How to Buy Roku Stock Online in 2021

Roku is a US-Based company that offers a streaming media player and allows users to access a range of channels and streaming services. Essentially, Roku is a media streaming device that turns standard TVs into smart TVs, but the company also has more than to offer.

If you are looking for an out of the box stock investment, Roku might be a stock for you to consider. And while the company is not profitable yet, you might want to consider the fact that profitability is not the only factor to consider when vetting a company’s viability.

You also have to pay close attention to the long-term outlook of the company, its business structure, and the resources the company achieves over time. Evidently, Roku has more than 39.8 million monthly active accounts and a market cap of $15.96 billion, as of May 2021.

Is it the right time to buy Roku? What are the risks and what is the growth potential of Roku?

If you are considering investing in Roku and not sure how to do it, then read this guide first. We will suggest three of the best brokers to invest with and provide detailed information about this promising tech company.

-

-

Buy Roku Stock in 3 Quick Steps:

If you do not have time to read our full guide simply follow these 3 quick steps to buy Roku stock right now.

[three-steps id=”202500″]Where to Buy Roku Stock

Roku went public on September 28, 2017, and is trading on the NASDAQ exchange. That means you will have to find an online stock broker that connects you to the markets and offers the tools and services you need. You will find out that all of our list of brokers have received good reviews from investors and are considered safe to trade with.

Below, we have listed the top three brokers that enable you to trade Roku stocks.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

How to Buy Roku Stock from eToro

Unlike most of the online brokers in the industry that allows you to buy stocks through stock exchanges, eToro is one of the few brokers out there that offers investors to buy stocks via the CFD trading market or via stock exchanges. As Roku has never paid cash dividends to its shareholders, buying Roku stock CFDs market should be the preferred option.

If you decide to continue the process with eToro, then you will find below the necessary steps you need to take to buy Roku stocks.

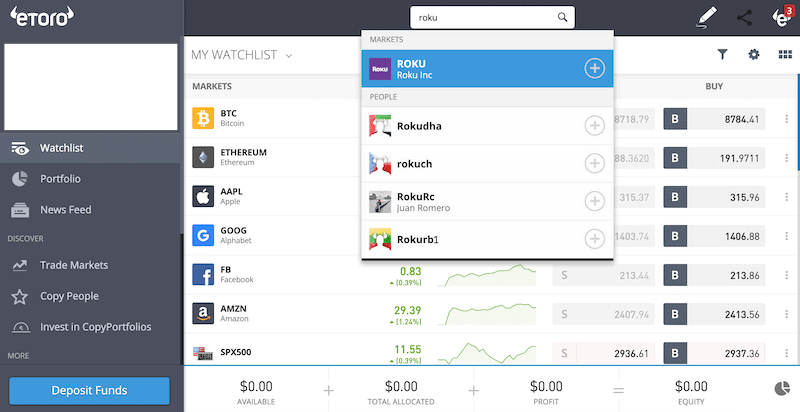

Step 1: Search for Roku stocks

Once your account has been approved by eToro and the funds have reached their destination, you can insert a buying order to the market.

The first thing you’ll have to do is to log in to eToro’s trading dashboard and type in Roku at the top search bar.

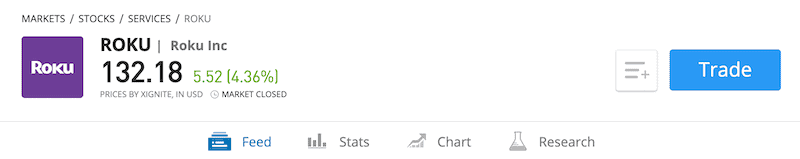

You should now see the Roku page that includes useful tools that can help you get better trading decisions. Those include the price chart, market stats, Twitter feed, and research tools (market sentiment, analyst recommendations, etc).

Step 2: Click on ‘Trade’

To proceed with your purchase, click on the ‘Trade’ button

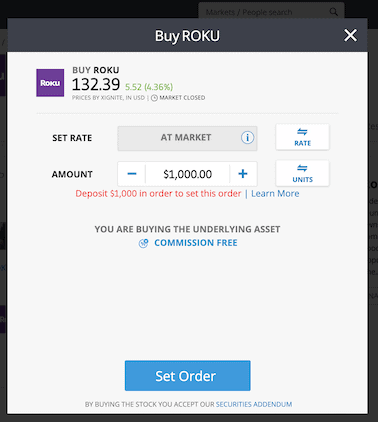

Step 3: Buy Roku Stock

You can make a buy order for any amount of Roku stock you want to purchase. Also, you need to choose the order type (market or limit order) and set the leverage ratio. It’s advisable to set a stop-loss order to reduce the risk based on your pre-defined risk-reward ratio.

Finally, click the ‘Open Trade’ button to complete your purchase.

Why Invest in Roku?

Roku is considered by many in the industry to be poised for huge growth over the next decade, while it occupies the epicentre of the global shift towards streaming media.

As a result of an increasing number of active users and monthly subscriptions, the company has provided outstanding results in 2019 and in the first quarter of 2021.

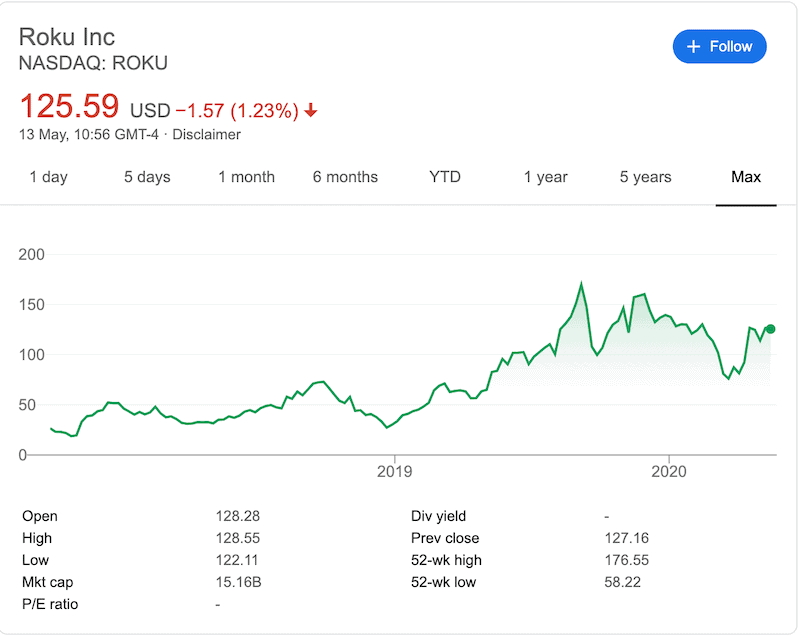

Although the stock has performed incredibly well since its IPO in 2017, it is currently trading in a gentle uptrend. As such, you should undertake thorough research before making any investment decisions.

Below, we list several reasons why you decide whether Roku is a stock to buy:

Roku plans to expand globally for long-term growth

In 2019, Roku has started its international expansion by setting up the foundations to enter Canada, Mexico, some parts of Latin America, and Europe. In early 2021, Roku has already begun its international expansion into emerging markets by venturing into Brazil. The company also plans to enter European countries with the most recent expansion is expected to occur in the United Kingdom, and Germany.

Roku’s management has already stated that there’s plenty more international expansion planned throughout 2021. That could a major game-changer for Roku in terms of its future growth and dominance in the industry.

Ads Revenue and Subscription Numbers Continue to Grow

Remarkably, Roku has seen a massive surge of 229% in ads and commission revenues between 2017-2019. In the same period, the total revenue has also increased by 120% from $513 million to $1.1 billion. In 2019, Roku closed the year with 36.9 million active accounts but the company’s growth continued in 2021 as it gained 2.9 million new accounts in the first quarter to reach a total of 39.8 million active users.

However, keep in mind that like other streaming media platforms such as Netflix, Amazon, and Google, the COVID-19 had a negative impact on Roku’s advertising business that’s also its main revenue source.

Strong Revenue Growth

Roku reported an impressive revenue of $1.1 billion in 2019, a 52% increase from the previous year. The average revenue per user grew by 29% in comparison to 2018 to $23.14. Moreover, the company’s revenue is expected to grow to $1.6 billion by 2021.

In the Q1 2021 earning reports, Roku reported a 49% year-over-year streaming growth with 39.8 million accounts and 13.2 billion hours of content. Furthermore, Roku reported revenue of $321 million in the first quarter of 2021, an increase of 55% YoY. The platform revenue rose by 73% from the previous year to $233 million.

Healthy Balance Sheet

The most crucial fundamental factor to take into account is the balance sheet. In terms of cash flow, the company had a total of 13.71 million as operating cash flow. Roku also maintains a relatively low debt level, particularly for a tech company. In 2019, Roku had $99.6 million of debt, the same level of debt the company had in 2018.

Overall, for a growing tech company, Roku has a solid balance sheet and its total liabilities are roughly equal to its liquid assets.

About Roku Stock

Roku Company Background

Roku was founded in 2002 by Anthony Wood, an English businessman, who is doubles up as CEO and chairman of the company. The name Roku derives from the word six in Japanese and represents the sixth company that Anthony Wood has founded. Ironically, Wood managed to convince Netflix (one of Roku’s competitors) to invest $5.7 million in Roku in 2007, however, Netflix sold its stake in Roku for a modest gain of $1.7 million in 2009.

In the following years, Roku has made smart partner choices and raised funds from various venture capital firms. In 2017, the company decided to go public and held an initial public offering (IPO) with stocks valued at $14 per share.

Roku manufactures and sells a line of digital media players and makes most of its income through advertising in addition to the sale of its unique products; the Roku TV, streaming player devices, and various accessories. As of 2021, Roku has established a stable revenue structure by selling advertising on its platform, as well as charging a pay-per-view and monthly subscription from third-party services. Currently, Roku monetizing system works through ads rather than monthly subscriptions although the company has recently introduced more than 30 premium subscriptions services through The Roku Channel.

Roku Stock

Overall, Roku stock has been enjoying a great run since its IPO in 2017, and investors who have invested in Roku in the day of IPO have gained around 600% profit on their initial investment.

Roku’s stock has reached its all-time high of $169.86 on September 06, 2019. In 2021, however, the stock dipped 35% through the first three months of the year, mostly due to the crisis caused by the coronavirus pandemic. However, since March 16, the stock is on an uptrend and is currently trading at $127.16.

Due to positive fundamentals, most market analysts and stockbrokers remain bullish on Roku with a ‘buy’ consensus rating and a price target that ranges between $120.72 to $132.74, according to MarketBeat.

Keep in mind that like most other tech companies such as Google and Facebook, Roku has two classes of shares – Class B common stock, which allows holders 10 votes for every one vote of the Class A stock.

What Else Should I Know About Roku?

Keep in mind that 68% of Roku stocks are in the hands of institutional investors. Those include FMR LLC, Vanguard Group Inc, and Blackrock Inc. That means that these institutional investors account for most of the trading of Roku’s stock and have a monopoly over the increase in the stock’s volatility and price movement.

On another note, like other content media platform, we can confirm that Coronavirus hasn’t had significant impacts on Roku.

Another huge factor regarding Roku’s stock is the anticipated short-squeeze. Mid-March 2021, nearly 15 million shares sold short over concerns that the stock is overvalued. If Roku succeeds in the upcoming year and continues its growth, a short-squeeze can drive Roku’s stock price to unprecedented levels.

Should I Buy Roku Stock?

For Roku, profitable earnings are not expected within the next year and it appears that the company prioritizes long-term growth over becoming a profitable company in the short term. Evidently, the company aims to expand into international markets and increasing growth investments. In the short-term perspective, that might be a problem for analysts, however, Roku has posted solid growth and relatively low debt levels. It is also notable that Roku is the number one streaming platform in the United States in terms of hours streamed. Based on these factors, you should consider adding Roku to your portfolio.

But while Rokus is more diversified than any competitor in the industry, it’s difficult to ignore other platforms that are taking slow steps to even out Roku’s services. If you decide to invest in Roku, you must be well-informed of developments in the company’s business operations.

Other notable factors include Roku’s growth, competitors, and the current growing number of short positions.

Click here to learn how to go short on stocks.

Conclusion

With the increasing popularity of streaming platforms services, Ruko is at the forefront of this industry. It also keeps pushing forward in order to offer even more innovative products and services. But it’s important to note that the company is still in its early stages of development and the high competition in the industry makes margins relatively low. Roku is not only facing increasing competition from tech giants such as Amazon, Apple, Google, and Netflix but also has to consider its platform business structure.

For more resources, make sure to consult our stock investing and stock trading guides!

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

How many users does Roku have?

As of May 2021, Roku has some 39.3 million active users and 41 million devices in use worldwide.

How many channels are available on Roku?

Roku has somehow between 3000-4500 available channels including the Roku channel, Stirr, Pluto TV, Tubi, XUMO, Crackle, Hoopla, YouTube, and many more.

What is the ticker symbol for Roku?

Roku stock is traded on NASDAQ under the ticker symbol ‘ROKU’.

Does Roku pay dividends?

No, Roku does not currently pay a dividend to its shareholders.

How much were Roku stocks originally?

Roku went public in September 2017 and offered shares to the common at a price of $14 per share.

Who are Ruko competitors?

Roku has faced considerable competition from many online streaming media companies. Those include Netflix, Vimeo, Amazon TV, Apple TV, Disney+, Hulu, Eros, Twitch, etc.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Tom Chen

View all posts by Tom ChenTom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up