Skilling Broker Review 2021 – Trading Platform, Accounts, Reliability, Pros and Cons

Traders and investors tend to stay away from new CFD brokerage firms. Indeed, some of these new CFD brokers in the industry lack the right regulation, reliable customer support, and enough capital to secure the financial success of your company. In less than three years however, Skilling has gained all the above requirements.

To help you in making the right choice when it comes to selecting an online broker, we’ve conducted a comprehensive review of Skilling. After checking all its features and feedback from its current users, we would not recommend Skilling because it lacks the functionalities an investor wants its forex broker to have.

- Broker

- Rating

- Features

- Trade

-

-

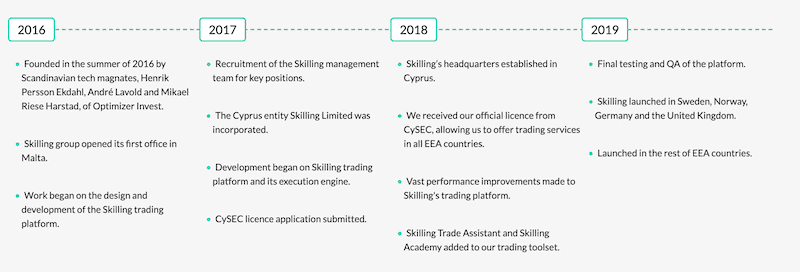

What is Skilling?

Founded in 2016, Skilling is a new CFD broker, offering to trade currency pairs, stocks, cryptocurrencies, indices, and commodities. Formerly known as Finovel Cyprus Ltd, the broker headquartered in Nicosia, Cyprus and has other two offices located in Malta and Spain.

Though the broker is a newcomer in the industry, Skilling’s experienced team has managed to gain the necessary trading tools and authorization in order to offer traders a safe and advanced trading environment. The broker is regulated and authorized by CySEC (Cyprus Securities and Exchange Commission) and FSA (Financial Services Authority of Seychelles), providing traders a simple and easy to use in-house trading platform, and a selection of more than 800 financial instruments.

The Scandinavian-owned fintech company reveals a great deal of information about the team and the company’s vision compared to any other CFD and forex brokers in the industry.

Pros and Cons

Pros:

✅Skilling offers a user-friendly and easy-to-use trading platform

✅Low minimum deposit requirement of EUR/USD 100

✅The broker offers extremely competitive spreads from 0.7 pip

✅Includes proprietary trading platform and MetaTrader 4

✅Regulated by CySEC (Cyprus) and FSA (Seychelles)

Cons:

❌ Skilling does not offer Exchange Traded Funds(ETFs) trading

❌ Skilling offers a low leverage ratio of 1:30 (1:200 for Premium accounts)

❌ Doesn’t support the popular MetaTrader trading platform

❌ Customer support cannot be reached 24/7

❌ Not available for US residents

❌ Provides limited payment methods

Tradable Securities

Skilling offers a solid selection of more than 800 tradable securities categorized into the following markets: forex, stocks, cryptocurrencies, indices, and commodities. Here are the available instruments at Skilling:

- Forex – 80 major, minor and exotic currency pairs

- Indices – 17 global indices

- Cryptocurrencies – 10 crypto coins. Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Monero, EOS, DASH, IOTA, NEO, and Ripple.

- Commodities – 5 commodities. Gold, Silver, WTI oil, Brent oil, and Natural gas.

- Stocks (shares) – more than 740 popular stocks from the US, UK, and EU.

Special Features

Skilling’s motto is to make trading simple and accessible to everyone in a transparent and secure environment, so don’t expect to find complicated features. Nevertheless, the broker does provide some essential trading features that you should know about.

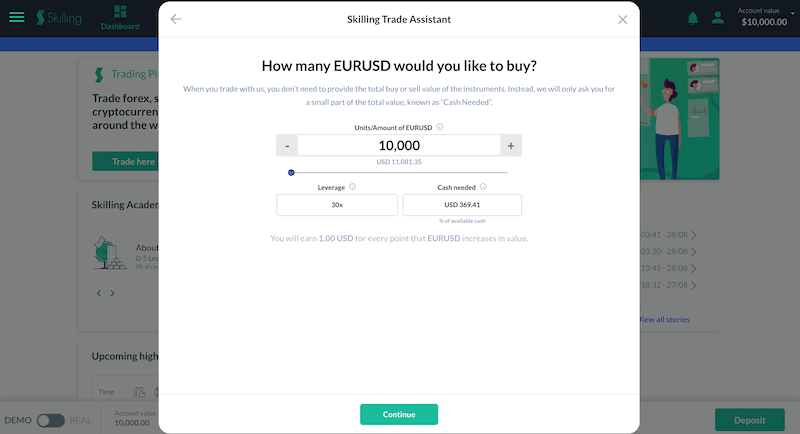

- Skilling Trade Assistant

The Skilling Trade Assistant is an intuitive tool that helps traders to place orders in an extremely easy process. The Trade Assistant first asks you to choose the market and the product you want to buy/sell. Then, you need to choose the amount and leverage and the Trade Assistant will display the cash needed to complete the transaction and the value of 1 pip.

- Negative Balance Protection

Skilling offers the negative balance protection which is a feature that prevents traders from big losses. Once the broker offers negative balance protection, traders cannot lose more than deposited.

Promotions

Due to CySEC and FSA regulation, Skilling cannot offer clients in the European Economic Area any promotional offers.

Minimum Deposit Requirement

Skilling requires a lower than average minimum deposit requirement of EUR/USD 100 or SEK/NOK 1000 for the Standard account and 5,000 EUR/USD/GBP or 50,000 SEK/NOK for the Premium account, which offers extremely low spreads and swaps.

Supported Countries

At the time of writing, the broker accepts traders from EEA countries: Those are Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland. The broker also offers its services in the United Kingdom.

In fact, Skilling is available around the world. The only countries that the broker doesn’t operate in are the US, Australia, Japan, Afghanistan, and North Korea.

Languages Supported

Skilling supports its website and the desktop/mobile trading application in 17 different languages, including English, German, Norwegian, Chinese, Spanish, Dutch, Swedish, and more. In order to change the trading platform language, click the top menu, settings and choose your preferred language.

Customer support is available in Italian, Swedish, Russian, Norwegian, German and Romanian.

Trading Platforms

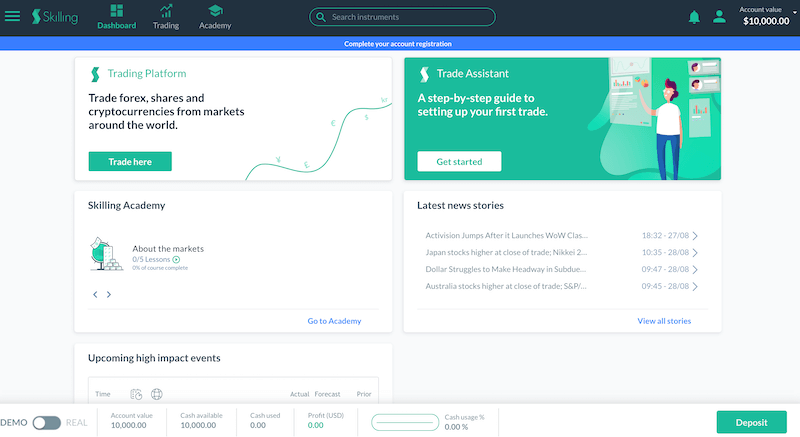

Like other CFD brokers in the industry, Skilling has developed its own proprietary trading platform which is available as a web-based trading platform (compatible on Mac and Windows) and as a mobile application. The platform was designed for an easy-to-use trading experience and has some unique trading features. It is not a professional desktop trading platform with an advanced charting package, and level two quotes, however, the Skilling platform offers traders an intuitive trading dashboard with the latest news, trading academy, and trade assistant sections.

Skilling Web Platform

Skillings’ web-based platform is well-designed and easy-to-use online trading platform. First, there’s no need to download the platform, you can sign up and log in to the dashboard from your browser. The platform is easy to understand and you won’t have to spend too much of your time trying to learn how to use the platform. As you can see in the image below, there are three main sections on the web-based platform – the dashboard, trading, and the academy. Once you click the trading tab, you can enter the markets and execute orders.

Skilling Mobile Application

Similarly to the web-based trading platform, Skilling offers an easy-to-use and intuitive mobile trading application which is available on iOS and Android. The platform provides the same features that are available on the web-based platform and you can easily maintain a trading account through the mobile platform.

Skilling MetaTrader 4

Skilling also offers integration with the popular MetaTrader 4 platform. This platform is built specifically for forex trading and offers a number of advanced features. For example, with Skilling MetaTrader 4 you can design your own custom indicators or build forex trading signals. You can also backtest strategies or set up trades right from the charting interface.

Fees, Commissions and Spreads

In terms of commission and spreads, Skilling does not charge its clients any hidden fees and the broker offers lower than average spreads. The broker has recently reduced the spreads on most financial assets. The new spreads are very competitive in the industry:

- EUR/USD – from 0.7 pips

- EUR/GBP – from 1.7 pips

- GBP/USD – from 1.3 pips

- USD/JPY – from 1.4 pips

- Germany – from 1.6 pips

- Bitcoin – from $40

Having said that, the broker does charge the following fees:

- Inactivity fee – A fee of 10 Euro will be applied for a period of 1 year that the trading account is inactive.

- Rollover/overnight fees – Similar to any CFD broker in the industry, Skilling charges a swap/rollover fee which is an interest fee that is either paid or charged at the end of the trading day.

Minimum Deposit and Withdrawals

Skilling minimum deposit requirements for the Standard account is EUR/USD 100 or SEK/NOK 1000. The minimum withdrawal amount is €50 for all payment methods.

Skilling offers the following payment methods:

- Trustly (Bank wire transfer included)

- Debit card (Visa, Mastercard, etc.)

- Credit card

- Skrill

- Neteller

- Klarna

- Swish

Take note that the broker does not charge any deposit and withdrawal fees.

How to withdraw funds on Skilling

Withdrawing funds from Skilling is a pretty clear and simple process. Here are the steps to follow:

- Log in to your account dashboard on PC or mobile phone

- Click the withdrawals tab on the left-side menu

- Enter the withdrawal amount and confirm

- You will receive an email shortly once your request has been approved

Note that withdrawals through credit card/debit card, Skrill, and Neteller are being processed within 1 working day and via Trustly (Bank wire transfer included) within 0-3 working days.

Account Types

Skilling offers two types of trading accounts: the Standard account and the Premium account.

Account type: Standard Pro Premium Minimum Deposit 100 EUR, GBP, USD and 1000 NOK, SEK 50,000 EUR, GBP, USD and 500,000 NOK, SEK Maximum leverage* 30:1 30:1 Micro Lots YES NO Account base currencies EUR, USD, NOK, SEK, GBP EUR, USD, NOK, SEK, GBP Commission – Equity CFDs NO NO Commission – Cryptocurrency CFDs NO NO Commission – Forex CFDs NO 0.004% on Nominal Value traded Commission – Indices CFDs NO NO Commission – Commodity CFD NO NO How to Sign Up on Skilling

The sign up with Skilling can be done in less than 10 minutes. To create a new trading account, follow the next steps:

- First, click here to sign up for your trading account. On the top right side of the home page, click the “Sign Up” button. Skilling sign up does not require a long registration process, you need to deliver your email, password, and account currency.

- Now, you can log in into Skilling’s web-based/mobile trading platform.

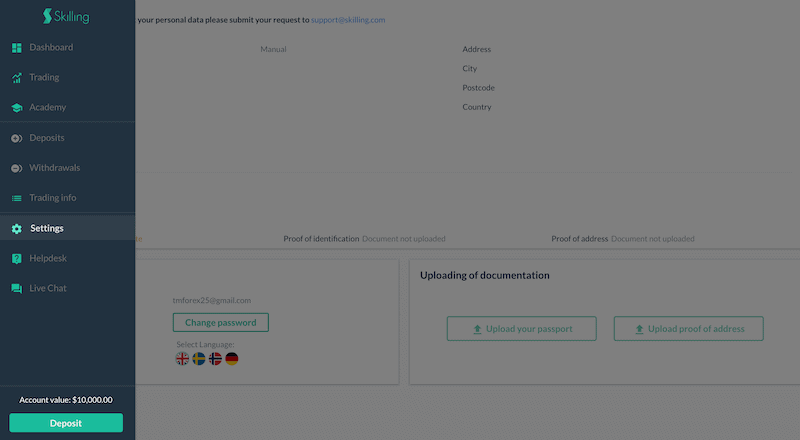

- Submit documentation – Before you fund your account, you will need to submit a copy of passport and proof of address. In order to do that, hover on the dashboard menu and choose ‘settings’.

- Fund your account through one of the payment methods offered by Skilling and start trading.

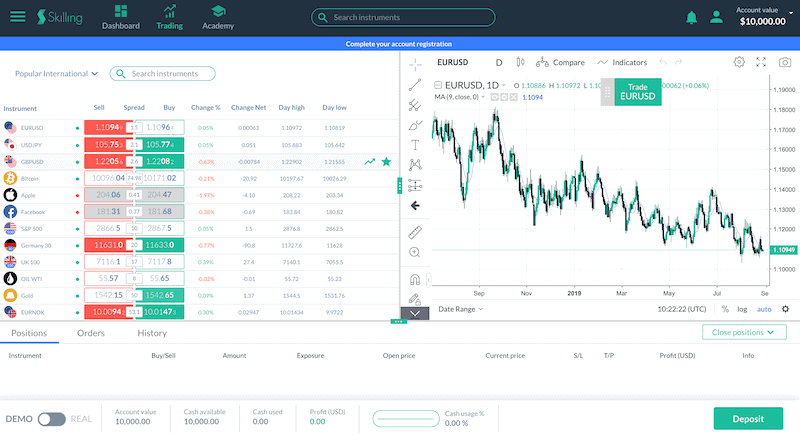

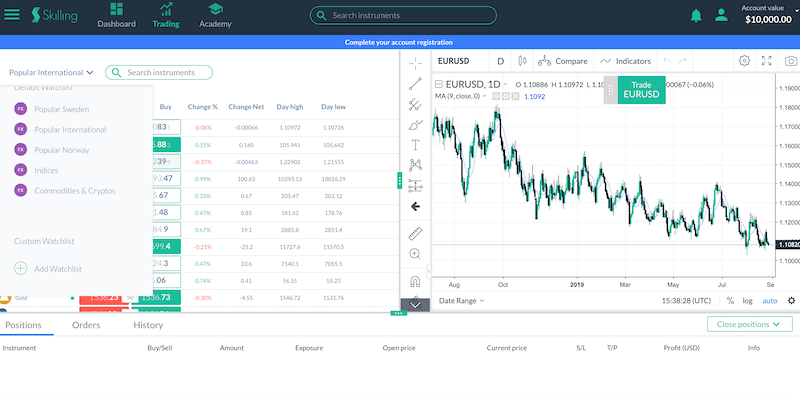

How to Configure Your Trading Account

Once you go through the Skilling sign up process, trading CFDs with Skilling is quite intuitive. As you can see in the image below, there are three main elements of the platform: Watch list, charts, and account balance (positions, orders, and history). If you would like to add a custom watchlist, click the ‘popular international’ and, at the bottom of the list choose ‘add watchlist’.

Though in first sight the charting package seems basic, the platform provides around 70 indicators, the ability to compare two securities, and all the necessary functions to use technical analysis in your trading. In order to configure the charting properties, click the ‘settings’ above the chart and find a template that’s a perfect fit for you. Here’s an example of what you can do with Skilling’s charting package.

Regulation and Safety of Funds

Skilling Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) and holds a CIF license (License number 357/18). Some of CySEC basic requirements for CFD brokers are to maintain at least €750,000 in operating capital, and keep regular financial statements and submit them to the CySEC for review on a periodic basis. Furthermore, clients’ funds are protected by the Investor Compensation Fund for Customers of Cypriot Investment Firms (CIFs) which protects customer’s funds up to a specific amount in the case of the company’s insolvency.

Skilling is also regulated by the Financial Services Authority of Seychelles (FSA).

Another feature that protects clients’ funds is the negative balance protection policy which in the event that a negative balance occurs in a trader’s trading account due to stop out and/ or extremely volatile market conditions, then a relevant adjustment to cover the full negative amount will be made.

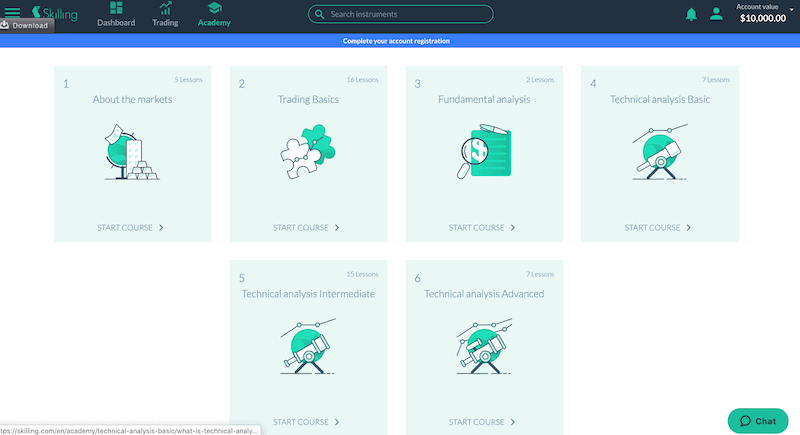

Education, Research and Data

Skilling’s trading platform was designed by traders so you do not have to get out of the platform in order to find useful resources. The platform dashboard includes the Latest News Stories, Economic Calendar, and Skilling Academy which contains six courses for beginners, intermediate and expert-level (About the markets, trading basics, fundamental analysis, technical analysis basic, technical analysis intermediate, technical analysis advanced).

Customer Service

Forex and CFD brokers have learned the importance of reliable customer support. Skilling made an effort to provide a knowledgeable customer support team which is available from Monday to Friday, between 07:00 and 21:00 CET through phone, live chat, submit a request, and email. The broker offers multilingual customer support team in the following languages: English, Swedish, Norwegian, German, Italian, Russian, and Romanian.

In addition, Skilling offers a useful FAQ section on the website and the Trade Assistant which is an informative step-by-step guide to place your first order.

You can contact Skilling via the following contact methods:

- Email address – [email protected]

- Phone – +44 208 080 6555 and +357 22 276710

Final Thoughts

Following our review, we can easily say that Skilling has developed a unique and simple trading platform, and is offering all the essential tools in order to operate a trading account.

However, US residents also cannot sign up on the platform. Another drawback is that users suffer from its limited payment methods as well as a lack of trading signals in Skilling’s proprietary platform (Skilling MetaTrader 4 supports forex trading signals).

Instead of Skilling, we highly recommend that you check out Alvexo. It is an ideal match if you are an investor that seeks a simple and innovative platform that connects you to the market for the first time.

- Broker

- Rating

- Features

- Trade

FAQs

Can US residents trade with Skilling?

No, US residents cannot open a trading account with Skilling. The broker is currently offering services to residents from European Area countries.

Is Skilling regulated?

Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and Financial Services Authority of Seychelles (FSA) and holds a CIF license (License number 357/18).

How can I contact Skilling in order to open a trading account?

In order to open a new day trading account with Skilling you can click here.

What is the maximum leverage ratio offered by Skilling?

Skilling complies with CySEC regulation that restricts the leverage ratio to 1:30 for non-professional traders. Premium accounts offer leverage up to 1:200. In case an experienced retail client wishes to increase the default leverage ratio, the broker will review the request before a trader can start trading with high leverage.

Can I trade cryptocurrencies with Skilling?

Yes, Skilling provides cryptocurrency trading. The broker offers a selection of 10 cryptocurrencies including bitcoin, ethereum, bitcoin cash, litecoin, Ripple, DASH, Monero, IOTA, EOS, and NEO.

See Our Full Range Of Forex Brokers Resources – Brokers A-Z

Tom Chen

View all posts by Tom ChenTom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up