Coop Funeral Plans Review 2021 – Everything You Need to Know

Funeral plans have become increasingly popular as a way to make sure the costs of your funeral don’t fall onto your family after you pass away. By paying for your funeral ahead of time, you can ensure that the financial burden of your burial or cremation is already taken care of when the time comes.

Coop Funeralcare is one of the more established funeral plan providers in the UK. The company is the single largest director in the country, with more than 1,000 individual funeral homes. It caters to all cultures and faiths, offering burial and cremation services throughout the year. Plus, Coop is a cooperative business, so it’s incentivised to take care of the families and communities it serves.

When it comes to choosing a funeral plan, you have a lot of options. In this guide, we’ll take a closer look at Coop Funeralcare, including what plans the company offers, what they cost, and how they stack up against competitors’ offerings. By the end, you’ll have all the information you need in order to make an informed decision about whether a Coop funeral plan is right for you.

-

-

Avalon - Best UK Funeral Plan

Our Rating

- Cremation options available with and without funeral service

- Coverage starts after one year of payments

- No restrictions on date and time of service

What are Coop funeral plans?

Funerals are expensive. On average, a burial in the UK costs more than £4,000. What many people don’t realise is that the family of the deceased is often paying for the funeral out of pocket. That’s a major and unexpected expense in the middle of a time of mourning.

Coop funeral plans allow you to prepay for your own funeral. When you buy a funeral plan, you and Coop agree to fix the cost of a set of funeral services at a certain price. The money that you pay into the funeral plan then goes into a trust, only to be taken out and used to pay for your funeral service at the time of your death.

So, when you buy a funeral plan from Coop, you’re taking ownership of a major expense that would otherwise be left for your loved ones. Even if you die before your plan is paid in full, Coop will honour your agreement and won’t ask your family to pay a dime towards your funeral service.

What are the pros and cons of Coop’s funeral plans?

Pros

- All funeral plans cover both cremation and burial

- Network of more than 1,000 funeral homes for local services

- Body collection up to 50 miles from a funeral home is included

- Installment payment plans over a period of up to 25 years

- All plans cover third-party costs like doctor’s fees

- Your family won’t pay anything if you die before paying your plan in full

Cons

- Lowest tier funeral plans are somewhat expensive

- No disbursement to help with additional costs like buying a burial plot

- The basic plan doesn’t allow funeral services on weekends or holidays

How do Coop funeral plans work?

When you sign up for a Coop funeral plan, Coop agrees to hold fixed the costs of various aspects of your funeral. That way, even if funeral costs go up over time, as they have in the past, your family won’t have anything extra to pay at the time of your death.

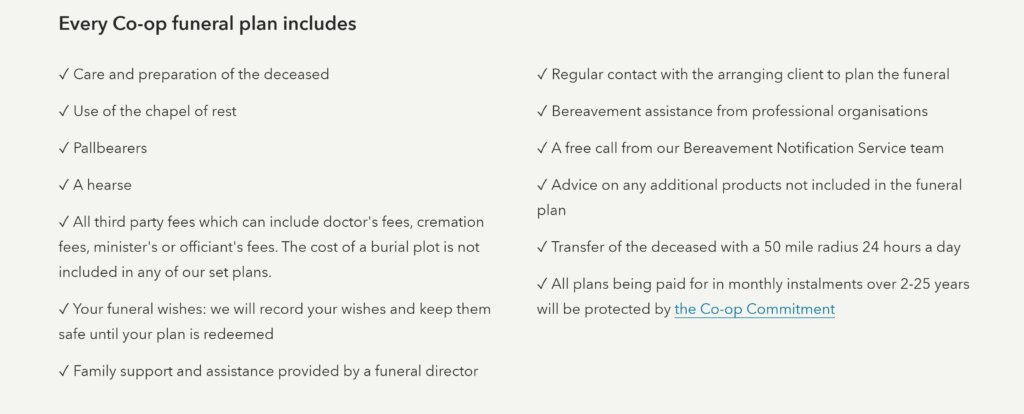

In fact, Coop funeral plans are designed so that your family doesn’t have to pay anything out of their pockets during their time of mourning. The company’s plans cover all the expensive components that are required as part of a standard funeral.

Every plan includes body collection up to 50 miles to take your body from your place of death to the nearest Coop-owned funeral home. At the funeral home, body preparation, doctor’s fees for a death certificate, and a coffin are also fully covered by your plan.

On the day of your funeral, your family is given the use of a hearse, pallbearers, and the chosen chapel of rest. If you request an officiant at the burial or cremation, their service fee is also included with your funeral plan. Finally, any costs associated with burial or cremation, including crematorium and cemetery fees, are fully covered.

There are only a few things that Coop funeral plans leave out. Catering and arrangements, beyond those normally provided by the funeral home, cost extra at the discretion of your family. More important, for burials, you or your family is responsible for the cost of your burial plot.

Significantly, Coop plans don’t provide a disbursement to your family to use for additional costs or arrangements. This isn’t a major issue if you’ve already purchased a burial plot, since there shouldn’t be any necessary expenses for your funeral that aren’t covered by your funeral plan. However, a disbursement could give your family more flexibility around minor expenses like catering, additional arrangements, flowers, and transportation to and from the funeral home.

What funeral plans does Coop offer?

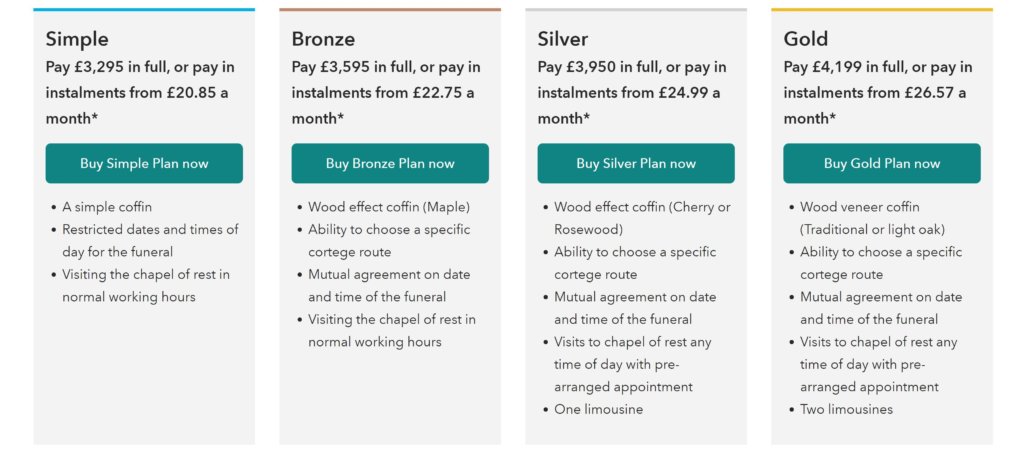

Coop offers four different funeral plans, which vary in cost and the services you get as part of your funeral.

Simple

The Simple Plan is Coop’s most affordable plan. It’s not entirely fair to say it’s a basic plan, however, as it includes everything you need for a standard burial or cremation. The Simple Plan starts at £3,295 if you pay the entire cost in a lump sum.

The main restriction around the Simple Plan is that your family doesn’t have complete flexibility in choosing the date and time of your funeral. In most cases, they’ll be required to schedule the funeral for a weekday, rather than on a weekend or holiday.

It’s also worth noting that the Simple Plan only includes a basic wooden coffin. This is not a problem for cremations, and in fact may be preferable to a more expensive and ornate coffin. For burials, a simple coffin is not as suitable for displaying your body if your family wishes to do so.

Bronze

The Bronze Plan is only slightly more expensive than the Simple plan, at £3,595, but it offers more flexibility for burials. That’s in large part because you receive a maple wood effect coffin, which is more suitable than a simple coffin for display at the funeral home and cemetery.

On top of that, the Bronze Plan gives your family the flexibility to choose the date and time of your funeral service. There are no restrictions on weekends or holidays. For transport to the crematorium or cemetery, your family can also choose a specific cortege route if so desired.

Silver

The Silver Plan, which starts at £3,950, includes everything that the Bronze plan offers. Your coffin is upgraded from maple to cherry or rosewood, and your family is given a limousine for transportation from the funeral home to the crematorium or cemetery. In addition, your family can visit the chapel of rest at any time with a pre-arranged appointment, as opposed to only during working hours.

Gold

The Gold Plan is Coop’s most generous funeral plan offering. For £4,199, it includes everything in the Silver Plan, plus a traditional or light oak wood veneer coffin and a second limousine for your family.

How much do Coop funeral plans cost?

Coop funeral plans cost between £3,295 and £4,199 if you pay the entire cost upfront. That said, Coop also allows you to pay for a funeral plan over time through monthly instalment payments. In that case, you can choose to pay as little as £20.85 to £26.57 per month over a period of up to 25 years.

It’s worth noting that if you do choose to pay over a period of two years or longer, Coop charges an instalment fee with each payment. That can significantly increase the cost of your funeral plan, even if your monthly payment is lower. As an example of how instalment charges can add up over time, the Simple Plan, when paid over a 25-year period as opposed to within two years, costs £6,255 as opposed to £3,295.

In addition, all Coop funeral plans must be paid in full by the time you turn 80 years old.

Although paying in monthly instalments is more expensive, your plan does come with the Coop Commitment. That means that if you die before your plan is paid in full, Coop will honour your agreement and will not ask your family to pay the remainder of your plan balance.

This commitment is valid as long as you make your payments each month and have made at least 12 monthly payments towards your plan. If you die within the first year of payments, Coop will simply return the money you’ve paid to your family to be used towards your funeral costs.

Another thing to consider when choosing a funeral plan from Coop is that you cannot make changes or additions to a funeral plan after you’ve chosen it. However, you can upgrade your plan later and there’s no cost to change your nominated Coop funeral director if you move within the country.

Customer support

Coop has an excellent customer support network in place. The company has a 24/7 hotline available for reporting a death as well as a general support phone number for inquiries about funeral plan coverage or other needs. You can also send an email to Coop’s support team and get a response within one business day.

One particularly nice thing about Coop funeral plans is that they all include bereavement assistance from professional organisations within the UK. This can be particularly helpful for family members who need help with mourning at the time of your death.

The company also helps family members by providing free advice on any additional products or services that are not included with your funeral plan. This can help your family members save money on unnecessary expenditures or to find recommendations for trusted providers during an otherwise stressful time.

How do Coop funeral plans compare to others?

Among the things that makes Coop different from other funeral plan providers is that the company is a cooperative. That means that its mission is to create the most value for members and the communities it operates in, rather than creating value for shareholders.

When it comes to funeral services, that ethos makes a big difference. Coop is able to hold itself and the funeral homes it operates to a higher standard and to focus on the well-being of the families in its care.

On top of that, Coop funeral plans tend to be more all-inclusive than the plans offered by other providers. Coop doesn’t provide a disbursement to your family, as other funeral plans do. But, your family also shouldn’t need that money with a Coop funeral plan, since all necessary third-party expenses are covered under the plan.

That said, Coop’s funeral plans aren’t particularly affordable. The Simple plan is around £1,500 more expensive than truly basic funeral plans for cremations or burials without funeral services. It’s also around the same price as many other providers’ mid- to upper-tier funeral plans.

Conclusion

Overall, Coop is a dependable choice if you’re looking for a funeral plan. The fact that Coop has a network of more than 1,000 local funeral homes across the UK means that your family won’t need to travel far to arrange your services. That, along with access to bereavement services, can make a huge difference in a stressful period of mourning.

Unfortunately, Coop’s plans aren’t particularly cheap, and they can become very expensive if you pay over an extended period. However, all of the plans do cover all of the costs of your funeral, including third-party costs, so that there’s nothing left for your family to pay. It’s also nice to know that Coop will honour your plan even if you die before making all of your monthly instalment payments.

Avalon - Best UK Funeral Plan

Our Rating

- Cremation options available with and without funeral service

- Coverage starts after one year of payments

- No restrictions on date and time of service

FAQs

Can I or my family choose the funeral director for my services?

You can nominate a Coop funeral director to be in charge of your funeral services. But, whether or not that director ends up working on your funeral depends on their availability at the time of your death. If you move and want to change your nominated funeral director, there is no charge for doing so.

Can my family use a funeral home that is not owned by Coop?

Your plan covers costs only at Coop-owned funeral homes. If your family decides to use a funeral home that is not owned by Coop, most of the services your funeral plan provides will not be covered.

What happens if I die before my funeral plan is fully paid?

If you die before your funeral plan is paid and you have made at least 12 monthly payments, Coop will honour your plan and will not ask for your family to pay the remaining balance. If you haven’t yet made one year’s worth of payments, Coop will refund the money you have paid to your family.

Can I add additional services to my funeral plan?

Coop funeral plans cannot be customized at the time of purchase. However, your family can purchase some optional extras, including flowers, embalming, newspaper notices, or extra limousines, at the time the plan is executed. Your family is also free to purchase third-party services outside the funeral plan.

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com