SafetyNet Credit Review – Read This Before Applying

If you need money fast, look to payday loan facilities like SafetyNet Credit for a quick fix. From all the financial advice you have read over the years, you know it’s prudent to set aside some cash for emergencies. But what you’ve also learnt is that this is easier said than done.

With a limited source of income, and the possibility of accidents and emergencies occurring, it’s close to impossible to be fully ready for what the world throws at you. But not all hope is lost. Payday loan companies like SafetyNet Credit are here to the rescue.

Speaking of payday loans, we should point out that they have experienced exponential growth in the UK ever since the government, through the FCA imposed regulations. As a result of these regulations, the cost of servicing a payday loan dropped.

So, since you are here, it’s safe to assume you are doing your due diligence. You want to know if SafetyNet Credit is secure, how it works, and if it’s a scam. We seek to answer this and many more questions in this guide.

Here we go.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

-

-

What is SafetyNet Credit?

It is a payday loan company that operates under Indigo Michael Limited. However, unlike most payday loan companies, it has an excellent proposition. It offers a safety net for its borrowers hence its name ‘SafetyNet’. If you opt to provide the company with access to information about your current account, SafetyNet creates a secure connection to the account and uses the connection to track your balance and assess your credit. What is the benefit of doing this?

Well, it allows the company to lend you money, and you only make repayments when you can afford to. This is a unique selling point since with most companies, they fix your emergency only to become the emergency a few weeks down the line.

Given the ongoing and ‘open’ nature of the agreement, financial experts refer to it as a revolving line of credit. If you think about it, it’s ideal for getting cash for the business to fulfil and order and pay it back in a few days or weeks.

But even with the innovative and creative approach, its core, it’s still a payday loan with expensive interest rates and low loan limits.

SafetyNet is not your typical payday loan company. Its goal is to provide you with a solution to an expensive bank overdraft rather than a personal loan.Pros and Cons of SafetyNet Credit

Pros:

- Speed – for a new customer, processing a loan can take as long as a day to complete setting up the account and getting credit. However, after this stage, accessing loans is fast and straightforward. For some customers, it’s automatic.

- Convenience – when you complete setting up your account, you can download the app or go to the online dashboard and request credit when you need it. With the app, you can request a loan on the go. Moreover, you can automate deposits when you get close to your overdraft limit.

- No fees – if you repay the loan within a given timeline, there’s no cost aside from the interest rate.

Cons:

- High-interest rate – SafetyNet Credit has a 0.8% daily interest rate. This is high and it toes the line of the legal maximum interest rate. However, in comparison to other payday loan facilities, this is a standard interest rate.

- Privacy – the fact that you need to provide the company with access to your account information makes some people uncomfortable. The internet has numerous stories of deals gone wrong because of sharing financial information.

- Too convenient – for some financial experts, the convenience of accessing loans could be the downfall of SafetyNet Credit. Yes, it a good thing to set up an automatic deposit. But on the flip side, it exposes you to the risk of taking a loan when you don’t need it because you forgot to stop the deposits. Also, with high levels of convenience, some individuals may have an even harder time resisting their expenditure.

How does SafetyNet Credit Work?

When you apply for a loan on SafetyNet Credit, you will need to provide your name, account details and physical details (the standard requirements). But in addition to this, SafetyNet Credits requires that you give access to your bank account. Now, before you freak out, as we have mentioned before, this does not mean that you provide them with the internet banking username and passwords. No, instead, they use open banking to read and analyse the transaction data on your account.

So what is open banking? You have probably heard it in connection with banking apps claiming to use it to provide you with better financial management and deals but you were not clear on how it works.

Open banking is simply a list of regulations that date back to January 2018. They allow third party financial providers to access basic data on your account. The process only happens with your authorisation and under the protection of UK banking laws.

SafetyNet Credit uses this connection to achieve several things:

- Provide you with bank balance top-ups in case your account balance falls below the required levels. SafetyNet calls it a Smart Top-up.

- Monitor the account balances to determine when you can afford to make a repayment

- Help in improving your finances with a free financial management tool

But why do they make a big fuss over the Smart Top-Up? Well, because it can save you a lot of money on overdraft fees. You see, overdraft fees are more expensive than payday loans. So SafetyNet Credit offers you an option to save some money. Through the online dashboard, you can set the SmartNet Credit account to send you money when the bank balance goes below a given level.

Repayments

How do you do it? SafetyNet Credit avails two methods of repaying loans: automatic and manual.

- Automatic repayment – to protect you from incurring unnecessary interests, SafetyNet deducts some amount from your account when the bank balance increases. But this does not mean that they take advantage and pay off the loan all at once. The rule is to never leave the account with less than £30 above the overdraft level. This leaves you with just enough money to spend. It also means that if you have less than the £30 above the overdraft level, SafetyNet will not make a deduction. You can always change this value in the settings.

- Manual repayment – Like with normal loans, you can choose to repay the loan in part or in full. This method gives you more control over your finances.

So not that you know how to repay the loan, the question is, how much do you repay every month? The amount you repay varies depending on your loan amount. However, the minimum monthly repayment is displayed on the dashboard and the monthly statement.

The minimum repayment amount is usually 5% of the total amount you owe plus interest. However, this is subject to a £20 minimum rule. This means that if the amount owed is less than £20, you repay the loan in full.

Note you are not limited to the minimum amount. Actually, experts advise that you increase the money to pay it back in a shorter period and reduce the interest rate you pay.

What Loan Products does SafetyNet Offer?

SafetyNet Credit focuses on offering overdraft facilities to individuals. The fact that it checks through your transaction details acts as a safety.

What other store services does SafetyNet Credit offer?

Aside from providing loans, SafetyNet Credit has a free app which it uses to helps you to manage their funds better and to optimise your borrowing.

SafetyNet Credit Account Creation and Borrowing Process

The account creation process is online and takes less than 8 minutes. Also, the application process is free.

- Go to SafetyNet Credit official website

- Here you’ll get an overview of how the facility works. At the bottom you’ll find a ‘Get Started’ button – click on it.

- Click ‘Get Started’

- A registration wizard will pop up detailing the legibility criteria along with some warnings to ensure you know what you are getting into.

- Select your bank from a list on the site. The banks on the list are the only ones SafetyNet Credit accepts at the moment.

- Confirm you have read the Terms and Conditions (mandatory). It’s optional to allow the company to send you updates and to have them share your information with third-party finance companies.

- Submit your details including your name, email address and mobile number.

- Enter your postal code. Along with the postal code, you’ll need to offer more details on your residence. Are you a tenant, or an owner? If you are a tenant, do you live alone or with your parents? And is the house furnished or unfurnished?

- Enter your income. The details include your employment status, name of employer, frequency of payment, expiry date and amount to borrow.

- Finish the setup process by creating a password.

Eligibility Criteria

Below are some of the SafetyNet Credit requirements for individuals looking for a loan on their platform.

- You should be either a resident or a citizen of the UK

- You should be above 18 years

- You should have a current bank account complete with online banking

- You should have a regular income/salary

- Have a debit card from your bank

- Your employer should pay your salary into the account you provide

Information Borrowers Need to Provide to Get SafetyNet Credit Loans

- Name

- Date of birth

- Email Address

- Contact details

- The amount you need to borrow – for new users it’s capped at £500. The maximum for subsequent loans is £1000

- Income details

- Frequency and method of payment

- Bank account number

- Bank sort code

- Debit card details

What countries does SafetyNet Credit accept?

SafetyNet Credit is available in the UK.

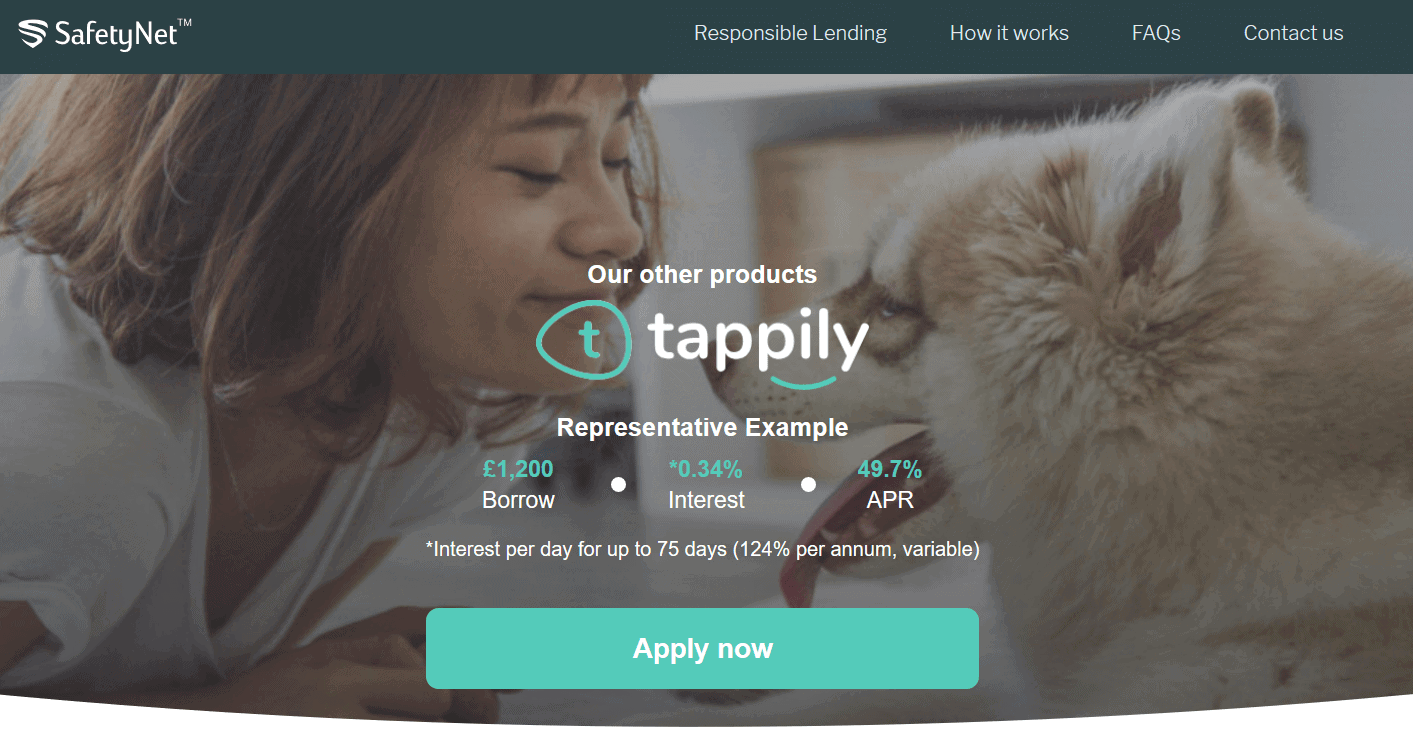

What are SafetyNet Credit loan borrowing costs?

Being a payday loan, the interest rates are high. SafetyNet Credit charges 0.8% interest per day capped at 40 days. This translates to 292% per annum (variable). The representative is 68.7% APR (variable).

SafetyNet Customer Support

SafetyNet Credit customer support is available on live chat, email ([email protected]), and on the phone (0800 180 8400 – a toll-free number).

On live chat and phone, the customer support is available from Monday to Friday between 8 am, and 7 pm and on Saturday between 8 am and 5 pm. If you choose to use their email, you will get a response within 24 hours.

Is it safe to borrow from SafetyNet Credit?

SafetyNet prides itself in being a reputable company. As such, it does everything in its power to keep the information you provide secure. The company uses 256-bit encryption to secure all information you provide. Moreover, Open Banking technology it uses only affords it read-only access.

And last but not least, SafetyNet Credit adheres to the FCA lending regulations.

SafetyNet Credit Review Verdict

Overall, SafetyNet Credit has done a great job of ensuring that loans are available in a convenient method. The only cons that may raise concerns for most individuals are the high-cost loans and the suitability of regular use. However, if you are always finding yourself getting into unauthorised overdrafts, SafetyNet Credit loan facility can help you save some money. But even then, you should look into other credit options as well.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.FAQ

How much can I borrow on SafetyNet Credit?

The amount you can borrow depends on a variety of factors including your income, whether it’s your first loan or not and the amount available in your bank. For new customers, the maximum amount you can borrow is £500. SafetyNet credit determines the exact amount through the affordability assessment. With continued use, your credit limit grows to a maximum of £1000.

If I have a poor credit score, can I still apply for a loan?

Yes, you can still apply even if your credit score is poor. However, SafetyNet Credit does its due diligence. This means that it checks your credit score with the credit reference agencies. If your bad credit history is recent, chances of having a successful application decrease. In addition to this, SafetyNet adheres to responsible lending. As such, it shares your repayment history with the credit reference agencies. If you repay without problems, the same will reflect on the credit reference agency database and will help to improve your credit score.

Is a bank account essential?

For SafetyNet Credit, yes it is. This is because of the overdraft service they offer. Your bank account should be in the UK and it should have online banking. Moreover, the bank account should be one that your salary is paid into or at the very least, where your primary source of income lands. If your bank isn’t on the list, you should call them to discuss the possibility of opening an account.

Do I need to enter into a credit agreement or sign a contract?

Yes, you do. You see, creating a SafetyNet account is just like getting into a credit card agreement. As such, there are some legal documents you have to sign to use the account. Some of these documents include the Standard European Consumer Credit Information, an Explanation of the Credit Agreement, and a Regulated Credit Agreement which needs an electronic signature. But do not shy away from setting up an account because of these agreements, SafetyNet is authorised and regulated by the FCA under the FRN 715525.

Can your SafetyNet account be locked?

Yes, it can. This happens when you have not cleared your debt, or when your financial situation has changed or the online banking details have been altered for various reasons. In this case, you need to contact customer support immediately through email or phone.

How long doe funds take to transfer into your account?

If your account has been approved and the setup is complete, once you apply for a loan it only takes 15 minutes (or less) for funds to reflect in your account. However, the process can take up to 2 hours. For new users, the process of account approval and funding can take a maximum of 24 hours.

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up