Uncle Buck Loans Review 2020

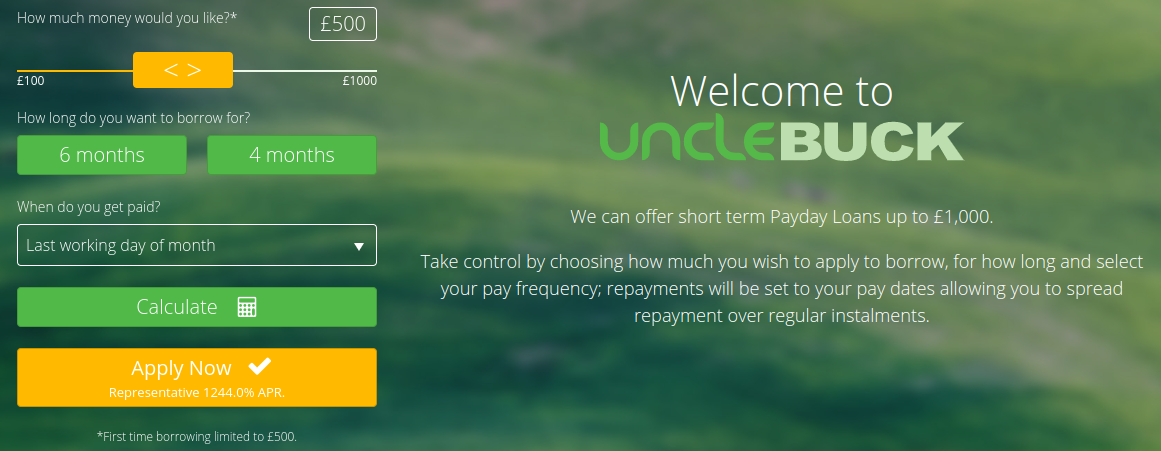

Do you need to borrow some emergency funds via one of the best payday loans provider, but need slightly longer to repay the cash? If so, it might be worth exploring the merits of Uncle Buck Loans. Unlike other short-term lenders in the market, Uncle Buck allows you to repay the loan funds over 4 or 6 months.

This could come in handy if you don’t want to repay the full amount when you next receive your salary. With loans of between £100 and £1,000, the lender is also able to facilitate same-day funding that can be executed in just 15 minutes. However, it is important to note that Uncle Buck Loans is not cheap – especially when you consider the 4/6 month repayment terms.

As a result, we would strongly suggest reading our Uncle Buck Loans Review before submitting your application. We’ll explain everything you need to know – such as who is eligible, how much interest you’ll be charged, repayment terms, and more.

-

-

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.Although you’ll likely be charged a high rate of interest at Uncle Buck, it is notable that the lender utilizes a soft search eligibility check. This means that you can find out your pre-approval rates without the application harming your credit score.

*Subject to lender requirements and approval.Although you’ll likely be charged a high rate of interest at Uncle Buck, it is notable that the lender utilizes a soft search eligibility check. This means that you can find out your pre-approval rates without the application harming your credit score.What is Uncle Buck Loans?

Uncle Buck Loans is an online-only lender that specializes in short-term loans. The lender does not have a physical presence in the UK, so everything is facilitated online. Uncle Buck Loans allows you to borrow from just £100, up to a maximum of £1,000. However, if you’re taking out a loan for the first time, Uncle Buck will restrict your loan size to £500. If you repay your first loan on-time, you’ll then be able to apply for a higher amount.

Nevertheless, one of the strangest aspects to Uncle Buck is that the lender offers just two loan term options. You can either borrow the funds for 4 months or 6 months – and nothing else. This is highly unusual, as lenders usually give you more flexibility in selecting a loan term.

When it comes to interest at Uncle Buck Loans, the lender is known to charge highly extortionate rates. In fact, the lender markets a representative rate of 1,224%, which is crippling. Although you might get a slightly more competitive rate in return for having a healthy credit score, the interest will still be expensive nonetheless.

With that said, Uncle Buck Loans is typically used by those that require emergency funding, and have no other options on the table. This is because the minimum eligibility requirements are somewhat low at Uncle Buck, and the lender is often able to transfer the loan funds in less than an hour.

What are the Pros and Cons of Uncle Buck Loans?

Uncle Buck Loans Pros:

✅Offers short-term loans of between £100 and £1,000

✅Loan terms of either 4 months or 6 months

✅Funding in as quickly as 15 minutes

✅The entire application can be completed online in less than 5 minutes

✅Option to repay the loan off early without being charged extra

Uncle Buck Loans Cons:

❌ A Representative interest rate of 1,224% is super-high

❌ Inability to borrow funds for longer than 6 months

How Does Uncle Buck Loans Work?

In a similar nature to other short-term loan lenders like Peachy Loans and LoanPig, Uncle Buck Loans allows you to complete the entire application online. You can do this throughout your desktop computer or mobile device, and you should receive a decision as soon as the application is submitted. With that said, you’ll need to head over to the Uncle Buck Loans website to get the ball rolling.

Move the slider to determine how much you wish to borrow, whether you want to opt for 4 months or 6 months – and then click on ‘APPLY NOW’. You’ll then be asked to enter a range of personal information. This includes your full name, home address, date of birth, and telephone number. As the lender will base its interest rates on your affordability levels, you’ll need to enter some information about your income.

This will include the name and address of your employer, how much you earn, and when you will next receive your salary. You’ll also need to state what outstanding debt obligations you currently have, and whether you own or rent your primary residence. Once the application is submitted, you’ll receive a decision on-screen in less than 30 seconds.

If you are pre-approved for a loan, you are under no obligation to proceed. In other words, if the APR rates are too high for your liking, you can simply shut down the application.If you are approved, Uncle Buck Loans will list your APR rates, as well as the amount you need to repay each month. If you are happy with the pre-approval terms, you’ll then need to enter your bank account details. This is the account that the loan funds will be transferred to. Once you have read and signed your digital loan agreement, Uncle Buck will then transfer the funds.

How do I Repay my Uncle Buck Loan?

There is only one option when it comes to repaying your Uncle Buck loan – a continuous payment authority (CPA). For those unaware, this gives Uncle Buck Loans authorization to take your monthly repayments from your debit card. This operates in a similar way to a direct debit, albeit, the funds will be taken from your debit card as opposed to your bank account.

With that said, as your debit card must be linked to the bank account in which you receive the loan funds, a CTA is a direct debit in all but name. Take note, you must ensure that you have enough money in your bank account to cover the payment. The lender will likely take your repayments in the early hours of your salary date, so unless there is an issue with your regular source of income, you shouldn’t miss a payment.

What Types of Loans Does Uncle Buck Loans Offer?

Uncle Buck specializes in short-term loans of either 4 months or 6 months.

✔️ Short-Term Loans

A short-term loan is merely a financing agreement of 12 months or less. These operate in a similar nature to a personal loan, insofar that you will be required to make monthly repayments. Moreover, these repayments will be at an equal amount on the same date of each month, until the loan is repaid in full. However, short-term loans typically come with much higher interest rates than personal loans – so do bear this in mind,

How Much Uncle Buck Loans Cost?

As is the case with most lenders operating in the online financing arena, Uncle Buck will base your interest rates on a number of factors. Crucially, if you have a good credit rating, you’re in receipt of a decent monthly income, and you don’t have a considerable amount of outstanding debt, you’ll likely be offered a more favourable interest rate. On the contrary, if your credit profile is less than ideal, expect to pay big.

Nevertheless, we’ve listed the main variables that Uncle Buck Loans will look at when assessing your APR rates.

❓The amount you need to borrow

❓How long you need to borrow the funds for

❓Your current credit score

❓How much you earn

❓Your debt-to-income ratio

❓Your regular outgoings

When you initially apply with Uncle Buck Loans, your eligibility and pre-approval rates can be obtained on a soft credit check basis. However, if you proceed with the loan terms offered, the lender will then execute a hard inquiry.Although you won’t know how much you are going to pay on your loan until the application has been submitted, Uncle Buck Loans lists a representative rate on its platform. As such, we have calculated how much you’ll likely pay.

💸 Let’s say that you borrowed £300 over the course of 4 months. At a representative rate of 1,244%, this would require 4 equal payments of £111.89. As a result, you would end up paying £442.95 on a loan of just £300, which is extortionate.

💸 By paying £107.28 in interest over 4 months, this equates to an APR of 292% per annum, which again, is huge. If you were to extend your £300 loan to a term of 6 months, you would pay even more.

💸 Uncle Buck Loans does not charge any early repayment fees, so you can reduce much of your interest by settling the debt at the earliest possible opportunity. Moreover, you won’t be charged an origination fee with Uncle Buck, as everything is built into the interest rate.

Am I Eligible for Financing With Uncle Buck Loans?

As is the case with most short-term lenders that charge high-interest rates, Uncle Buck Loans is very flexible with who it lends money to. This is to be expected when you consider its target audience – those who require emergency funding but have nowhere to turn. With that being said, not everyone will be eligible for a loan at Uncle Buck, so be sure to check your eligibility prior to applying.

In most cases, Uncle Buck Loans will be able to verify your identity electronically. However, in times where it is unable to do so, you might be asked to upload supporting documentation.Below we have listed the minimum requirements to be eligible with Uncle Buck Loans.

✔️ Credit Score

Although Uncle Buck Loans will not base its loan decision primary on your credit score, it will still be required to extract information from your report. This is to assess your previous relationship with credit, and crucially – whether you have ever defaulted on a short-term loan. As such, you will at the very least need to have a credit history of some sort to be eligible.

✔️ Regular Monthly Income

Once again, Uncle Buck Loans is somewhat vague with its minimum requirements on income. On the one hand, the lender does state that you must have your salary paid into your UK bank account, so this indicates that you must have a job at the very least. However, Uncle Buck does not state a specific figure.

✔️ Age and Residency

As is the case with all online lenders, you need to be aged at least 18 years old and be a UK resident.

✔️ No Outstanding Defaults

You won’t be eligible for financing with Uncle Buck Loans if you have an outstanding default obligation. This includes the likes of an IVA (Individual Voluntary Arrangement) or a bankruptcy proceeding.

✔️ Valid UK Bank Account and Debit Card

Uncle Buck Loans requires you to have a bank or building society account, with a linked debit card. The account is where the funds will be transferred to, and the debit card is where the repayments will be taken from.

Customer Service at Uncle Buck Loans

Uncle Buck Loans offers a number of support channels if you require assistance, which we’ve listed below.

📱Phone: 01959 543400

📧 Email: [email protected]

✉️ In Writing: Riverbridge House, Anchor Boulevard, Crossways Business Park, Dartford, DA2 6SL

Customer support is available between the hours of 8 am and 8 pm, Monday to Friday. If you require assistance over the weekend, customer support is available on Saturday between 9 am and 5 pm, but closed on Sunday.

Uncle Buck Loans Review: The Verdict?

If you’ve read our review from start to finish, you should be able to make an informed decision as to whether or not Uncle Buck Loans is right for your financing needs. As is the case with most borrowers who require emergency loan funding, a lender like Uncle Buck is often a last resort. The reason for this is that you are likely to pay a significantly high rate of interest. In fact, the lender advertises a representative rate of 1,224% – which is huge.

On the flip side, if you do decide to proceed with Uncle Buck Loans, there are a number of positives. Not only does the application process take just 5 minutes, but funding can be executed in 15 minutes. Moreover, you’ll have the option of repaying the loan funds over a term of 4 or 6 months, which gives you a bit more breathing space. Finally, it’s also notable that Uncle Buck Loans does not penalize you if you decide to pay the loan off early, so you always have the opportunity to reduce your interest.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.FAQ:

What interest rates does Uncle Buck Loans charge?

You won’t know how much interest you need to pay until you complete the initial application process. With that said, Uncle Buck Loans advertises a representative rate of 1,224%.

How much can I borrow from Uncle Buck Loans?

Uncle Buck Loans allows you to borrow from just £100, up to a maximum of £1,000. However, if it’s your first time applying, you’ll only be able to borrow £500.

How do I repay my loan with Uncle Buck Loans?

The only way to repay your Uncle Buck loan is via automatic debit card payments. As such, the money will be taken from your card on the day that you get paid.

How quickly are Uncle Buck Loans funded?

Once your loan has been approved, and you’ve signed the digital loan agreement, Uncle Buck Loans will automatically start the funding process. In most cases, this will be anywhere between 15 minutes and 1 hour.

UK Payday Loan Reviews- A-Z Directory

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up