Best Bitcoin Brokers for 2025

Bitcoin’s meteoric rise and subsequent volatility have made the fortunes of many astute traders around the world. By luck or by correctly timing the market, trading Bitcoin has the potential to be very lucrative.

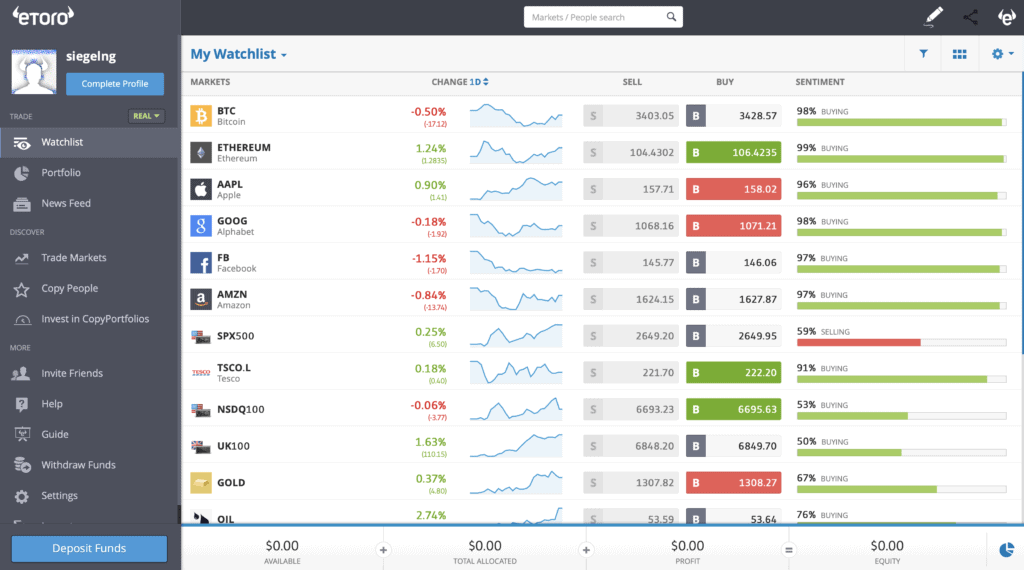

Before you get started, you need to choose the right broker for you. The trading platform’s ease of use, the broker’s fee structure, and leverage limits are all important factors for review.

In this guide, we will walk you through the key things to look for, highlight the best Bitcoin brokers in 2025, and show you how to get started!

-

-

Our criteria for choosing the best Bitcoin brokers

Sifting through dozens of brokers is no easy task. To help you cut through the noise and highlight the best Bitcoin brokers in 2025, we considered the following 6 criteria:

- How user-friendly is the platform?

- Can Bitcoin be bought directly or via CFDs?

- Are the fees & spreads as low as they can be?

- What are the leverage limits & margin requirements?

- How do deposits & withdrawals work?

- Where is the broker regulated?

The best Bitcoin brokers in 2025

1. CryptoRocket: A popular offshore Crypto broker with higher leverage limits

CryptoRocket is an up & coming crypto-focused broker that offers a wide range of fiat-to-crypto trading pairs (e.g. BTC/USD), crypto-to-crypto pairs (e.g. ETC/BTC) as well as Stocks, Forex & other instruments via CFDs.

CryptoRocket is a relatively new online brokerage that takes pride in its simplicity.

Opening an account is very fast, without cumbersome ID verification, and customer service is helpful & responsive.

The minimum deposit to start trading is $10, and you can try your hand with their free demo account before using your own money. Deposits can be made via credit card, wire transfer, or directly via a Bitcoin wallet. Withdrawals are also relatively faster than other brokers.

CryptoRocket is integrated to the popular MetaTrader desktop and web trading platform and to its complementary mobile app for trading on the go. Despite a more complicated interface, MetaTrader allows great customization and offers a wide range of charting & analysis tools for more advanced traders.

CryptoRocket offers tight spreads on Bitcoin & other cryptos and does not charge commissions.

As an offshore broker based in Saint Vincent and Grenadines, it is not regulated and offers significantly higher leverage, up to 100:1, for Bitcoin trading. While this may seem appealing, do not forget that high leverage carries equally high risk and should be used cautiously!

Our Rating

- Much higher leverage limits

- MetaTrader integration offers access to advanced tools

- Fast signup, easy deposits & withdrawals

- Offshore (unregulated) broker

- Overall range of tradable assets remains limited

Trading leveraged products such as Forex and CFDs may not be suitable for all investors as they carry a degree of risk to your capital.What to consider when choosing a Bitcoin broker

Now that you had a look at our top 2 Bitcoin brokers, let us look at some of the factors you should pay attention to when choosing a crypto broker:

-

User-friendliness of the platform

When evaluating a broker, look for a platform that makes sense to you at first use.

Are the search functions clear? Can I place trades easily? Do I have the charting & analysis tools I need? Can I easily monitor my portfolio, my P&L, and the fees I’m paying?

Asking these questions will help you decide whether a broker’s platform is right for you.

-

Trading directly or via CFDs

There are several ways to trade Bitcoin, but they can be placed in 2 categories: direct and indirect. Direct trading means that you have a Bitcoin wallet, actually own Bitcoin and buy or sell your own.

Trading CFDs, on the other hand, does not involve actual Bitcoin changing hands, it is simply a directional bet on the price of Bitcoin. CFDs are more flexible because they do not go through the blockchain. You can thus easily buy & sell Bitcoin in any quantity, leverage your trades, and even short-sell. Before you start, make sure you understand the trading options your broker offers.

Learn more about investing in Bitcoin, shorting Bitcoin, and CFD trading with our dedicated guides!

-

Commissions, fees & spreads

Once you like the Bitcoin broker’s platform and the instruments it offers, you need to look at the fee structure. Most CFD brokers do not charge commissions on each trade, but some may offer commission-based accounts.

The main way CFD brokers make money is through the spread: the difference between the price at which you can buy or sell. You want to compare the Bitcoin spread between brokers to determine who offers the lowest prices.

Last, you should consider the other fees you could be charged. The standard ones are withdrawal fees, overnight rollover fees for multi-day CFD trades, and currency conversion fees. Make sure you fully understand how much a trade cost you before opening a trading position!

-

Leverage limits & margin requirements

To expand the value of your trade position (albeit at greater risk!), you may want to use leverage buy or short Bitcoin. When comparing Bitcoin brokers, you may want to look at the maximum leverage offered on Bitcoin trades.

Similarly, it’s important to know the margin requirements on leveraged trades. How much minimum equity do you need to have in your portfolio? Below which margin level will the broker automatically close your trade?

If you fancy leverage trading, make sure to review these points for each broker.

-

Deposits & withdrawals

When trading Bitcoin directly, you want to be able to transfer Bitcoin seamlessly from your wallet to the Broker. Similarly, when trading CFDs, you would like to have as many deposit options as possible for maximum convenience.

You should consider the minimum withdrawal amount, the withdrawal fees, and the time required for the money to be transferred to your bank account.

-

Regulation

You should always review whether and where the broker is licensed to operate. Regulated brokers face tougher constraints on marketing, leverage & instrument types, but they are also safer.

Unregulated Bitcoin brokers are not necessarily unsafe, but you should always cross-check their references to make sure they are sound before deciding to trade with them.

Summary

Trading Bitcoin can be very profitable if done well, and finding the right cryptocurrency broker is the first step of the journey.

In this guide, we reviewed the key dimensions to consider when choosing a broker, highlighted the best Bitcoin brokers in 2021, and showed you how to set up an account & place your first trade. You’re now set and ready to start trading Bitcoin!

FAQs

What are the main ways to trade Bitcoin?

The simplest, cheapest and most accessible way is to trade via CFDs, as they do not require a Bitcoin wallet or to go through the Blockchain. You can also trade directly with your own Bitcoins, or use derivative products such as futures, options and ETNs.

How volatile is Bitcoin?

Bitcoin is arguably one of the most volatile assets in the world. In the past, BTC has frequently jumped or fallen >30% in a single day!

What are the most important factors when selecting a Bitcoin broker?

This guide offers more details but at a high level, some of the main factors are: direct vs. CFD, fees, ease of use of platform, leverage limits and regulation.

Do I need a crypto wallet to trade Bitcoin?

You can have one, but you do not need it to trade via CFDs! Bitcoin CFD trading does not involve ownership of Bitcoin, it is simply a directional bet on the price of the asset.

What type of fees can I face in trading Bitcoin via CFDs?

Fees will typically include the bid-ask spread and daily rollover costs for multi-day positions.

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

Scroll Up