Why 60/40?

First, I think it’s important to have a clear definition of what “stocks” and “bonds” mean in this context. For stocks, we are talking about investing in the S&P 500 through a bond mutual index fund or ETF. With bonds, we are talking about the Barclays US Aggregate Bond index which is also available for investment through index mutual funds and ETFs.

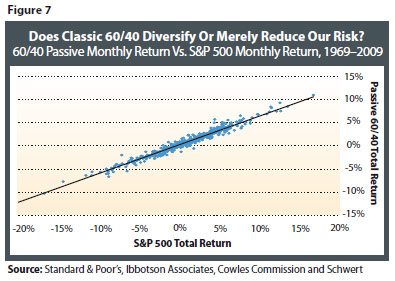

In the article, “Bonds: Why Bother”, published in the Journal of Indexes, Robert Arnott crunches the monthly data from 1969 to 2009. A portfolio invested 60% in stocks and 40% in bonds over that time period had a 98% correlation with a portfolio that was invested in 100% stocks. Very, very similar performance. But, that the portfolio had much less volatility. Essentially, the combination portfolio gave you 2% less return but with 40% (36% to be exact) less swings in value.

Chart From Index Universe Article “Bonds: Why Bother”

How does the 60/40 Rule of Investing Work?

Imagine if you had a portfolio that was 40% in cash which you kept in a vault, and 60% in stocks. If the stock market went down by 10% in the first year, the entire portfolio would lose only 6%. They key is that the value of cash has no volatility. Just by adding cash to a portfolio mix you reduce the ups and downs of the portfolio.

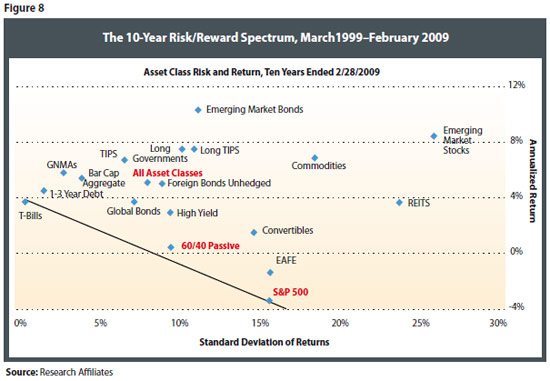

Chart From Index Universe Article “Bonds: Why Bother”

The 60/40 portfolio works on the same concept. It replaces no volatility cash, with low volatility bonds. The bonds in the Barclays US Aggregate Bond Index are very high quality (low-credit risk) and have a moderate sensitivity to interest rate changes. The index is not subject to the relatively large short-term swings of stocks. However, unlike cash in a vault, the investing in bond does produce returns. The 60 / 40 investor is trading off a little return (40% of the difference in the returns between stocks and bonds) for a lot less volatility.

If you needed to take money out of the market in 2008-2009, imagine how happy you would be if you had a 60/40 portfolio instead of 100% stocks. I should note that the 60 / 40 portfolio requires regular (ideally monthly rebalancing) to lower volatility to degree mentioned in this article.

Is the 60/40 Rule Still Relevant Going Forward?

The premise behind 60 /40 asset allocation is that stocks will provide higher annual returns than bonds but, by having a mixed portfolio that an investor will have less volatility. Over the last 5 years however, the annual total return for investing in the stock market, was negative 0.41%. This is versus a positive return 6.91% a year for the bond market, or a difference of over 7% annually. To be fair this period did include the 2008-2009 financial crisis which makes the period less than representative. When the time horizon is broadened to 10 years, the difference decreases 1% annually. Stocks had gains of 4.71% and bonds went up 5.63% over the last decade. In fact, bonds have outperformed stocks for the last 30 years.

If stocks are not going to provide more gains than bonds, there is no point in having the majority of your funds in stocks. However, there are several reasons to believe that this period of time was an anomaly and stocks will outperform bonds going forward.

- Interest rates have dropped dramatically over the last 5, 10 and 30 years. Bonds have increased in value because of the decline of interest rates Assuming that interest rates on T-bills don’t go below zero, there just is not very much more for them to fall. Potential capital appreciation on bonds right now is severely limited with the 10 year trading below 2.0%.

- The market demands compensation for risk. Assuming that markets are efficient over long periods of time, the market will only place money in stocks if they expect the return to be higher than less risky bonds.

What’s the Bottom Line?

While there is no “one size fits all” investment portfolio investors could do a lot worse than a 60% stock and 40% bond portfolio. As bonds are not likely to outperform stocks in the future having the larger weighting of the portfolio in stocks also still make sense going forward.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account