How to Buy Abbott Laboratories Stock: ABT Stock

Abbott Laboratories is a highly acclaimed American healthcare company with a market cap of $165.741 Billion. In the past few months, the Abbott Laboratories Stock price has gained a lot of attention, especially after the healthcare company launched three Coronavirus tests kits.

That, however, isn’t the primary reason why you should invest in Abbott Laboratories. Regardless of the company’s involvement in the Coronavirus treatment, Abbott Laboratories is a global, broad-

Furthermore, Abbott Laboratories was founded in 1888 and is one of the oldest pharmaceutical companies in the United States and across the globe.

In this guide, we discuss whether you should invest in Abbott Laboratories stocks, provide essential information about the company and stock, and list three top online brokers from whom you can buy the Abbott stock.

-

-

Buy Abbott Stock in 3 Quick Steps

don’t have time to read our guide? Follow these three quick steps to buy Abbott Laboratories stock right now.

[three-steps id=”202195″]Where to Buy Abbott Stock?

Since Abbott Laboratories has become a top leading company in the pharmaceutical industry, a few online brokers have incorporated it into their stock product portfolio.

In order to buy Abbott Laboratories stock, you’ll need to open an account with a regulated online broker. Here below, we have listed the top three brokers that currently offer you the stock. But first, we detail the step-by-step guide on how you can buy your first Abbott Lab stock on eToro.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

How to Buy Abbott Stock from eToro

If you are looking for the easiest way to buy Abbott Laboratories stocks, then eToro is our broker of choice. Unlike other online stockbrokers, eToro allows you to buy Abbott stock through the CFD market as well as through stock exchanges. The difference between the two is that while buying Abbott through the stock market means you hold the underlying asset, buying an Abbott CFD will allow you to speculate on the price without owning the stock.

This guide will help you buy Abbott Laboratories stocks via eToro.

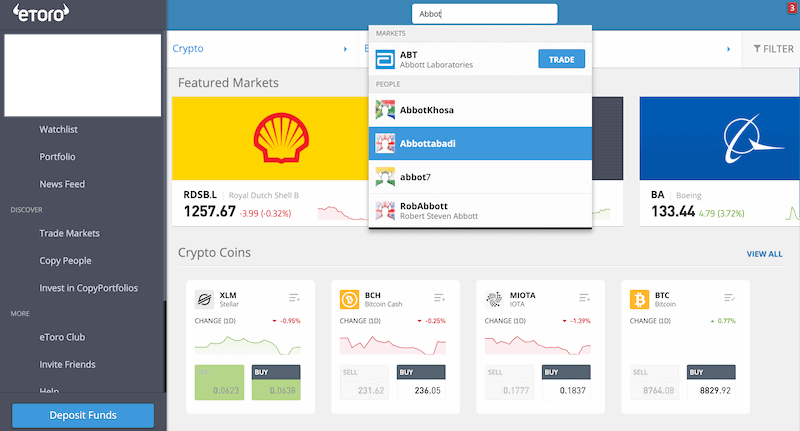

Step 1: Search for Abbott stock

eToro’s trading platform is intuitive and easy to use. Once you enter the platform, simply type in Abbott or ABT at the top search bar. You will immediately be transferred to the Abbott stock page where you can get crucial info about the stock and set the order to buy or sell the stock.

Some of the tools you can use include the price chart, stats, twitter sentiments, and research tools such as general market sentiment, analyst recommendations, and more.

Step 2: Click on ‘Trade’

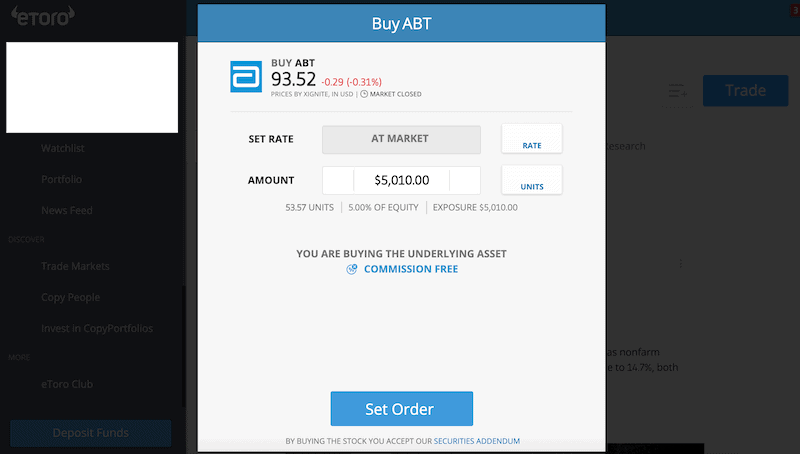

Next, click on the Trade button to proceed with your stock investment.

Step 3: Buy Abbott Stock

On this stage, you will have to set the trade parameters by choosing the type of buy order(market/limit order), the amount you wish to invest in Abbott, the leverage ratio, and the stop-loss, and take profit orders. Then, click the ‘Open Trade’ button to complete your purchase.

Why Invest in Abbott?

Abbott Laboratories shares have been trading in the stock markets since 1929. That makes Abbott one of the oldest companies listed on NYSE as well as one of the most diversified pharmaceutical brand in the world with a wide selection of products consumed by over one million people every day.

To help you along the way, we have listed some of the reasons why you should consider investing in Abbott Labs.

High Price/Earnings (P/E) Ratio

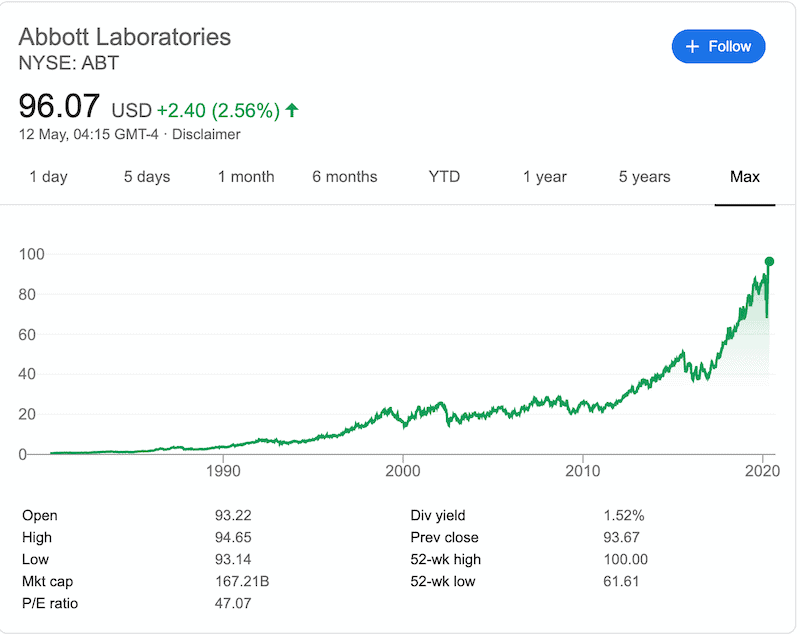

At the time of writing, the Abbott Laboratories P/E ratio is 47.06 which is much higher than the market average of 13 to 15. A higher P/E ratio means that investors will be willing to pay a higher price for the shares of the company, and indicates that investors are optimistic about the future growth of the company. They expect higher growth from the company compared to the overall market. Keep in mind, however, that Abbott’s P/E ratio is extremely high and most likely investors are pricing the available potential sales of the Coronavirus tests.

Stable Dividend Policy

If you are a dividend investor, you should definitely consider Abbott Laboratories as one of the best paying dividends stocks. Even though the company has a relatively low dividend yield of 1.54%, Abbott has a healthy payout ratio and a stable 47 consecutive years of increasing dividend policy.

Better than Expected Q1 2020 Earnings Reports

In April 2020, Abbott Laboratories announced better-than-expected first-quarter earnings. The company reported earnings per share of 65 cents, above analysts’ expectations of 61 cents and revenue of $7.7 billion. The company, however, has postponed its full-year profit guidance due to the uncertainty over the impact of COVID-19.

Abbott Sells Three Covid-19 Tests

In recent weeks, Abbot Labs has gained attention from investors all over the world after it has announced the release of two COVID-19 test kits that can detect if a patient has early signs of the Coronavirus. The company has also introduced a third Covid-19 test kit that can identify whether a person has ever been infected with the Coronavirus. So far, Abbott’s coronavirus antibody test has been proven to be highly accurate in detecting the virus.

While most companies are negatively affected by the Coronavirus outbreak, Abbott Laboratories can increase its sales due to the production of successful COVID-19 tests.

About Abbot Stock

Abbott Laboratories Company Background

Abbot Laboratories was founded in 1888 by Wallace Calvin Abbott, a famous physician who had the knowledge to formulate a tiny pill called “Dosimetric granules”. The pill contained active ingredients of plants and herbs and had much more accurate and effective dosing for patients, which was revolutionary at that time.

Since then, Abbott Laboratories has developed and manufactured a wide range of medical devices, and pharmaceutical products, eventually becoming one of the largest global healthcare companies in the world. Today, Abbott Laboratories operates in more than 160 countries.

Abbott has three core business areas: medical devices, diagnostics, pharmaceutical products, and nutrition. The company is the manufacturer of many popular products in various healthcare areas categorized into nutrition, diagnostics, and medical device. Some of Abbott’s fields of specialisation include:

- Nutrition – Similac, Pedialyte, PediaSure, Ensure, Glucerna, Juven, and ZonePerfect.

- Diagnostics – i-STAT, Alinity, and Architect.

- Medical Devices – FreeStyle Libre, MitraClip, Confirm Rx, Amplatzer Piccolo Occluder, Heartmate, Xience, and CARDIOMEMS.

In 2013, Abbott was divided into two companies: Abbott Laboratories and AbbVie. The first specializes in medical products, while AbbVie is responsible for research-based pharmaceuticals.

Since its foundation, Abbott Laboratories has been responsible for significant discoveries such as the first licensed test to identify the HIV virus in the blood, the Introduction of Glucerna, the glucose monitoring system, and more.

Abbot went public in 1929 and listed on the New York Stock Exchange (NYSE) and has since made to the prestigious S&P 500 Index, as well as the S&P100 Index.

Abbott Stock

Abbott stock reached its all-time high of $98.00 on April 20, 2020.

In 2019, Abbott Laboratories reported a net profit of $3.7 billion, and the annual revenue for 2019 was $31.904 billion, a 4.34% increase from 2018.

The company’s revenue levels have been steady for the past few years and the trend continued in the first quarter of 2020. The company announced that the revenue for the quarter ending March 31, 2020, was $7.726B, a 2.53% increase from the Q1 in 2018.

What Else Should I Know About Abbott?

In 2013, Abbot Laboratories split into two companies: Abbott and AbbVie. You should note AbbVie is traded separately on the New York Stock Exchange under the ticker: ABBV. While Abbott is a diversified medical products company, AbbVie is a researched-based global biopharmaceutical company.

Perhaps one of the greatest advantages of Abbott is the operational coverage in over 160 countries and its dominance in some regions and countries. For example, Abbott is currently the largest healthcare product company in India and holds a large number of domestic biopharmaceutical companies in Chile, China, Argentina, Austria, and Canada.

Furthermore, Abbot has 123 domestic subsidiary companies in the United States, and 103 foreign subsidiary companies across the globe.

Overall, Abbott’s business model is well diversified with four sources of income: Medical devices account for 37% revenue, diagnostics 25%, nutrition 24%, and pharmaceuticals 14%.

Should I Buy Abbott Stock?

Looking at the fundamentals, Abbott’s stock is a buy. The company reports consistent profits over several years and continues to develop new products according to the needs of patients. As such, the recent three coronavirus-related test kits released by Abbott are a great example of the company’s ability to develop new medical devices.

It is also notable that Abbott will remain a dominant force in the biopharmaceutical and healthcare sectors, which are sectors that are resilient to any economic status, and are in any case temporarily. The 2020 first-quarter results presented earnings per share growth as well as higher revenues. Also, the company’s year-to-year Q1 results surpassed its expectations and the Q1 revenues in 2019.

Consequently, Abbott Laboratories stock is trading near its all-time high of $98 with a possibility of hitting an even higher record as it continues to study coronavirus.

And even though Abbott is trading near its all-time high with a Relative Strength Index (RSI) of 60.47 on the daily chart and 69.82 on the monthly chart, technical analysis indicators point to an even more promising performance. The RSI conditions indicate that the stock will move higher at a slower pace or consolidate in the near-term

Based on these, we can conclude that Abbott Laboratories is currently a buy.

Conclusion

Abbot is the 11th most profitable biomedical company in the world, according to Wikipedia. This makes Abbott a blue-chip stock with a long history of dividend growth, a stable basis of income, and huge growth potential. Abbott stock is currently trading at an all-time high price level thanks to the successful release of three Coronavirus test kits.

That said, you must also realize the risk of such an investment. Even though most analysts have issued buy and hold ratings for the Abbott stock, you should always be attentive to any new developments in the company, the market, and the stock.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

What is the main revenue of Abbott Laboratories?

Abbott makes its income from sales of medical devices, diagnostics, nutritional products, and pharmaceuticals products. The company’s main income derives from its medical device segment that generates 37% of Abbott’s total income.

How can I get assistance with my Abbott stock purchase?

If you are not familiar with trading, it is advisable that you contact your online stockbroker. Otherwise, we recommend that you follow the steps above to get familiar with eToro’s trading platform and complete your first transaction.

What is the ticker symbol for Abbott Labs?

Abbott Laboratories stock is traded on the New York Stock Exchange (NYSE) under the ticker symbol ABT.

Does Abbott Laboratories pay dividends?

Yes, Abbott Labs pays dividends for shareholders of the company. As a matter of fact, the company has recently announced the dividend payout for the 48th consecutive year.

What stock exchange are Abbott stocks listed on?

Abbott Laboratories is listed on the New York Stock Exchange (NYSE) under the symbol ABT, and on the London Stocks Exchange (LSE) under the symbol ABTN.

Tom Chen

View all posts by Tom ChenTom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up