Oakham Review 2020 – Is it Recommended?

With Bank of England interest rates still at record lows, high street lenders are offering some incredible loan deals. However, if your credit is somewhat damaged – or you don’t meet the minimum requirement when it comes to income or assets, you’ll likely struggle to get a look-in. As such, you might need to consider a specialist bad credit lender like Oakham.

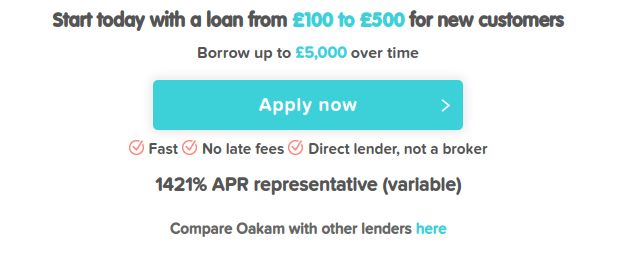

On the one hand, the online lender allows you to borrow between £200 and £1,750 – with loan terms ranging from 3 months to 1 year. Moreover, you only need to be earning £400 per month to qualify, and the lender will even consider income in the form of benefits. However, all of this comes at a tremendous cost. More specifically, you will pay an extortionate amount of interest on your Oakham loan – especially considering the minimum repayment term of 3 months.

Nevertheless – if you’ve got nowhere else to turn in your search for emergency funding, we would strongly suggest reading our Oakham Review prior to starting an application. We’ll cover everything you need to know – such as eligibility, funding times, interest, loan terms, and repayments.

-

-

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.If it’s only a small amount of emergency funding that you need, then it might be worth seeing if your bank can offer you an overdraft. As long as you repay the money back at the earliest possible opportunity, this will work out much cheaper than using Oakham.

*Subject to lender requirements and approval.If it’s only a small amount of emergency funding that you need, then it might be worth seeing if your bank can offer you an overdraft. As long as you repay the money back at the earliest possible opportunity, this will work out much cheaper than using Oakham.What is Oakham?

Oakham is a direct lender that offers short-term loans to those based in the UK. In a similar nature to fellow providers Drafty Loans and LoanPig, the lender does not have any physical branches. As such – you can complete the entire loan application process from the comfort of your own home, or via a telephone agent. Oakham specializes exclusively in loans for those with bad credit. This is evident when you head over to the lender’s homepage, and you see that the first advertising slogan reads “On Benefits & CCJs OK”.

Nevertheless, as a first-time customer you will be able to borrow between £200 and £1,750. This is quite a lot when you consider the target market of bad credit borrowers. You will have the option of choosing a loan term of 3, 6, 9, or 12 months. In the vast majority of cases, approved applicants will see the loan funded on a same-day basis. As such, the lender might be suitable if you need to access to super-fast cash.

The lender also offers an Oakham Lift Loan service, which is available to those that have successfully repaid a prior loan at the platform. This increases the loan size to between £2,000 and £5,000, and you’ll have 24 months to repay the funds. The requirements for the Oakham Lift Loan option are slightly higher, as you’ll need to be earning £700 via a regular salary.

At this stage of our Oakham review you might be thinking that the lender ticks all of the right boxes. However, Oakham charges a huge amount of interest. This isn’t a surprise when you consider the end-market for Oakham, which is those that require emergency funding and have nowhere else to turn. With that said, the platform lists a representative rate of 1,421% APR.

What are the Pros and Cons of Oakham?

Oakham Pros:

✅Offers short-term loans of between £200 and £1,750

✅Allows you to repay the funds in 3, 6, 9, or 12 months

✅Same-day funding is often available

✅The entire application can be completed online

✅Oakham Lift Loans offer between £2,000 and £5,000 over 24 months

Oakham Cons:

❌ Huge representative rate of 1,421%

❌ Performs a hard credit check

How Does Oakham Work?

Oakham works largely the same as any other bad credit lender operating in the online space. To get the ball rolling, you will need to head over to the Oakham homepage and click on the ‘APPLY NOW’ button. Next, you’ll need to start the application process. You’ll need to state whether you’ve previously taken a loan out with Oakham, followed by the amount you wish to borrow and for how long. You will then need to enter some personal information. This will include your first and last name, date of birth, marital status, and the number of dependents you have at home.

On the next page of the application, you will need to provide some information about your home address. This should include all of the addresses you’ve lived at over the past 3 years, and whether the home is owned or rented. Oakham will also ask you about your financial standing. This includes your monthly income – and how it is earned (full-time employment, benefits, etc.)

Finally, you’ll need to enter some information about your current debt obligations, and whether you currently possess any CCJs.Once the application has been submitted, you should receive a pre-approval decision in a matter of seconds. One of three things will happen at this stage. You will either have the loan approved instantly, rejected outright, or need to take a telephone call from an advisor for more information.

In some cases, you might limited to a maximum loan size of £500 on your first application. If this is the case, the longest term available will be 6 months.If a call is required, this will be to discuss your financial standing in more detail. Once the loan is approved, you will then need to provide your current account details, as well as the debit card that is attached to the account. As soon as the digital loan agreement has been signed, Oakham will then start the funding process. If the loan was approved early on a working day, then you should receive the funds later in the afternoon.

How do I Repay my Oakham Loan?

When you initially read through the digital loan agreement that Oakham got you to sign, it would have provided a full breakdown of the repayment terms. This would have included the applicable interest rate, and what your repayments will amount to. Unlike other short-term lenders, Oakham asks you to make your repayments on a weekly or bi-monthly basis, as opposed to once a month.

Regardless of which option you go with, you will need to make your repayments through a continuous payment authority (CPA). This means that Oakham will take your repayments via the debit card that is linked to your bank account. The CPA differs to a more conventional direct debit agreement, insofar that the lender can continue to take money from your card until the loan is repaid in full. As such, if a repayment is declined by your bank, the lender might attempt to take a smaller amount.

How Much Do Oakham Loans Cost?

Oakham does not charge a fixed APR rate. Instead, the interest is based on a number of variables linked to your application. As a result, you won’t know how much you need to pay on the loan until you actually submit an application. This is somewhat problematic, as the lender executes a hard credit inquiry. This means that regardless of whether or not your application is approved, the search will appear on your credit score.

There are heaps of other bad credit lenders that allow you to search on a soft credit check basis. Not only will this allow you to ascertain whether you are eligible without it impacting your credit score, but you can assess your pre-approval rates.Nevertheless, we’ve listed the main variables that Oakham will look at when assessing your APR rates.

❓The amount you need to borrow

❓How long you need to borrow the funds for

❓Your current credit score

❓The historical relationship with debt

❓When you next receive your salary

❓How much you earn

❓Whether you have any CCJs on your credit file

Although the interest rates at Oakham will vary from borrower-to-borrower, the lender does list a representative rate of 1,421% on its website. This allows us to perform some calculations to assess how much the average borrower will end up paying at Oakham.

💸 At a representative rate of 1,421%, let’s say that you borrowed £800 over the course of a 6-month loan term. This means that you would need to make weekly payments of £57.21 until the loan was repaid. Your total repayment amount would be £1502.02, even though you only borrowed £800. This amounts to £702.02 in interest, which is almost the same as the amount you borrowed.

💸 On the other hand, the Oakham Lift Loan option does come with a more favourable interest rate. At a representative rate of 73.1%, let’s say that you borrowed £800 over the course of 12 months. You would need to make weekly payments of £29.79 throughout the year, taking the total loan size to £1,548.56.

💸Other than the interest rates that you pay on the loan, there are no other fees to consider. As such, you won’t need to pay any application or origination fees. Moreover, there are no late repayment fees, and you can even pay the loan off early without being financial penalized.

Am I Eligible for an Oakham Loan?

As we have discussed throughout our review thus far, the eligibility requirements to get a loan at Oakham are super-low. This is even the case if you have extremely bad credit, or your monthly income is in the form of benefits. However, not all applicants at Oakham will be successful, so we would suggest reading through the eligibility requirements outlined below.

Make sure you are 100% confident that you meet the below requirements before applying. This is because the application will be posted to your credit report, which can then damage your score even further if the application is rejected.✔️ Credit Check

Oakham will always run a credit check on you as soon as the application is made. The good news is that the lender does not stipulate a minimum credit score to be eligible, so you might qualify even if your financial standing is below par.

However, if you’ve got repeated defaults on your credit file, alongside a number of CCJs, you might have the application rejected outright.

✔️ Minimum Monthly Income

You will need to have a minimum monthly income of just £400 to qualify, which is very low. Furthermore, this doesn’t need to come in the form of full-time or part-time employment. Instead, it can also come via benefits.

If opting for the Oakham Lift Loan, you’ll need to have a minimum income of £700 per month, and this does need to be via employment.

✔️ UK Resident and 18 Years +

While it’s standard practice for a bad credit lender to ask that you are a UK resident, Oakham only requires you to have held this status for 6 months. This means that you might be eligible even if you’ve only recently moved to the UK. All applicants must be aged at least 18 years old.

✔️ Valid UK Bank Account and Debit Card

You will need a valid UK bank account and a debit card. As per the CPA agreement, the debit card needs to be from the same account that you receive the loan funds.

In cases where Oakham is unable to verify your identity electronically, you might be asked to provide supporting documentation. This might be a payslip to verify your income, or a bank statement to confirm your current address.Customer Service at Oakham

If you need to speak with a member of the Oakham customer service team, you can contact them on the following:

📱Phone: 0203 9111 777

📧 Email: Online Support Form

✉️ In Writing: 3rd Floor, Moray House, 25-31 Great Titchfield Street, London

The customer support team works Monday to Friday between the hours of 8 am and 7 pm, and on Saturdays between 9 am and 6 pm.

Oakham: The Verdict?

If you’ve read our Oakham review up to this point, you should now have the required information to decide whether or not the lender is right for you. In terms of the positives, the lender permits a reasonable loan range of between £200 and £1,750 – although in some cases you might be capped to £500 on your first application. Loan terms amount to either 3, 6, 9, or 12 months, If you have a repeated history of making repayments at Oakham, the lender also offers its Lift Loan service. This permits a 24-month loan of between £2,000 and £5,000.

It is also notable that the lender facilitates the entire loan process online, although you might be required to verify some details over the phone before the funds are released. Once the application has been approved, you might receive the money later in the day. However, this is where the positives end. With a representative rate of 1,421%, loans at Oakham are extremely expressive. In fact, by borrowing £800 for just 6 months, you could end up repaying nearly double the amount borrowed.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.FAQ:

What interest rates does Oakham charge?

You won’t know your APR rate at Oakham until you submit an application. The rate will vary from borrower-to-borrower, based on a number of different variables. With that said, Oakham lists a representative rate of 1,421%, which is huge.

How much can I borrow from Oakham?

Oakham allows you to borrow between £200 and £1,750, although first-time applicants are sometimes restricted to £500. The platform also offers a Lift Loan of between £2,000 and £5,000 – which is taken out over 24 months.

How do I repay my loan with Oakham?

You will have your loan repayments taken directly from your debit card, via a continuous payment agreement (CPA). Payments will be taken weekly or bi-monthly.

Does Oakham perform soft credit checks?

As soon as you submit an application at Oakham, the lender will execute a hard credit card. As such, the application will appear on your credit report regardless of the decision.

UK Payday Loan Reviews- A-Z Directory

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up