Cash Kitty Review 2021 – Read This Before Applying

When you need some extra cash to get you to your next paycheck, you should consider getting help from an online service like Cash Kitty. We get it, the economy is tough, and your budget may get out of hand from time to time. You can consider getting a same-day loan from lenders in the UK.

This is an excellent solution. But there’s only one problem. So far, you’ve only received bad reports about personal loan providers. The internet is full of scam stories and all your friends advise you to stay away. But before you write off these lenders, it’s essential to have all the facts. Let’s have a look at Cash Kitty, for instance. Is it worth your time? Is it safe and secure or will it rob you blind?

To help you make an informed decision, below is a fact-filled Cash Kitty review. It contains all the information you need to decide if it’s the right platform for you or not.

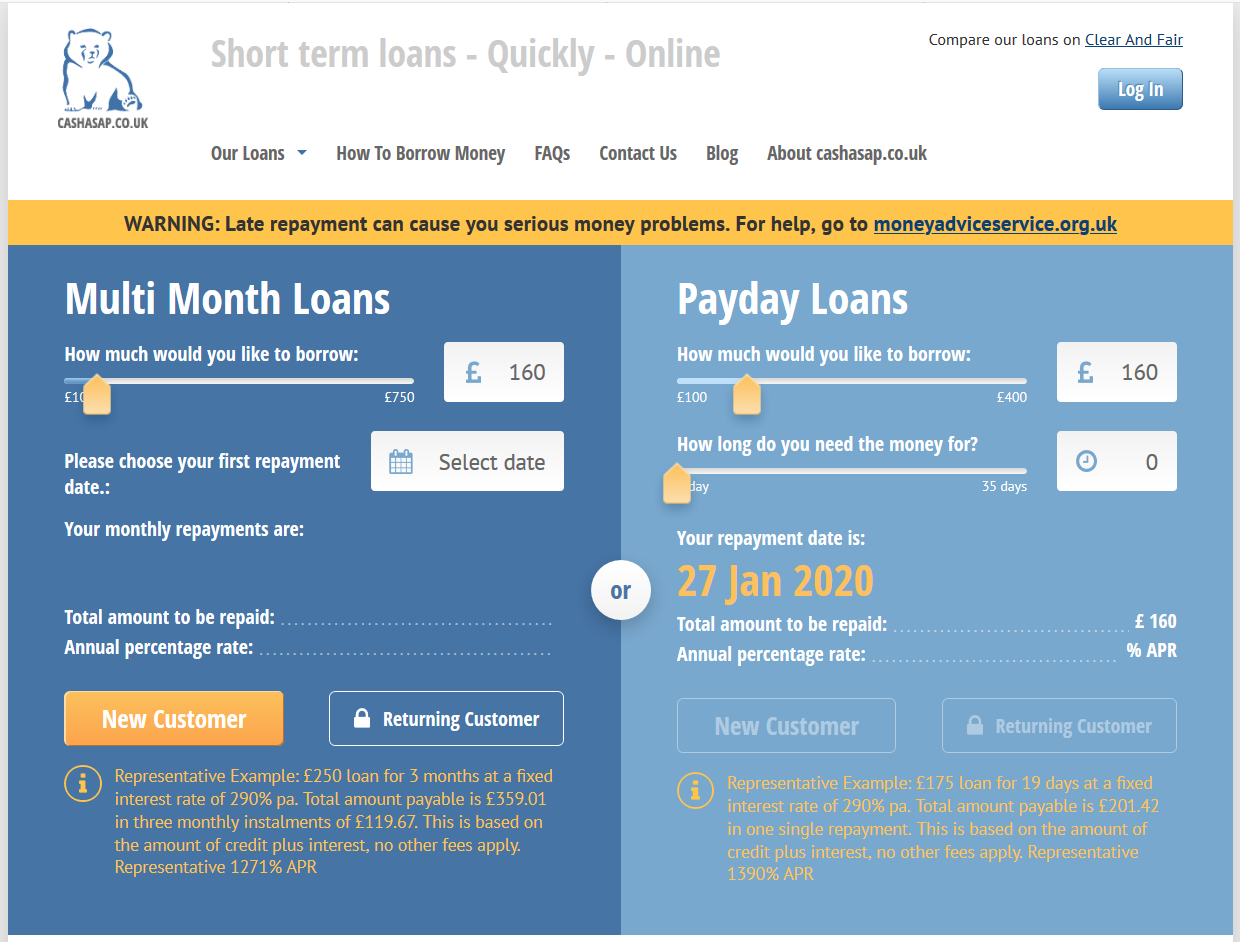

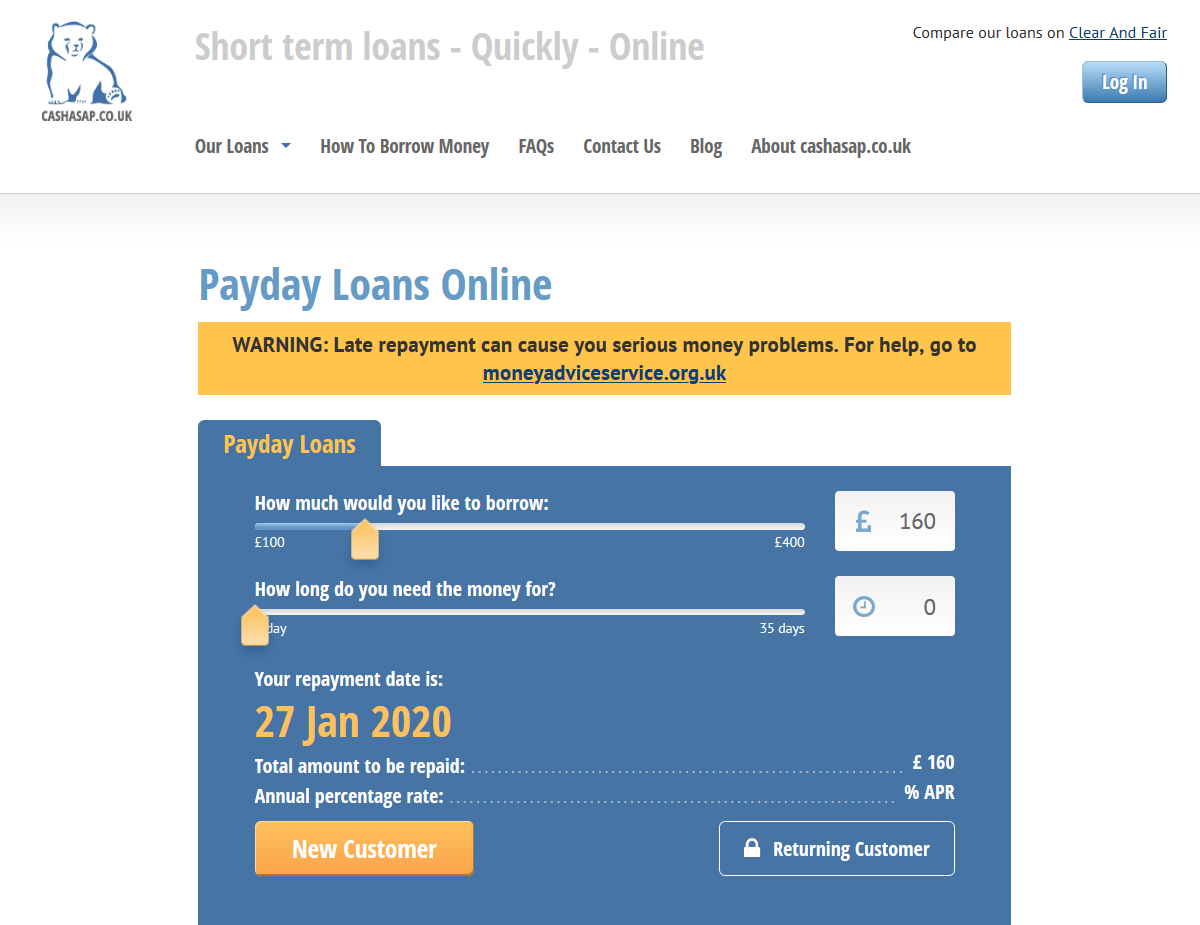

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

-

-

What is Cash Kitty?

Before we get into Cash Kitty, you should note that financial emergencies are not unique. Everyone experiences financial crises from time to time. It’s because of this that the short term loan industry in the UK continues to thrive. And with the increased demand for short term loans, there’s an influx in the number of lenders in the UK. This makes it difficult for you to choose on that is ideal for your situation. And if we are being honest, choosing the best short term lender in an emergency, when you are under pressure, is an impossible task. But this is why Cash Kitty was created – to help you choose the best lending facility.

You see, Cash Kitty is not your typical personal loan provider. Instead of lending cash, the company acts as a broker matching its customers to the best lenders in their database based on the information they provide. You could say Cash Kitty is all about reducing your research time and ensuring you get the best possible loan through a simple online form. But though Cash Kitty improves your chances of getting a loan when you need it most, every loan application is subject to the requirements of the lender and approval.

Now, Cash Kitty is a brand by William Elis Sinclair, a company authorised to operate in the UK and regulated by the FCA under reference number 618190. The Information Commissioners Office also licenses it under the registration number ZA033005.

Before you apply for a loan with Cash Kitty, they insist that you review your reasons. Ask yourself if you really need to spend the cash or if you have alternative ways of financing your expenditure. They also insist on evaluating your ability to pay back the money within stipulated timeframes. Also, if you feel you’ll need to take multiple short term loans in the following months, they insist you consider long term loan options.

Cash Kitty only connects you to lenders. But short term loans are expensive and can be a gamble. Weigh other loan options before submitting your application through Cash Kitty.Pros and Cons of Cash Kitty

Those who have used the platform before have a lot to say about their experience. Some love the platform, and others don’t. Below is a quick breakdown of the pros and cons of the Cash Kitty.

Pros:

- Easy and quick applications – the application process takes only a couple of minutes to complete. It requires users to fill in basic information

- Your application form is sent to many lenders – this alone means that you save a lot of time you would have otherwise spent researching great emergency loan companies, creating accounts, and sending loan applications. With Cash Kitty, a single application goes to an entire network of potential lenders.

- Money is approved fast – if you apply for a bad credit loan and get approved, the funds will be in your account in less than 24 hours (provided you fill the application before the close of business on Saturday).

- Free Service – Cash Kitty doesn’t charge users any fee to find potential short-term loan lenders.

Cons:

- You don’t have control over who gets to see your application – Cash Kitty does not list the lenders who are in its network. Because of the lack of transparency on this front, it’s impossible to research the lenders beforehand. And just because Cash Kitty ensures your information is safe does not guarantee you that the lender you get has the best customer support or the best website. It is a case of ‘you take what you get.’

- It is not a lender – most users say Cash Kitty has a simple and straightforward website. However, the website is not the final destination. The loan you get will not be serviced on the platform. Therefore, before you accept a loan, ensure you are comfortable with the lender and the terms they stipulate for the loan.

- Terms are not listed – you do not know the exact terms and rates that apply to the loan until you get an offer. And since the terms differ from lender to lender, it is difficult to know how much time you have to service the loan.

- The costs are steep – short term loans are notorious for high APRs. The lenders on Cash Kitty’s network are no different. Though other types of credit forms take longer to process, they usually are cheaper.

How does Cash Kitty work?

Cash Kitty is a loan provider that allows users to submit loan applications and connects them to multiple lenders in its network through a single application. So instead of lending money, it uses the information on your application to get you a short term loan.

Their selling point is that they save you research time and help you get a loan that’s perfect for your financial situation in the shortest time. Whether they achieve this selling point experience is debatable, as seen on the pros and cons section.

So the process starts by filling a form. Cash Kitty then sends this form to lenders in its database, but after verifying your credit history through Credit Information Services like William Ellis Sinclair and others. There is no way a user can know which third-party provider will review the application before it’s complete. But what is a given is that all these Credit Information Services have a 14-day free trial, after which they require a monthly membership costing between £10 and £30 (if your loan application is rejected and you’d like to know why you can use these services). Since Cash Kitty isn’t the lender, once your loan is approved, they pass you on to the lender in question and you deal with them directly. The loan terms that apply are those of the lender and not Cash Kitty.

Cash Kitty doesn’t charge any fees, protects your personal details, and doesn’t have paperwork.

What loan products does Cash Kitty offer?

The loan products on offer depend on what the lenders in its network offer. The products include:

- Secured loan – this requires an asset for approval.

- Personal loan – this type of loan is unsecured and ideal for those with bad credit. However, the loan often comes with high-interest rates as a reward for the high risk.

What other store services does Cash Kitty offer?

Aside from connecting you to lenders, Cash Kitty doesn’t offer any other financial service. The services you can take advantage of are those your lender offers.

Cash Kitty account creation and borrowing process

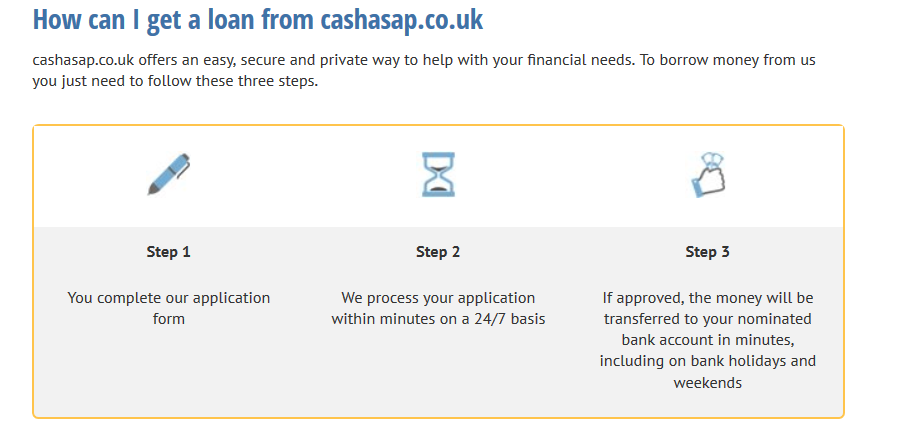

The process is simple and straightforward, as outlined below:

- Step 1: You specify the loan amount, duration, and reason for taking the loan. It could be for an emergency, car repair, home improvements, travel expenses, utility bills or any other thing.

- Step 2: Enter your details. This section specifies the name, residence, and contacts.

- Step 3: Here, you enter your work details. You will have to specify the name of your employer, your income, how long you’ve been working for your current employer ad when you expect your next paycheck.

- Step 4: Specify your Monthly expenses. This step is essential since it helps Cash Kitty and lenders to determine if you can afford the loan you are requesting. This section is part of its adherence to responsible lending

Eligibility criteria for Cash Kitty

Like any other Same Day Loan company, Cash Kitty has criteria it follows to screen users before they make applications. The eligibility criteria help to save time and resources for all parties involved. For Cash Kitty, it means they don’t have to go through a long list of applications in which more than 50% don’t meet the requirements, and for customers, it means that your chances of a loan approval increase. Below are the bare minimum requirements for Cash Kitty loan applicants.

- You should be a UK citizen

- You should be more than 18 years old

- You should have a bank account in the UK and with a valid debit card

- You should have a regular income of not less than £800

- You should have a valid address

- Have internet connection

Information borrowers need to provide to get Cash Kitty loans

The information you should provide is split into:

- Personal details – these include your name, contacts, address, and marital status

- Work details – these details include your employer’s name, how much you make, how long you have been with the company, and when you get paid. You also need to provide your bank account details.

- Expenditure details – you should provide details including mortgage, expenses on food, entertainment, transport, and utilities.

What countries does Cash Kitty accept?

Cash Kitty works with lenders in the UK. As such, it means that it only works for UK citizens or residents. If you don’t have a bank account debit card or a physical address in the UK, you cannot apply for the loan

What are Cash Kitty loan borrowing costs?

By now, it should be clear that Cash Kitty is only a broker in this ecosystem and not a lender. So the question is, how does the company make money? Because whether they are a broker or a lender, they are a company and need profits to operate. Indeed they earn money but not through charging direct fees (some lenders in their network may have some fees). Instead, Cash Kitty allows you to borrow loans in the range of £100 and £5,000. The upper limit is high because it works with different lending companies. From the money they ‘lend,’ they get a commission from the lender (more on this on the FAQ).

If you apply for a £400 loan and wish to repay it within 90 days, you will repay £187.31 every month. Once the 90 days elapse, you will have paid an interest amounting to £161.92. This puts their interest rate at 161.9% pa with a representative of 305.9% APR.

Because of these costs, Cash Kitty advises that you think through the choice of taking short term loans before finalising the application process. You should only borrow what you can afford to pay back. An easy way of determining whether you can afford to repay the loan is to determine your disposable income and subtract from the total amount you apply for including interest. If you have enough money left to afford monthly repayments, then complete the application.

Cash Kitty customer support

Cash Kitty is entirely an online service. Because of this, they do not run a traditional call centre. Some users consider this a downside. But with their business structure, Cash Kitty doesn’t see the need to have a customer support centre.

If you experience trouble while on their website (you find the application process confusing for you or cannot find some valuable information), you should email them on [email protected]. They claim to respond within 24 hours to any queries. You can also reach out through their phone number: 01740 582046. To reduce the need of reaching out, Cash Kitty has an FAQ section.

However, if you are servicing a loan and have questions about the loan, then you should contact the specific lender for more assistance. This system works because individual lenders and not Cash Kitty set the money and the loan rules and regulations for the loan. When your loan is approved, you’ll know which lender offered the loan, and you will get relevant contact details at that point.

Is it safe to borrow from Cash Kitty?

How can you trust a company that shares your information with third-party companies? Cash Kitty makes your application available to lenders in their database. It also gets Credit Information Services from William Ellis Sinclair or other third-party providers. Though your concerns are valid, there is nothing to worry about since the company seems to have covered all its basis.

First, Cash Kitty protects all information you provide on the website with 256-bit encryption technology. And all lenders in their database adhere to a strict code of conduct as stipulated I the Online Lenders Alliance. This alliance ensures that customers are fairly treated and always in the know. Overall, Cash Kitty claims the security it offers its clients is at par with that of traditional banks.

Cash Kitty review verdict

As a broker platform, Cash Kitty receives decent reviews. It reduces the time spent looking for lenders in the UK and ensures you work with safe lenders in the UK. Since it’s a brand, Cash Kitty is careful with the companies that it works with to maintain its public image and offer the best service. However, they could offer a little more information on the lenders they work with before completing the application process.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.FAQ

How does Cash Kitty make a profit?

To keep the platform running, it receives commissions from lenders they refer to users. With every successful match, they earn a commission that is paid by the lender. Cash kitty doesn’t charge its users a fee for the matching process.

Can anyone apply for a loan?

Yes. However, they have to meet a set of rules, as outlined in the eligibility criteria section. You must have a bank account because this is where the loan will end up.

Why is the APR so high?

Focusing on the APR is missing the point. Why? Because short-term loans are often taken for 30 days max. Cash Kitty network of lenders, therefore, prefer to focus on the amount you pay back instead of the APR. Generally, Cash Kitty has competitive rates in the Short term loan UK industry.

How will I repay the loan?

Your loan will be repaid through your debit card. This will be paid directly to the lender. In the case of instalments, the repayment amount will be deducted on the repayment date.

If I have bad credit, can I still apply?

Yes, you can. Most lenders extend loans to individuals with bad credit histories as well.

How long will the loan process take?

The time depends on the lender that gives the loan and the type of loan you want. If it’s a short term loan, it can take less than half an hour. This means money will be in your account on the same day you submit your application.

Thadues

Thadues

View all posts by ThaduesThadeus Geodfrey has been a contract writer for Lernbonds since 2019. As a fulltime investment writer, Thadeus oversees much of the personal-finance and investment-planning content published daily on this site. With a background as an iGaming expert and independent financial consultant, Thadeus’s articles are based on years of experience from all angles of the financial world.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up