Best Trading Platforms UK for 2023 Revealed – Guide to Online Trading Platforms

Whether you’re looking to invest on a long-term basis or engage in day trading – you will need to find a trading platform that meets your individual needs.

There are now hundreds of trading platforms in the UK market, each of which comes with its own pros and cons.

For example, while some platforms are popular for its super-low fees, others stand out for listing thousands of financial instruments.

Either way, we would suggest reading our ultimate guide to Trading Platforms in the UK.

Within it, we list the top 7 platforms currently in the market, alongside an overview of what you need to look out for prior to joining a new broker. This includes platforms for beginners and more advanced traders.

Best Trading Platform UK List

Before we look at trading platforms in more detail, here’s a look at the best trading platform UK and the top alternatives.

- Plus500 – CFD broker with tight spreads

- Capital.com – AI trading platform with educational resources

- FXCM – Reputable and trusted forex and CFD broker

- Markets.com – Excellent forex app

- DEGIRO – Good platform for long-term trading

- Libertex – Low minimum deposit

-

-

What Criteria are Used to Rank the Best Trading Platforms?

- The number of payment methods supported

- How easy is the KYC process?

- What trading fees will you need to pay?

- How many financial instruments can you trade?

- The reputation and regulatory standing of the platform

Top Online Trading Platforms UK

Below we have listed the best 7 trading platforms currently operating in the UK market.

This includes a platform for both trading newbies and seasoned investors. Before you read through our recommendations, be sure to check out the criteria that we look out for prior to listing a broker.

Plus500 – Great Broker for CFDs and Spread Betting

Plus500 is a UK-based forex, CFD, and spread betting broker. In addition to being licensed in Australia by the ASIC, and Cyprus by CySEC, Plus500 UK LTD is authorized and regulated by FCA. Its parent company is listed on the London Stock Exchange. This is good in the sense that your trading balances and the company's funds are maintained in segregated bank accounts.

Plus500 has a highly advanced proprietary trading platform that allows you to buy and sell 2000+ CFD products using some of the most advanced trade and market analysis tools. What we really like about the broker is that you can choose from conventional CFDs, or spread betting. If opting for the latter, this means that your profits are exempt from UK tax.

The CFD asset classes hosted on the platform include stocks, indices, ETFs, hard metals, energies, Forex, options, and cryptocurrencies. All trades at the platform are executed on a commission-free basis, so it's only the spread that you will pay. When trading most of these CFDs, you will also be exposed to attractive leverages of up to 1:300. The spreads and other trade-related fees are highly competitive and there are no deposit/withdrawal fees.

Our Rating

- Fast order execution

- No trade commissions

- Competitively low variable spreads

- Imposes overnight funding fees

- Its educational resources are scarce

80.5% of retail CFD accounts lose money.Capital.com – Best for feature-rich proprietary trading platform

Capital.com may be a relatively new trading platform established barely four years ago, but it has carved its niche in the world of superior trading platforms. Its stands out with one of the most sophisticated, easy to use, and feature-rich AI-Powered trading platform where its clients can trade over 2000 CFD securities. These CFDs range from shares and stocks to Forex, Indices, Commodities, ETFs, and cryptocurrencies drawn from numerous international markets.

Other features that endear it to the online trading community include its wide range of educational and training resources. Additionally, it boasts for having one of the widest range of technical indicators and risk management tools and is one of a handful of brokerage platforms that offer customer support over the phone.

Our Rating

- Maintains a highly sophisticated yet easy to use trading platform

- Gives you access to real-time market data and speedy trade execution speeds

- Trades are commission-free and you also benefit from attractively low spreads

- One may consider their choice of trading accounts limited

- All the securities tradable here are only available as CFDs

FXCM – Highly transparent price structure

FXCM, also known as Forex Capital Markets, has been around for over two decades making it one of the most reputable and trusted online trading platforms. One of the factors that have endeared it to the online trading community is the competitiveness and transparency of its trading fees and commissions.

Its trading fees and spreads, though variable, is highly competitive and visible on the broker platform. You can view the trading fees associated with a trade beforehand. Not to mention that it supports a wide range of free deposit and withdrawal methods including credit and debit cards, online wallets like Skrill, and bank wire transfers.

Other factors making FXCM one of the best trading platforms in the UK include the fact that it maintains a highly advanced trading platform, it’s accessible via desktop and mobile trading platforms, and its dedication to traders education via its educational and training resources as well the demo trader.

Our Rating

- Maintains highly competitive trading fees and 0 commission fees

- Hosts a wide range of tradable CFD instruments

- Dedicates a section of its website to CFD trader education and training

- Charges inactivity fees

- Will only support three base currencies for the trader accounts – USD/EUR/GBP

Markets.com – Best for Advanced Traders

Markets.com is a UK based trading platform that has an extensive list of assets. This includes a huge forex department, as well as commodities, stocks and shares, energies, and futures.

Markets.com does not charge any trading fees or commissions. Instead, Markets.com makes its money from the spread. The platform is best suited to those with advanced skills in trading, as you'll have access to more than 100 technical indicators.

You will also have the option of trading with leverage, and the platform hosts a number of research tools that covers both fundamentals and technical analysis. Markets.com has an excellent regulatory standing, which includes a license from the FCA.

Our rating

- No fees or commissions other than the spread

- Lists thousands of assets

- Rigged with more than 100 technical indicators

- One may consider their list of features quite limited

- Has relatively high trading fees

DEGIRO – Best for Longer-Term Trades

If you prefer trading on a longer-term basis, then you might want to consider the merits of DEGIRO. The trading platform offers heaps of financial instruments across multiple markets.

If you want to trade stocks and shares, you'll be able to invest in companies from dozens of national exchanges. This includes the US, UK, France, Germany, Canada, Australia, and Singapore. DEGIRO also lists a number of markets in the futures, ETF, bonds, and indices departments. DEGIRO is also known for offering some of the most competitive fees in the UK trading space. You will pay a fixed fee on your trades, which will vary depending on the market you are looking to access.

The trading platform is regulated by multiple licensing bodies, including that of the UK's FCA and the Dutch AFM/DNB. The only drawback to DEGIRO is that the platform does not support forex trading.

- Its one of the few UK platforms to offer corporate bonds

- Its simple to deposit funds via a UK bank account

- Has a strong regulatory standing

- No forex trading

- Limited educational resources

Libertex – Best for Low Minimum Deposits and Zero Spreads

Launched in 1997, Libertex is an online broker that now boasts a customer base of well over 2 million traders. The trading platform is ideal if you are just starting out in the online investment space, as minimum deposits amount to just $10 (about £8). This gives you a great opportunity to get your head around online trading without risking too much.

Then, once you begin to get more comfortable, you might decide to start increasing your stakes. Libertex covers most asset classes - such as stocks, cryptocurrencies, metals, ETFs, and energies. A major selling point of the platform is that it does not charge any spreads. This means that you will get the price that you see, with no hidden extras between the bid and ask price. You will, however, need to pay a trading commission at Libertex.

The specific rate will vary depending on the asset you are trading. Libertex offers leverage to all account holders. If you're a retail trader this follows ESMA limits, so you'll be capped at 30:1. Professional traders are offered leverage of upto 600:1, which is huge. In terms of getting started at Libertex, the platform accepts debit and credit cards, but no e-wallets.

- Minimum deposit of just $10 (£8)

- Deposit funds with a debit/credit card

- Zero spreads on all assets

- Number of financial instruments is somewhat limited

- Limited educational resources

What to Consider When Choosing a Best Trading Platform?

As there are now hundreds of trading platforms competing for your business, knowing which broker to go with is no easy feat. You will first need to assess what it is that you are looking for from a platform. For example, are you looking for a platform that offers the lowest trading fees, or are you more concerned with the broker’s reputation? To help you along the way, we have outlined some of the main factors that you need to consider prior to joining a trading platform.

- Regulatory Considerations – Is it FCA Regulated?

You should only join a trading platform if the broker is in receipt of a license. In the UK, trading platforms are governed by the Financial Conduct Authority (FCA). This is a minimum requirement for trading platforms that wish to offer their services to the UK market.

You can check if a platform is FCA regulated on the register here: https://register.fca.org.uk/

The FCA website provides a simple way to check if a firm is regulated here. - Platform Fees and Charges

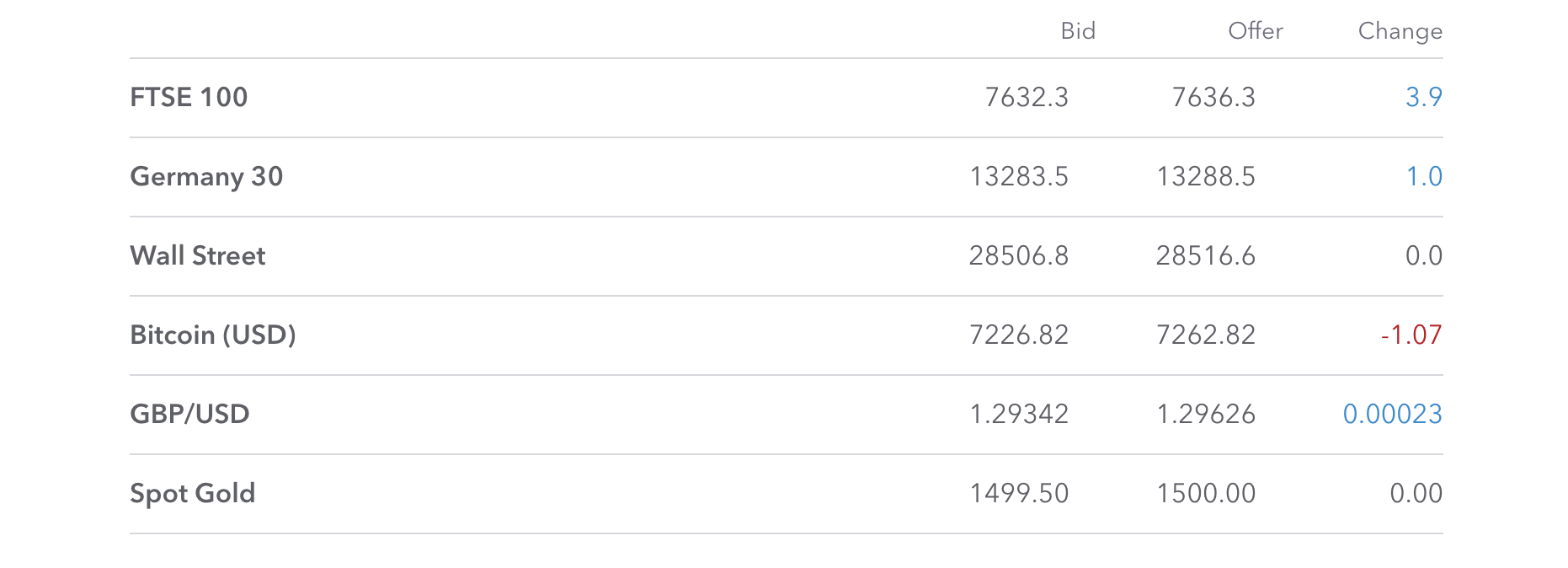

Fees are one of the most important factors that you need to look out for when choosing a new trading platform. Some platforms will charge you a flat fee every time you buy and sell an asset. For example, you might pay £7 per trade, regardless of how big or small the trade is. This option is best if you’re trading larger amounts. Other platforms will instead charge a variable fee. For example, you might pay 1% of the trade size, so a £100 trade would cost £1. This is the better option if you typically trade smaller amounts.

- Financial Instruments Coverage

There is nothing worse than joining a new broker, only to realize that the number of tradable assets is thin on the ground. Instead, you should go with a broker that covers thousands of instruments across dozens of asset classes. Alternatively, if you’re looking to trade a specific asset like cryptocurrencies, find a platform that supports multiple coins.

- Payment Methods

You will first need to evaluate what payment methods the trading platform supports. Most brokers will allow you to deposit funds with a traditional debit or credit card, and bank transfers are usually an option too. Some platforms even allow you to deposit funds with an e-wallet like PayPal or Skrill. Just make sure that you understand what deposit and withdrawal fees you will be required to pay.

- Customer Support

While a trading platform might offer lots of payment methods, low fees, and thousands of financial instruments, you still need to assess what customer support is like. We prefer trading platforms that offer 24/7 support across a number of different channels. This should include live chat, phone, and email support.

- User-Friendliness

If you are just starting out in the world of online trading, you will want to choose a platform that is suited for beginners. This should start at the very offset with the deposit and verification process. The platform should also make it easy to buy and sell assets to those without any prior experience in the space.

- Technical Indicators

If you are a seasoned online trader with lots of experience under your belt, then you should have a firm grasp of how technical analysis works. This is a fundamental part of trading, as you will be basing your decisions on historical data. As such, you’ll want to choose a trading platform that offers a good number of technical indicators. This includes the likes of Fibonacci levels, Parabolic Stop and Reverse, Exponential Averages, and Bollinger Bands.

- Scalping

Scalping is the process of ‘scalping’ profits from small price movements. It can be utilized in virtually any asset class, as long as there are sufficient levels of liquidity. Scalping is especially useful when an asset is going through a period of consolidation.

This is where an asset moves sideways between two key points of support and resistance. In order to be successful in scalping, you will need to install strict entry and exit points. In a similar nature to day trading, scalping requires you to be sat at your screen for the duration of your trades, as you’ll rarely hold on to an order for more than an hour.

If you’re looking to be a scalp trader, you need to sign up with a trading platform that allows this type of trading. Many platforms prohibit scalpers because of the difficulty in liquidity and balancing quick traders in their order books.

Am I Eligible to Join a Trading Platform?

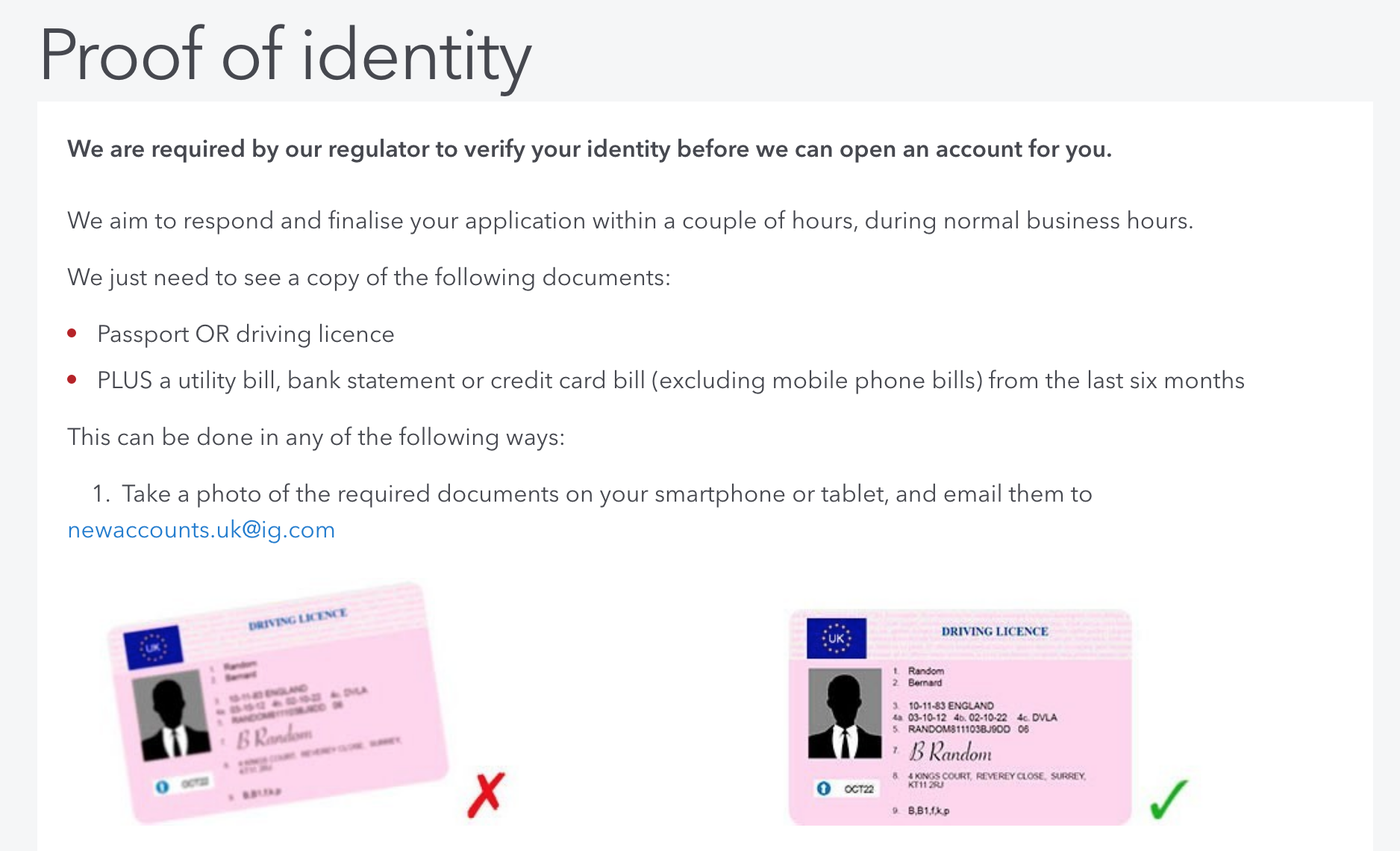

Most trading platforms will cater their services to both retail and institutional investors. You can join a trading platform as long as you are 18 years of age, a UK resident, and in possession of a UK bank account. If you are a tax resident outside of the UK, you will also need to supply your tax identification number. As per anti-money laundering laws, platforms will need to identify each and every user that joins its platform.

This is known as KYC (Know Your Customer). You will need to upload a copy of your government-issued ID (passport or driver’s license), as well as a proof of address. This can include a bank statement, utility bill, or tax statement. Once you have passed the KYC process you will have your trading limitations removed.

What Financial Instruments can you Trade?

Trading platforms typically offer thousands of financial instruments that can be traded across heaps of asset classes.

While the extensiveness of the trading arena will vary from platform-to-platform, we have listed the most commonly supported asset types below.

- Trading platforms for stocks

Most trading platforms will support stocks and shares from multiple markets. This includes well-known stock exchanges such as the New York Stock Exchange (NYSE), Nasdaq, London Stock Exchange (LSE) and Tokyo Stock Exchange (TSE). Some platforms will also host stocks from less liquid exchanges. This includes markets from Spain, South Africa, Canada, Australia, and Hong Kong.

Learn more about buying stocks and shares here.

- Commodities Trading

If you’re looking to trade commodities, most trading platforms in the UK will support precious metals like gold, silver, and platinum. You’ll also have the option of trading energies like oil and natural gas. The commodity scene is especially useful if you’re looking for a highly liquid marketplace that operates on a 24/7 basis.

- Indexes

A stock market index allows you to invest in the wider economy, as opposed to trading a single stock. For example, if you wanted to gain exposure to the LSE, you could invest in the FTSE100. This consists of the 100 largest companies that make up the LSE. Other popular indexes include the NASDAQ 100, S&P 500, and Dow Jones.

- Futures and Options

If you’re an advanced trader that seeks sophisticated investment products, then you might want to consider futures and options. These allow you to speculate on the future price of an asset without actually owning it. Most contracts come with a maturity of 3 months.

- ETFs

An exchange-traded fund (ETF) is a financial product that seeks to track an asset, or group of assets. For example, if you wanted to invest in the global marijuana industry, but you don’t want to trade individual stocks, you could purchase an ETF that tracks the largest companies operating in the space. ETFs are available on virtually every asset class, and they even allow you to go short.

- Trading platforms for bitcoin and cryptocurrency

If you’ve got a slightly higher appetite for risk, you might consider trading cryptocurrencies. Trading platforms typically offer pairs against the USD, and supported coins will include Bitcoin, Ethereum, Bitcoin Cash, and Ripple. Take caution when trading cryptocurrencies, as the market is extremely volatile.

Learn more about cryptocurrency trading here.

Summary – Choosing a UK Trading Platform

In summary, there are now hundreds of trading platforms to choose from in the UK.

While some are best for super-low fees and commissions, others excel in the technical indicator department. This is why you should spend some time assessing what it is you are looking for in a platform.

By following the tips we have outlined in our guide, you should be able to locate a broker that meets your individual needs.

Just make sure that the platform has a good regulatory standing, which should include an FCA license at the absolute minimum.

Glossary of trading platforms

Platform Fee

Platform FeeThe trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. It can be a one –time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. Others will charge on a per-trade basis with a specific fee per trade.

Cost per trade

Cost per tradeCost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades.

Margin

MarginMargin is the money needed in your account to maintain a trade with leverage.

Social trading

Social tradingSocial trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders.

Copy Trading

Copy TradingCopy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. The copiers -in most cases - are then required to surrender a share of the profits made from copied trades – averaging 20% - with the pro traders.

Financial instruments

Financial instrumentsA Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties.

Index

IndexAn index is an indicator that tracks and measures the performance of a security such as a stock or bond.

Commodities

CommoditiesCommodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver.

Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs)An ETF is a fund that can be traded on an exchange. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. ETFs allow you to trade the basket without having to buy each security individually.

Contract for difference (CFD)

Contract for difference (CFD)CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. CFD’s will basically allow you to speculate on the future value of securities such as stocks, currencies and commodities without owning the underlying securities.

Minimum investment

Minimum investmentThe minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Daily trading limit

Daily trading limitA daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

Day traders

Day tradersA day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes.

FAQs

What trading platform is best for beginners?

There is no one-size-fits-all answer to this question, as there are heaps of platforms that cater to newbies.

How are trading fees calculated?

This depends on the trading platform in question. Some platforms charge on a fixed-fee basis, while others will charge you a percentage of the trade size. Others charge no trading fees at all, other than the spread.

What does it mean when trading platforms only charge via the spread?

The spread is the difference between the buy and sell price. This means that you will be buying or selling the asset at a price slightly less favourable than the market is offering. For example, if the spread amounts to 1%, this is what you will need to make just to break even.

Will I need to provide ID when I join a trading platform?

All trading platforms are required to identify you when you first register an account. The process is simple, and merely requires you to upload a copy of your passport or driver’s license, and a proof of address.

What is the minimum deposit amount at a trading platform?

Minimum deposits will vary from platform-to-platform. Some allow you to get started with just £10, while others will ask for much more.

How do I withdraw funds from a trading platform?

As per anti-money laundering laws, you will need to withdraw your funds back to the same payment method that you used to deposit.

UK Brokers A-Z directory

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up