Perfect Money UK – How to Open an Account and Deposit Guide

When you are looking for a good online forex broker, there are many different aspects that you need to consider. The payment methods that are on offer can often be one of the deal breakers for a lot of people, which is why it is important to consider this before signing up for an account with a given platform.

This guide looks at using Perfect Money as a payment method for your forex broker account, walking you through the process of setting up your Perfect Money account, funding it and using it to conduct transactions with your chosen forex broker.

AvaTrade - Best Perfect Money Trading Platform in the UK Our Rating Perfect Money has been operating in the UK market since 2007 and it has constantly been expanding what it can offer to its users. Let’s take a look at the advantages of using Perfect Money when funding a forex broker account. Functionality The process of starting an account with Perfect Money, getting verified and depositing into your account only takes a matter of minutes. Using it to send or receive money couldn’t be easier, so you are saving a lot of time and energy by using this type of offering. The platform is well-designed and there is a mobile app for iOS and Android users if you need to use Perfect Money in the UK on the go. You can set up regularly scheduled payments if you need to and Perfect Money has a relationship with many leading third-party merchants. Security Perfect Money is a way for you to safely store your funds in an online environment. A specialist team of security experts has developed the security framework for the platform to ensure that sensitive data and customer funds are always kept safe and sound. When using Perfect Money to fund an online forex broker account, you will not have to share your sensitive data with this broker, so Perfect Money acts as an extra shield of protection. There is a comprehensive security toolbox at Perfect Money that includes the likes of identity checks, SMS authentication and CodeCard protection.

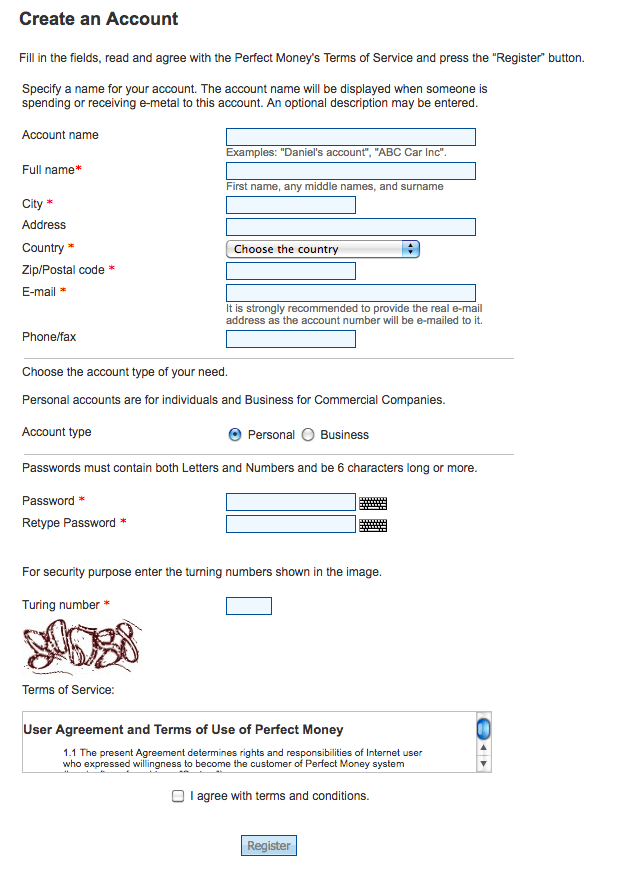

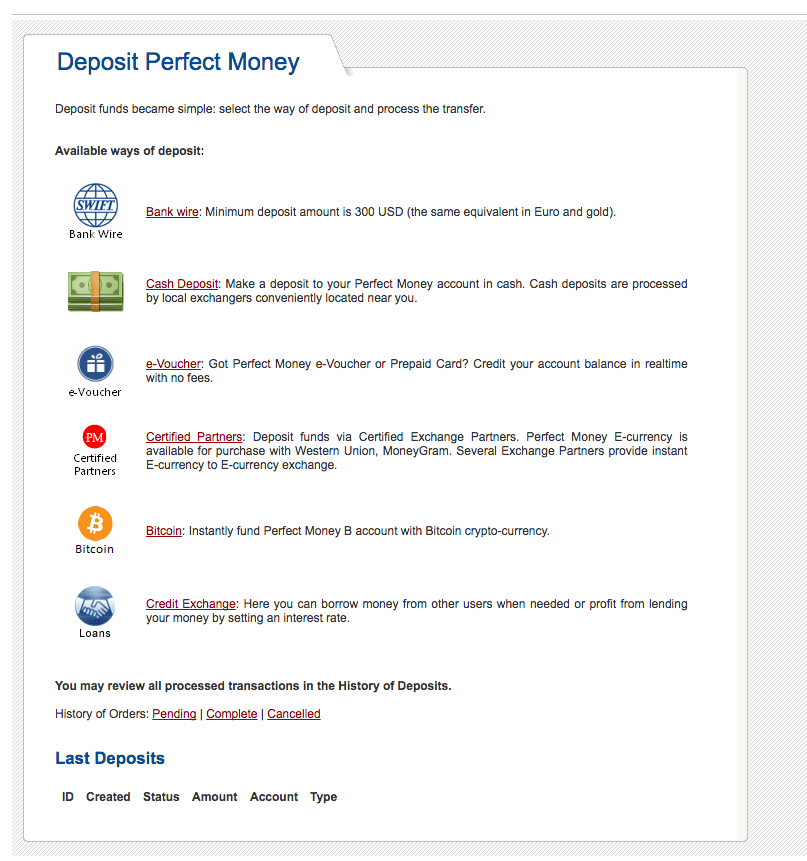

If you like the look of Perfect Money as a payment method, then you can register for your own account and get started using it as a payment method in no time. You can sign up for an account on a desktop computer or download the dedicated Perfect Money mobile app for iOs and Android devices. Whatever the case may be, visit the site and select the ‘Sign Up’ option. Choose a name for your account and enter your personal and contact info in the relevant fields. You will choose between a personal and a business account before setting your password. Finally, you will need to agree to the Perfect Money terms and conditions to finalize this account creation process. There will be an email sent to you containing your new Member ID that allows you to log into your Perfect Money UK account. Now that your Perfect Money account is up and running, you will be ready to deposit some funds into it to use at an online forex broker. Login to your new account using your member ID and password. Select the ‘Deposit’ option on the main menu and you will then see your different funding options. Choose the option that you prefer, enter how much you wish to deposit and in what currency, and you will then be good to go. These funds should appear in your account at Perfect Money within seconds. There are many great online UK forex broker out there today, so you can end up spending a lot of time trying to find the best one for your needs. To help you out, we’ve done the hard work for you, handpicking the best forex brokers that accept Perfect Money and tick all the boxes for traders.

AvaTrade was founded in 2006 and is one of the leading destinations for new and experienced traders alike. It is regulated by many leading bodies across the world, giving clients peace of mind that their funds and data will be kept safe and sound when using AvaTrade. The forex trading fees on AvaTrade are a slight bit higher than what you will usually find. There is also a quarterly inactivity fee that kicks in after three months of no trading that needs to be considered. It supports both the MetaTrader 4 and MetaTrader 5 trading platforms, which offer a range of advanced tools. There is also a proprietary web based platform and AvaOptions for trading forex options. You are well supported in terms of charting and research as a whole, with the trading experience being very user friendly. The education side of things is also decent.

Our Rating

RoboForex was started back in 2009 and it has developed a very impressive offering in the intervening years. It has one of the most comprehensive trading instrument offerings around. You can choose from eight different asset classes, with almost 10,000 different assets to trade.

Our Rating

XM.com is a global forex and CFD broker that was established back in 2009. XM.com is regulated in Europe by the Cyprus Securities Exchange and Commission (CySEC), and it is also is regulated in other regions across the world, so you know that you are going to be using a reputable platform. You will find more currency pairs here than a lot of competitors, with 57 different options available for you to trade. There are also commodity, stock and indices CFDs that you can trade. There are also five different cryptocurrencies that you are able to trade.

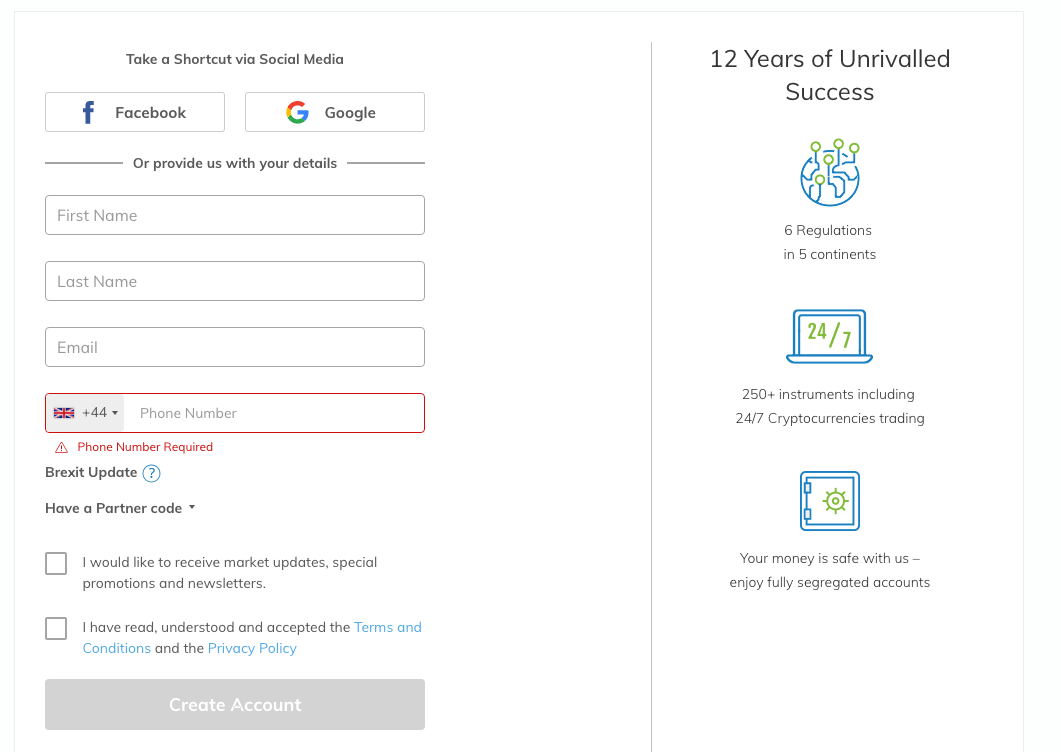

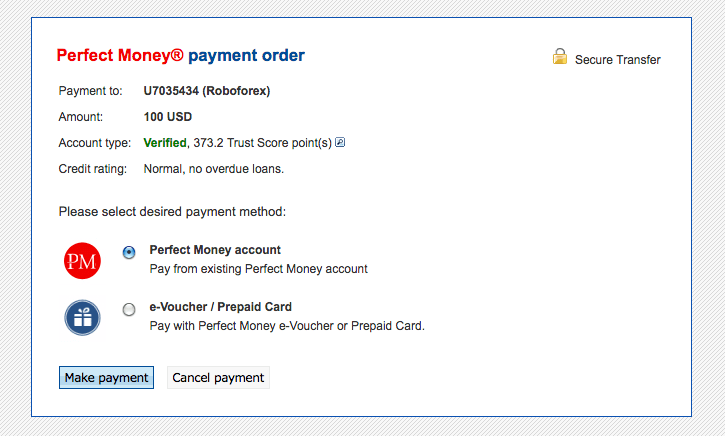

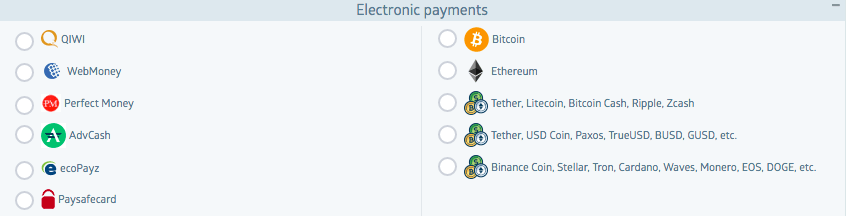

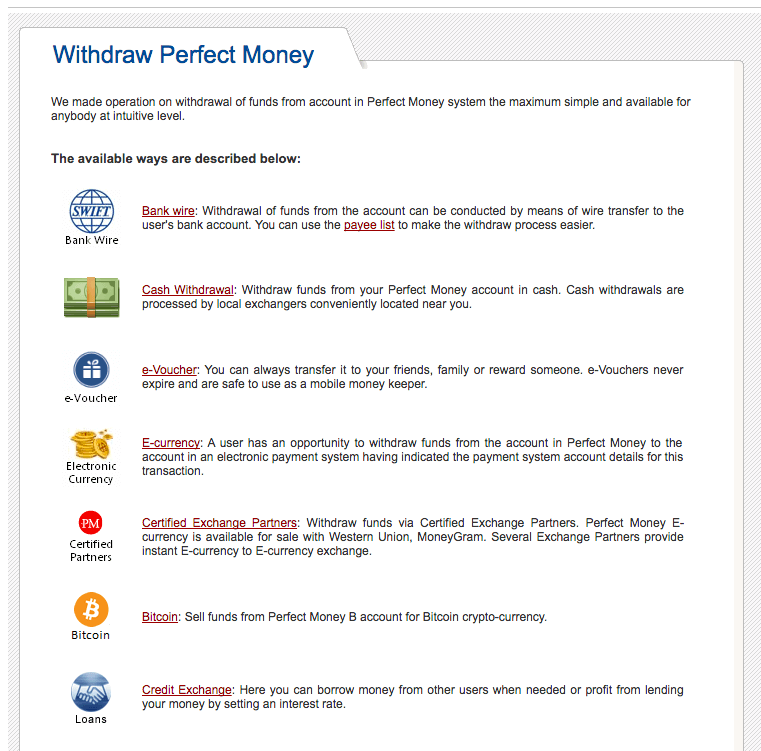

Our Rating Once you have chosen which online forex broker you want to use and signed up, you can begin adding funds to your account. It’s a similar process at most forex brokers, but we’ve decided to show you to use Perfect Money on AvaTrade. To sign up for an AvaTrade account, you will need to go to the broker’s website and select ‘Open an Account’. You will then need to enter your email, full name and mobile phone number and then agree with the terms and conditions of the platform. You will then need to choose your account type and add additional contact info. After doing so, your new account will be created. To verify this account, you will need to enter the code that has been emailed to you. You will also need to provide proof of ID and proof of address. To add funds to your account, click the ‘Banking’ menu option. You then need to select Perfect Money as your preferred deposit method. You will then be taken to the Perfect Money interface where you can add your relevant payment details. If you have managed to make some profit through your trading on AvaTrade, you may want to withdraw funds to your Perfect Money account. Simply go to the ‘Banking’ page and select what withdrawal method you want to use and how much you wish to withdraw. Simply enter your Perfect Money details and confirm the transaction. It can take a couple of days sometimes for these funds to hit your Perfect Money account. If you are looking to remove funds from your Perfect Money account to your bank account, this process is very simple and easy to do. On your Perfect Money UK account, select the ‘Withdraw’ menu option. Select the bank wire option. Then select how much you want to withdraw and enter your bank account details. Once the withdrawal has been confirmed, it can take a few business days before these funds hit your bank account. There are a few fees to consider when using Perfect Money. There is no cost usually for making a deposit, with currency conversion rates set at the current market rate. For internal transfers, there is a 0.5% transaction charge for verified accounts and a 1.99% fee for unverified accounts. There is a withdrawal fee of 2.85% plus a bank fee for making a wire transfer withdrawal. As you have seen, Perfect Money is a very useful way to add and withdraw funds from an online forex broker account. It is cost-effective and a great way to safely and securely make digital payments without having any worries. If you think Perfect Money is the payment method for you, we think AvaTrade is the best broker that accepts it. Simply click the link below to register an account with AvaTrade today. AvaTrade - Best Perfect Money Trading Platform in the UK Our Rating No, there is currently no annual service fee in place for using Perfect Money. There is an option to receive SMS notifications, with each message costing you £0.10. If your Perfect Money account has been inactive for a certain amount of time, your account with deactivate and there will be a £100 restoration fee. There are four main currency accounts available on Perfect Money. These are USD, EUR, GOLD and Bitcoin. If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of... The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home... WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site. Copyright © 2022 | Learnbonds.com

Why Use Perfect Money UK?

Step 1: Open a Perfect Money UK Account

Step 2: Fund Your Perfect Money UK Account

Step 3: Select Your Perfect Money UK Forex Broker

1. AvaTrade - MT4 and MT5 Compatability

There is a very good range of different financial assets that can be traded at AvaTrade. You have more than 55 different currency pairs, over 600 stock CFDs, indices, commodity, ETFs and bond CFDs as well as more than 17 different cryptocurrencies to trade. There are also two different options for social trading on AvaTrade that allow you to copy the trades that others on the platform are making.

2. RoboForex - Wide Range of Assets

It has more than one million customers signed up for an account, so it’s a popular and trusted platform.. There is very strict regulation at RoboForex, with the platform taking the security of its clients very seriously.

You can get started with a RoboForex account with a deposit of as little as £10. There are floating spreads and leverage is available at varying levels depending on how much you are going to be trading with and what instruments you’re trading.

There is a good selection of different account types, which you can choose from depending on your specific needs. You also have a choice of a few different trading platforms. There industry-standard MetaTrader 4 and MetaTrader 5 are options, as well as cTrader and rTrader. You can download apps for your mobile device also if you want to place trades on the go.

3. XM.com - Over 57 Forex Pairs

The XM.com CFD trading fees are pretty low and the forex commissions are about average for the sector. There are discounts available for those who are trading large sums. In terms of trading platforms, there are no proprietary options on offer as of yet.

You can use MetaTrader 4 and MetaTrader 5 to conduct your trading. The research and education offering is decent and there is fast customer support on offer, so XM.com is a great option for new traders and experienced ones alike.

Step 4: Fund your Forex Account

Open Account

Verify Your Account

Add Funds

Step 5: How to Withdraw Your Funds to Perfect Money UK

Step 6: How to Withdraw From Perfect Money UK to Your Bank

Perfect Money UK Fees and Other Expenses

Conclusion

FAQs

Is there an annual service fee for using Perfect Money?

Can you get SMS notifications for Perfect Money transactions?

Is there an account restoration fee?

What are the supported currencies on Perfect Money?

Andrew O'Malley

Andrew O'Malley

Latest News

Halifax Share Dealing Review

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago