Smart Pig Review 2021 – Do We Recommend it?

Are you currently engaged in a university course and require a bit of extra cash until you next receive your student loan? If so, it might be worth considering the merits of Smart-Pig. The UK-based lender specializes in short-term loans for higher education students.

Loans of up to £350 are available, which needs to repaid when you next receive your student loan, grant, or bursary. Although short-term loans typically come with high-interest rates, Smart-Pig caps this at 50% of the amount you borrow.

With that being said, the lender won’t be suitable for everyone, so we would suggest reading our in-depth Smart-Pig Review prior to submitting your application. We cover everything from eligibility, fees, funding times, repayments, and more.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

-

-

What is Smart-Pig?

Smart-Pig is a UK-based lender that specializes in short-term loans for university students. As such, you’ll need to be engaged in a UK university course to eligible, as well as be in receipt of a student loan, grant, or bursary. This is because you will need to repay the loan funds when you next receive your payment.

Nevertheless, if you do fit the bill – Smart-Pig allows you to borrow from just £50, up to a maximum of £350. Although this mirrors the type of financing structure offered by the best payday loans company, Smart-Pig is slightly more competitive in the interest department. For example, while payday loan firms will often charge the maximum interest rate permitted by the Financial Conduct Authority (FCA), Smart-Pig caps this at 50% of the loan size.

If you need a small boost of cash before you next receive your student loan, you might be better off obtaining an overdraft. Most high street banks now offer top-notch rates on student overdrafts, so it’s likely to be much cheaper than Smart-Pig.

On the contrary, payday loan companies will often charge right up to the 100% limit. With that said, fees that amount to 50% of the loan size still comes at a hefty APR rate, so you might be better off utilizing your overdraft limit if you need access to emergency funding.

In terms of the application process itself, everything can be completed online in a matter of minutes. If your application is approved by Smart-Pig, the funds can be in your UK bank account in as little as 15 minutes. Interestingly, the lender was founded by two university graduates that previously had a bad experience with conventional payday loan lenders. As such, the founders claim to engage in ethical lending practices.

What are the Pros and Cons of Smart-Pig?

Smart-Pig Pros:

✅Offers short-term loans of between £50 and £350

✅Specializes in loans for university students

✅Approved applicants can receive the funds in just 15 minutes

✅The entire application can be completed online

✅Repay the funds when you next receive your student loan

Smart-Pig Cons:

❌ Maximum loan of £350

❌ More expensive than an overdraft facility

How Does Smart-Pig Work?

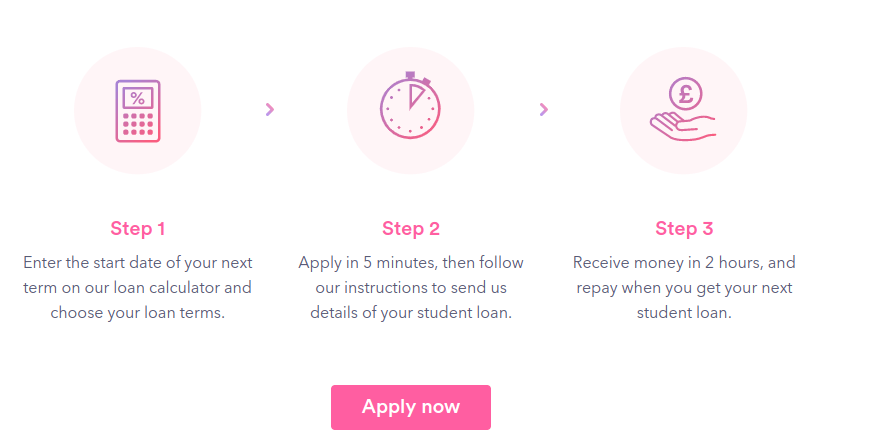

Smart-Pig operates in a different manner to other short-term lenders like MoneyPug and Satsuma, insofar that it only offers financing to those engaged in a UK university course. Nevertheless, if you do meet the minimum eligibility requirements and you want to proceed, you’ll first need head over to the Smart-Pig homepage. You then need to stipulate how much you wish to borrow (£50-£350), and how long you need to borrow the funds for (1-180 days).

Once you click on ‘Let’s Get Started’, you’ll then be required to open an account with Smart-Pig. This will ask you a range of questions pertaining to your identity, as well as your student program. Regarding the former, this includes your full name, home address, term address, date of birth, and contact details.

You’ll then need to state the type of student finance that you receive (student loan, university bursary, etc.), as well as the date in which you will receive your next payment. Next, you’ll need to upload a document that validates your student loan agreement. This is to ensure that you are eligible for a loan with Smart-Pig.

Smart-Pig will be required to perform a credit check on you. This means that regardless of whether or not the loan is approved, the application will appear on your credit report.Once this has been verified, you will then need to enter your bank account and debit card details. When you submit the application, Smart-Pig should give you a decision in less than 90 minutes (during standing business hours). If you are approved, the funds will be transferred into your bank account upon singing the digital loan agreement.

How do I Repay my Smart-Pig Student Loan?

When you go through the application process, you will be asked whether you want to repay the loan on the date in which you next receive your loan payment, or if you want to choose a custom date. If opting for the latter, you will have up to 180 to repay the funds. Irrespective of the loan terms itself, all repayments are executed via a continuous payment authority (CPA).

This will give Smart-Pig authorization to take the repayment from your debit card, which is why you are asked for your card details when you apply. CPAs are common practice in the short-term financing arena, as it provides a safety net for lenders. This is because unlike direct debit agreements, CPAs allow the lender to debit a payment at any amount, on any date – as long as it mirrors the conditions outlined in the loan agreement.

How Much Do Smart-Pig Loans Cost?

Attempting to understand how much you are likely to pay on a short-term loan in pounds and pence is no easy feat. This is because lenders stipulate interest rates in various ways – such as the APR, representative rate, or a percentage of the amount being borrowed. With that being said, Smart-Pig will base your lending rates on a number of variables, so you won’t know how much you are going to pay until you apply.

There is no option to assess your loan terms on a soft credit check basis, meaning that the initial application will be posted to your credit report.Nevertheless, we’ve listed the main variables that Smart-Pig will look at when assessing your APR rates.

❓The amount you need to borrow

❓How long you need to borrow the funds for

❓Your current credit score

❓The size of your student loan or grant

❓When you next receive your student loan payment

Although you won’t know your specific rate until applying, Smart-Pig does give us a rough idea of how much you are likely to be charged on the loan.

💸 Smart-Pig lists a representative rate of 1,058%, which is super-expensive. As is the case with all representative rates, this is merely the rate that Smart-Pig wishes to advertise. As such, you could end up paying even more.

💸 Attempting to calculate the interest from the representative rate is somewhat complex, so it’s best to look at how much you will need to pay back in total. Smart-Pig charges 0.8% interest per day, which continues to increase until the 50% cap is reached.

💸 This means that by borrowing £350 with Smart-Pig over the longest loan term available, the most that you can pay back in interest is £175.

💸 You will always have the opportunity to reduce your interest payments by paying the loan off early. The lender won’t penalize you for this which is great. Smart-Pig doesn’t charge any origination fees either, as everything is built into the interest.

Am I Eligible for a Smart-Pig Loan?

Smart-Pig is a lender that tailors its services to students, and only students. As such, you’ll need to be engaged in a UK-based university course to be eligible. With that said, you will also need to meet some other eligibility requirements to get a loan with Smart-Pig, so be sure to read the following section before applying.

If you want to check with Smart-Pig whether or not you are likely to be eligible, you might be best to call them on 0203 5071 930. This will allow you to avoid applying in vain, with the rejection all-but-certain to appear on your credit report.✔️ Credit Check

Smart-Pig will be required to conduct a credit check on you. Although the lender does not state a minimum credit score, you might not be eligible if your financial standing is less than ideal. Take note, some university students will not have a credit score at all due to their age.

✔️ Be Studying at a UK University

As Smart-Pig is a student loan provider, you will need to be engaged in a recognized university course to be eligible. This needs to be at a UK university, so if you’re a UK resident studying abroad, you likely won’t be eligible.

✔️ Receiving Student Financing

You also need to be receiving student financing of some sort. This can be in the form of a student loan or grant, as well as a university bursary. Don’t forget, you will need to upload copies of your student financing agreement before Smart-Pig can approve your loan application.

✔️ UK Resident and 18 Years +

You must be a UK resident to be eligible for a Smart-Pig loan. As such, even if you’re a foreign student studying at a UK university, you won’t be able to apply. Moreover, you’ll need to be aged at least 18, although this will likely be the case anyway if you are attending university.

✔️ Valid UK Bank Account and Debit Card

Finally, you need to have a valid UK bank account and debit card. The card needs to be linked to the same bank account that you receive the funds.

Customer Service at Smart-Pig

Smart-Pig offers a number of support channels if you require assistance, which we’ve listed below.

📱Phone: 0203 5071 930

📧 Email: [email protected]

✉️ In Writing: 3 Jephson Court, Tancred Close, Leamington Spa, Warwickshire, CV31 3RZ

The customer service team at Smart-Pig operates 7 days per week. You can speak with an advisor between 9 am and 7 pm during the week, and between 10 am and 6 pm on Saturday and Sunday.

Smart-Pig Review: The Verdict?

If you’ve read our comprehensive Smart-Pig review from start to finish, you should now know whether or not the platform is right for your financing needs. Ultimately, the lender is suited for those of you that to borrow up to £350 on a short-term basis, with the funds being repaid when you next receive your student finance payment. This can include a traditional student loan or grant, as well as a university bursary. Although Smart-Pig will be required to carry out a credit check, it basis its decision on your overall affordability levels.

As such, as long as you can prove that you are in receipt of regular student financing payments, you should be eligible. On the flip side, it is important to note that it might be cheaper to use an overdraft facility as opposed to a short-term loan with Smart-Pig. This is because the lender can charge up to 50% of the loan size. Overdrafts – especially those tailored to student accounts, will charge significantly less. In fact, student overdrafts are often interest-free until you graduate.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.FAQ:

What interest rates does Smart-Pig charge?

Although the specific rates will depend on your individual credit profile, this usually amounts to around 0.8% per day. The interest will be applied every day until it reaches the 50% cap, or the loan is repaid in full.

How much can I borrow from Smart-Pig?

Smart-Pig allows you to borrow between £50 and £350, illustrating that the provider is engaged in sensible lending.

How do I repay my loan with Smart-Pig?

If your Smart-Pig loan is approved, you will be required to enter your debit card details. The lender will then set up a continuous payment authority (CTA) meaning that you authorize Smart-Pig to take the repayment from your debit card automatically.

How quickly are Smart-Pig loans funded?

Once your Smart-Pig loan has been approved – which can take up to 90 minutes during standard business hours, the funds will be transferred instantly. This means that you could receive the funds in just 15 minutes of having the loan approved.

UK Payday Loan Reviews- A-Z Directory

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up