Nutmeg Review 2021 – Is it Worth Trying?

Robo-advisors are growing fast in the UK and are already threatening to take away

The automated services are also being preferred by more people as they are cheaper than human advisors. However, the robo-advisor field is now flooded, making it harder for a beginner to choose the right platform.

In this Nutmeg review, we take a closer look at the UK’s largest robo-advisor that adds a human touch to its automated services to help you narrow down your choices.

-

-

What is Nutmeg?

Nutmeg is the UK’s first online discretionary investment management company and market leader with over 1.5 billion of assets under management. It was founded in April 2011 by Nick Hungerford and William Todd. According to Nick, frustration by the exclusivity and lack of transparency in the investment world pushed him to start Nutmeg and make investing easier for others. Today, the company has over 60,000 customers, of which more than 40% have never invested before. Earlier this year, Golden Sachs backed the company in a £45 million investment round that will push the now eighth largest wealth manager in the UK to global markets.

Robo-advisors are digital platforms that provide financial and or investment management based on algorithms and with less or no human intervention. Have a look at our list of best robo-advisors hereThe company uses algorithms and in house market analysts to provide tailored investment portfolios that consist of ETFs. The exchange-traded funds give investors some degree of portfolio diversification. Each portfolio is chosen for the investor depending on their risk appetite. The service targets beginners and passive investors who prefer a laid-back investing approach with decent returns and low-risk levels. Nutmeg is also a great option for cost-conscious investors.

The company is always in the headlines, not only for its many clients but also because it is yet to turn a profit despite its clients doubling and over 187.9% growth in assets from £521 million in 2016 to £1.5 billion in 2018. Martin Stead, the CEO, says that the business is on track and they are investing heavily in the business to further establish itself in the market. However, this should not be a concern for investors as their investments are held by the appointed custodian, State Street Corporation. It is also covered by the FSCS. So is Nutmeg right for you? Read on!

Nutmeg Pros- Competitive and transparent fees structure

- The user interface is simple and easy to use.

- Quick account and portfolio set up

- Personalized risk and portfolio according to the risk appetite of the investor.

- Proven track record – Nutmeg was the online discretionary investment management company and is the largest robo-advisor in the UK with over £1.5bn in assets under management

- Great customer service

Nutmeg Cons- High minimum investment requirements. Especially for General and ISA accounts that require a minimum investment of £500 and a minimum monthly deposit of £100 until £5,000 is reached

- The platform does not provide tax optimization features present in other robo-advisors

- No third party research, the research and educational material available on the site is pretty basic.

How Nutmeg works

During the sign up process, Nutmeg asks you about your goals and risk appetite and uses the information to decide what type of investor you are. The algorithm will then choose the portfolio that is most likely to help you achieve your objectives, whether you are classified as adventurous or cautious. The funds you deposit are invested in a wide range of funds to minimize the risk while increasing the opportunity for higher returns.

The company’s team chooses the investments from a pool of over 1800 ETFs. The team selects the ‘best’ ETF for every asset class, industry sectors or region. Some of the factors they consider include:

- The components of the index – the team looks at the underlying components to be able to judge if it is a suitable investment, in their own opinion

- Costs –the fund management fees and costs of running the fund are charged to the investor, therefore the team looks for the funds with the lowest total expense ratio in each category

- Size and trading volume – the team considers the size of each ETF and also ensures the trading volume is not limited.

- Type of ETF – Nutmeg only invests in physically backed ETF with high liquidity and good tracking performance.

Nutmeg is an independent company and therefore it can select any securities, assets or holdings and they are not tied to a single provider. The ETFs track developed equities, emerging markets equities, developed and emerging government bonds, corporate bonds, commodities, and global equities. Nutmeg reinvests your dividends automatically and rebalances your portfolio to stay in line with your risk tolerance. Either investment you choose, the platform gives you the ability to change your risk level anytime.

Even though Nutmeg chooses and invests your money automatically, the pools of funds are selected by human investment managers who are always looking for better funds and reviewing the existing ones to ensure they still meet the client’s needs. This strikes a balance between the low cost and high efficiency of algorithms and the flexibility and insights of human managers.

Nutmeg Investment styles

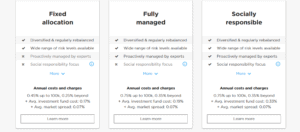

For any account you choose, you are given a choice of three investment styles, fully managed, socially responsible and fixed allocation. All three styles are diversified and regularly rebalanced and have a wide range of risk levels.

- Fixed allocation – If you select fixed allocation, your ‘pot’ will be assigned one of five diversified risk-based portfolios. The portfolios are designed to perform without human intervention and they will only be reviewed once a year to ensure they still match your risk appetite. However, they have the lowest fees, up to 40% lower than managed portfolios. This is the perfect portfolio for experienced investors who are not afraid of the up and downs of the market.

- Fully managed – If you choose this option, your investments will be managed by Nutmeg’s investment team who will make adjustments to ensure you get higher returns in your risk level.

- Socially responsible – The portfolios in this investment style are guided by the in-house management team, just like in the ‘fully managed’ style. However, they lean towards companies with strong sustainability profiles and avoids those that engage in controversial activities. The platform works with MSCI to give each portfolio a range of scores. The socially responsible investment is offered at the same charge as the fully managed portfolios.

Getting started with Nutmeg

Nutmeg is primarily intended for UK residents but it also considers non-UK residents in certain countries. You may be eligible for an account as a non-UK resident if you hold a British Passport and have a UK bank account. It no longer accepts US persons due to the tax reporting requirements imposed by the IRS.

The platform offers a portfolio preview where you can view the options offered before opening an account. To open an account, click ‘get started’ or ‘invest now’ on the homepage. You will be asked to choose an account, select either a general investment account, a stocks and shares ISA, a Lifetime ISA or a personal pension.

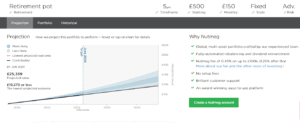

The next step will involve answering questions to determine your risk tolerance. the questions include what you are investing for, how long you intend to invest for and how much you can invest, starting amount and monthly deposits. The platform will then show you a projection of how they expect your portfolio to perform.

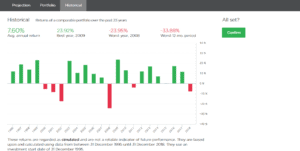

If what you see impresses you, you can proceed and create an account. You will be required to enter your email and enter further details about your investment experience and questions to ascertain your risk tolerance. A risk profile will be displayed and if you are not happy with it, you can retake the assessment. To ensure you are satisfied with your risk level, the historical returns of a comparable portfolio will be displayed for the period over the last 23 years. Double check the information and you will be ready to set up your account.

Account types available at Nutmeg

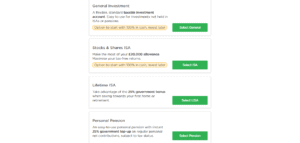

Nutmeg offers four account options, general account, Stocks and shares ISA, Lifetime ISA and Personal Pension /SIPP. Currently, the platform does not offer trust, joint, corporate or Junior ISAs.

Stocks and Shares ISA – this tax-free Individual savings account allows you to invest up to a certain amount every year without having to pay taxes. The Stocks and shares ISA will be tax-free even when it is time to sell. However, there is an annual contribution limit.

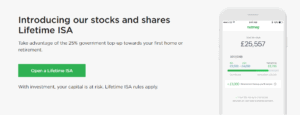

Lifetime ISA (LISA) – this is a government initiative to encourage people to put aside for their first home or retirement. It is available as a cash ISA or a Stock and shares ISA, Nutmeg only offers the stocks and shares ISA. With this account, you can contribute up to £4000 each year until 50. For every contribution, you will receive a 25% government incentive. If you withdraw from the LISA before 60, you will be charged a 25% government penalty on the amount you withdraw unless you are buying your first home or you are terminally ill and have less than 12 months to live.

General Investment account – this is an account you should open after you have exhausted all the tax-free options. This is a general account and you will not receive tax breaks or government incentives.

Nutmeg Pension – (SIPP) this is an option if you are willing to lock your savings away until you are 55 years old. The government tops up every contribution you make. The contributions you make towards the SIPP are usually eligible for a tax relief. The government tops up 25% of any amount if you are a basic taxpayer. You can also withdraw the first 25% free and pay income tax on the remaining 75%. On the downside, you only qualify to withdraw from your pension scheme at 55.

Nutmeg Features

Proactively managed portfolios – Nutmeg offers investments styles that are managed by the human investment team. To use this feature attracts an extra cost although it is a great option for investors who will only feel comfortable if a human is looking over their investments. The team reviews the market trends daily and rebalances your portfolio accordingly.

Two-step verification – to add extra security, the platform allows you to set up two-factor authentication. The feature requires two forms of identification before access is granted to your account. Other security measures include the use of TLS encryption.

Socially Responsible Investing – Nutmeg provides socially responsible investing to cover the growing investing approach. The platform provides proactively managed portfolios that lean towards environmental, social and governance principles including what the companies do internally and externally. The acceptable investments exclude companies that deal in weaponry, nuclear production and tobacco. Nutmeg’s portfolios are given scores that rank each in relation to ESG principles. They carry the same fees as the fully managed investing style portfolios.

Research tools and insights – the platform seems to have fewer research tools compared too other robo-advisors but that is because it does not allow self-directed investments, there is no option for customers to choose individual investment vehicles. However, they have a page on their website called Nutmegonomics where investors can access market-related information.

Customer care – the platform has an online chat feature for clients and prospective clients. Customer service is also available during working hours and it has different email addresses for support and complaints.

Financial advice – Nutmeg provides an option to book a call and speak with a financial advisor regarding your circumstances. If you go on and take the advice, the charge will be £350.

Nutmeg Fees

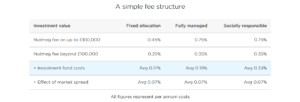

For fixed allocation portfolios, Nutmeg charges a standard 0.45% on the first £100,000 and 0.25% thereafter. Other fees include investment fund cost averaging at 0.17% and average market spread charges of 0.07%. For the fully managed portfolio, the annual cost up to £100,000 is 0.75% and 0.35% thereafter, plus 0.19% investment fund cost and 0.07% market spread charge. The Socially Responsible portfolios will cost you 0.75% up to £100,000 and 0.35% thereafter. Additional costs include 0.07% market spread and 0.33% average market investment fund cost.

Nutmeg Review: Verdict

The platform provides competitive services with user-friendly tools, interface and easy account set up. When compared to other robo-advisor services, it provides a more hands-on investing experience but it may seem more expensive. Nutmeg is a great option for investors who are interested in discretionary investment manager but still want to save on the costs.

Nutmeg offers great investment and customization options although the high fees and relatively high minimum investment balance may be a deterrent to some investors.

FAQs

Is my money safe with Nutmeg?

Your investments are held by the State Street Corporation as the appointed custodian. The corporation has over $28 trillion in assets under custody. Your investments are not mixed with Nutmeg’s assets. Uninvested cash is kept segregated at Barclays. Your money and investments are therefore protected in case either of the three institutions goes bust. And if they do, the overall management of your investments is covered by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Can non-UK residents use Nutmeg?

Yes, if they have a UK postcode and bank account. Contact the Nutmeg customer support team to know if your resident country is eligible.

How do I close my Nutmeg account?

The first step is to withdraw all the money in your General or ISA account, then send them a ‘Nutmail’ to the support staff requesting to deactivate your account. Your account will be deactivated within 6 months after the request, Nutmeg will retain your records even after you have closed the account.

How long does it take to withdraw?

Withdrawals typically take between 3-7 business days but can take longer in some circumstances.

When is my money invested?

Nutmeg generally invests twice a week, typically on Monday and Thursday.

Is my investment locked in?

No, despite investing being a long term proposition, you can withdraw at any time from Nutmeg.

Is there a minimum investment?

Yes, for a LISA, the minimum is £100, for a General account and ISA the minimum is £500 and £100 per month. The Pension’s minimum investment is £500.

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up