How to Buy Mylan Stock in 2020

Mylan (NASDAQ:MYL) is a leading American pharmaceutical company specialized in generic drugs. It markets its products in more than 165 countries, employs over 35,000 people worldwide and is listed on the NASDAQ.

Considering buying Mylan stock today? In this guide, we’ll walk you through how to choose the right broker, how to buy stocks and what elements make Mylan an attractive investment opportunity!

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.3 Simple Steps to Buy Mylan Stock

In a hurry? No problem! Simply follow these 3 easy steps to buy Mylan stock now!

[three-steps id=”200551″]Where To Buy Mylan Stock

1. eToro: Best Broker for Trading Stocks Directly and Via CFDs

eToro is a leading online broker that offers thousands of tradable instruments (Stocks, ETFs, Cryptos, Forex...) for direct or CFD trading. It counts over 5 million users and is one of the most popular brokers in Europe.

Stock trading is direct for unlevered Buy orders (meaning that you will own the underlying), while all others are done via CFDs (a bet with the broker on the price change of the stock). Buying and selling stocks is always commission-free. Like most brokers, eToro remunerates itself via tight spreads and very transparent other fees (inc. daily rollover for CFD trades).

eToro is fully licensed in the UK and offers Crypto trading to US customers. Trading on its web and mobile platforms is seamless thanks to the analysis & charting tools, newsfeed and other features that enhance the trading experience.

eToro particularly stands out thanks to its social CopyTrader system. This feature allows you to look up the performance of other traders and decide to allocate a portion of your money to automatically trade alongside the. This way, you can learn from the pros while taking a more hands-off experience to your trading!

Our Rating

- 0% commissions for direct and CFD trades

- Transparent and low fees

- Great social trading component

- Stock trading unavailable in the US

- No MetaTrader integration

Disclaimer: 62% of investors lose money when trading CFDs with this provider.2. Plus500: The CFD Trading Specialist

Plus500 is one of the leaders in online CFD trading. It offers commission-free trades on thousands of instruments, and is one of the few leading brokers to allow options trading.

Spreads and fees are highly competitive, and Plus500 is licensed in many countries including the UK. Users may find it comforting that Plus500's parent company is a publicly listed entity on the FTSE 250, a testament to the broker's reputation.

Trading on its web and mobile platforms is seamless, and Plus500 offers great analysis & charting tools and other features to please traders of all levels. Leverage for CFD trades is accessible up to 5:1 for Stocks and 30:1 for Forex.

Last, opening an account is quick and easy and Plus500 accepts many different payment methods to help you get started quickly!

OUR RATING

- Thousands of tradable instruments

- Competitive spreads

- Excellent reputation

- Not available to US customers

- Limited educational resources

- No MetaTrader integration

Disclaimer: 76% of retail investor accounts lose money when trading CFDs with this provider.3. Stash Invest: Best-in-Class Mobile Stock & ETFs Trading for Beginners

Stash Invest is a US mobile investing app that offers hundreds of stocks and curated ETFs to trade directly. Its interface is beautiful and very intuitive for beginners.

Investors on a budget will love Stash's fractional shares option that allows users to buy small fractions of shares starting at $5. This allows you to buy popular but very expensive stocks without putting a large portion of your portfolio on one name!

Trading stocks and ETFs is commission-free once you select one of the 3 plans available ($1, $3 and $9 per month), which all come with a different range of additional options.

While Stash only offers trading on the US stock market, it compensates with great options like customizable auto-investing and automatic dividend reinvestment. As such, Stash is the perfect app for beginners, investors on a budget or investors who want to take a more passive approach!

OUR RATING

- Makes Stocks & ETFs investing easy and fun

- 0% commissions

- Fractional shares, automatic investment options

- Limited to the US

- Narrow range of ETFs

- Monthly fees

How To Buy Mylan Stock Using eToro

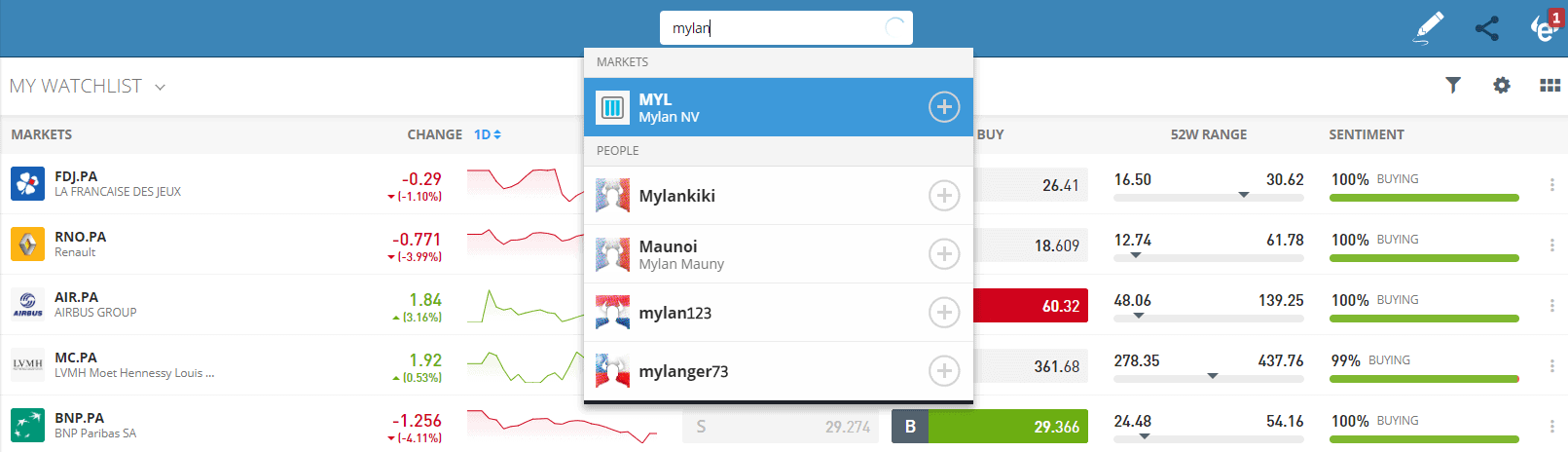

Step 1: Search for Mylan (MYL) stock

On the eToro platform, search for Mylan or “MYL” stock. You will see both stocks and other trader names in the search results: the ability to browse other traders is at the core of eToro’s social trading system.

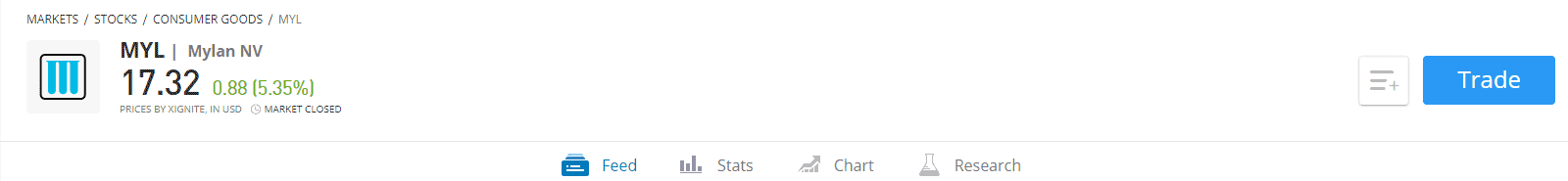

Step 2: Select “Trade” to get started

With your own money or with eToro’s free demo account, click on “Trade” to select trading options including order type, amount and leverage.

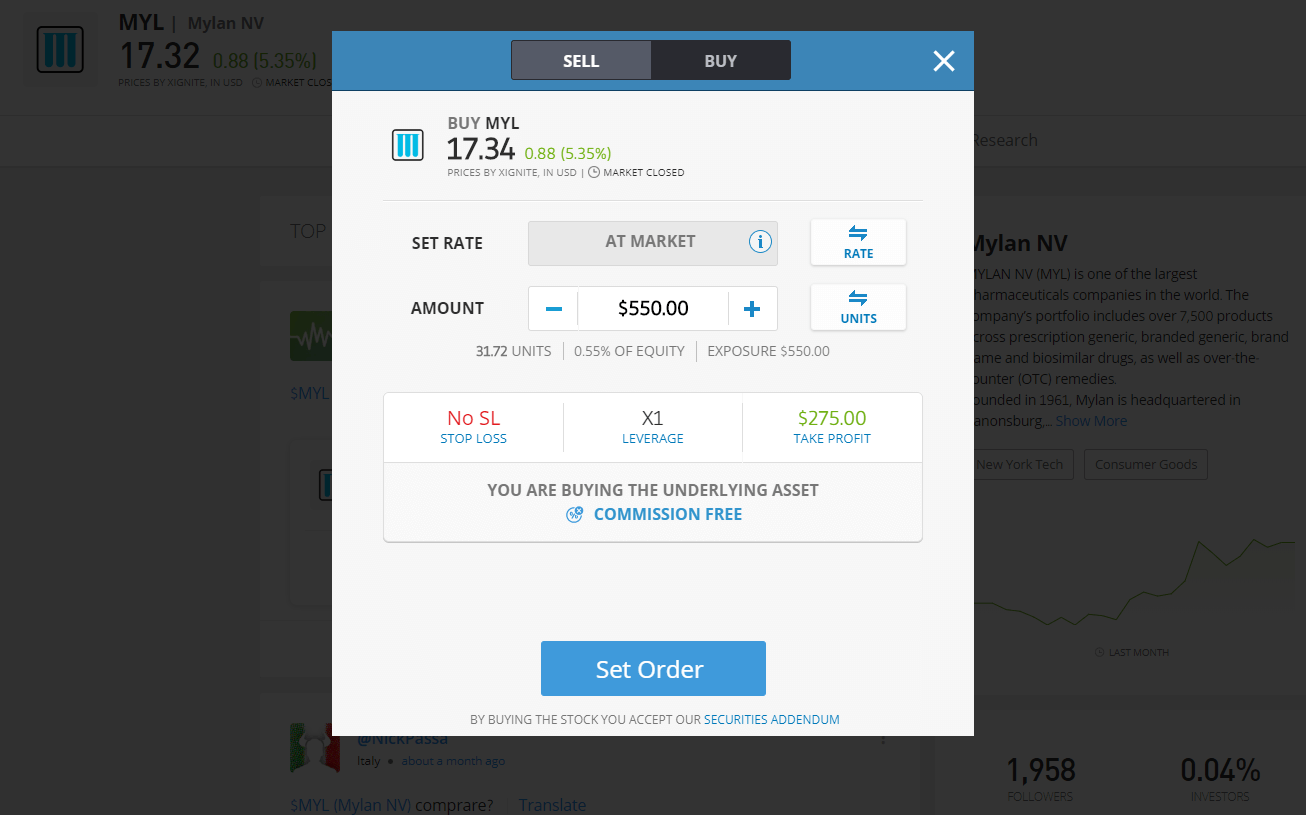

Step 3: Choose how much to buy or sell and the options you want

Once you clicked “Trade”, you will then decide to buy or sell the stock, at the market or via a limit order.

You can then specify how much you want to trade (number of shares or total amount) and review the exposure that the trade involves.

Buy orders with no leverage are executed directly (i.e. you will own the stock), while short-selling and other more complex trades are executed via CFDs. You can also add leverage to your trade or choose a special order types (e.g. stop-loss).

Before trading, make sure you have done your own careful research, have reviewed the risks and understand the fees if you trade via CFD! Have a look at the FAQ section below for suggestions on what else to consider before pulling the trigger on a trade.

Once you’ve made up your mind, click “Set Order” to get started!

Company Background

Mylan is an American pharmaceutical company best known for its leadership in generic drugs manufacturing. Its portfolio of over 7,500 drugs includes prescription and branded generics as well as over-the-counter remedies.

Originally incorporated in the Netherlands, Mylan is headquartered in Pennsylvania and has been listed on the NASDAQ since 1973. At the end of 2019, its product were marketed in over 165 countries & territories, and Mylan employed more than 35,000 people.

Over the years, Mylan has grown both organically and through major acquisitions including Matrix Laboratories (2007), Merck KGaA’s generics business (2007), Meda AB (2016) and others.

Mylan is currently in the process of merging with Pfizer’s Upjohn generics business division, a mega-merger that will create a ~$20 billion dollar company (in sales). The completion of the transaction is expected by late 2020 and Mylan shareholders will hold ~43% of the new combined entity (with the remainder owned by Pfizer shareholders). The combination will give Mylan access to Upjohn’s portfolio of leading brands, including Xanax, Viagra and Lipitor and help it strengthen its global footprint.

Mylan’s business model emphasizes diversification, be it geographical (>165 countries), in product mix (>7,500 products, none generating more than 5% of sales) or in sales channel (wholesale, retail, hospitals, e-commerce and specialty pharmacy). Its drugs are spread across 10 major therapeutic areas, including cardiovascular health, anesthesia, dermatology, infectious diseases, oncology etc.

In 2019, Mylan generated $11.5 billion in revenues, stable year-on-year. At the time of writing, its market capitalization hovered around $9 billion.

Mylan Stock Performance

Mylan is listed on the NASDAQ under the NASDAQ:MYL ticker.

Like many other companies, Mylan has had a difficult start to 2020, with the stock down over 16%. At around $17, it currently trades significantly below its all-time high of $74, hurt by stagnant sales, rising costs and increasing competition in the global generics market. The future is rosier however, with the Upjohn merger expected to give Mylan-Upjohn the scale and firepower needed to better compete in this environment.

At the time of writing, the analyst consensus was split between “Buy” and “Hold”, with next 12 months price targets between $16 and $19 (median of $22.5).

Why Invest in Mylan?

Mylan is the world’s largest generic drug manufacturer by sales, expected to double in size after its merger with Upjohn.

Deciding which stocks to buy is a difficult but personal decision that must be supported by personal research. Nevertheless, to assist you in your research, we highlight below 3 aspects that make Mylan an attractive stock to buy:

1. Leadership in the generics business

With $11.5 billion in 2019 revenues (flat year-on-year), Mylan is the largest generics drugs manufacturer in the world.

The global generics business is characterized by intense competition that drives prices down. In this environment, scale allows business to stay profitable and continue to grow while others struggle. As such, Mylan’s size gives it a strong advantage over competitors such as Teva, Sandoz or Sun Pharmaceuticals.

Scale not only allows Mylan to stay profitable but also to continue developing new generic drugs and expanding in new markets.

2. Highly diversified and resilient business

Mylan’s portfolio of over 7,500 products (with none generating over 5% of revenues) insulates it from the product dependencies that plague many pharmaceutical companies. In the generics business where price competition can be intense, not being overly exposed to a few key products is essential.

The company also markets is products in virtually every country in the world, with its revenues split between North America (37%), Europe (35%) and the Rest of the World (28%). This geographic diversification offers it further protection against regional legal action (such as country-wide price controls on specific drugs).

Last, Mylan’s sales are split almost evenly between pure generics and brand-name drugs + branded generics products, offering further diversification to solidify the business

3. A promising combination with Pfizer’s Upjohn divison

The proposed merger between Mylan and Pfizer’s Upjohn generics business would create the uncontested world leader in generic drugs manufacturing, with an expected $20 billion in revenues.

Structured as a Reverse Morris Trust, the combination would see Mylan shareholders retain 43% of the combined entity. The deal would also involve $1 billion in annual cost synergies.

Mylan would access Upjohn’s best-in-class portfolio of generic and branded generic drugs, including Viagra, Xanax and Lipitor. It would also help it increase its diversification and reduce its exposure to the brutally competitive US generic market.

Upjohn is based in China, which would give the combined entity not only a privileged access to one of the world’s largest market but also offer Mylan the opportunity to cut costs by outsourcing.

The merger would also help Mylan de-risk its balance sheet by improving cash flows and significantly lowering its leverage. This is a particularly strong advantage over rivals in a business where debt levels tends to be extremely high.

Last, the new combined entity will pay a dividend, a strong plus for Mylan stockholders who have yet to receive any dividends from their stock.

Should I Buy Mylan Stock?

As discussed, Mylan is one of the largest generics manufacturers in the world, set to become the uncontested global leader after merging with Upjohn. Consequently, investors may find it attractive to buy Mylan stock.

However, we cannot offer investment advice and the decision to invest rests solely on your shoulders. Before investing in any security, we highly recomment reading the company’s SEC filings, reviewing its press coverage and understanding the risks to make sure you are making the right call.

Investing can be difficult and time consuming but it can be incredibly rewarding. For more resources, make sure to check out our stock investing and stock trading guides!

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

Where is Mylan listed and incorporated?

Mylan is incorporated in the Netherlands and listed on the NASDAQ under the MYL ticker. Its headquarters are in Pennsylvania.

What businesses is Mylan primarily involved in?

Mylan is the world’s largest generic drugs manufacturer by sales. It develops & markets generic drugs, branded generics, brand-name drugs and over-the-counter remedies.

Does Mylan pay a dividend?

Mylan does not currently pay a dividend, but the combined entity after its expected merger with Upjohn will pay dividends.

What should I do before buying Mylan stock?

This guide is meant to help you in your research, but it cannot be the only source of your decision. We recommend carefully reviewing Mylan’s SEC filings and press coverage to inform your investment choice

Can I buy Mylan stock if I am not a US citizen?

You can, you simply need a broker that offers US stocks listed on the NASDAQ. All the brokers covered in this guide do!

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up