How to Buy AMD Stock in 2021

Advanced Micro Devices (NASDAQ:AMD) is one of the world’s most successful semiconductor companies. Its microprocessors, chipsets, and graphic components are used in personal computers, servers, and gaming consoles across the world.

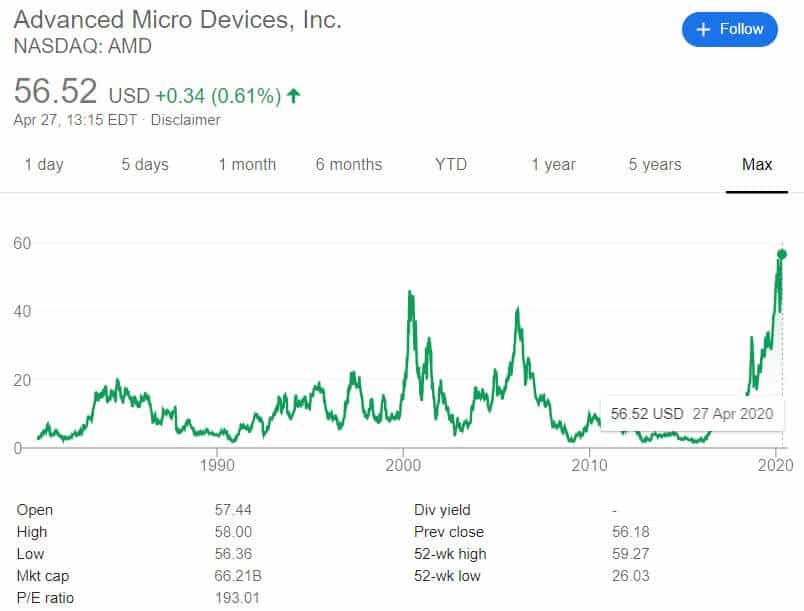

Headquartered in California, AMD stock has been listed on the NASDAQ since 1972. Over the past 5 years, AMD’s stock price has vastly outperformed both the S&P 500 and the Nasdaq composite indices. At the time of writing, its market capitalization exceeded $65 billion.

Looking to buy AMD stock? This guide will review some of the best brokers to choose, walk you through how to place your first trade, and highlight some of AMD’s key selling points to help you in your investment decision!

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.3 Simple Steps to Buy AMD Stock

Don’t have time to read our guide? If you’re in a hurry, simply follow the following 3 steps to buy AMD stock!

[three-steps id=”199863″]Where To Buy AMD Stock

1. eToro: Best all-around broker for buying stocks directly or via CFDs

eToro has become one of the most popular online brokers in the world with over 5 million users and thousands of instruments from Stocks and Commodities to Forex and Cryptocurrencies. Stocks are available directly or via CFDs.

For long and unlevered transactions, users can buy stocks directly on eToro. Short or levered transactions are executed as CFDs. eToro does not charge commissions, offers competitive spreads & daily rollover fees for all CFD trades, and prides itself on being transparent with fees.

The mobile and web platforms are well-designed and very intuitive, with analysis and charting tools that will suit traders of all levels. The newsfeed and search function further contributes to making the trading experience seamless.

What distinguishes eToro from its peers is the social dimension of the platform, mainly via the CopyTrader system. Users can browse other traders, review their performances and risk profile, and choose to automatically copy their trades. This way, users not only draw inspiration from others, but can also take a more hands-off approach to their trading!

Our Rating

- Stocks can be bought directly (unlevered, long trades) or via CFDs

- No commissions, tight spreads & low fees

- User-friendly and well-designed web & mobile platform

- Stock trading is not available to US customers

- No MetaTrader integration

Disclaimer: 75% of investors lose money when trading CFDs with this provider.2. Stash Invest: The best mobile stock trading experience for beginners

Stash Invest is a US investing mobile app specially designed for beginners, passive investors, and investors on a budget. It makes stock investing fun & accessible by allowing users to choose between hundreds of popular stocks and a selection of curated ETFs.

The app is very well-designed and user-friendly. One of its key features is to offer fractional share investing, that is, the ability to buy portions of a share starting with $5. For example, instead of investing in a $60 AMD share, you may simply invest $20 and own a third of a share!

Stash Invest makes all trading commission-free, but users must choose between 3 plans ($1, $3, and $9 per month) that allow investing in full or fractional shares & offer different options depending on their needs.

Last, Stash offers customizable auto-invest (Auto-Stash) and dividend reinvestment features that will greatly enhance the experience of hands-off and long-term investors!

OUR RATING

- Stocks & ETFs investing made simple for beginners

- No commissions, offers fractional shares

- Automatic investment and dividend reinvestment options

- Only available in the US

- Limited range of ETFs

- Monthly account fees

3. Plus500: Leader in CFD trading offering a wide range of instruments (including options)

Plus500 is a well-established and leading online brokers based in Cyprus, whose parent company is listed on the UK FTSE 250 Index. It offers over 2000 financial instruments from Stocks and Forex to Commodities and ETFs (all via CFDs), and is one of very few brokers to offer a panel of call & put options.

Plus500 does not charge commissions on trades but instead relies on low spreads and overnight rollover fees on CFDs. Its mobile and web platforms are very functional and intuitive, suited to the needs of beginners and experienced traders alike.

Opening an account is quick & easy, with a $100 minimum deposit, and Plus500 offers leverage up to 5:1 for Stocks and 30:1 for Forex.

Last, Plus500 offers a range of useful risk management, analysis and charting tools to enhance the trading experience.

OUR RATING

- Hundreds of instruments offered via CFDs

- No commissions, low spreads & competitive fees

- User-friendly web platform & mobile app

- Not available to US customers

- Limited customization options vs. peers

- No MetaTrader integration

Disclaimer: 76% of retail investor accounts lose money when trading CFDs with this provider.How To Buy AMD Stock Using eToro

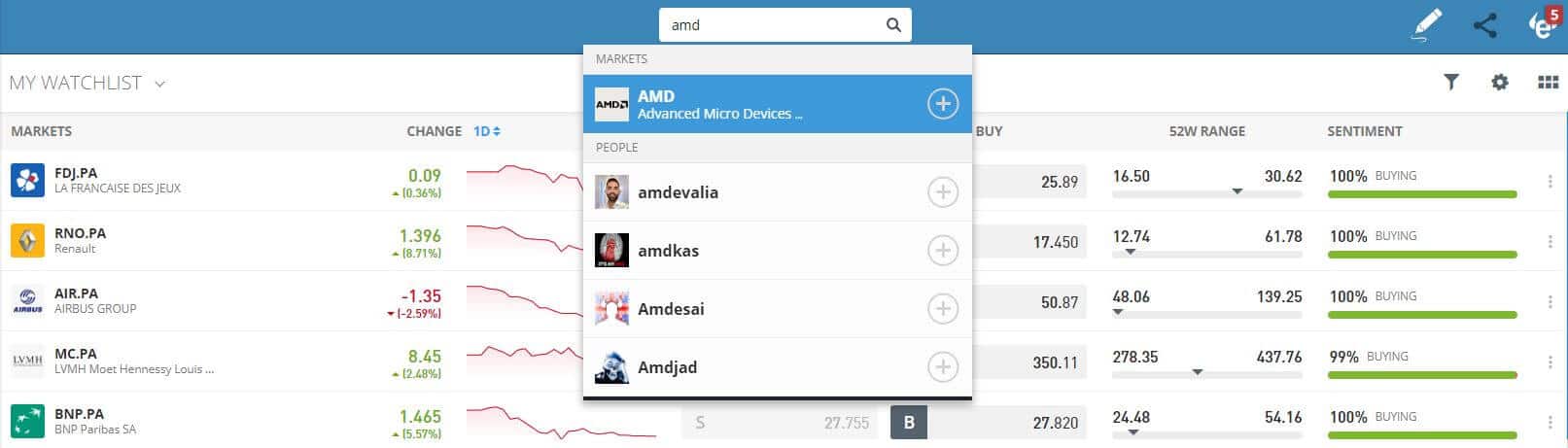

Step 1: Search for Advanced Micro Devices (AMD) stock

Using eToro’s search function, look for “Advanced Micro Devices” or “AMD”. In addition to financial instruments, the search tool allows you to find other traders on eToro’s platform, which you can use for copy trading.

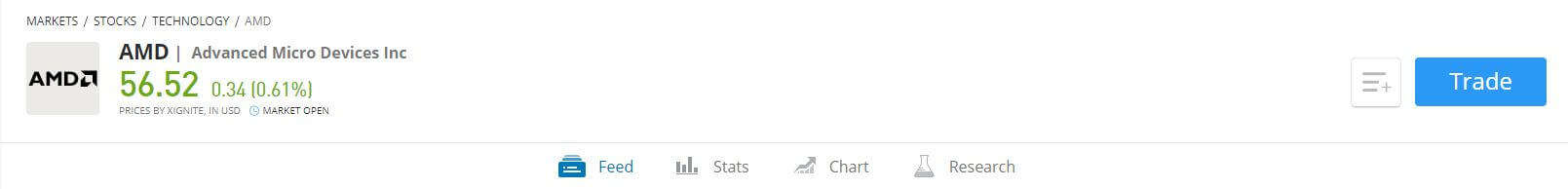

Step 2: Click on “Trade”

When you have decided to buy or short AMD stock, you can access the transaction window by clicking “Trade”. Always remember to check whether you’re using your real portfolio or eToro’s free demo account (“Virtual Portfolio”)!

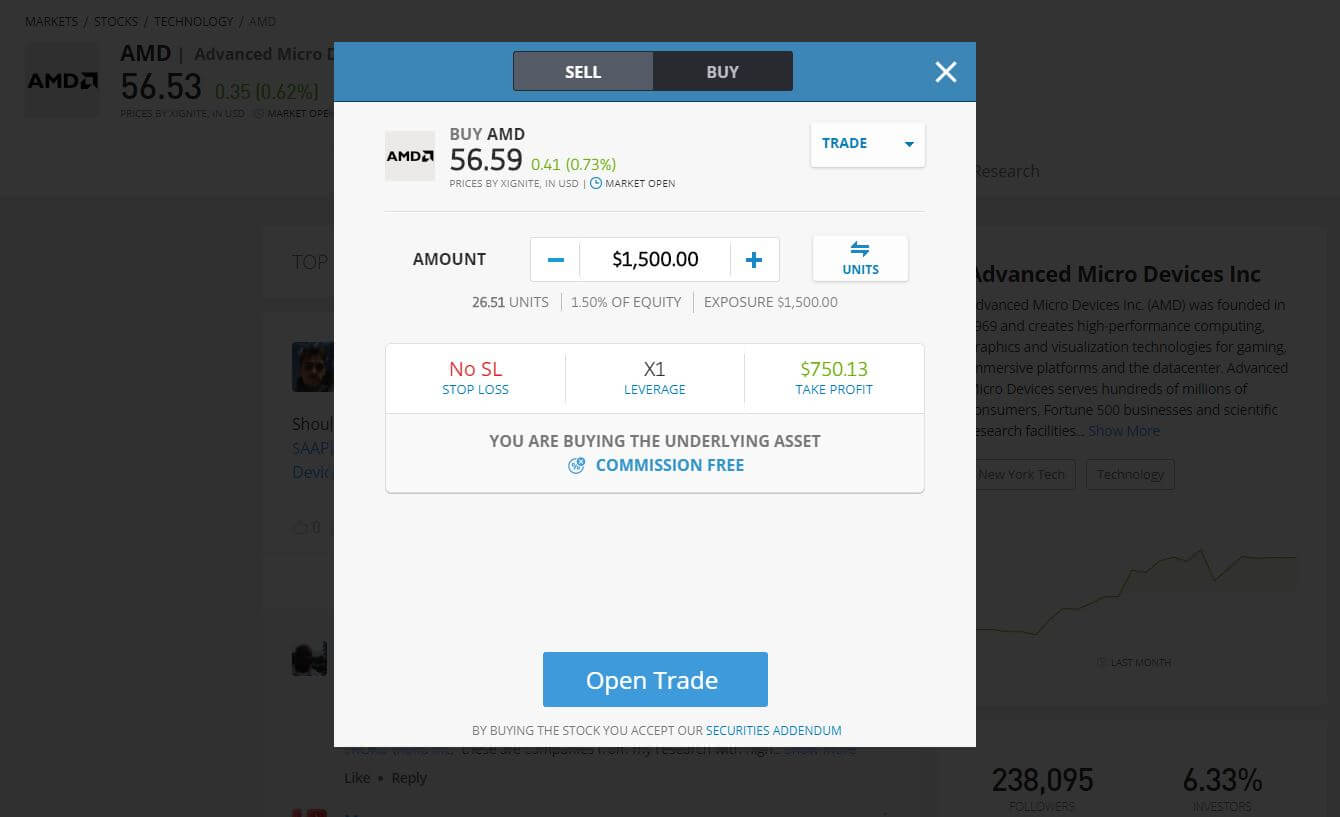

Step 3: Select your order type, the amount and the options you want

In the transaction window, you will see a range of options to specify your trade.

If you choose to buy AMD stock, unleveraged orders will be executed directly and commission-free. Short and/or leveraged trades on AMD stock will be executed via CFDs.

You can choose the number of units of the stock or the specific dollar amount you want to trade.

You may also choose to apply leverage or use special order types (take-profit, stop-loss) for your trade. Last, for all CFD trades, you will see the daily rollover fees displayed at the bottom.

Before executing the trade, make sure you have conducted your own, thorough research (particularly if you are using leverage!).

When you are ready, click “Open Trade”.

Company Background

AMD is a leading global semiconductor company based in California and listed on the NASDAQ.

The company manufactures a wide range of computing products, including microprocessors (AMD Ryzen, AMD EPYC etc.) and chipsets (X570, B450) for personal computers and servers. AMD also manufactures graphics products, including the famous AMD Radeon series, used in personal computers & servers around the world.

It mainly sells its products to original equipment manufacturers (e.g. PC or gaming console makers), data centres, and independent distributors around the world.

AMD primarily competes with the Intel Corporation in the microprocessors realm, and with Nvidia Corporation for graphical processing units (GPUs).

As of December 31st, 2019, AMD employed approximately 11,400 people worldwide and generated $6.7 billion in revenues (up 4% year-on-year).

Its main division, Computing & Graphics (selling high-volume processors & GPUs), accounted for 70% of its revenues, with its Enterprise, Embedded & Semi-Custom (selling specialized equipment for gaming consoles, servers & data centres) making up the rest.

At the time of writing, the company had a market capitalization of $67.8 billion.

AMD Stock Performance

AMD has had a strong start to 2021, up just over 14% since January 1st at the time of writing. In 2019, AMD was the top-performing stock in the S&P 500, up 148%, beating its remarkable 80% return in 2018.

It benefited from strong sales growth across the board, particularly as its Ryzen processors continued to gain market share from Intel. With Sony and Microsoft set to launch their next-gen PlayStation and Xbox gaming platforms later this year and AMD set to supply the necessary chips, analysts expect further growth in the Semi-Custom segment.

The coronavirus-induced boost to the PC and gaming markets heralds more good news for AMD, who will benefit from growing demand for its chips & GPUs. In addition, worldwide stay-at-home orders are spurring massive growth in demand for data centers to power the internet, forecasting more growth alleys for AMD stock.

At the time of writing, the median analyst consensus was $50 with a high of $66, and ratings split between “Buy” and “Hold”.

Why Invest in AMD?

AMD is one of the world’s leading semiconductor companies, second only to Intel. Its microprocessors, chips, and GPUs power millions of PCs, gaming consoles (including the upcoming new PlayStation and Xbox), servers and data centers around the world.

As the best-performing stock on the S&P 500 in 2019 and one of the top performers in 2018, AMD stock has historically been very lucrative for stock trading investors.

Past performance alone is no indication of the future, but there are many reasons to be enthusiastic about AMD’s prospects. Deciding to invest is a personal call that must be informed by thorough personal research. But to help you get started, we list below 4 aspects that make AMD an attractive stock to buy:

1. Strong top-line growth

In 2019, AMD recorded $6.7 billion in revenues, up 4% year-on-year, and 11% per year on average for the past 5 years.

All of AMD’s growth in the past 3 years has come from its Computing & Graphics division, mostly explained by price increases due to high demand together with modest increases in shipment volume. Going forward, an increase in demand for PCs and growth in the gaming market sets AMD’s microprocessors and GPU units for further growth.

While its Enterprise, Embedded, and Semi-Custom divisions have shrunk in size in recent years, increased demand for data centres (due to the coronavirus-induced internet boom) and the release of the new PlayStation and Xbox devices later this year should bring the division back to growth.

2. Growing margins

Thanks to price increases and operational improvements, AMD has significantly grown its margins in the past 3 years, with Gross Margins going from 34% in 2017 to 38% in 2018 and 43% in 2019.

With 13.7% EBITDA margins and 9.4% EBIT margins (up from negative just 2 years earlier), AMD is on the right track. In 2019, its operating cash flow margin was 7.3%, up substantially year-on-year.

Last, although it had failed to turn a profit for several years, AMD’s profit margins have been positive since 2018 and steadily rising to 5.1% at year-end 2019.

3. Promising and fast-improving returns

At year-end 2019, AMD generated remarkable returns, with a return on equity (ROE) of 15.7%, return on assets (ROA) of 6.4%, and return on invested capital (ROIC) of 11.3%.

While these returns still trail those of archrival Intel, they have been growing very fast quarter-on-quarter and are expected to keep improving as AMD finds its footing in key markets.

4. Strong net cash position

Despite AMD’s large spending in R&D, its debt load is small ($486 million) compared to its cash pile of $1.47 billion. With $631 million in EBIT, AMD can cover its interest expenses more than 6 times over, placing it in a comfortable position.

In addition, AMD’s cash flows from operations have improved greatly in the last 3 years, making it sufficiently cash-flow positive to reduce dependency on additional funding.

Thanks to its deleveraging trend in recent years, AMD’s credit rating was upgraded in 2019 from BB- to B by S&P, highlighting an improved credit profile.

Should I Buy AMD Stock?

As we discussed, AMD is a leading player in the global semiconductors industry, on track for further profitable growth despite a rocky past. AMD stock’s earth-shattering performance in 2019 and the company’s future prospects have made it an attractive target for stock investors.

We cannot, however, give you specific investment advice, and the decision to buy AMD stock rests on your shoulders. To go further, we highly encourage you to read AMD’s SEC filings, review its financial statements & press coverage, and look for broker & analyst reports on the company. Ultimately, understanding the risks and the upside potential is crucial to guide your decision.

Investing in the stock market can be tough and time-consuming, but also incredibly rewarding. For additional resources, have a read of our stock investing and stock trading guides!

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

Where is AMD listed and incorporated?

Advanced Micro Devices is an American company headquartered in California and listed on the NASDAQ under the AMD ticker.

What businesses is AMD primarily involved in?

AMD is a semiconductor company that manufactures microprocessors, chipsets and graphic units for personal computers (PC and Mac), servers, data centers and gaming consoles (PlayStation and Xbox) around the world.

Who are AMD’s main competitors?

AMD competes on many segments, but its major rivals are Intel Corporation in the microprocessors and chipsets business, and Nvidia Corporation in the graphics processors segment.

What should I do before buying AMD stock?

While this guide is designed to help you get started, it cannot be the sole source of information for your investment decision. We highly recommend reading AMD’s SEC filings, reviewing its financial statements & press coverage, and getting a clear picture of the business and its risks before investing!

Does AMD pay a dividend or have a share buyback program?

At the time of writing, AMD was not paying dividends or repurchasing shares, and did not signal any intention to do so.

Can I buy AMD stock if I am not a US citizen?

You can, you simply need a broker that offers US stocks listed on the NASDAQ. All the brokers covered in this guide do!

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up