If you are interested in shorting travel & leisure stocks, see our updated picks from some of the best stock brokers to trade with.

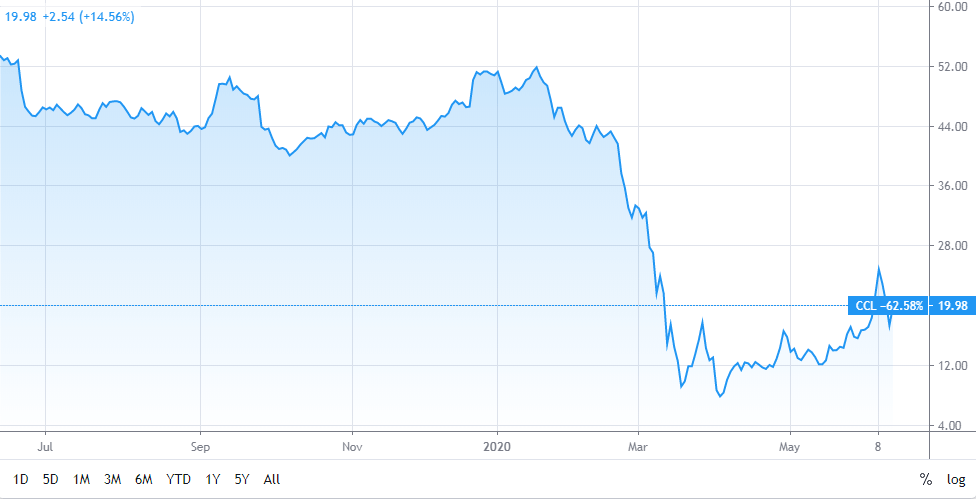

Embattled cruise line operator Carnival is expected to show a sharp fall in earnings when it posts its quarterly earnings on Thursday.

Airlines and cruise operators have seen their revenues all-but dry up this year as governments imposed lockdown measures in the face of the coronavirus pandemic.

This cruise operator is expected to post a quarterly loss of $1.78 per share in its upcoming report, which represents a year-over-year change of -369.7%, according to a Zacks consensus estimate.

Analysts estimate that Carnival’s revenue will hit $15.25bn by November 2021, according to a poll by Seeking Alpha. This will be up from an estimated $10bn by November 2020 based on the assumption that cruise travel opens up and returns to pre-pandemic levels.

For the year to November 2019, Carnival’s operations generated $20.8bn in revenue and almost $3bn in net income. That represents a margin of 14.375%, with normalized diluted earnings at $2.76 per share.

After several difficult months for the leisure and travel industry, cruise liners announced massive discounts in June in an attempt to bring back tourists and offset some of their massive losses.

As the likelihood of a vaccine for the coronavirus becomes more of a possibility, the tourism industry is showing signs of revival in the months ahead of the new treatment being made available. Still, travel companies and cruise operators will face the challenge to adhere to new government-mandated social distancing regulations when they reopen.

However, the Centers of Disease Control and Prevention (CDC) warned that social distancing might need to be intensified if the number of coronavirus cases continues to rise rapidly. “If cases begin to go up again, particularly if they go up dramatically, it’s important to recognize that more mitigation efforts such as what were implemented back in March may be needed again,” CDC deputy director Jay Butler said.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account