Best UK Investment Trusts in 2020

Investment trusts are among the best assets you can own to grow your wealth over time. These assets have a history not only of increasing in value year after year but also of returning an increasingly large dividend to investors each year.

In this guide, we’ll take a closer look at what investment trusts are, how they work, and how they differ from investment funds. Importantly, we’ll focus on how putting your money in the best investment trust can help you profit steadily and predictably over the long term. We’ll also highlight three of our favourite brokerages for buying and selling investment trusts in the UK.

-

-

What are Investment Trusts?

Investment trusts are essentially a type of fund, in which a money manager takes in investors’ money and reinvests it across the stock market and other assets like energy, infrastructure, and real estate. Some investment trusts specialise in a particular market, for example, there are stock investment trusts and real estate investment trusts, while others distribute investors’ money across a wide expanse of asset classes and countries.

One important thing to know about investment trusts is that they’re traded on the stock market just like a traditional company. The share price of an investment trust isn’t always matched exactly to the value of the assets that the trust itself invests in. Rather, investment trust prices go up and down according to share supply and demand, just like prices for any other company.

Examples of Investment Trusts

There are hundreds of investment trusts available in the UK, but some of the best investment trusts are offered by just a handful of companies. Aberdeen investment trusts and Baillie Gifford investment trusts, for example, each offer a variety of investment trusts that you can buy on the open market (you don’t need to hold a trading account with Aberdeen or Baillie Gifford). Other major players in the UK investment trust space include Blackrock and Allianz.

The trusts managed by these financial institutions span the gamut from stock-only trusts to real estate investment trusts to trusts that invest in emerging economies. The companies’ most popular trusts are among the best investment trusts for income. As an example, Ballie Gifford’s Scottish Mortgage investment trust is a global real estate investment trust with a three-year return of more than 75% and an annual dividend yield of 0.6%.

Best Brokerages for Buying Investment Trusts

Since investment trusts are traded as you would buy shares on the open market, it’s important to find a reliable, low-cost brokerage for trading them. To help, we’ll highlight three of our favourite UK brokerage for buying and selling investment trust shares.

AvaTrade - Best for Trading CFDs

AvaTrade is another commission-free online brokerage, but with this platform you can only buy and sell contracts for differences (CFDs) rather than actual investment trust shares. That may be good or bad depending on your investing goals. Importantly, since you don’t own the shares outright, you’re not eligible to collect dividends.

On the other hand, AvaTrade enables you to trade CFDs for investment trusts with leverage up to 20:1. So, if you think that an investment trust is underpriced relative to the assets it holds, you can use leverage to make a big bet that the price of the trust shares will rise. It’s also noteworthy that AvaTrade supports copy trading. So, you can also use your leverage to speculate on the price of a custom bundle of assets pieced together by copying the contents of other traders’ portfolios.

To help with speculating on the price of an investment trust, AvaTrade offers a wealth of research tools. This brokerage has its own proprietary charting platform and it comes with access to MetaTrader 4. These tools also make AvaTrade an attractive choice if you want to trade more than just investment trust shares with your brokerage account.

- Trade Commissions: No

- Minimum deposit: £100

Our Rating

- Leverage: Trade investment trust CFDs on a 20:1 margin

- No Commissions: Trade CFDs at no cost

- Research Tools: Comes with access to MetaTrader 4

- No Dividends: You’re not eligible to collect dividends when trading CFDs

IG - Best for Investment Trust Choice

IG is one of the largest and most well-established brokerages in the UK. In all, this brokerage offers investors access to more than 9,000 shares across UK-based and international stock exchanges. If you want the widest choice of investment trusts to trade in, including the option to buy and sell real estate investment trusts, then this is the brokerage we recommend.

Unfortunately, IG isn’t a commission-free brokerage, so you’ll need to pay a fee of around £5 every time you buy and sell shares of an investment trust. This is a definite drawback if you’re only investing with small amounts of money or want to invest your cash piecemeal rather than all at once. But, in IG’s defence, the trade commissions that this broker charges are significantly less expensive than what many other established UK brokerages charge per trade.

We also like IG because it offers a fair amount of resources for beginner and intermediate investors. The brokerage has a massive trove of educational videos, articles, and tutorials that you can use to better understand investment trusts and choose the one that’s right for you. IG stockbrokers also hold weekly webinars and trading courses. So, if investment trusts are just the start of your investing journey, IG can help you progress to trading more complex assets.

- Trade Commissions: £5

- Minimum deposit: None

- Wide Range of Choices: Trading for more than 9,000 shares

- Trusted: IG has been in business since 1974

- Educational Resources: Webinars and video tutorials to help your trading

- Trade Commissions: Can be £5 or more per trade

Investment Trusts vs. Funds

UK investment trusts and investment funds are very similar on the surface. After all, both types of investments pool investors’ money and reinvest it in the stock market or other assets.

But, there is a major difference in the way that investment trusts fundamentally work that differentiates them from investment funds. Investment trusts are closed-ended, meaning that the amount of money the trust manager has to invest doesn’t change when new investors buy into or leave the investment trust. This is why investment trusts are bought and sold as shares, rather than by investors directly putting money into a pool.

The fact that investment trusts are closed-ended gives trust managers much more freedom and financial stability compared to investment funds. As an example, real estate investment trusts can put money into development projects that may take years to see a return because the trust manager knows that the trust won’t be short of cash in the interim if investors decide to pull out.

There are a few additional ways in which investment trusts in the UK stand out from traditional funds. Investment trusts are able to borrow money to fuel new investments. That increases their potential return, as well as their potential risk. On top of that, UK investment trusts are allowed to keep up to 15% of their profits in any year to put towards future investments or to use as a cash stockpile for future dividend payments.

Advantages of Investment Trusts

The number one reason to opt for an investment trust is that these assets historically offer excellent returns. One of the best investment trusts of recent years, the Blackrock Throgmorton investment trust, returned more than 40% in 2019 and has seen a three-year return of more than 100%. Investment trust returns are typically higher than what funds return, in no small part because trust managers have more freedom to invest in long-term projects.

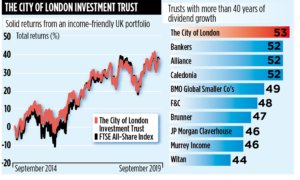

Another major reason that many investors like investment trusts is that they offer high dividends that consistently grow over time. There are more than 20 investment trusts in the UK that have increased their dividend payouts every year since they launched. This is where the option to sock away 15% of profits during good years comes in handy. Investment trusts are able to use that stored money to maintain high dividend payments even during years that aren’t so great.

The only significant downside to investment trusts is that since they’re traded as shares on the open market, you’re subject to trade commissions and other brokerage fees when buying and selling them. However, this drawback can be entirely mitigated by opting for a brokerage that waives trade commissions.

Conclusion

Putting your money in the best UK investment trust is a great option for growing your money over-time to save for goals like retirement. Investment trusts can return steady income through dividends, and they often yield significantly greater returns than similar investments like funds. The diversity of investment trusts is an advantage, too, since you can diversify your portfolio by investing in a mix of different asset classes through multiple trusts.

Since investment trusts are traded on the stock market, it’s also important to find a trustworthy and low-cost brokerage to move your money in and out of trusts. With our recommendations in mind, you can find the broker that’s best suited to your needs and get started with trading investment trusts today.

FAQs

How much money do I need to start investing in trusts?

Investment trusts are often priced inexpensively, on the order of £5 to £10 per share. That means that you don’t need much money at all to start investing, as long as you meet the account minimum required to open a brokerage account. This is another advantage of investment trusts for long-term saving, since you can easily move small amounts of money into a trust each month.

Do I need to open an account with the company that manages an investment trust?

Investment trusts are bought and sold as shares on the stock market, in contrast to many investment funds. That means that you can take a position in an investment trust from any brokerage that offers the shares and not just the broker or company that created the investment trust in the first place.

How do I find the best investment trust for income?

If your investing goal is to generate a steady income from an investment trust, you’ll want to look at the dividend yield. This is a measure of how much money is paid out as dividend relative to the current share price. Some investment trusts have a dividend yield of less than 1%, while others have dividend yields of more than 5%. The Henderson Far East Income investment trust currently offers the highest yield of any trust, at 6.3%.

What do I need to know when trading investment trusts through CFDs?

If you opt to trade investment trusts through CFDs, it’s important to recognise that you’re not eligible to receive dividend payouts. In this case, you’ll generally be better off buying and selling trusts with a low dividend yield, since these trusts are more likely to focus on increasing share price to create returns than trusts with high dividend payouts.

See Our Full Range Of Investment Resources – Investments A-Z

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up