How to Buy Berkshire Hathaway Stock in 2020

Berkshire Hathaway (NYSE:BRK.B) is the company behind Warren Buffett’s legendary success. In addition to its presence in the stock market, Berkshire Hathaway’s business spans across sectors from insurance, utilities & energy to transportation, manufacturing and retail.

Warren Buffett’s investment acumen helped grow Berkshire from a near-bankrupt textile company into one of the largest companies in the US. Today, Berkshire Hathaway’s Class A stock trades at over $280,000 (up more than 3,800% since inception), and its more affordable class B stock trades around $190.

Thinking of buying Berkshire Hathaway stock today? This guide will walk you through how to choose the right broker, how to purchase shares, and the elements that make Berkshire an attractive investment opportunity!

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.3 Simple Steps to Buy Berkshire Hathaway Stock

Don’t have time to read this guide? Simply follow these 3 simple steps to buy Berkshire Hathaway stock now!

[three-steps id=”200276″]Where To Buy Berkshire Hathaway Stock

1. eToro: Best broker for direct and CFD stock trading

With over 5 million users and thousands of tradable instruments, eToro is one of the most popular online brokers in Europe. It offers Stocks, Forex, Commodities, and more directly or via CFDs.

eToro is license with the FCA, CySEC, and ASIC. Its web and mobile platforms are easy to use, with a range of analysis & charting tools and lots of other features to make trading seamless.

For stock trades, long & unleveraged orders are executed directly and all other trades are made via CFDs. Trading on eToro is always commission-free and spreads & daily rollover fees are very low for CFD trades.

eToro differentiates itself from its peers with its social trading features (CopyTrader system). Users can look up other traders, see what they hold and what their past performances have been, and decide to automatically trade alongside them. This not only allows you to learn from the best but also to delegate some of your trading to more experienced traders!

Our Rating

- Buy stocks directly or via CFDs

- 0% commissions and competitive spreads & fees

- User-friendly web & mobile platform

- Stock trading not available in the US

- No MetaTrader integration

Disclaimer: 62% of investors lose money when trading CFDs with this provider.2. Plus500: Leader in online CFD trading

Plus500 is a well-established online broker specialized in CFD trading. To lend it additional credibility, its parent company listed on the UK FTSE 250 Index. On top of thousands of instruments, Plus500 is one of the few brokers to offer a variety of options to trade.

Plus500 is regulated in several jurisdictions, including the UK, Australia and Singapore. Opening an account is quick and seamless, and users can access leverage up to 5:1 for Stocks and 30:1 for Forex.

Trading on Plus500 is commission-free and the broker offers low spreads & daily rollover fees. Beginners and seasoned traders will find Plus500's web and mobile platforms very well-designed and user-friendly.

Last, Plus500 offers great analysis & charting tools and plenty of other features to help you make the most of your trading experience!

OUR RATING

- Thousands of tradable instruments via CFDs

- 0% commissions, low spreads & competitive fees

- Great web platform & mobile app

- Not available in the US

- Limited customization options

- No MetaTrader integration

Disclaimer: 76% of retail investor accounts lose money when trading CFDs with this provider.3. Stash Invest: The best mobile trading experience for beginners

Stash Invest is a US mobile app that allows you to trade stocks and ETFs on the go. With a user-friendly interface, hundreds of stocks and a range of curated ETFs, Stash is perfect for beginners and investors with smaller portfolios.

Trading stock and ETFs on Stash is commission-free. However, Stash users must choose between 3 plans ($1, $3 and $9 per month) that all offer commission-free trading but come with different additional options.

What makes trading on Stash great is the possibility to buy fractional shares starting at $5. For example, if you don't want to buy a $190 Berkshire Hathaway Class B share, you can simply invest $20 and own just under a tenth of a share!

Finally, passive, hands-off, and long-term investors will love Stash's customizable auto-investing function and the possibility to automatically reinvest dividends!

OUR RATING

- Best mobile Stocks & ETFs investing experience

- No commissions, includes fractional shares

- Automatic investment and dividend reinvestment options

- Only available to US customers

- Smaller range of ETFs

- Monthly fees despite 0-commission trades

How To Buy Berkshire Hathaway Stock Using eToro

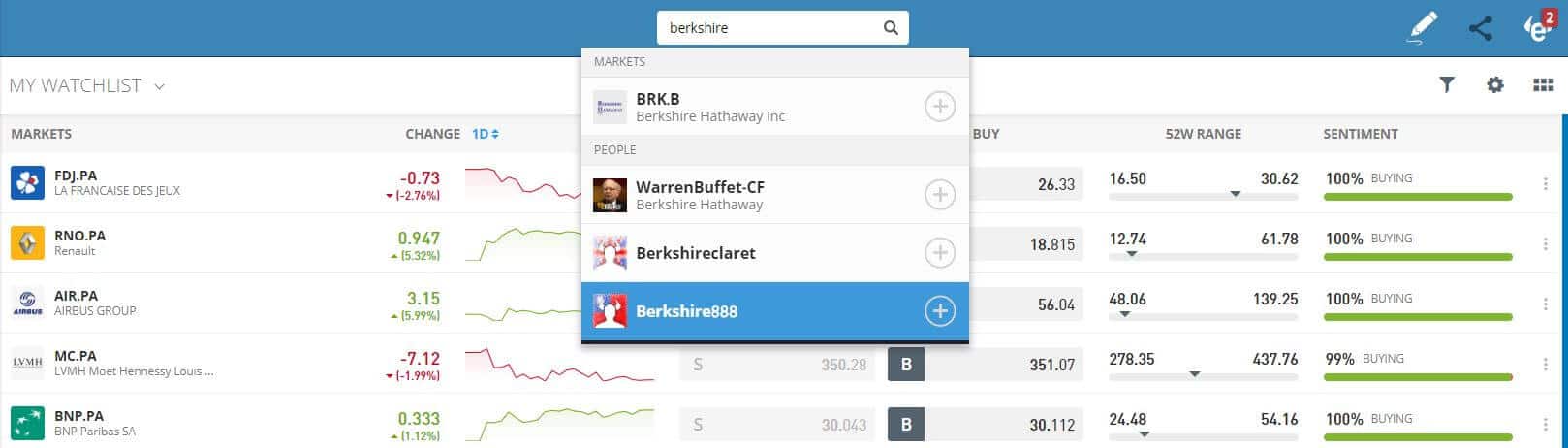

Step 1: Search for Berkshire Hathaway (BRK.B) stock

Using eToro’s search function, look for Berkshire Hathaway or the “BRK.B” stock ticker.

You will see that the search bar also displays people: browing other traders is a key component of eToro’s social trading experience.

Step 2: Open the trading window

When you want to trade Berkshire Hathaway stock, click on the “Trade” button to open the trade window.

Make sure you are using your own money and not eToro’s free “Virtual” trading account (unless you simply want to paper trade!).

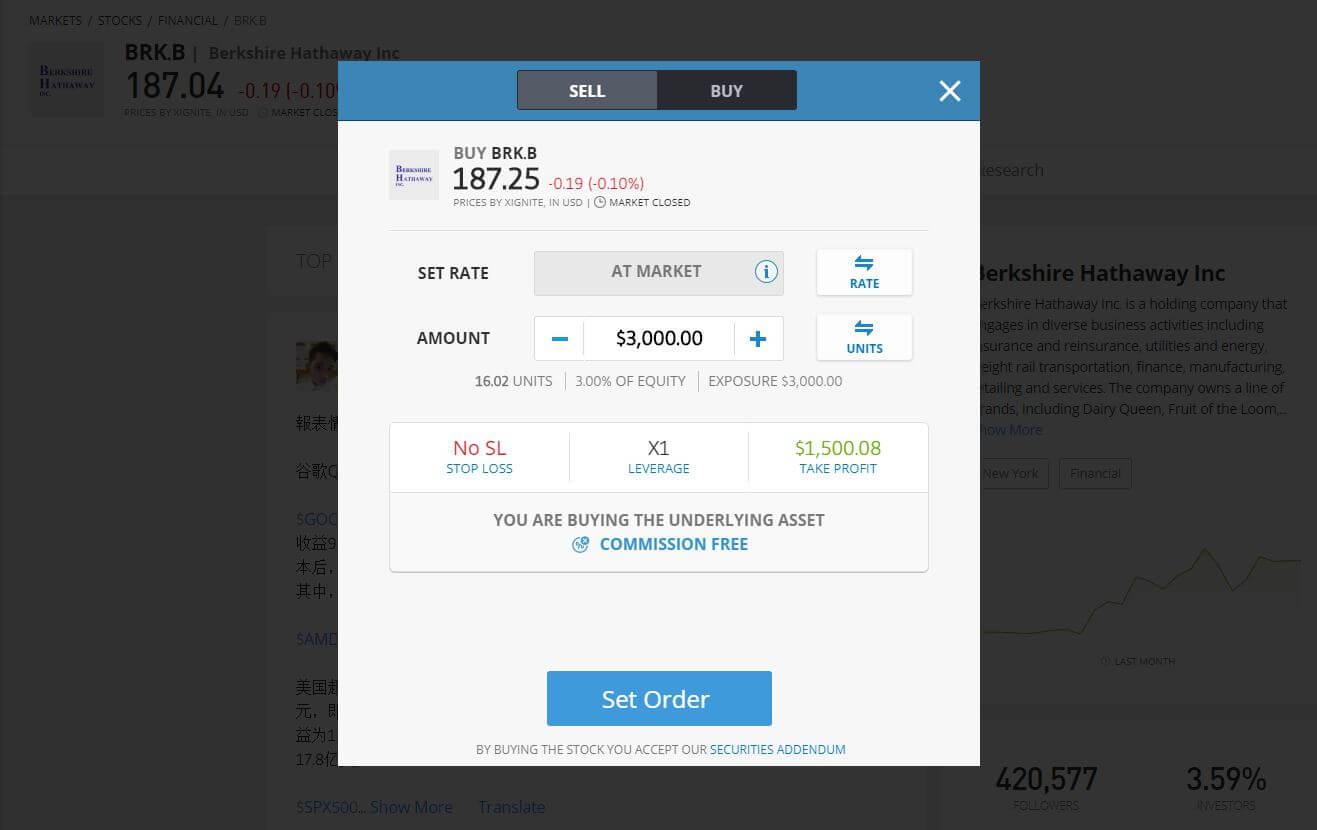

Step 3: Set up your order and trade

In the trading window, you will have to specify several items to buy or sell the stock:

- Buy or Sell (note: buy orders without leverage are executed directly while other trades like short-selling are executed via CFDs.)

- Number of shares or dollar amount

- Order type (market or limit order)

- Leverage

- Special order types (stop-loss, take-profit)

Take a second to review the dollar amount, exposure and percentage of your equity that a given trade entails. If you trade via CFD, you will also see a summary of the daily rollover fees at the bottom.

Before opening a trade, make sure that you have done your own careful research, especially if you’re using leverage! When you are ready, select “Set Order” to open your position.

Company Background

Berkshire Hathaway is an American diversified conglomerate run by legendary investors Warren Buffett and Charlie Munger. It owns various franchises and invests in publicly-listed companies in the US.

Incorporated in Delaware, it is listed on the New York Stock Exchange and headquartered in Warren Buffett’s hometown of Omaha, Nebraska. At the time of writing, it employed over 390,000 people worldwide.

As a large conglomerate, Berkshire Hathaway’s operations are split into several segments:

- Insurance & Reinsurance: through GEICO, Berkshire Hathaway Primary Group and Berkshire Hathaway Reinsurance Group, active in insurance and reinsurance of property, casualty, life, accidents and health risks

- Railroad Transportation: through the Burlington Northern Santa Fe Railway Company, one of the largest railroad systems operators in North America

- Utilities & Energy: through Berkshire Hathaway Energy, which generates, transmits, stores, distributes & supplies energy throughout North America via a web of companies

- Manufacturing: through a myriad of companies in the industrial, building and consumer products sectors

- Industrial: mainly via Precision Castparts (metal components manufacturer for critical energy & aerospace projects), Lubrizol (specialty chemical manufacturer), IMC (one of the world’s largest manufacturers of precision metal cutting tools) and Marmon Holdings (diversified conglomerate in the autonomous manufacturing & services sector)

- Building: through Clayton Homes (vertically integrated housing company), Shaw Industries (carpet manufacturer), Johns Manville (insulation products manufacturer), MiTek Industries (engineering & services provider to the construction industry), Benjamin Moore (paints & coatings manufacturer) and Acme Brick (brick & concrete blocks maker)

- Consumer: through apparel companies (Fruit of the Loom, Garan and BH Shoe), Duracell (batteries maker), Forest River (RVs & trailers manufacturer) and various others

- Service & Retailing: through food and food service companies (McLane, Dairy Queen, See’s Candies), aviation training & services (FlightSafety International, NetJets), electronics distribution (TTI), car dealerships (Berkshire Hathaway Automotive), home furnishing (Nebraska Furniture, Jordan’s), jewelry (Borsheim) and various other companies

- Real Estate Brokerage: via HomeServices of America, the largest residential real estate brokerage firm in the US

In 2019, Berkshire Hathaway’s vast empire generated over $250 billion in revenues (+3% year-on-year) and over $70 billion in capital gains from its investments in the financial markets.

At the time of writing, Berkshire had a market capitalisation of $455 billion.

Berkshire Hathaway Stock Performance

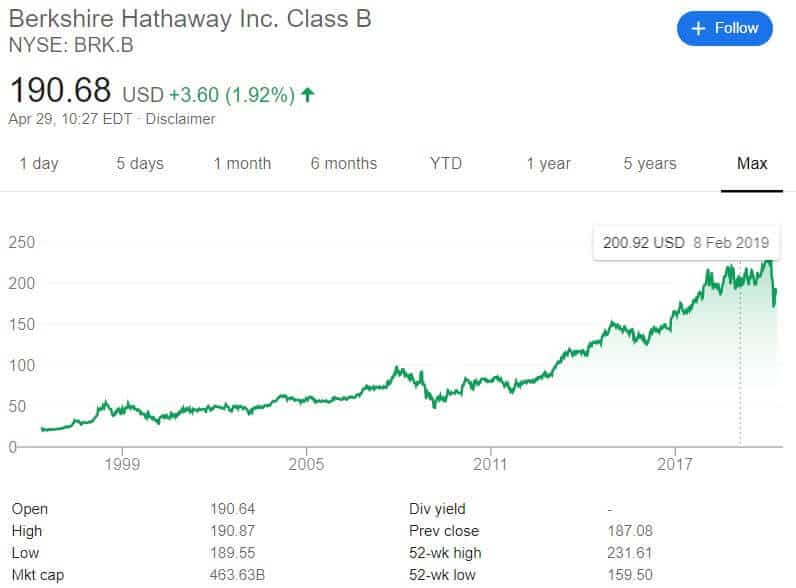

Berkshire Hathaway has two stocks listed in the NYSE: Class A stock (BRK.A) and Class B (BRK.B).

Class A stock is the oldest and was priced at around $280,000 at the time of writing. This stock is extremely expensive to encourage only long-term investors to hold it.

Class B stock, on the other hand, is economically equivalent to 1/1500th of Class A stock (in terms of dividends & voting rights), and traded around $190 at the time of writing. While both stocks track the performance of the same company, they may not always trade at a 1/1500 ratio due to the lower liquidity of Class A stock.

As a result of the coronavirus crisis, Class B stock has lost 16.5% since the beginning of 2020. Despite this slide, the stock is still up 33% from 5 years ago, and almost 700% since inception.

At the time of writing, the analyst consensus was equally split between “Buy” and “Hold”, with next 12 months price targets between $207 and $239 (median of $221).

Why Invest in Berkshire Hathaway?

As one of America’s largest companies, Berkshire Hathaway has been incredibly successful and is the source of Warren Buffett’s immense wealth. Its franchises span dozens of industries, generate over $250 billion in revenues, and a large part of the company’s value comes from capital gains in Warren Buffett’s investments.

Deciding which stocks to invest is a personal decision that must be based on personal research. However, to help you in the process, we highlight below 5 aspects that make Berkshire Hathaway an attractive stock to buy:

1. Strong & profitable track record

Berkshire Hathaway’s $250 billion revenues in 2019 have grown at an average rate of 5% since 2015, while its net profits ($81 billion in 2019) have grown at a stunning ~28% per year over the same period.

A large part of this growth is due to increasing capital gains on Berkshire’s investments (large holdings in Coca Cola, Apple, American Express, Bank of America and Wells Fargo).

Nonetheless, all of Berkshire’s operating divisions have posted very strong top- and bottom-line performances over the past 5 years.

2. A history of successful investments

Warren Buffett is probably the world’s most successful investor, with almost all of his wealth tied up in Berkshire Hathaway stock.

Thanks to the large premiums generated through its insurance division, Berkshire has invested in many of the world’s most iconic companies (Coca-Cola, Apple, American Express etc.) and been immensely rewarded for it.

Not all of Berkshire’s investments have been successful (e.g. Kraft Heinz or Occidental Petroleum), but Berkshire Hathaway has an incredible track record of creating wealth from investments.

Holding Berkshire stock, therefore, offers not only exposure to the performance of its great subsidiaries, but also to its highly successful investment portfolio.

3. Unparalleled leadership

Warren Buffett (Chairman & CEO) and Charlie Munger (Vice Chairman) have been at the helm of Berkshire Hathaway since the 1970s. Under their watch, Berkshire changed from a near-bankrupt textile manufacturer into a gigantic conglomerate and one of the world’s most successful investment companies.

While Buffett and Munger are in their 90s, they remain entirely focused on the business and have been preparing a succession plan for several years. Still today, a bet on Berkshire is a bet on Warren Buffett, one of the most successful investors of all time.

4. Strong cash flows and massive cash pile for acquisitions

In 2019, Berkshire Hathaway generated a net $34 billion in cash through its operating, investing and financing activities, with $39 billion in operating cash flows (~16% of revenues).

Berkshire Hathaway generates so much cash that there simply aren’t enough good opportunities to deploy it. At the end of 2019, the company sat on a gigantic cash pile of over $120 billion.

As the coronavirus-induced crisis hits the global economy, once-overvalued investment opportunities become cheaper. With so much cash on hand, an investor of Buffett’s caliber may be able to add even more high-quality business to his empire in the next few years.

5. Significant diversification

Last, the size and scope of Berkshire Hathaway are such that holding the stock offers significant diversification for the investor, albeit at a possible discount to net asset value.

Buying Berkshire Hathaway stock offers exposure not only to a panel of high-quality companies in different industries but also to Warren Buffett’s personal investment portfolio.

Should I Buy Berkshire Hathaway Stock?

As discussed in this guide, buying Berkshire Hathaway stock is both an investment in a set of great companies and in Warren Buffett’s personal portfolio. Consequently, investors may find the proposition quite attractive.

However, we cannot give you specific investment advice and the decision to invest is ultimately your own. Before investing in any stock, we highly recommend reading the company’s SEC filings, reviewing its press coverage and understanding its business and risks to ensure you make an informed decision.

Investing can be tough and time-consuming but it can be incredibly rewarding. For more resources, make sure to check out our stock investing and stock trading guides!

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

Where is Berkshire Hawthaway listed and incorporated?

Berkshire is an American company headquartered in Nebraska and listed on the NYSE under the BRK.A and BRK.B tickers.

What businesses is Berkshire Hathaway primarily involved in?

Berkshire is a sprawling conglomerate but its main business lines are insurance, railroads, utilities & energy, manufacturing, retail and various services.

What’s the difference between Class A and Class B stock?

BRK.A and BRK.B are economically equivalent (same rights) on a 1/1500 ratio. Simply put, a Class B share is an affordable version that represents 1/1500th of a Class A share.

What should I do before buying Berkshire Hathaway stock?

This guide is designed to help you in your research but cannot be the sole source of your decision. Since Berkshire is a large and complicated firm, we advise that you carefully review its SEC filings and press coverage to inform your investment choice

Can I buy Berkshire Hathaway stock if I am not a US citizen?

You can, you simply need a broker that offers US stocks listed on the NYSE. All the brokers covered in this guide do!

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up