How to Buy Intel Stock for Beginners

Intel doesn’t get as much coverage as more ‘exciting’ tech stocks like Apple, Google, and Facebook. But this 52-year old corporation has been at the forefront of driving technology forward with groundbreaking computer processors and chips.

Intel’s tradition of innovation continues today and there are plenty of reasons to think that the future is bright for this vaunted company. In fact, any pullback could be the perfect opportunity to buy Intel stock.

If you’re thinking about picking up Intel stock before the price has a chance to jump any higher, this guide will cover everything you need to know. We’ll highlight some of our favorite online brokerages you can use to build a stock portfolio, as well as explain why Intel could be a good stock to buy right now.

-

-

Buy Intel Stock in 3 Quick Steps:

Want to buy Intel stock before the price can rise any higher? You can buy Intel stock with just these three quick steps:

[three-steps id=”202129″]Where to Buy Intel Stock

Trading Intel stock requires an account with a licensed stock broker, and specifically one that allows stock trading on the NASDAQ exchange. There are a lot of brokerages out there, but getting the right one is important to ensure you have a smooth trading experience. Plus, the right brokerage can help you minimize trading fees that otherwise eat into your profits.

With that in mind, here are our three favorite online brokerages for stock trading.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

How to Buy Intel Stock from eToro

eToro allows you to open an account and start trading Intel shares within just a few minutes. Plus, this online broker allows you to trade fractional shares and doesn’t charge any trade commissions.

Let’s walk through the steps required to buy Intel stock using eToro after you’ve set up an account. If you’ve set up an account with another online broker, don’t worry, the steps are largely similar between trading platforms.

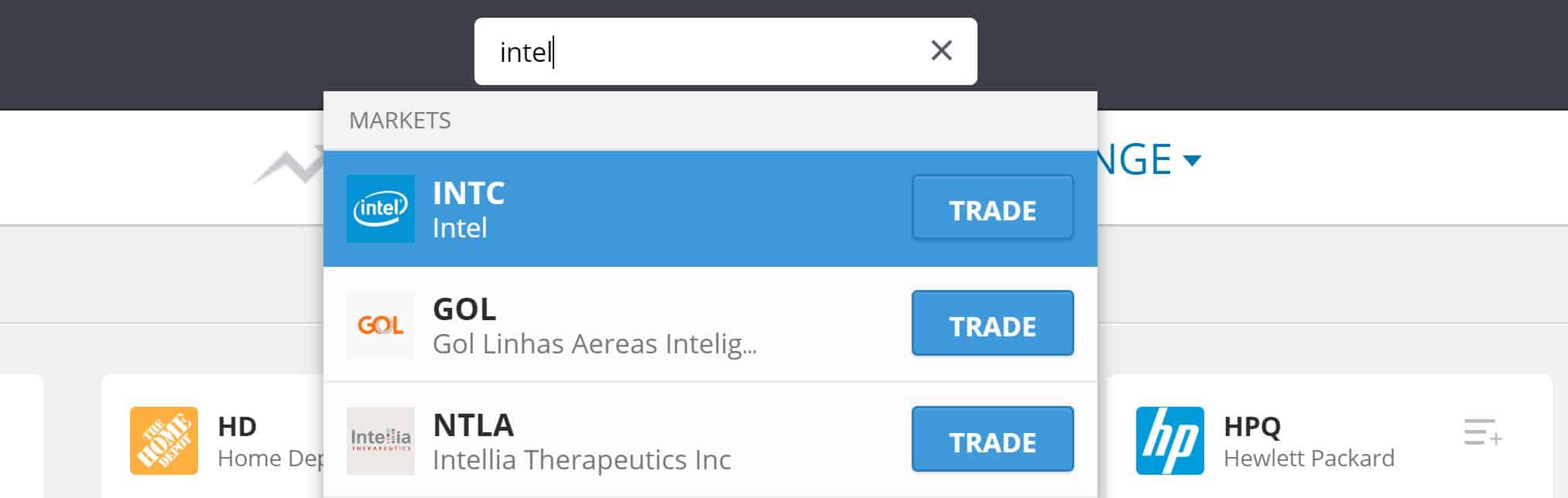

Step 1: Search for Intel Stock

You can trade hundreds of US stocks on eToro. To find Intel shares, enter ‘Intel’ or ‘INTC’ in the search bar at the top of the page. When Intel appears in the drop-down menu, click on it.

Step 2: Click on ‘Trade’

In front of you is the main page for Intel stock, where you’ll find social discussions, technical charts, news, and more. To enter an order to buy Intel shares, you’ll need to click the ‘Trade’ button at the top of the page.

Step 3: Buy Intel Stock

eToro’s order form allows you to specify how much Intel stock you want to buy and what parameters you want to put around your trade. To start, enter how much money you want to invest in Intel. If you’d rather specify how many shares of stock you want to purchase, you can click the ‘Units’ button on the right.

You’ll also want to consider setting a stop loss. This is a price, below the current share price, at which eToro will automatically sell the Intel shares you’re buying now. A stop loss is important because it prevents you from losing too much money if Intel stock suddenly drops in value.

Why Invest in Intel?

Intel has a long and storied history as the largest computer chip maker in the world. The company had a bit of a rough patch in 2017 and 2018, when it struggled to adapt to the smartphone era and was briefly overtaken by Samsung in terms of revenue. But in 2019, sales at Intel jumped and investors were rewarded with a rising stock price.

Now, after a major tumble in response to the coronavirus pandemic, Intel’s stock price is climbing back up towards the 20-year high it set in February due to a rise in those working at home. So is this the best time to buy Intel stock? Let’s take a look at the case for why this is a worthwhile investment.

Intel has Diversified

A lot of Intel’s historical growth during the 1990s and 2000s was driven by a strategic partnership with Microsoft. Microsoft’s personal computers took over the personal computing space, and there was an Intel processor inside virtually every single unit. For years, Intel’s growth was tied to Microsoft’s growth and the development of PC makers like Dell and Gateway.

That all changed with the rise of smartphones. Intel was left holding the bag as consumers increasingly switched away from Intel chip-driven PCs to iPhones and Android devices. In fact, by 2017, Samsung had overtaken Intel as the largest chipmaker in the world.

Intel took some time to respond, but the company has quietly transformed itself over the past decade. Today, Intel has not only taken back the reins as the world’s leading chip producer. It’s also invested in the technology of the future. Intel now makes lines of semiconductors and processors designed for 5G networks, the Internet of Things, and artificial intelligence.

That diversification means that even as competition heats up from companies like Nvidia and AMD, Intel is poised for growth. Expect to see demand for Intel’s chips heat up after the coronavirus pandemic is over and the world pivots back to developing new technology infrastructure for the coming decade.

Sales are Booming

In fact, Intel’s diversification has already borne fruit. The company had a stellar earnings announcement at the end of April, when it reported a year-over-year earnings increase of 63% and a sales increase of 23%. A lot of that was driven by sales to data centres, which increased by 43% year-over-year.

All told, 2019 represented Intel’s fastest sales growth in more than five years. While the company cautioned that the forecast for the next couple quarters is uncertain because of coronavirus, the company remains optimistic that these sales will continue. Interestingly, the potential growth hasn’t yet been reflected in the share price, meaning that new investors could still get a deal.

Intel Trades at a Discount

One of the most appealing things about Intel stock for long-term investors is that it’s trading at a discount almost any way you slice it. The company’s stock is currently selling at around 12 times analysts’ expected earnings for 2020. That’s compared to roughly 30 times expected earnings for AMD and Nvidia.

In fact, one analyst believes that fair value for Intel stock based on the latest earnings report is $70. The stock is currently trading at around $60 per share.

Intel’s dividend payout is also very attractive for investors looking for passive income. The company pays a 2.35% dividend yield, which is a better payout than investors can get with almost any other US stock right now. In fact, Intel is one of the few major players in the tech industry to pay a dividend to investors. The dividend also isn’t likely to diminish or disappear even if the broader market struggles to recover after the coronavirus crisis.

Not convinced? The vaunted Investor’s Business Daily Leaderboard, a stock picking service with a long history of choosing top stocks, rates Intel a 99 out of 100. It’s also in first place (out of 31 stocks) in the service’s Electronics-Semiconductor Manufacturing industry group.

About Intel Stock

Intel was founded in 1968 in what is now known as Silicon Valley thanks in large part to Intel itself. The company’s founders included several of the inventors of microchips, and it was early on one of the largest companies in the burgeoning computer industry. Up until 1980, Intel made most of its money developing the SRAM and DRAM processing chips used in early computers.

Intel switched to inventing and perfecting microprocessors for personal computers during the 1990s. The company had a strategic partnership with Microsoft, although Intel and Microsoft had differing views about the future of the PC. It also competed fiercely with AMD, another US chipmaker, although Intel overwhelmingly dominated the market during this period.

Perhaps Intel’s most important recent innovation was the Core processor line, introduced in 2006. This processor series represented a major technological jump and allowed Intel to regain market share it had slowly been losing to AMD. In 2010, Intel purchased the widely renowned cybersecurity firm McAfee, and the company has since expanded its holding to diversify into new technologies.

Intel first went public in 1980, trading at just $0.35 per share. The stock’s history was one of continuous increase until, at the height of the tech bubble in 2000, the price reached $73 per share. Intel stock traded as low as $12 per share for much of the period from 2000 to 2015 before starting to climb again. It ultimately reached a 20-year high in February 2020 just before tumbling to $44 per share as the coronavirus pandemic shut down the US and disrupted supply chains around the world.

Should I Buy Intel Stock?

Is now the time to buy Intel stock? There are certainly a number of good things to say about Intel as a company, and the stock is still trading at roughly 15% below the 20-year high it reached in February.

Analysts are torn on whether Intel is a buy right now. Some have predicted that the sales growth Intel reported in April is unsustainable. These fears seem to be driven largely by the fact that Intel withdrew its guidance for the rest of the year due to uncertainty over the effects of the coronavirus pandemic. It’s too early to tell whether Intel will keep growing at the current rate, especially as the world reopens after the pandemic.

That said, most analysts are at least encouraging about Intel’s prospects. The company’s diversification is likely to serve it well in years to come. Plus, while Intel has lost some market share to AMD and Nvidia, it’s still the largest chipmaker in the world and is trading at a much more reasonable earnings multiple. The dividend yield, which is expected to increase, is also a major plus since that can help cushion any short-term pullbacks as well as provide investors with long-term, stable income.

With all that in mind, Intel stock could be a worthwhile investment. While not every analyst is on board, virtually everyone agrees that Intel isn’t going anywhere and the stock isn’t overvalued at the current price. So the downside risk is relatively low, and the potential reward for long-term investors remains excellent.

Conclusion

Intel is one of the oldest tech stocks on the market, but the company is quickly reinventing itself for the technology market of 2020. It’s diversification strategy has worked well so far, with Intel reporting explosive growth in the past year even as the coronavirus pandemic disrupted supply chains. Analysts worry that Intel could see a slowdown over the remainder of the year due to the virus, but the company’s longer-term prospects remain bullish.

With all that in mind, right now could be a great time to buy Intel stock. There is plenty of long-term upside, and the dividend yield makes it attractive as an income investment. If you’re ready to purchase shares of Intel, make sure to use one of our featured brokerages to get a smooth trading experience.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

What is Intel’s ticker symbol?

Intel trades on the NASDAQ stock exchange under the ticker symbol ‘INTC’.

Does Intel make processors for smartphones?

Intel doesn’t make any chips for smartphones. The company made an ill-fated decision to pass on designing chips for the iPhone in 2007, and lagged severely behind Apple, Qualcomm, and Samsung in mobile chip production for the following decade. Intel recently cancelled a line of chips aimed at mobile devices, ending its production of processors for the mobile market.

Are Intel chips used in China?

Intel chips are used in PCs in China. In fact, China accounted for more than 40% of Intel’s chip revenue last year. The company has increasingly faced issues with counterfeiters in the Chinese market, although none of the counterfeit chips have the same processing power as Intel chips.

How much of the CPU market does Intel control?

Intel controls around 77% of the global CPU market. It’s next closest competitor is AMD, which controls around 23% of the total market.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up