Bad Credit Loans – Guaranteed Approval 2021

Getting a loan from a traditional lender isn’t always easy. If you are reading this article, it probably means that you are thinking about getting a loan, and chances are you’ve previously been rejected. Your eligibility for a loan is based upon several factors, but most notably, your FICO score, which is a gauge of your creditworthiness. A poor credit score means that many providers won’t be prepared to take the perceived risk of lending to you.

The good news is that there are a number of providers detailed below that do offer loans for bad credit scores, and even some that offer loans with guaranteed approval. When seeking finance with a poor credit score, you will find the interest rates will not be comparable to a traditional personal loan from a bank like Wells Fargo or Bank of America, but it will help you overcome your need for cash and help lay the first stone towards fixing your credit score.

In this article, we explore a range of bad credit loan providers, their interest rates and the fundamentals of understanding your credit score. By reading through you will be better prepared to make an informed decision on which provider to choose or if using a bad credit loan provider is even right for you at all.

-

-

Summary of the Best Bad Credit Loans Providers

Reviewers Choice

Upstart RatingAvailable Loan Amount$1,000 - $50,000Available Term Length3 or 5 yearsRepresentative APR7.69% to 36%Product Details

RatingAvailable Loan Amount$1,000 - $50,000Available Term Length3 or 5 yearsRepresentative APR7.69% to 36%Product Details- Best for individuals without a borrowing history or credit record

Pros- More than 70% of loan applications are processed automatically

- Overlooks FICO and embraces AI in determining credit score

- AI removes bias from the credit decision

- Imposes origination fees on loans

Key Facts- Advances loans to individuals without a credit history

- Reports lowest cases of loan defaults

- Has a higher than the banks' average credit approval rate – 73%

One Main Financial RatingAvailable Loan Amount$1500 - $20,000Available Term Length24 monthsRepresentative APR16% to 35.99%Product Details

RatingAvailable Loan Amount$1500 - $20,000Available Term Length24 monthsRepresentative APR16% to 35.99%Product Details- Suitable for individuals with the worst credit scores

Pros- Advances credit to individuals with lowest/non-existent credit scores

- Maintains a wide presence throughout the country

- Maintains higher loan limits of up to $20,000

- Hard credit inquiry hurts your score

Key Facts- Lends to high-risk borrowers

- Clear loan terms with no prepayment fees

- Nationwide branches offer one-on-one interactions

Lending ClubRatingAvailable Loan Amount$5000 - $40,000Available Term Length3 yearsRepresentative APR6% and 35.89%Product Details- Best P2P lender for bad credit borrowers

Pros- Long term loans of up to 60 months

- Lenders willing to advance you loans despite the low credit score

- Soft credit search doesn’t hurt your credit score

- Imposes an origination fees of up to 6%

Key Facts- Maintains the largest base of lenders both individuals and institutions

- Presents you with several loan options to choose from

- The loan terms – APR and term length are dependent on your credit score

Note, if you’re looking for UK bad credit payday loans, visit our site here.

Understanding FICO Credit Scores

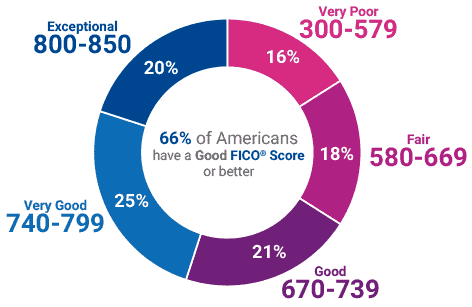

There are several methodologies and models utilized in the US to determine the creditworthiness of an individual, the most common is the FICO Credit Score which is used by 90% of US lenders.

The FICO model classifies individuals in five different categories, ranging from 300 which is the worst score possible, all the way up to 850, which is the perfect score. Even though this is the benchmark utilized by most lending companies, it is common to see individuals struggling to understand their credit rating, and the possible steps that could help them improve.

There are five main factors that influence credit scores, including; payment history, credit utilization, length of credit history, new credit applications, and credit mix.

Payment History

- This factor refers to your ability to pay your bills on time. If you have period blips on payment history timeline this can adversely affect your score. FICO is known to use past payment behavior to forecast your long term outlook of reliability.

Credit Utilization

- A view of how much credit you have available to you and how much you are taking advantage of. If you are maxing out your credit limits on a regular basis it may look like you are not being responsible with your funds. If you can maintain a low-level credit utilization over the long term, you will build a pattern of behavior that makes you more trustworthy.

The length of credit history

- This the amount of time you have had open accounts and the frequency of your interactions with those accounts. It is suggested that this factor accounts for 15% of your FICO credit score. Increase the frequency of interactions with your credit accounts by using low levels of credit will improve your score. Remember to always pay the contracted minimum payment back each month for your bad credit loan, and if possible, in the case of credit cards, clear the entire balance each month to avoid paying any interest.

New Credit

- Every time you open up a new line of credit, a check is completed on your record. If you have multiple checks done in quick succession, it can indicate to lenders that you are experiencing financial trouble. Try to space out applications from different sources. This factor is said to be approximately 10% of the FICO scoring system.

Credit Mix

- Another factor worth 10% of the overall score. Credit mix is a less clear category, in that experts suggest that you should have a variety of credit relationships for different types of finance. The theory is that those who can manage a balanced range of credit agreements are better with managing their money.

Very Poor 300-579Fair 580-669 Good 670-739 Very Good 740-799Exceptional 800-850You can find yourself in this category either because you have no credit history or because you have damaged your score over time. The most common causes for a bad credit score are related to defaulting on payments to multiple lenders, this is a red flag to all lenders that you have a history of not paying on time, or not doing it at all.

The other possible reason for such a number could be because of bankruptcy, in this case, keep in mind that it will be a part of your record for a maximum of 10 years. If this is your case, there are not many things you could do in order to improve your score during this time. Putting in place a plan to manage your money and credit relationship now can help you once the bankruptcy notice has been lifted from your file.

If you already have a bad credit score you are not alone, but now you have recognized the issue you can put in place steps to improve! If you need more help, reach out to your financial advisor or your local bank in order to receive guidance on how to improve your score. Keep in mind that this is not something that will change overnight, but the sooner you start, the sooner you will be able to see the results reflecting in your score. Remember there are bad credit providers out there that can offer personal loans with guaranteed approval. There are also similar providers that can cater for bad credit payday loans, but use these only as a last resort.

In this category, you are a little under average, most likely you’ve had challenges with monthly payments here and there but without other more serious problems. Under this classification you will be able to apply for personal loans or credits and chances are you will be approved, the only problem is that the rates at which you would be able to borrow money will be higher than for those with better scores.

Before applying for a loan you should thoroughly review the market to see if you will be able to take a loan while in this category and to find an interest rate that is manageable for you. Interest rates at this level will be expensive and can cause financial challenges if you don’t keep up with your monthly payments. Consider the lowest levels of borrowing that will suit your needs in order to create a manageable repayment scenario for yourself.

The sooner you start the more money you will save on any borrowing in the future. It is worth noticing that financial institutions perceive individuals in this category as subprime borrowers.

If your score is in this category you rank as above average in America. Keep in mind that at this level you will be able to get your hands on most types of personal loans but the offered interest rate while better than lower categories will still not be the best-advertised rates.

To put it into perspective, when a bank or a lending agency sees a “Good” FICO Score they are forecasting that historically speaking only 8% of individuals in this category will incur in major delinquency in terms of repaying.

Only 25% of all Americans can say that they are in this category. If you have done things the right way all of your life and you are lucky enough to have a clean slate you should feel proud about it. With all the points that are taken into consideration to be part of this higher range, it is definitely not easy to maintain. Continue with all the healthy habits that have brought you here.

The objective in this category is to manage, maintain and reach for the highest credit rating category. With this rating, you will be offered good rates most of the time when applying for a loan. The premiums on interest rates will surprise you once you pass this class.

If you are fortunate to be in the upper category of credit rating, it may be that your earnings are offering you more security when it comes to paying back on time. Do remember to use credit even if your earnings suggest that you might not need to. Without a regular relationship with financial providers, your score may drop due to a lack of visibility for providers. Utilizing credit cards and paying back the full balance each month will offer you the easiest method of keeping on a credit provider’s radar without paying any additional fees. Be aware not to overstretch yourself, however, as this can lead to problems down the line.

Being part of the 21% that comprises the upper range of the FICO score system is a big achievement. Under this category, you are considered as an individual of very low risk as you have proven to be exceptionally responsible with your monthly payments and your debt management. This category is what advisors and other experts usually refer to as the Big 8.

Besides being able to access any single type of loan or credit in the market, you will also be able to enjoy preferential market rates. This is a level where banks may call to offer their services and not the other way around.

Best Lenders for Individuals with a Bad Credit Score

1.Upstart – Best For Individuals with No Credit History

In the first of our first bad credit loan reviews, we explore Upstart. They might not be the most recognizable name on this list but the company is truly a hidden gem in the market. The company was founded in early 2012 by a group of ex-executives from Google and a private equity fund.

Over the years they’ve generated a substantial fan base due to their approach to credit risk. This is a firm where instead of solely focusing on a FICO score the company also analyzes and takes into consideration how other factors influence your creditworthiness. This includes factors such as education, GPA, area of study and more.

From a loan perspective, the firm is the goto for individuals that don’t have a credit history or simply a credit score that was not sufficient for more traditional lending companies.

This is a reputable company with the backing of important names in the tech industry like Google Ventures and even Mark Cuban.

- APR: 7.69% to 36% (This is where your credit score will make the difference)

- Loan Type: Personal Loan

- Loan Amounts: $1,000 t0 $50,000

- Minimum Credit Rating: 620 (The firm does not request credit history)

- Length: 3 or 5 years

Our Rating

- Fast execution: This is a company that offers lightning-fast processing and funding. With Upstart, you can expect the funds in your bank account in less than 24 hours after the approval

- Soft Inquiry: Different from other institutions, Upstart starts the whole credit score analysis with a soft review. This ensures that any applicant credit scores won’t be affected just for finding out if they are eligible.

- Process Selection: As mentioned above, being evaluated on factors above and beyond FICO score offers credit seekers a genuine alternative.

- Repayment: Even though you can choose to repay your loan amounts early, the company only offers two basic loan durations, either 36 or 60 months.

- Origination Fees: The firm can charge anywhere from 5% to 8%, this will be deducted from the money prior to delivery. Keep this in mind in order to calculate how much money you truly need, there isn't anything worse than having to request a loan just to later realize that money in hand is less than expected after commissions and fees. Do your math beforehand to avoid finding out the hard way.

2. OneMain Financial – Best For Really Bad Credit Rating

OneMain is a financial institution with more than 100 years of history. Over its life, the company has changed its business model many times, from being focused solely on corporate banking to being the distress loans subsidiary of one of the most important American banks. Through this time the company has remained a strong and necessary part of the American financial system.

In the past decade, the focus of the firm has changed to a model of offering personal loans for bad credit individuals. The intention is to offer a borrowing solution to those individuals without proper credit history or who reside in the lowest credit score category. OneMain Financial will use your FICO score to determine their risk exposure and assign an interest rate accordingly.

If your credit score falls into anything above “Good”, you should try to apply somewhere else as the interest rates that will be offered can be incredibly high compared to a traditional bank or lender.

- APR: Anywhere from 16.05% to 35.99%

- Loan Type: Personal Loan

- Amounts: $1,500 to $30,000

- Minimum Credit Score:

- None Length: 24 to 60 months

Our Rating

- Credit Score: If what you were looking for was a company that will give money to anyone, then this could be for you as it is exactly what this company does. Keep in mind that this is one of the only reputable companies that will lend money even if you have a bad credit score.

- Large Branch Network: The company offers hundreds of branches over 44 different states. The company is so widespread that you are likely to live in a state where you can take advantage of OneMain Financials services.

- Expensive: The rates are without doubt expensive, but if you are highly in need of a loan amount and your score is in the lows, then this could be an option.

- Can’t be done fully Online: The firm will require you to visit one of the branches to fulfill documentation and approve the loan.

- Credit Rating Inquiry: Different to Upstart, OneMain will conduct a hard credit check, which can lower your credit score. Consider that if you are at the minimum of any bracket, chances are this strategy will take you into a lower band.

3. LendingClub – Best For P2P Loans

LendingClub is another disruptive FinTech company straight out of California. The company focuses on connecting lenders and borrowers through their app and charging a commission for any loan processed.

This is a very simple and straightforward operation that focuses on offering borrowing solutions to individuals who have been rejected by traditional financial institutions.

The company has a proven market place where lenders offer their money, individuals come to borrow, and at a desirable interest rate. Not only does the platform offer to lend from individuals in a more traditional p2p environment, but they also offer access for certain institutions to offer their money through the app.

If you have a credit score with one too many dents you might want to take a look at LendingClub, it is very likely that you will be able the find a lender that is open to considering your profile. Keep in mind that borrowing through this platform will be extremely expensive due to your credit score. It is important for you to understand what all the payments will be and to ensure you have the ability to repay fully.

- APR: 6.95% to 35.89%

- Loan Type: Personal

- Loan Amount: $500 to $40,000

- Minimum Credit Score: 600

- Length: 36 to 60 Months

Our Rating

- Long Loan Terms: Being able to access long term personal loans with such ease is a great deal for many individuals with a bad FICO.

- Low Credit Score: The main reason you are dealing with these institutions in the first place.

- Soft Inquiry: The firm will perform a soft inquiry to determine your credit score, this is in order to preserve your current credit rating through the inquiry process.

- Slow Funding Process: This may be problematic for those seeking funding by a close date in order to cover a payment or expense. With LendingClub you will have to plan in advance or simply gain some patience as their disbursement time can be longer than many names on this list.

- Origination Fee: Origination fees can easily surpass 6% of the value of the loan. This is a hefty chunk that you are loosing simply in management fees.

4. Prosper – Best For Flexibility

Prosper Funding is a subsidiary of Prosper Marketplace Inc. It is headquartered in San Francisco, California. The platform mainly deals with unsecured personal loans. The difference with Prosper is that the personal loans are offered as part of peer to peer lending platform. This means that the people funding your loan amounts are often members of the public or institutional investors as opposed to companies lending directly out of their own reserves.

The process of acquiring a loan is much the same as many other providers. Enter your details through the online portal, choosing the amount you want to borrow and the desired timeframe. Borrowers can apply for as little as $2,000 up to a maximum of $40,000 with a fixed interest rate and term.

Prosper evaluates the creditworthiness of the borrower and gives the loan a risk rating. The request is placed on the P2P platform and lenders make bids on your loan. If you have good credit you are likely to get an attractive interest rate, whereas more risky loans will attract inflated rates to offset the investor's risk. If your loan amounts are funded by the time the bidding closes, you will be contacted to confirm your identity by providing documentation to complete the process. It is at this point that your funds will be transferred to you.

- APR: 6.95% to 35.99%

- Loan Type: Personal

- Loan Amount: $2,000 t0 $40,000

- Minimum Credit Score: FICO Fair

- Length: 36 to 60 months

Our Rating

- No Prepayment Penalty: Most lenders offering their services to individuals with bad credit scores usually demand individuals to complete within the full duration of the loan or to pay for a penalty for early repayment. Prosper is different as the firm allows individuals to prepay their debt with no penalty, instead, they are active in offering this incentive to their customers.

- Soft Inquiry: The firm will review your existing credit rating with a soft check on your information. This ensures that you will not be penalized for the inquiry.

- Origination Fees: In some scenarios, there are high origination fees that can be challenging for individuals with bad credit scores. Whenever you are in need of a loan amount to cover some specific payment you should consider all the fees associated with it and also how much you will receive in hand.

- Potential to go Unfunded: This platform works different from other P2P companies, this is because you are basically listing in the exchange and that does not mean you will always get funded. It is possible that depending on the risk appetite of the lenders you can walk away unfunded. Typically the firm allows listings to be active for 14 days but it could be less.

Guaranteed Approval Loans For Bad Credit

Of the providers that we have reviewed only a few can claim to guarantee approval for a bad credit loan. Of those that do, the company that you are most likely to get credit with is OneMain, who as we discussed, examine your credit profile, and provide an interest rate based upon your circumstances. The fees will be high but this is the provider you probably have the best chance with. It’s also reassuring to know that this is one of the oldest financial establishments in the US.

The second most likely provider to provide a guaranteed bad credit loan from our review list is Upstart, as they take a wider view of your circumstances. It’s not strictly speaking guaranteed that you will get a loan, but they are worth considering due to the wider consideration they pay to other factors.

Conclusion – Getting a Bad Credit Loan Fast

It is not an easy task to rebuild your credit rating but with time and effort, it can be done. Even with a bad credit score, if you take the time to research the offerings of various providers, you will be able to get the loan amount you need.

As a result of your FICO score, you will need to deal with high fees and interest rates, but manage the amounts you borrow and the repayment terms carefully, and your interest rate for finance in the future will come down. Investigate who will lend to you with your current score and triple check the terms, the monthly payments and that you are sure you can make repayments within the agreement. Proceed by checking out our recommended lender below.

We hope that by reading our bad credit loan reviews you will now be in a better position to make a balanced decision on how you take out finance. Should you require specific advice on your personal circumstances speak to your bank or a financial advisor for tailored support.

Glossary of Loan Terms

FAQs

💸 Can I get an instant decision on a quick bad credit loan?

A lot of bad credit loan providers will give you an instant decision if you apply online. By applying online, providers will assess your credit history, your FICO score, and your income and be able to deliver an instant decision. Upstart pride themselves on having your loan to you within 24 hours. Some few providers also offer guaranteed approval like OneMain Financial.

💸 Who are Bad Credit Loans for?

Bad credit loan providers are primarily for people who have no credit rating or sit within the lower credit rating bands. If you have good intermediate credit or better consider more traditional lenders as this category of loan provider often comes with much higher interst rates.

💸 Can I get a guaranteed loan with any bad credit loan providers?

Yes, bad credit loan providers are there to lend you money when your FICO score and financial history have let you down. Depending on how much you want to borrow and how long for will play a large part in which provider is right for you.

💸 What are bad credit loans?

Bad credit loans are for people looking to consolidate debt, address a cash flow emergency or service a necessary big purchase. They work the same as traditional personal loans, however, the eligibility criteria is much lower.

💸 What is Credit Usage?

Credit usage represents how much of your standing credit balance you are using on average. This means that if between credit lines and credit cards you have available credit for $10k, and you use $2,000 your usage would be 20%. Even though there is not a magic number, it is important to always remember that the higher the usage the more it will affect your credit score. Many experts and financial advisors recommend to never exceed 30% at any time, this will ensure that you won’t be affecting your credit rating. The idea behind having credit is to take advantage of it, having lots of credit lines and credit cards unused will do even more harm to your score than if there were used properly.

💸 Is it true that checking a credit score brings it down?

The answer is No, but also Yes at the same time. The situation here is that there are two different types of credit score inquiries, one being soft reviews that are usually done by you or your employer and they will not have an impact on your score. On the other hand, if the inquiry is being done by a financial institution or a credit card provider it will be considered as a hard review, and it will cost you some points of your score (at least for a couple of days). The reason for hard reviews to have an impact is that they usually come before new products or credit types. The idea is to be preparing the score beforehand. With this, I mean that other credit agencies will see that there is a movement being done. This also prevents individuals from simply applying to 10 credit cards at the same time.

Types of Loan – A-Z Directory

Vidal Arias

Vidal Arias

Vidal is an experienced Strategist and Portfolio Manager with a keen interest and passion for the financial markets and also writing. During his career, he has developed excellent market timing skills, focusing mainly on the macro analysis of the US Equity Market and the overall US Financial Market. He started his career as a financial analyst for a major American bank and continued his way into the trading desk as a Sr. Trader and later as a Portfolio Manager for an Offshore Hedgefund in Europe. Linkedin: vidalarias Email: [email protected]View all posts by Vidal AriasWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up