before you get to learn what scalping, trade gap, slippage, stop loss and take profit limits are, you need to understand a few terminologies that are basic and crucially important to every beginner in forex trading.

A pip is one of those terms and perhaps, the most common one for a frequent trader. Here we will discuss what it is, how to calculate it given different scenarios and the impact it could have on your account every time you make a trade.

-

-

What is a Pip?

In simple terms, a pip is a unit of measurement for currency exchange rates. It is the last decimal place in a price quote consisting of 4 decimals. It measures the up and down movement of currency exchange rates.

Basically, all assets listed on a forex brokerage platform have specific values assigned to each pip. The value can change depending on the performance of the underlying currencies.

For instance, in the EUR/USD currency pair, one pip is signified by 0.0001 movements in the exchange rate. This applies to all currency exchange rates that end in 4 decimals.

What is a Pipette?

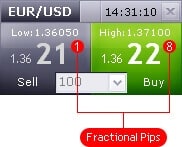

However, not all currency exchange rates have 4 decimals. The USD/JPY currency pair has two decimals, which means that one pip is illustrated as 0.01. The figure below illustrates the position of a pip as seen when trying to place a trade on a trading platform.

As you will have noticed, the exchange rate quotations have an extra decimal. The fifth decimal is now widely employed by forex brokers as they try to make trading more interesting to day traders. With the fifth decimal, it means that scalpers (those who prey on tiny fluctuations in exchange rates for a profit) can now capitalize on even smaller inter-hourly fluctuations, which allow them to make profits out of volume trading rather than the margin of price fluctuations.

In forex trading, the fifth decimal is called a pipette.

Pipette calculation

A pipette is a tenth of a pip, which means that for every 1 pip movement in price, there are 10 pipettes. In a currency pair illustration, the AUD/USD currency pair is currently trading at around 0.75744, the fifth digit in that sequence of decimals represents 4 pipettes. This means that the value of one pipette is expressed as 0.00001. Therefore, if the AUD/USD currency pair advances from 0.75744 to 0.75745, it will have moved up by one pipette.

The figure below shows how a pipette (a fractional pip) looks like in an MT5 trading platform.

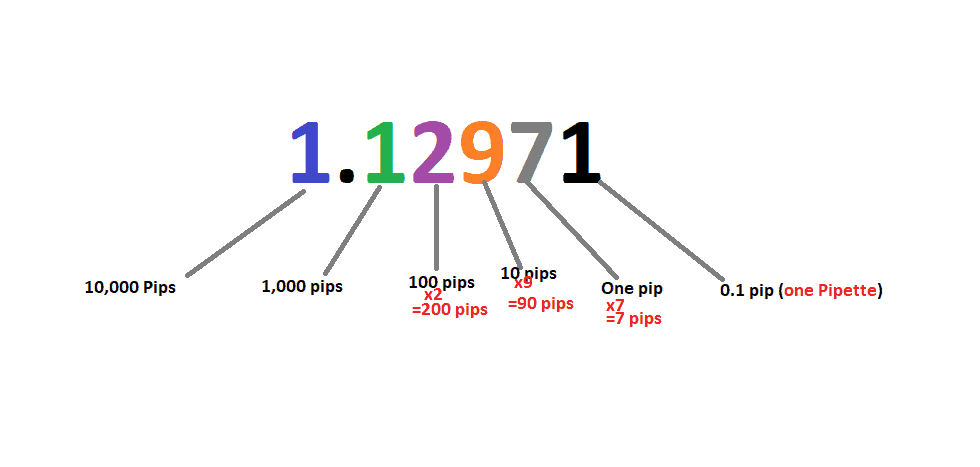

The value of the pips moves up 10-fold every digit to the left starting from 0.1 pip (one pipette all the way to 10,000 pips in a standard currency exchange rate with 5 decimals. The figure below illustrates the pip value of each digit in a EUR/USD currency pair exchanging at 1.12971.

How to Calculate the base currency value of a Pip

The pip value in every currency pair is different. To illustrate this clearly we are going to use a 4 decimal exchange rate for the EUR/USD. To make matters more straight forward, we will use a more rounded figure of 1.1500.

With the EUR/USD currency pair trading at 1.1500, this implies that 1 EUR= 1.1500 USD. This can be expressed as 1EUR/1.1500USD. Therefore, 1EUR/USD=1.1500.

The value of a pip is calculated as,

The value change in counter currency multiplied by the exchange rate ratio, which gives us the pip value in base currency.

Therefore, [0.0001 USD] x [1 EUR/ 1.1500 USD]

This can be simplified as,

[(0.0001 USD)/(1.1500 USD)] x [1 EUR], which is equal to 0.0000869565 EUR.

This is the value of one pip per unit traded. Therefore, if we traded a standard lot of 100,000 units, the impact on our position for every pip gained or lost would be:

[100,000x 0.0000869565 EUR/unit] = EUR 8.6956.

For a mini-lot of 10,000 units, this would reflect a value change of EUR 0.8695.

Second example

Now let look at an example where we only have an exchange rate of 2 decimals, the USD/JPY currency pair.

The pair is currently trading at 105.076. The third digit in this sequence of decimals represents the pipette. We are going to simplify the exchange rate to 105.00 for simpler arithmetics.

In this case, the value of one pip in the base currency will be expressed as,

[0.01 JPY] x [1 USD/ 105.00 JPY]

This can be simplified as [(0.01 JPY)/ (105.00 JPY)] x [1 USD] = 0.0000952381 USD per unit traded. In the same calculation as demonstrated in example 1, if we trade one standard lot of 100,000 units, then this will equate to [0.0000952381 USD/per unit] x 100,000 = USD 9.5238 in pip value for every pip gained or lost in an open position.

Calculating the pip value in your account currency

This is another important step every trader should consider. We have established how to determine the pip value based on the base currency of a currency pair. But what if the base currency is not the denomination currency of your account? To establish the monetary impact of every pip gained or lost in a transaction we need to convert the amount to your account denomination currency.

This is done by simply multiplying the pip value of the given currency with the exchange rate of that currency to your account denomination currency. For instance, in the first example, the value of one pip for 10,000 units traded is 0.8695 EUR. Now, to convert that to USD, you basically multiply by the EUR/USD exchange rate, which at an exchange rate of 1.1500 should give you 1 USD. That is, 0.8695 EUR x [1 EUR/ 1.1500 USD] = [0.8695 x 1.1500].

In some cases, the permutations could involve two different currency pairs, in which case the calculation would not be as straight forward.

Why we don’t have pips in CFDs

We have demonstrated how to calculate pip value in a four decimal exchange rate and a two decimal pair using the EUR/USD and USD/JPY, respectively. So, the next thing in you mind is what about the numerous stock CFDs and indices listed on forex brokerage platforms? The commodities and cryptocurrencies?

Well, the answer here is simple. As described at the beginning of this article, a pip is basically a unit of measurement for currency exchange rates. Since we already have the specific currency units for various stock CFDs and commodities, there is no need to use pips to calculate the implied value to your account per every unit traded.

However, if the stock CFDs are listed in a currency different to your account denomination currency, you will need to calculate the monetary impact to your account by using the same currency translation formula. That is,

The value per unit traded in the stock CFD currency multiplied by the exchange rate of that currency to your account denomination currency.

Summary

In summary, we have established that a pip can be expressed differently in an exchange rate depending on the currency pair in question. But in essence, the general pip value is relatively the same given the prevailing exchange rate. For instance, in the 4 decimal EUR/USD currency pair, the implied value of one pip in our example was 0.00008695 EUR.

In the 2 decimal USD/JPY currency pair, the implied value of one pip in our example was 0.00009523 USD. As such, after the calculations, there was not much of a difference. But again, this can change rapidly depending on the prevailing exchange rates.

We also established the importance of pipettes especially for high-frequency traders, who rely on multiple trades a day benefitting from small price fluctuations. Pipettes can change quickly during live trading and only traders fast trading systems are able to capitalize when they use automated trading.

And finally, we also established that while stock CFDs are listed in either dollar or EUR units, if your account denomination currency is different then you can still use the pip calculation formula to translate the value per unit traded into your account currency.

A-Z of Forex Trading

Nmaithya

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up