Citi Private Bank warned that investors are not facing up to the chance that the coronavirus might return in a “second wave”.

The chief investment officer of the US giant’s private banking unit David Bailin (pictured) warned that markets were underestimating the impact of a contagious disease that has no known cure.

“In the event that we have a very significant second wave of disease in the United States that cause a further shutdown of the economy . . . that clearly is not priced into the market” said Balin in a weekend interview with CNBC’s Squawk Box Asia.

He added: “The other thing that may not be priced into the market is the fact that this virus may take another 18 to 24 months to really cycle through the globe, and ultimately have a vaccine”.

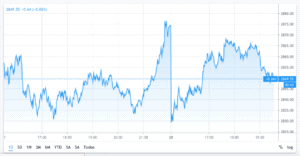

The US markets have been rallying for the past two weeks, with the S&P 500 accumulating a 15.6% gain since the index touched its month-to-date bottom at 2,470.

The senior Citi Private Bank executive, which manages assets for people with a net worth over $25m, also said he expected more pain to come in the second quarter. Balin said: “In the second quarter we expect earnings to literally fall by 40% or more across the board, and we don’t expect earnings in the United States to get back to their first-quarter levels for nine quarters from now”.

That said, Bailin still sees certain opportunities in the bond market, adding that some investment-grade “upper end” corporate bonds were “very attractive” right now.

He said: “I think there are plenty of places to seek yield and I think it’s important that investors seek that yield now because once this crisis passes — six months, 12 months, 18 months from now — I expect that these spreads on these bonds are going to definitely retreat.”

The Citi executive added that for stocks, US financial institutions have held up strongly during the crisis.

You can buy shares of Citigroup (C) by using one of these stock brokers, or you can also invest in ETFs that track a basket of financial stocks including JP Morgan, Citi, Morgan Stanley, and Goldman Sachs, among others.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account