FinmaxFX Broker Review: Platform, Features, Pros and Cons

FinmaxFX is an offshore broker that allows you to trade forex, stocks, commodities, and more. The overarching selling point of the platform is that it offers super-high leverage limits. In fact, while retail traders are typically capped to just 30:1 when trading forex, FinmaxFX offers up to 200:1. But is this broker right for you? This FinmaxFX review is here to help you find out.

In this FinmaxFX review, we cover the ins and outs of how the broker works and what it offers. This covers key metrics like tradable assets, fees, trading tools, payments, regulation, customer support, and much more.

-

-

FinmaxFX: Trade with up to 1:200 Leverage

Our Rating

- Up to 1:200 leverage

- Wide range of CFD assets

- MT5 trading

- Educational resources

There is no guarantee you will make money with this provider.

There is no guarantee you will make money with this provider.What is Finmax FX?

FinmaxFX is an online broker that offers a range of asset classes that can be traded at the click of a button. Launched as recently as 2019, this makes FinmaxFX one of the newest entrants to the ever-growing brokerage arena. In terms of what you can trade, this centers on major and minor currency pairs, stocks, commodities, and cryptocurrencies.

FinmaxFX is an online broker that offers a range of asset classes that can be traded at the click of a button. Launched as recently as 2019, this makes FinmaxFX one of the newest entrants to the ever-growing brokerage arena. In terms of what you can trade, this centers on major and minor currency pairs, stocks, commodities, and cryptocurrencies.Each and every asset class hosted at the platform is in the form of CFD trading, meaning that you won’t own the underlying asset. This does, however, mean that you will be able to trade with leverage, as well as short-sell your chosen instrument. FinmaxFX is located offshore and is licensed in Vanuatu.

It also holds a fully-fledged license with the Financial Market Relations Center. Although it would be nice if the broker held a tier-one license (such as with the FCA or ASIC), this would limit the platform’s ability to offer high leverage limits. When it comes to trading, you will need to use the MetaTrader 5 (MT5) platform, which is available online, via software on your desktop device, or as a mobile application.

FinmaxFX Pros and Cons

Pros:

- Wide range of asset classes

- Leverage of up to 1:200 offered to retail clients

- Supports bank cards, e-wallets, bank wire, and crypto deposits

- MT5 trading platform allows automated trading robots

- Mobile trading app available via MT5

- Takes just minutes to open an account

- Lots of educational materials including webinars

Cons:

- Does not hold a tier-one license – regulated in Vanatua

- Withdrawal fees are high

- Still relatively new in the online brokerage space

Regulation and Trust

As we briefly noted earlier, FinmaxFX does not hold a brokerage license with a leading governing body. Typically, online stock brokers will turn to the likes of the UK’s FCA or ASIC in Australia, as this presents a range of regulatory protections for traders, and it gives the platform an element of credibility. Instead, FinmaxFX has decided to obtain a brokerage license with the Vanuatu Securities and Exchange Commission (VSEC).

On the one hand, using a broker that is licensed in Vanuatu offers less in the form of regulatory protection than if you use an FCA licensed broker, for example. On the other hand, the overarching reason that FinmaxFX has opted for such a move is so it can bypass the strict leverage limits imposed by tier-one licensing bodies.

With that being said, FinmaxFX’s license with the Financial Market Relations Regulation Center does ensure that FinmaxFX complies with all relevant laws on anti-money laundering and terrorist financing. It is also required to keep client funds in separate bank accounts from its own. We should also note that to date, FinmaxFX seems to have a relatively good reputation in the public domain, so long may that continue.

Products and Markets

FinmaxFX is home to an extensive library of assets that contains over 500 financial instruments. Each and every instrument is traded via CFDs (contracts-for-differences), meaning that traditional stock or bond ownership is not supported.

Below are the main asset classes that you can trade at FinmaxFX:

- Forex: This broker offers for dozens of currency pairs across the majors, minors, and exotics

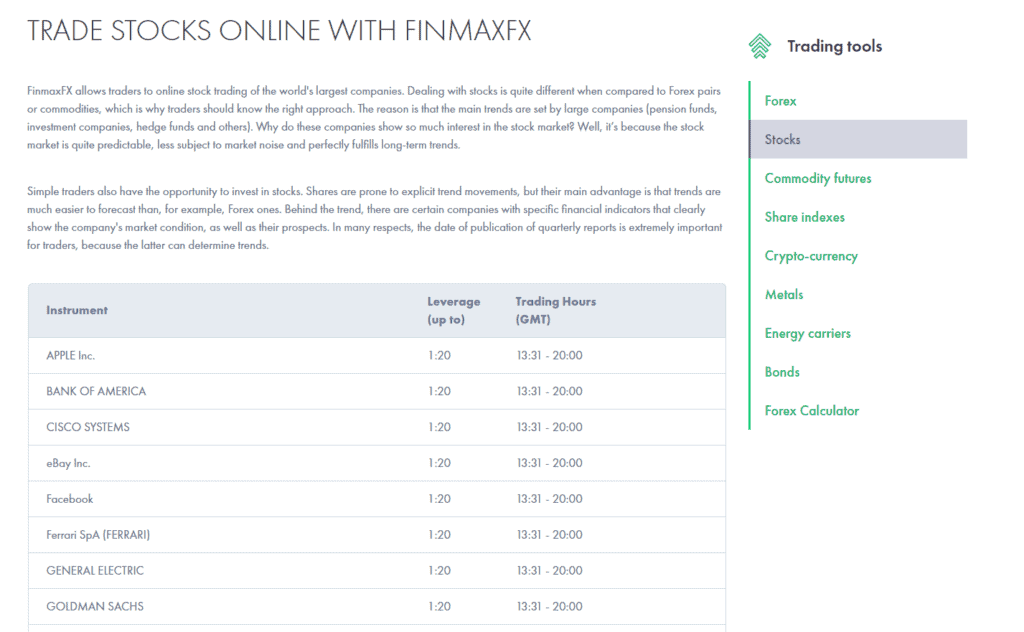

- Stocks: You will have access to just under 200 CFDs for stock trading. Most of these are listed on the main two US exchanges of the NYSE and NASDAQ. This means that you will be able to trade large-cap companies like Amazon, Facebook, Netflix, and IBM.

- Indices: FinmaxFX also offers an extensive library of stock market indices. This includes everything from the NASDAQ 100, S&P 500, Dow Jones, and FTSE 100. You can also trade indices in Hong Kong, Australia, France, Germany, and Japan.

- Cryptocurrencies: The broker is also popular with those that are interested in cryptocurrency trading via CFDs. The platform hosts 12 different coins, which include the likes of Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple.

- Commodities: Although you can’t buy commodities in the traditional sense, you will be able to trade bonds. This includes just five different instruments, all of which center on government securities. This includes Euro Bunds and US Treasuries.

Ultimately, with close to 500 financial instruments supported by FinmaxFX across several asset classes, most bases are covered.

Leverage

If you’re a seasoned trader then you will know first hand that most UK forex brokers active in the online space limit retail clients when it comes to how much leverage they can apply.

If you’re based in the UK or Europe, this is because you will be bound by the restrictions put in place by the European Securities and Markets Authority (ESMA). In fact, non-European brokers typically follow the same limits to ensure that retail clients are protected from huge losses.

In a nutshell, this stands at 30:1 on major currency pairs and 20:1 on minors and exotics. This goes down to 2:1 on cryptocurrencies and 5:1 on stocks. However, as FinmaxFX is based offshore, it is not restricted by these limits, which is why it offers retail clients significantly more.

This stands at:

- Forex: Up to 1:200

- Stocks: Up to 1:20

- Indices: Up to 1:200

- Cryptocurrencies: Up to 1:10

- Non-Gold Commodities: Up to 1:100

- Gold: Up to 1:200

- Bonds: Up to 1:100

As tempting as it might be to go gung-ho with leverage at FinmaxFX, you should tread with extreme caution – especially if you are a newbie trader. After all, while leverage can boost your potential gains super-quickly, it can also amplify your losses.

Bonus

As a trading platform that was launched just last year, FinmaxFX is still relatively unknown in the online brokerage space. As a result, the broker offers a welcome package as a means to entice new traders to its site. There are two deposit bonuses available to all new customers.

- Firstly, you will receive a 50% deposit bonus when you first load your account.

- This needs to be at a minimum of €/$100, and the bonus is capped at €/$500.

- This means that in order to get the full bonus allocation, you will need to deposit €$1,000.

- Then, you will also get a second welcome bonus, which stands at 25% of your deposit amount.

As great as the forex bonus sounds, there are a number of terms and conditions that you need to take into account. Crucially, for each €/$1 that you wish to cash out from the bonus, you will need to trade $10,000 at the platform. In other words, if your bonus amount stands at $20, you will need to trade the equivalent of $200,000.

Education and Trading Tools

Although FinmaxFX is perfectly suitable for advanced traders, the platform also caters its services to those with little to no experience. At the forefront of this is a fully-fledged educational department. For example, the broker has compiled an in-depth eBook that you can access for free.

The eBook contains a wealth of information that intends to introduce you to online trading. This includes everything from key terminology to setting up an order. We also like the regular Webinars that FinmaxFX hosts. This is where one of its senior in-house traders will present a specific topic – such as the current state of the financial markets.

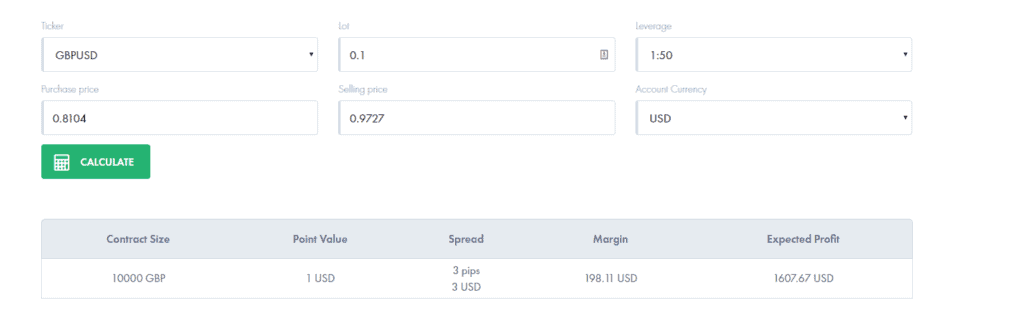

You will have the opportunity to ask questions throughout the Webinar, which is great for improving your knowledge of how forex trading works. You will also find an economic calendar, alongside a number of useful calculators. This includes a calculator that allows you to estimate your potential gains on an upcoming trade.

Fees

One of the most important factors that you need to look out for before joining a new brokerage platform is that of its fee structure.

When it comes to the size of the spread at FinmaxFX, this will depend on the type of account that you sign up for. For example, spreads start from 3 pips if you have a micro account. In comparison to other brokers in the space, this is somewhat costly.

Some other brokers offer spreads of less than 1 pip on major forex pairs, and as low as 0.2 pips on gold. You can at the very least get this down to 1 pip if you open a VIP account at FinmaxFX, which is a plus, though this will require a minimum deposit of $100,000.

When it comes to transaction fees, this can vary quite considerably depending on the payment method. This starts at $25 on bank wires, right up to 7% if you decide to cash out your profits via Bitcoin. Some account types come with one free withdrawal per month, while others offer this on an unlimited basis.

Banking

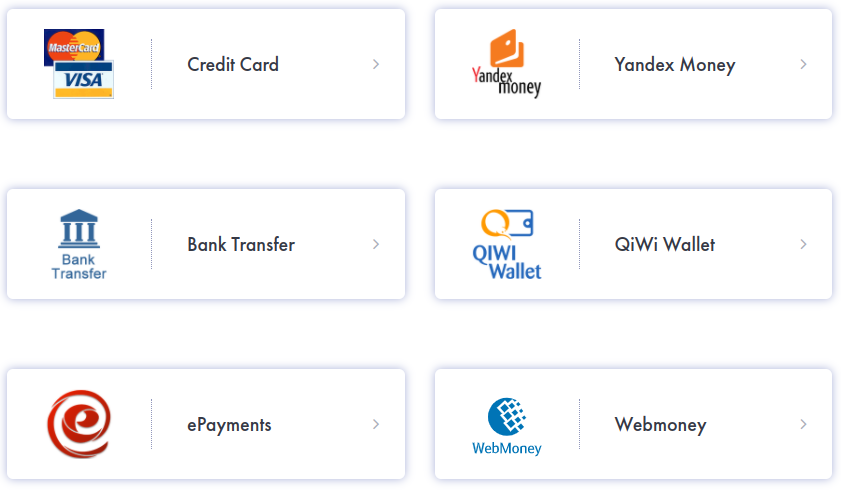

FinmaxFX offers a plethora of deposit and withdrawal methods that will allow you to get money into and out of the broker with ease.

This includes:

- Debit/Credit Cards

- Bank Transfer

- Neteller

- Skrill

- Yandex Money

- QiWi Wallet

- Webmoney

- Bitcoin

Just remember, you will need to upload some ID before you will be permitted to make a withdrawal. Once you do, your account restrictions will be lifted.

Desktop Platform

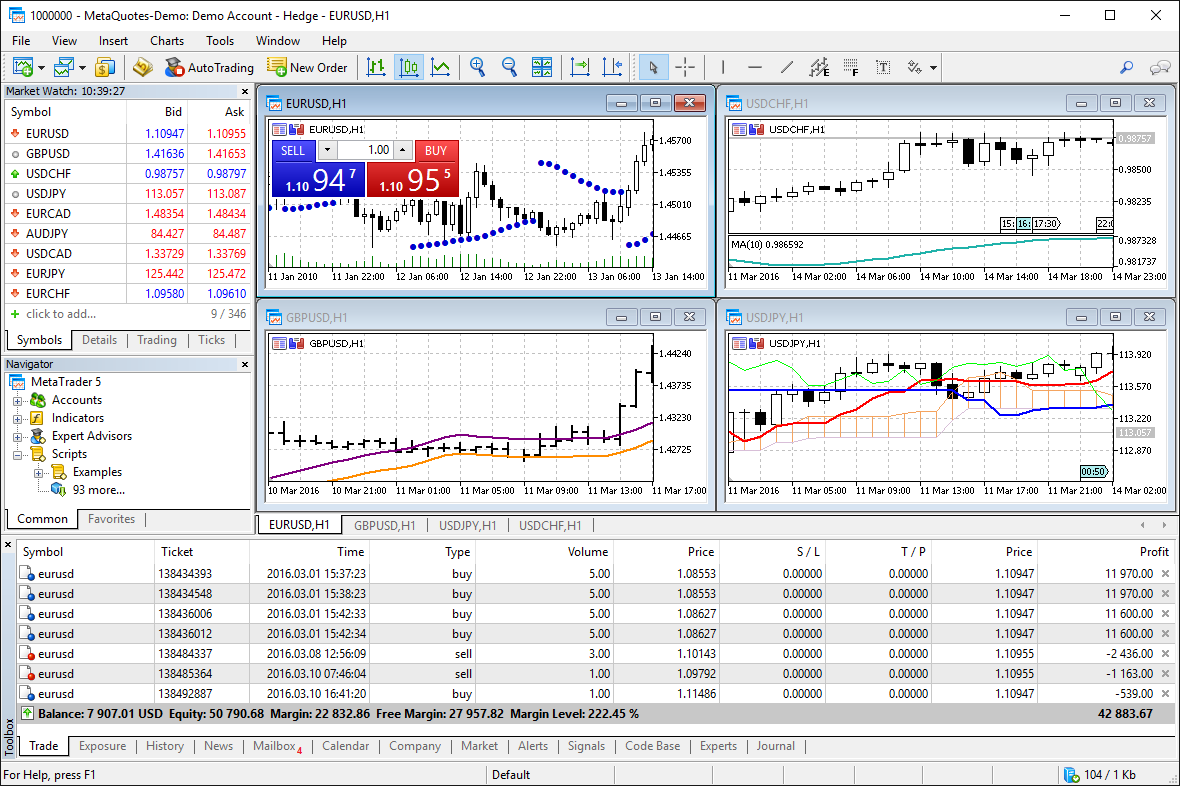

FinmaxFX has opted against creating its own proprietary trading platform. Instead, the broker has integrated its systems with MetaTrader 5 (MT5). For those unaware, MT5 is one of the most popular third-party trading platforms in the space. Much like its MT4 counterpart, the platform allows you to customize your trading screen to the ‘t’.

You will have the option of trading via MT5 at the main FinmaxFX website, meaning that there is no requirement to download any software. However, if this is something that you wish to do, MT5 can also be installed onto your desktop device. This is something that would be useful if you are planning to use a forex EA or trading robot, as these are fully compatible with the MT5 platform.

Mobile Platform

On top of offering support for browser-based trading and desktop software, FinmaxFX also allows you to access your MT5 trading account via your phone. Its known for having one of the best trading apps that have been fully-optimized for smaller screens, so all you need to do is access the platform from your standard mobile web browser.

If you want to take your mobile trading experience to the next level, it might be worth downloading and installing the MT5 application on your phone. This is available on both Android and iOS devices. Once you have logged into MT5 with your FinmaxFX credentials, you will have unfettered access to your account.

Irrespective of whether you opt for the MT5 application or standard web browser platform, you can perform most account features from your phone. This includes the ability to place buy and sell orders, check the value of your portfolio, and deposit and withdraw funds.

Account Types

When you go through the registration process at FinmaxFX, you will get to choose from five different account types. In a nutshell, the benefits that you get with each account type is directly correlated to the amount you deposit.

- For example, the smallest account type on offer is that of the Micro Account, which requires a minimum deposit of just $250. In doing so, you will be offered the least favorable spread on your chosen asset – which starts at 3 pips.

- If you are comfortable meeting a minimum account balance of $1,000, the Micro account gives you access to two live webinars per week.

- Moving up the deposit later, a minimum account balance of $5,000 will get you the Standard Account. Although you will still be offered minimum spreads of 3 pips, you will at the very least get one free withdrawal per calendar month.

- The Premium and VIP accounts, which require a minimum deposit of $25,000 and $100,000, get you unlimited free withdrawals. This is fundamental, as the transaction fees ordinarily charged by FinmaxFX when cashing out can be somewhat costly.

Ultimately, it might be best to start off with the Micro account. If you then find that FinmaxFX is suitable for your long-term trading goals, you can then consider moving up to a more competitive account plan.

Customer Service

FinmaxFX offers support via email, which you can access at [email protected]. If you want to speak with a live agent in real-time, you can call FinmaxFX at 0208 089-2575. Unfortunately, there is no live chat facility offered by the broker.

The good news is that the FinmaxFX customer service team works 7 days per week. You can catch them between 8 am and 8 pm GMT.

Supported Countries and Regions

FinmaxFX is a global brokerage firm that accepts traders from most nations. However, alongside countries listed as a sanctioned jurisdiction, those from the United States are prohibited from opening an account. This is because FinmaxFX is a CFD broker, which US citizens are generally not allowed to access.

FinmaxFX Tutorial: How to Sign Up & Trade

Like of the sound of FinmaxFX, but not too sure where to start? Below you will find a step-by-step walkthrough that covers the registration, deposit, and trading process!

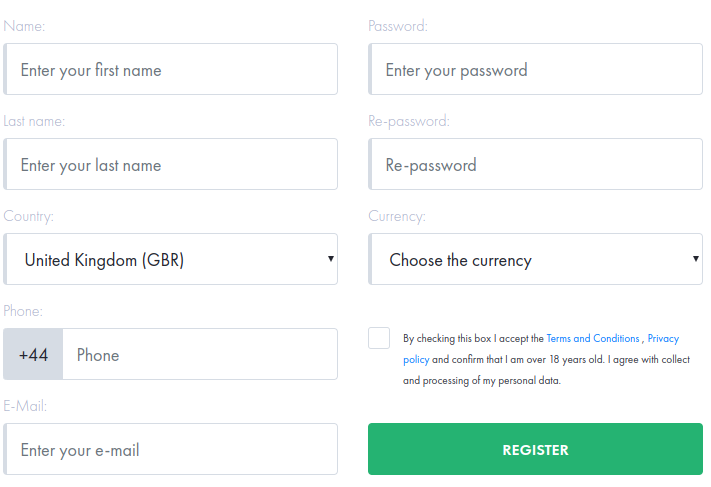

Step 1: Open an Account

First and foremost, you will need to visit the FinmaxFX website and click on the ‘OPEN AN ACCOUNT’ button.

As is the case with all trading platforms active in the online space, FinmaxFX will now ask you to enter some personal information.

This includes your:

- Full Name

- Nationality

- Home Address

- Date of Birth

- National Tax Number

- Telephone Number

- Email Address

Step 2: Verify Your Identity

Just because FinmaxFX is licensed offshore, this isn’t to say that it doesn’t take its regulatory responsibilities seriously. On the contrary, the broker will identify each and every trader that opens an account.

As such, you will need to provide FinmaxFX with the following documents:

- Government-Issued ID, such as a passport or driver’s license

- Proof of residential address, such as a bank account statement or utility bill

- If depositing with a debit/credit card, you’ll need to provide a copy of the front and back of the card

If you don’t have the above document to hand, you will still be able to make a deposit. However, your ability to make a withdrawal will be restricted until you do.

Step 3: Deposit Funds

You will now be asked to deposit some funds into your newly created FinmaxFX account. There is a range of minimum deposit thresholds in place, depending on the type of account you wish to open. As we noted earlier, this starts at $250 on the Micro Account and goes right up to $100,000 on the VIP Account.

Regardless of the account type that you opt for, you will have a plethora of deposit methods to choose from. As you can see from the screenshot above, this includes everything from a debit/credit card, bank transfer, and e-wallet. Apart from the bank wire option, all other deposits are instant – or near-instant in the case of Bitcoin.

Step 4: Choose Your Trading Platform

Once your deposit has been credited by FinmaxFX, you will then need to choose how you wish to access MT5. You can do this via the main desktop website, by downloading software to your device, or through the mobile app.

Step 5: Start Trading

Once you have logged into your preferred platform, you can then start trading straight away. If you’ve used MT5 previously, then you should know your way around the platform. If not, we would suggest starting out with really small amounts before you get a bit more comfortable.

FinxmaxFX vs Other Brokers

When it comes to comparing FinmaxFX with other brokers active in the space, it has both its good and bad points. For example, the broker stands out for the fact it offers leverage to retail clients of up to 200:1.

Ordinarily, this is capped to 30:1 if you do not come from a professional trading background. FinmaxFX is also notable in the payments department, as it supports everything from debit/credit cards, bank wires, e-wallets, and even Bitcoin.

On the flip side, there are certainly cheaper options in the market – especially when it comes to spreads. For example, while FinmaxFX offers a ‘top-rate’ spread of 1 pip on major forex pairs, some other brokers average lower rates. Similarly, unless you upgrade to the standard account, you will need to pay a somewhat expensive withdrawal fee.

Overall, we think FinmaxFX is a solid platform. With a great range of tradable assets, educational resources, an array of payment methods and MT5 support, there’s plenty to like about this broker.

If it offered slightly lower fees than it would be up there with the very best platforms around. In fairness, FinmaxFX has only been in business since 2019, so there’s plenty of room for it to grow its service and provide more competition to the top brokers.

Conclusion

All in all, FinmaxFX is an option well worth considering if you are a retail client and you are looking to obtain higher leverage limits. As we have noted throughout our guide, while most brokers cap this to 30:1, FinmaxFX offers a huge 200:1. The platform also has an impressive range of CFDs and is useful if you are looking to deposit and withdraw funds with a specific payment method, like e-wallets or Bitcoin.

If you want to try out FinmaxFX for yourself, you can sign up and get trading within minutes. Simply click the link below to create an account with FinmaxFX today.

FinmaxFX: Trade with up to 1:200 Leverage

Our Rating

- Up to 1:200 leverage

- Wide range of CFD assets

- MT5 trading

- Educational resources

There is no guarantee you will make money with this provider.

There is no guarantee you will make money with this provider.FAQs

When was FinmaxFX launched?

FinmaxFX was launched as recently as 2019. This makes it one of the newest entrants to the online CFD space.

What can you trade at FinmaxFX?

FinmaxFX is a specialist CFD broker that hosts hundreds of financial instruments. This includes everything from stocks, cryptocurrencies, forex, bonds, and commodities.

Is FinmaxFX available in my country?

FinmaxFX is a global broker that accepts traders from most countries. The main exception to this rule is the United States, as the country has very strict guidelines on CFD trading.

What are the spreads like at FinmaxFX?

Spreads at FinmaxFX depend on the type of account you hold. At the lower end, this starts at 3 pips on major pairs. You can get this down to 1 pip with a VIP account, albeit, this requires a minimum deposit of $100,000.

What trading platform does FinmaxFX use?

FinmaxFX is fully integrated with MetaTrader 5 (MT5). You can access the platform via the FinmaxFX website, by downloading and installing software to your desktop device, or through the mobile app (iOS and Android only).

Alan Draper Lewis

View all posts by Alan Draper LewisAlan is a content writer and editor who has experience covering a wide range of topics, from finance to gambling.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up