City Index Broker Review 2021

If you’re in the lookout for an established UK-based broker that covers a range of asset classes, have you considered the merits of City Index? Launched way back in 1983, the broker allows you to trade both CFDs and forex, and it also facilitates a fully-fledged spread betting platform.

Crucially, all of the tradable products available at City Index can be accessed via a desktop or mobile device. If you’re keen to find out whether or not the broker is right for you, be sure to read our in-depth City Index Review. Within it, we’ll cover the ins and outs of how the platform works – such as fees, regulation, payment methods, spreads, and more.

-

-

eToro - Invest in shares with 0% commission

Our Rating

- 0% commission on stocks

- No markup, ticketing fees, management fees

- Fractional shares available

- Easy to use platform

75% of investors lose money when trading CFDs.What Criteria do we Apply When we Review a Forex Broker?

All of the reviews on our platform are impartial and completely independent from the UK forex broker in question. As such, the information that we publish allows you to make an informed decision as to whether or not the platform is right for you. Below we have listed some of the main criteria that we look for when reviewing a new broker.

?? The number of payment methods supported

?? How easy is the KYC process?

?? What trading fees will you need to pay?

?? How many forex pairs can you trade?

?? The reputation and regulatory standing of the platform

What is City Index?

City Index is an online trading platform that allows you to buy and sell a range of asset classes. This includes both CFDs and spread betting facilities. As such, whether its commodities, stocks, options, or indices – City Index has you covered. The UK-based broker is also known to have one of the most extensive forex departments. The broker covers dozens of pairs across the major, minor, and exotic currencies.

Launched way back in 1983, City Index is also one of the most trusted platforms in the online trading space. It also has a strong regulatory standing. This includes a fully-fledged trading license from the UK’s Financial Conduct Authority, as well as authorities in Australia (ASIC) and Singapore (MAS). This ensures that you have regulatory backing on three key fronts.

Note: City Index is one of the few brokers in the UK that allows you to deposit funds with PayPal. This allows you to fund your account instantly without paying any fees.When it comes to the trading platform itself, City Index offers a number of options. This includes an intuitive web trader platform and a mobile application. For those of you with advanced knowledge in charting analysis, both platforms support heaps of technical indicators and drawing tools. In order to get started with City Index, you will need to deposit at least £100. The broker also hosts institutional clients that are looking to trade 6 or 7 figures.

Pros and Cons of City Index

The Pros

- Established in 1983 – Great reputation

- Industry-leading customer support department

- Thousands of financial instruments to trade

- 80+ forex pairs

- CFDs

- Premium chart analysis tools

- Tight spreads

The Cons

- Minimum £10 trading fee on stock CFDs

How to Sign-Up at City Index: Step-by-Step Walkthrough

If you’re keen to get started with City Index, but you’re not too sure what you need to do, be sure to follow the steps we have outlined below. We’ll walk you through the process of signing up, depositing funds, and verifying your account!

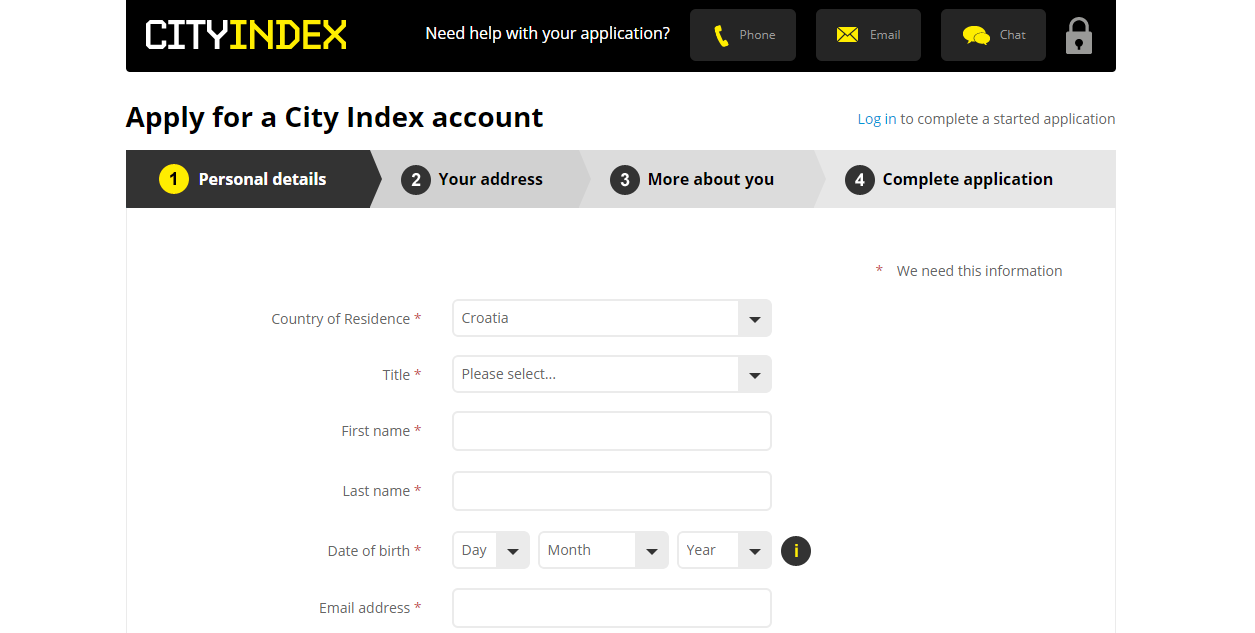

Step 1: Open an Account

First and foremost, you’ll need to head over to the City Index website and open an account. You will initially be asked to enter your personal information. This will include your full name, home address, date of birth, nationality, and national insurance number. You will also need to provide your telephone number and email address.

Step 2: Financial Information and Trading Experience

As is the case with all broker applications, you will need to provide some information about your financial standing. This is to ensure that you have the financial means to trade online. For example, you’ll need to let City Index know how much you earn, as well as an estimation of your net worth.

Next, you’ll then need to satisfy City Index that you at least have a basic understanding of trading. After all, the platform lists thousands of sophisticated financial instruments, so the platform needs to know that you’re comfortable trading with real money. Simply answer the multiple-choice questions that are presented on-screen.

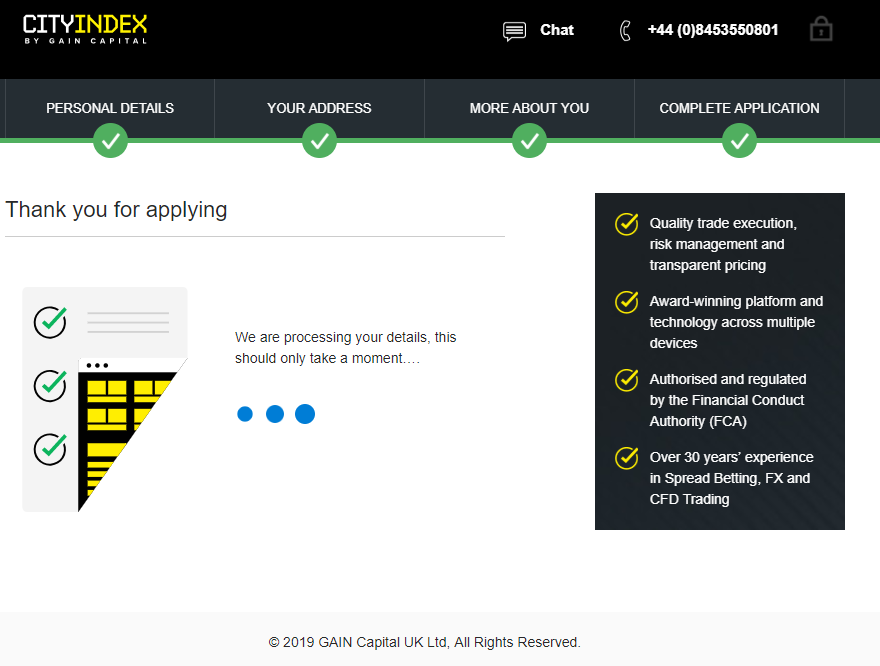

Step 3: Verify Your Identity

In order to comply with UK regulations on anti-money laundering, as well as the licensing conditions set out by the FCA, City Index will need to verify your identity. The good news is that in the vast majority of cases, City Index will be able to electronically verify your information. They do this by cross-referencing your data with third-party sources.

However, in some cases, you might be asked to email supporting documents. This is likely to be the case if you are not listed on the electoral role, or you recently changed address. Either way, you’ll need to upload a copy of your government-issued ID, which can be either a passport or driver’s license.

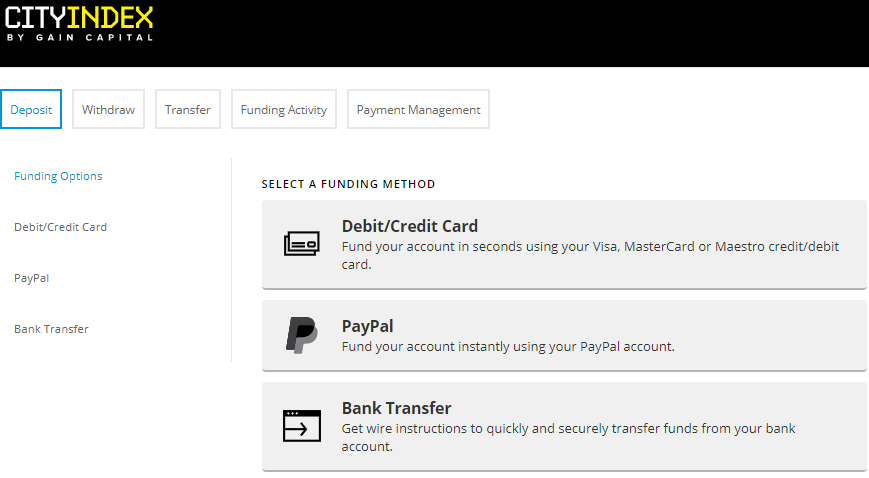

Step 4: Deposit Funds

You will need to fund your City Index account if you plan to trade with real money. Click on the ‘Deposit’ tab, and then select the payment method that you wish to use. You’ll need to decide how much you want to fund your account with, which needs to be at least £100. If opting for an instant payment method like PayPal, the funds will be credited to your account straight away.

Step 5: Start Trading

As soon as your account has been funded, you can then start trading. The platform offers thousands of financial instruments across multiple asset classes, so you’ll never be stuck for choice at City Index. If you’ve got an asset in mind, you can go straight to its respective trading area by searching for the instrument.

What can I Trade at City Index?

Although City Index also facilities spread betting, its two key marketplaces center on forex and CFDs. Below we have listed some of the main asset classes that the platform supports.

CFDs

- Stocks and shares

- Indices

- Bonds

- Metals

- Energies

- ETFs

- Cryptocurrencies

Forex

- 84 forex pairs

- Supports majors, minors, and exotics

City Index Fees

In a nutshell, most of the financial instruments listed at City Index come with super-competitive trading fees. However, the fee structure is somewhat complex to understand, not least because the fee will depend on what you are trading. As such, we’ll give you a couple of examples to give you an idea of how much you’ll be paying at City Index.

? If you are trading non-stock CFDs or forex pairs, you will not pay any commission. On the contrary, the fees are built into the spread. The specific spread will vary quite considerably at City Index depending on what you want to trade.

? If opting for markets with heaps of liquidity, the spread is ultra-tight. For example, the S&P 500 averages just 0.6 pips, and the EUR/USD pairing typically stands at just 1 pip. At the other end of the spectrum, minor and exotic trading pairs are slightly more expensive, although this is industry standard in the forex space anyway.

? If you’re looking to buy shares in the form of CFDs, then you will pay a commission. This amounts to $0.018 per share if buying or selling US stocks. Companies listed on the UK or European stock markets will cost 0.08% of the trade value. However, City Index does implement a minimum commission of £10 if buying stock CFDs.

? If your account remains inactive for 1 year, you will need to pay a fee of £12 per month. Other than this, City Index does not have any hidden fees that you need to be made aware of.

Deposits and Withdrawals

City Index supports a number of everyday payment methods. This includes the following:

? Visa

? MasterCard

? Maestro

? PayPal

? Bank Wire

? Instant Bank Transfer

Don’t forget, you’ll need to deposit at least £100 to get started with City Index. While PayPal and bank transfers do not attract any deposit fees, the broker does charge a rather hefty 2% on debit and credit cards. When it comes to withdrawals, you will need to request a cashout of at least £50. The only way around this is if you are looking to withdraw your entire balance. The maximum withdrawal per transaction is £20,000.

Trading Platform and Features

City Index offers a number of trading options. Most traders will utilize the City Index web trader platform, which you can access from your standard desktop browser. You can also trade via your mobile phone. Regardless of which platform you opt for, you will have access to the following trading features.

✔️ Technical Indicators: City Index offers more than 80 technical indicators. This includes the likes of Exponential Averages, Stochastic Oscillator, and the RSI.

✔️ Charting Tools: The broker allows you to customize your charting screen to meet your preferences. You can also utilize a number of drawing tools to assist with your technical analysis.

✔️ Market Orders: The platform hosts a number of well-known market orders. This includes stop-loss and limit orders, stop trailing, and one-cancel-other. We also like the fact that City Index offers GTC (good-till-canceled) and GTT (good-till-time) orders.

✔️ Alerts and Notifications: If you’re looking to track a particular instrument or marketplace, City Index allows you to install alerts and notifications. This can pop-up on your desktop or mobile device in real-time.

✔️ Going Short: As is the case with most CFD and forex platforms, City Index allows you to short assets. This is great for making gains when the markets are down.

Leverage Trading at City Index

City Index is strong in the leverage department, as the platform allows you to trade on margin with ease. The specific limits fall in-line with ESMA regulations. For as long as the UK is still part of the European Union, City Index will need to follow these limits.

- Major Forex Pairs: 30:1

- Minor/Exotic Pairs: 20:1

- Indices CFDs: 10:1

- Stock CFDs: 5:1

Note: 72% of retail investors lose money when trading CFDs, so applying leverage is an extremely high-risk strategy. Make sure that you fully understand the risks prior to opening a margin account.Moreover, you might have your leverage limits further restricted if you are deemed to be an inexperienced trader. City Index will be able to determine this as per the answers you gave during your account application.

Account Types at City Index

As is the case with most online brokers, City Index offers a number of different account types. The one that you opt for will depend on how much experience you have in the space, and how much you plan to trade.

Trader Account

The Trader account is for those of you that are just starting out in the investment space. Similarly, if you’ve got experience but you’re only looking to trade small amounts, this account will likely suffice.

✔️ Minimum Account Balance: £0 ✔️ Negative Balance Protection ✔️ 24/7 Standard Customer Support

Premium Trader Account

If you’re a seasoned full-time investor that typically places larger trade sizes, then you might want to consider the Premium Trader account. You’ll need to hold an account balance of at least £10,000.

✔️ Minimum Account Balance: £10,000 ✔️ Leverage: Up To 30:1 ✔️ Personal Relationship Manager

Professional Account

The Professional account is only suitable for institutional clients. You will need to have a personal investment portfolio of at least £500,000 and be able to support this via documentation. Alternatively, you’ll need to have experience working in the financial sector.

✔️ Benefit From Super-Low Fees ✔️ Leverage: Up To 400:1 ✔️ Access to More Sophisticated Instruments

Research Department

Regardless of how much experience you have in the online trading space, it’s crucial that you have access to key market data in real-time. City Index offers the following research tools:

? City Index offers fundamental analysis via third-party platform Recognia. This allows you to be kept abreast of key market developments on your chosen asset class.

? You’ll also find trading ideas at City Index. This provides an in-depth analysis of a specific financial instrument, and how you can set-up your trading parameters.

? Financial data is also hosted at the broker for those that are looking to gauge the strength of a company’s balance sheet. This includes debt-to-equity ratios, dividend payments, and earnings reports.

? If you’re still a trading newbie, you’ll be pleased to know that City Index offers a plethora of educational guides. For example, the platform offers a simple overview of how short selling works, and how you can implement it at City Index.

Is City Index Regulated?

The most important metric that you need to look out for when choosing a new broker is that of the platform’s regulatory standing. Crucially, you need to assess what trading licenses the broker holds. In the case of City Index, the platform is regulated by the UK’s FCA. Moreover, the broker is also regulated by financial bodies in Singapore and Australia.

On top of a strong regulatory standing, City Index also has an excellent reputation in the online trading space. With the platform first launching in 1983, it has an impressive track-record that exceeds 37 years. The broker’s parent company – GAIN Capital Holdings Inc, is publically listed on the New York Stock Exchange.

Is My Money Safe?

As per FCA regulations, City Index is required to keep client funds in segregated bank accounts. This ensures that your funds are kept separate from its main operating costs. City Index also allows you to install two-factor authentication. This requires you to enter a unique PIN that is sent to your mobile phone every time you wish to log in. We would strongly suggest setting it up.

Customer Support

If you need to speak with a member of the customer support team, City Index offers a number of channels. The easiest way to contact support is via the live chat facility.

You can also call City Index directly on 0845 355 0801.

Alternatively, emails can be sent to [email protected].

Support is highly rated at the platform. For example, the trading team is happy to explain sophisticated financial instruments to you over the phone, and they can even help you place a trade. Take note, the trading team will not be able to give you advice on what you should and shouldn’t trade.

Conclusion

If you’ve read our in-depth guide on City Index from start to finish, you should now be able to make an informed decision as to whether or not the platform is right for you. The broker is suitable for traders of all shapes and sizes, with minimum deposits starting at just £100. Crucially, the broker lists thousands of assets from a range of trading sectors. This includes CFDs, forex, and even spread betting.

We really like the competitive fee structure employed by City Index. This includes commission-free trading on non-stock CFDs and currencies. This also includes tight spreads on major marketplaces, so if low fees is your main priority, City Index is a notable option. Finally, the customer service team at City Index is highly rated. You’ll benefit from 24/7 support across multiple channels, including phone, live chat, and email.

eToro - Invest in shares with 0% commission

Our Rating

- 0% commission on stocks

- No markup, ticketing fees, management fees

- Fractional shares available

- Easy to use platform

75% of investors lose money when trading CFDs.FAQs

When was City Index launched?

City Index was launched way back in 1983. As such, this makes it one of the most established brokers in the trading space.

Is City Index regulated?

City Index has an excellent regulatory standing. On top of a license from the UK’s FCA, the platform is also regulated in Australia and Singapore.

What is the minimum deposit required at City Index?

You will need to deposit at least £100 to get started at City Index. If you’re looking to open a Premium Trader account, minimum deposits start at £10,000.

What fees does City Index charge?

This depends on the asset you are trading and the type of account you hold. Nevertheless, the broker does not charge any commissions if you’re trading non-stock CFDs or forex. Spreads are super-competitive, too.

Does City Index offer leverage?

Leverage is available on most asset classes at City Index. The limits are dictated by ESMA regulations, meaning that major forex pairs are capped at 30:1, and minors/exotics at 20:1.

What payment methods does City Index support

City Index allows you to deposit funds with a debit/credit card, bank wire, and instant bank transfer. The broker also allows you to deposit funds with PayPal.

-

Kane Pepi

Kane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...