CashASAP Review 2021 – Is it Recommended?

If you’re on the lookout for emergency funding to see you through the month, you’ll likely need to use the best payday loans provider if you’re credit is less than ideal. This is because payday loan companies are willing to approve applicants that are in receipt of bad credit. One such provider active in this lending space is CashASAP.

As the name suggests, CashASAP is a lender that specializes in super-fast funding times. In fact, if your application is approved – which can be for a funding amount of between £100 and £750, you’ll likely receive the funds later that day. However, CashASAP charges extremely high-interest rates, so only used the lender as a last resort.

With that said, we would suggest reading our comprehensive CashASAP Review before starting your application. We’ll cover the ins and outs of how much you’ll pay, eligibility, funding times, customer support, and more.

-

-

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.It might be best to use an alternative funding source if you only need to borrow a small amount of cash. The likes of credit cards and overdrafts will be significantly cheaper than taking out a payday loan with CashASAP, so do bear this in mind.

*Subject to lender requirements and approval.It might be best to use an alternative funding source if you only need to borrow a small amount of cash. The likes of credit cards and overdrafts will be significantly cheaper than taking out a payday loan with CashASAP, so do bear this in mind.What is CashASAP?

CashASAP is a UK lender that offers payday loans. The company is an online-only lender, meaning that it does not have any physical branches. Instead, the entire end-to-end loan process is facilitated online, or via your mobile device. Nevertheless, CashASAP allows you to borrow from £100, up to a maximum of £750. In the vast majority of cases, you will be required to repay the loan funds when you next get paid – which is industry-standard in the payday loan space.

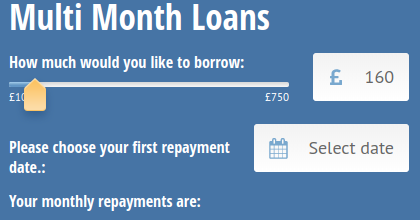

However, CashASAP also allows you to repay the money over a longer period of time. Although this allows you to select a loan term of 3 months, this will make the overall cost of the loan more expensive. While we’re on the subject of fees, CashASAP charges some of the highest interest rates in the UK lending space.

In fact, at a representative rate of 1,390%, this is just below the limits imposed by the Financial Conduct Authority (FCA). This is why a lender such as CashASAP should always be a last resort. If you don’t have anywhere else to turn, the loan provider is super-flexible with who it lends money to.

For example, as long as you have a regular income of some sort, you’re a UK resident, and you don’t have any outstanding bankruptcy orders on your credit report, you should be eligible. If you are, CashASAP is known to transfer the loan funds into your bank account as soon as you are approved. This makes the lender ideal for those of you that need funding fast – albeit, you will pay for the privilege with an extremely high-interest rate.

What are the Pros and Cons of CashASAP?

CashASAP Pros:

✅Offers short-term loans of between £100 and £700

✅Eligibility requirements are very low

✅Typically transfers the loan funds on a same-day basis

✅Choose to repay the funds when you next get paid or over 3 months

✅The entire application can be completed online

CashASAP Cons:

❌ Representative rate of 1,271%

❌ More expensive than an overdraft facility

How Does CashASAP Work?

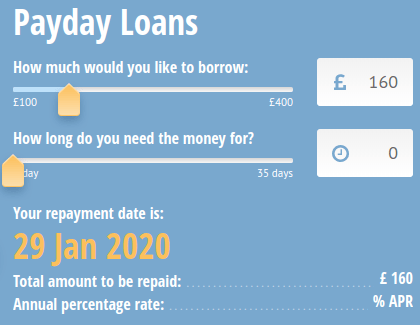

As is the case with other payday loan lenders active in the space – such as Satsuma and Cash Float, CashASAP is an online-only lender. This means that you will need to complete the application via your desktop computer or mobile device. To get the ball rolling, simply head over to the CashASAP homepage and decide whether you want a multi-month loan (3 months), or a conventional payday loan.

Once you select how much you wish to borrow, click on the ‘New Customer’ button. You will then be taken to the main application page. This will ask you a range of questions about your identity. For example, you’ll need to enter your first and last name, date of birth, home address, telephone number, and email address. You then need to state the name and address of your employer, how long you have worked there, your take-home salary after-tax, and the date that you next get paid

Moreover, you also need to outline your regular monthly outgoings. This will include costs such as your monthly rent/mortgage, groceries, and utility bills. Once you have completed the application form, CashASAP will then run a credit check on you. This is with the view of validating the information that you provided in your application, as well as to gauge your historical relationship with debt.

.Unlike other payday loan lenders active in the space, CashASAP does not permit soft credit checks. This means that regardless of whether or not your application is successful, the loan decision will appear on your credit report. As such, make sure you read through the eligibility requirements before applyingIf the lender deems you suitable for a short-term loan, you should get approved instantly. If you are, you will then be able to view your loan offer. This will include the amount that CashASAP is willing to lend you and at what interest. If you want to proceed, you will then need to enter your UK bank account and debit card details. The debit card needs to be linked to the bank account, as this is where your repayments will be taken from.

How do I Repay my CashASAP Loan?

Once your application is approved, you will be able to review the digital loan agreement in great detail. This will outline the amount that you need to pay back, and when. If it’s a standard payday loan, this will be one payment on the date that you next get paid. Alternatively, if opting for a 3-month term, you will need to make three equal payments. Regardless of which option you go with, your repayment(s) will be taken from your debit card.

Known as a continuous payment authority (CPA) – you will be asked to sign an authorization form that allows CashASAP to take the money automatically. Although this operates in a similar nature to a conventional direct debit, a CPA gives CashASAP more flexibility in taking your repayments. For example, a direct debit must be for a fixed amount on a set date of the month. On the contrary, a CPA allows CashASAP to take smaller amounts if there isn’t enough money on your card to cover the full repayment.

How Much Do CashASAP Loans Cost?

As we noted earlier in our review, obtaining a loan through CashASAP is not going to be cheap. As is the case with most payday loan companies that target those in desperate need of cash, the annualized APR rate at CashASAP is going to be three-figures. With that said, you won’t know how much the lender will charge you on the loan until you make an application. Once again, this will always be on a hard credit check basis, so make sure that you meet the minimum requirements before proceeding.

Even if you are approved for a CashASAP loan, you are under no obligation to proceed. If you think that the APR rate is too excessive (which it likely will be), simply walk away.Nevertheless, we’ve listed the main variables that CashASAP will look at when assessing your APR rates.

❓The amount you need to borrow

❓How long you need to borrow the funds for

❓Your current credit score

❓Your historical relationship with debt

❓When you next receive your salary

❓How much you earn after tax

Although the specific APR rate will vary from borrower-to-borrower based on the above variables, we have made some calculations based on the stated representative rates.

💸 If you were to engage in a payday loan at CashASAP – meaning that you must repay the money on your next salary date, you could pay a representative rate of 1,390%. This amounts to an annualized APR of 290%, which is huge. For example, if you borrowed £175 over the course of 19 days, you would end up paying £201.41 back.

💸 In the above example, this would amount to an interest payment of £26.92 – even though you only borrowed the funds for 19 days.

💸 If you were to borrow the funds via a multi-month loan, meaning that you would need to make three equal repayments, things start to get even more costly. For example, at a representative rate of 1,271%, a £250 loan over the course of three months would end up costing you £359.01. This amounts to an interest payment of £119.67.

💸 There are no other financing fees to consider, other than what is included in the APR rate. Moreover, you will always have the option of repaying the loan off early if you wish to reduce your interest payments. This will be especially beneficial if opting for a multi-month loan.

Am I Eligible for a CashASAP Loan?

Although CashASAP is a payday loan lender that tailors its products to those with bad credit, not everyone will be eligible. As such, we would strongly recommend reading through the following requirements before starting the application process.

If your credit score is badly damaged, CashASAP will then look at other metrics of your financial standing – such as your income. However, it will likely need you to upload supporting documents, such as a bank account statement or a recent payslip.✔️ Credit Check

CashASAP will run a credit check on all of the applicants that apply for a loan on its site. Although it does not require a minimum credit score per-say, it will want to see what your historical relationship with debt is like. As such, if you’ve previously defaulted on loans – and the loans still remain unpaid, you might not be eligible.

✔️ Be in Employment

CashASAP requires all applicants to be in employment. This can either be part-time or full-time, and no minimum income is stipulated. As noted above, you might need to provide supporting documents on your stated income.

✔️ UK Resident and 18 Years +

You will need to be aged at least 18 years old to apply for a loan with CashASAP. You’ll also need to be a UK resident. If the lender is unable to verify your identity electronically, you might need to upload a copy of your passport or driver’s license.

✔️ Valid UK Bank Account and Debit Card

As CashASAP will be transferring your loan funds electronically, you’ll need to have a valid UK bank or building society account. You will also need to have a debit card that is linked to the aforementioned account, as this is what the CPA will be linked to.

Customer Service at CashASAP

CashASAP offers a number of support channels if you require assistance, which we’ve listed below.

📱Phone: 0845 094 1905

📧 Email: [email protected]

✉️ In Writing:3rd Floor, 12 Gough Square, London, EC4A 3DW

Customer support at CashASAP is available 7 days per week. You can contact the team between 8 am and 9 pm during the week, and between 8 am and 7 pm on Saturdays and Bank Holidays. The support teams works between 9 am and 7 pm on Sundays.

CashASAP Review: The Verdict?

In summary, we hope that you are now able to make an informed decision as to whether or not CashASAP is right your funding needs. As is the case with most payday loan lenders active in the space, you should tread with caution before applying. The overarching reason for this is that the underlying APR rate is going to be sky-high. In fact, the platform lists a representative rate of 1,390% on its payday loans, and 1,271% on its multi-purpose loans.

If opting for the latter, you’ll pay a whopping £119.67 in interest on a £250 loan. As such, it’s well worth trying to obtain an alternative financing source before starting your application. On the flip side, we do like the fact that CashASAP allows you to complete the entire application online, with the process rarely taking more than 5 minutes. If you are approved, you should have the funds transferred the very same day.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.FAQ:

What interest rates does CashASAP charge?

CashASAP lists a representative rate of 1,390% on its payday loans, and 1,271% on loans of three months. However, you won’t know your individual APR rate until you submit an application.

How much can I borrow from CashASAP?

CashASAP offers loan from £100, up to a maximum of £750. However, if this is your first time applying with the lender, the most you can borrow is £300. If you repay your first loan on-time, you will then be able to apply for a higher amount.

How do I repay my loan with CashASAP?

As is the case with most payday loan lenders, you will need to repay the loan via your debit card. Known as a continuous payment authority (CTA), CashASAP will have the legal remit to take your repayment(s) automatically. Moreover, if the repayment fails due to insufficient funds, it can try for a smaller amount.

How do I contact CashASAP?

You can call CashASAP on 0845 094 1905, or send an email to [email protected]. The customer support team works 7 days per week – including Bank Holidays.

UK Payday Loan Reviews- A-Z Directory

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up