Debt Consolidation 2021 | Best Consolidation Loan Providers

Are you currently in a position where you are holding multiple debts with multiple providers? If so, not only are you likely paying extortionate fees in the form of interest, but you are also likely to be under financial stress. If you feel like there is no way out – there is, in the form of a debt consolidation loan. Whether your debts are tied to loans, credit cards, store cards, or overdrafts – a debt consolidation loan can clear your outstanding balances in one fell swoop. In return, you will now have a new, single loan with your new financing provider.

This will ensure that you only need to make one repayment per month, and most importantly, you can reduce the amount of interest that you are paying on your debts. If this sounds like something you would like to explore further, be sure to read our in-depth guide on the Best Debt Consolidation Loans of 2021. Within it, we’ll explain how a debt consolidation plan can get you debt-free once and for all, and what you need to consider in order to do this is in the fastest time-frame possible. Finally, we’ll cover the best three debt consolidation loan providers currently active in the UK market.

-

-

Our Featured Business Loans Provider for 2020

Our Rating

- Offers business loans of between £1,000 and £25,000

- Advertised APR interest rate of 7.4%

- Perfect for small businesses

- Loan terms of between 1 - 10 years

Note: Just because you currently hold multiple debts and thus – require a debt consolidation loan, this doesn’t necessarily mean that you are in possession of bad credit. On the contrary, as long as you have never missed a payment on your debts, you might still have a good credit score! This means that you should be able to obtain a favourable rate of APR.

Note: Just because you currently hold multiple debts and thus – require a debt consolidation loan, this doesn’t necessarily mean that you are in possession of bad credit. On the contrary, as long as you have never missed a payment on your debts, you might still have a good credit score! This means that you should be able to obtain a favourable rate of APR.Pros and cons of debt consolidation loans

The Pros

- Chance to pay all of your outstanding debts off in one hit

- Your new loan will come with one repayment date, as opposed to multiple dates throughout the month

- You can reduce the amount of interest you are paying

- Work towards becoming debt-free once and for all

- Rebuild your credit profile along the way

The Cons

- Only worth doing if you are able to obtain a lower APR rate

Best consolidation providers: Reviewer’s choice

Reviewers Choice

HSBC RatingAvailable Loan Amount£7,000 - £15,000Available Term Length8 yearsRepresentative APR3.3% APROcean Finance

RatingAvailable Loan Amount£7,000 - £15,000Available Term Length8 yearsRepresentative APR3.3% APROcean Finance RatingAvailable Loan Amount£10,000 - £100,000Available Term Length5 yearsRepresentative APR49.9% APRShawbrook Bank

RatingAvailable Loan Amount£10,000 - £100,000Available Term Length5 yearsRepresentative APR49.9% APRShawbrook Bank RatingAvailable Loan Amount£1,000 - £35,000Available Term Length7 yearsRepresentative APR

RatingAvailable Loan Amount£1,000 - £35,000Available Term Length7 yearsRepresentative APRHow does a debt consolidation loan plan work?

It is crucial to note that simply obtaining a debt consolidation loan and clearing your current debts is not the end of your desired journey of becoming debt-free. On the contrary, your new loan means that you still have a long way to go. In fact, you will now be obliged to meet your monthly payments on-time each and every month without fail. If you don’t, you’ll once again get sucked into the realms of debts, interest, and late payment fees.

With that being said, we would strongly advise you to read through the following step-by-step guide on how to engage in an effective debt consolidation plan.

Step One: Assess what debts you currently have

Your first port of call will be to sit down and evaluate what debts you currently have outstanding. You need to break each debt down by the name of the provider, the amount currently owed, and the specific repayment date. The last point is super-important, as the initial debt consolidation phase can take some time. As such, you need to ensure that you are still keeping on top of your monthly repayments – otherwise further complications will arise.

Step Two: Find a debt consolidation loan provider

Once you have assessed how much debt you are going to need to clear, you will then need to find a debt consolidation loan provider that meets your individual needs. By this, we mean finding a provider that has the capacity to offer you enough money to clear your debts in full. This is crucial, as you don’t want to be left with any outstanding balances whatsoever. On the contrary, you need to ensure that you borrow enough funds to clear the debts in their entirety.

Furthermore, you also need to ensure that the debt consolidation provider is suitable for your financial profile. In other words, if you are currently in possession of bad, or really bad credit, then you might need to go with a specialist lender that is willing to consider less than ideal credit scores.

In order to help you along the way, we have listed three of the best debt consolidation loan providers currently in the market at the bottom of this guide.

Step Three: Apply for a debt consolidation loan

Now that you have found a suitable provider, you will now need to go ahead and apply for the debt consolidation loan. In the vast majority of cases, you can complete the entire process online. If your circumstances are more complex, then it might be worth speaking to a representative over the phone. The most important thing that you need to get right is the amount. As noted above, you need to be 100% sure that you are applying for a loan that will cover all of your outstanding debts.

You also need to take into account a potential origination fee, which is typically deducted from the amount of funds you receive. Don’t worry, we’ll cover this – alongside any other fees that you need to be made aware of, further down in our guide.

To give you an idea of what you need to do when going through the debt consolidation loan process, check out the steps below.

- Enter the size of the loan and how long you need to borrow the funds for

- Enter details pertaining to your identity, such as your full name, address, date of birth, residency status, and contact details.

- Enter details about your current income, such as how much you earn, whether you work full-time, part-time, or are self-employed, and how frequently you get paid.

- Enter information pertaining to your current debts, such as who the debt is with, and to what value.

- Enter your bank account details. This is the account that you want the funds paid in to, as well as the account that you will be making your direct debit payments from.

Once the loan application has been submitted, the loan provider should let you know within a couple of minutes whether or not your application has been approved. If it has, you will then be shown your pre-approval rates. This will display the APR rate on the loan, the origination fee (if applicable), and what your monthly repayments will amount to. If you are happy with what has been offered, you will then need to sign the digital loan agreement to complete the application.

Step Four: Clear your debts

Once the application has been completed and fully approved, the loan provider should transfer the funds within a few working days. As soon as the money hits your bank account, you are then ready to kick-start your debt consolidation plan. Do not think about delaying the process, as it is crucial that you act NOW. As such, start working through each debt one-by-one. You can do this via your online account portal at the respective debt provider’s website.

You will need to select the option that allows you to make a ‘one-time payment’ with your debit card. Enter your card information, and most importantly, select the option that allows you to clear the balance in full. Once you submit the payment, the debt provider should update your account within a couple of days.

Log back in a few days later to ensure that the outstanding balance is set to ‘zero’. Once it is, contact your debt provider by telephone to ask them to close your account. This will remove the temptation for you to start reusing your credit limit in the future. Repeat the above process until all of your debts are clear.

Step Five: Ensure you make your repayments every month

The final stage of the debt consolidation plan is to now focus on your newly obtain loan. As noted above, you will already be aware of how much you need to pay each month, and it is likely that the lender will have asked you to set up a direct debit for this amount. As such, as long as you have enough money in your bank account to cover the payment, you will not be required to take any further action.

However, don’t become complacent. By this, we mean that you must ensure your bank account has sufficient funds every month to meet the repayment date. As a side tip, it might be worth requesting a repayment date with your new loan provider that falls just after your monthly salary date. This will give you the best chance possible of meeting your monthly payment without fail.

Best 3 debt consolidation loan providers

So now that you have a full grasp of what a debt consolidation loan is, and how you can best utilize one to get you that all-important status of ‘debt-free’, we are now going to discuss three of the best debt consolidation loan providers in the UK market. We utilize a strict set of criteria before listing a loan provider on our platform, so be sure to check out some of the metrics that we look for before recommending a lender.

Criteria used to rank the best debt consolidation loan providers

- Lenders with the most competitive interest rates

- How much the lender is able to offer

- What credit score you need to obtain the debt consolidation loan

- What length of time you have to repay the loan

- What the late payment and missed payment process is

1. Ocean Finance – Best if you currently have bad credit

If you are in the process of starting a debt consolidation plan, then there is a good chance that you currently have a credit profile that is less than ideal.

If so, then you will be extremely limited in the number of lenders that are happy to consider your application. With that being said, we would point you in the direction of Ocean Finance. On top of personal loans, home improvement loans, and bad credit loans, the provider also facilitates debt consolidation loans.

However, Ocean Finance is not a direct lender. Instead, the company will attempt to find you the best loan deals currently in the market - based on the information you enter at the time of the application. In terms of the specifics, Ocean Finance will consider loan applications of between £10,000 and £100,000, and you have the option of both secured loans and unsecured loans.

The one you opt for will, of course, depend on how hampered your credit profile currently is. Take note, Ocean Finance typically partners with UK lenders that are best suited for consumers with poor or very poor credit. As such, if you are looking for a debt consolidation loan, but your credit is still in-tact, then we would suggest looking elsewhere.

Our Rating

- Maximum debt consolidation loans of between £10,000 and £100,000

- Embraces soft-credit enquiry - applying won't hurt your credit score

- Lets you choose between a secured loan or unsecured loan

- Consolidation wont work if you aren't committed to loan repayment

- Won't work if you continue using credit cards

2. Shawbrook Bank – Choose between a secured or unsecured loan type

Shawbrook Bank is a relatively unknown financial institution in the UK, not least because it only opened its doors in 2011.

However, don't let this put you off, as the lender is offering some very competitive deals on debt consolidation loans. The loan will be an unsecured loan, meaning that you will not be required to put any assets up as security. However, the provider also offers homeowner loans, which you can also utilize to pay off your debts.

Although the interest rates will be much lower, your home is at risk if you fall behind on your repayments. Nevertheless, you can select a loan term of between 1 and 7 years, and the APR rate will be based on the size of the loan, how long you decide to borrow the money for, and of course, your current credit score.

Moreover, you need to be aged between 21 and 75, have an annual income of at least £15,000, and have been a UK resident for at least three years.

Our Rating

- Extended loan repayent periods of 7 years

- Both secured and unsecured loans available

- Attractively high loan limits of up to £35,000

- You need to have an income of at least £15,000

- Penalises early loan repayments

3. HSBC UK – Best if your credit rating is good

As we noted earlier, just because you are looking to take out a debt consolidation loan, this doesn't mean that you have a bad credit profile.

On the contrary, you might have always made the point of meeting your minimum monthly payments, meaning that you stand the chance of obtaining a debt consolidation loan at a favourable rate of interest. If this sounds like you, it might be worth considering HSBC.

The bank is now offering a headline rate of just 3.3% APR, which is one of the best deals currently in the market. This rate is reserved for those with a good credit score, and you don't need to have a bank account with HSBC to qualify.

The bank will allow you to borrow between £7,000 and £15,000 at this rate, so if you need the full £25,000 that HSBC is willing to loan out, then you'll pay slightly more. In even better news, HSBC will not penalize you for making overpayments, or paying the entire loan back in full early. This should act as further motivation to pay back as much as you can afford in the quickest time possible.

Our Rating

- Offers debt consolidation loans of between £1,000 and £25,000

- Lowest APR rate of 3.3% available to those with great credit

- Extended loan repayment of up to 8 years

- Not available to individuals with bad credit

- No secured loan or co-sign options

What is a debt consolidation loan?

In a nutshell, a debt consolidation loan is simply a personal loan that you take out with the intention of clearing your outstanding debts. While you might be thinking “It’s a terrible idea to take out yet more debt when I am already sinking in debt” – think again – as the benefits of doing this are two-fold.

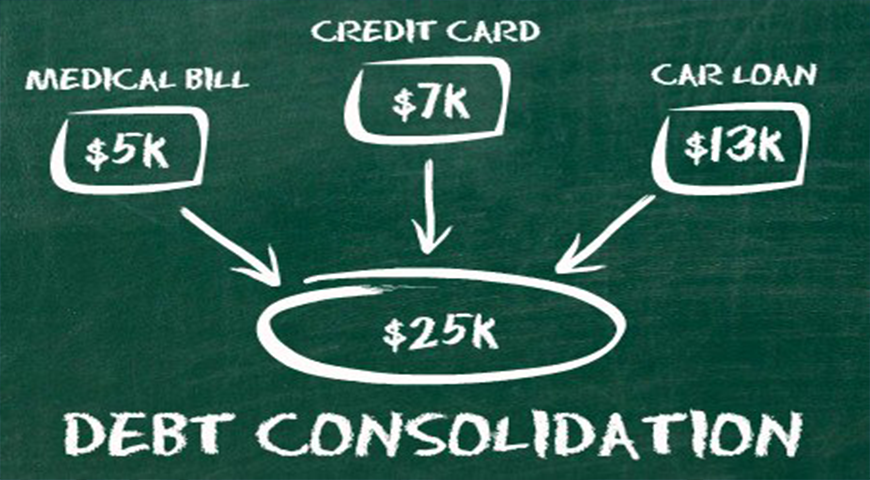

- Turning multiple debts into one debt

First and foremost, if you are holding multiple debts with a range of different providers, this can be an awfully stressful situation. Think along the lines of holding debt across loans, credit cards, overdrafts and store cards. If this sounds like you, then you will know first-hand that making your repayments on time can be a logistical nightmare. You will most likely need to set up multiple direct debits throughout the month for each provider.

Moreover, if one of your direct debits fails because you don’t have enough funds in your bank account, then you’ll not only be accustomed to additional fees, but this will likely be reported to the main three credit agencies. As such, your credit score will be hampered even more. On the contrary, by taking out a NEW loan with a debt consolidation specialist, you can turn all of your outstanding debt obligations into a single debt with one provider. In doing so, you will only need to set up one direct debit agreement and thus – make one repayment each month.

- Reducing your interest payments

The second key advantage to engaging in a debt consolidation plan is that you stand the very real chance of reducing your interest payments. The amount that you are currently paying on your outstanding balances will depend on a number of key factors – such as the type of debt (credit cards, loans, etc.), and the provider behind the debt. For example, you might be paying 20% APR on your credit card, 15% APR on your store card, 550% APR on even the best payday loans, and 150% APR on your overdraft. With that being said, a debt consolidation loan could allow you to obtain a lower rate of interest.

Let’s look at a quick example to assess how this works in practice.

- You currently owe £5,000 on a credit card, £4,000 on a store card, and £11,000 on a personal loan

- This takes your total debts to £20,000

- To keep things simple, let’s say that you pay a base rate of 18% APR on all three debt instruments

- As you are only able to afford the minimum repayment amount each month, your interest is building in size month-on-month

- In order to take action, you decide to take out a debt consolidation loan

- The loan provider offers you a £20,000 loan at an APR rate of 11%

- As such, not only have you cleared all of your outstanding debts, but your loan comes with an APR rate that is 7% lower

How much will a debt consolidation loan cost?

So now that you know what you need to do to meet your objective of becoming debt-free via a debt consolidation loan, you now need to make some considerations regarding costs. As we have noted throughout our guide thus far, you need to ensure that the APR offered by the loan provider is lower than what you are currently paying. Otherwise, it effectively makes the process pointless, as you will be paying more in interest!

With that being said, there are a couple of other costs that you need to be made aware of when taking out a debt consolidation loan, which we have listed below.

i) Origination Fee

The origination fee is charged by lenders as a means to ‘cover the cost’ of arranging the loan. This isn’t exclusive to just debt consolidation loans, but to many other loan types. However, not all loan providers will charge you an origination fee. If they do, then the specific amount can vary quite considerably. For example, the origination fee might be a variable charge that is based on your current credit score. In other words, if you have a really bad credit profile, then you might end up paying more than somebody that is in possession of a good score.

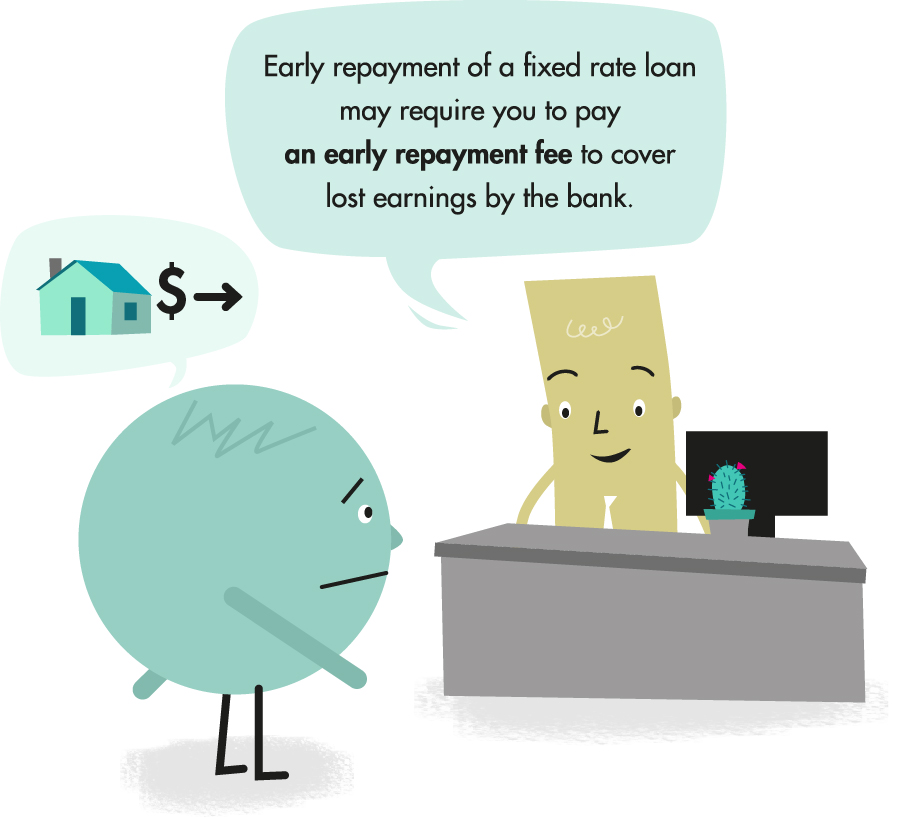

ii) Early Payment Fees

It is a sad state of affairs when everyday consumers are penalized for paying their debts off early, however, this is sometimes the case in the debt market. Once again, not all debt providers charge you an early payment fee, but if they do, then the specific cost can vary wildly.

We find that traditional personal loan providers are notorious for this, as an early payment means that they will receive less money from you in the form of interest. If you do need to pay an early payment fee with your current debt providers – pay it. At the end of the day, it is better to pay a small fee to obtain a status of ‘debt-free’, as opposed to keeping the debt open and paying extortionate interest.

iii) Late Payment Fees and Charges

You will also need to make some considerations regarding financial penalties that are charged if you fall behind with your new debt consolidation loan provider. On the one hand, you shouldn’t be taking out a debt consolidation loan if you think that there is the chance that you will miss a payment. Doing so will not only lead to a damaged credit score, but you’ll also be faced with additional fees.

However, this isn’t to say that you shouldn’t assess what the late payment fees are in the unforeseen event that you do fall behind. Unexpected life events will always happen, so it’s best to know what the financial consequences will be if you miss a payment. If the fees are extortionate, you should probably walk away from the application at the pre-approval stage.

Our Featured Business Loans Provider for 2020

Our Rating

- Offers business loans of between £1,000 and £25,000

- Advertised APR interest rate of 7.4%

- Perfect for small businesses

- Loan terms of between 1 - 10 years

Glossary of loan terms

Credit Score

Credit ScoreA credit score shows your creditworthiness. It's primarily based on how much money you owe to loan or credit card companies, if you have ever missed payments or if you have ever defaulted on a loan.

Guaranteed Approval

Guaranteed ApprovalGuaranteed Approval is when, no matter how bad, your credit score its, your loan application will not get declined.

Credit Limit

Credit LimitA Credit Limit is the highest amont of credit a lender will lend to the borrower.

Collateral

CollateralCollateral is when you put up an item against your loan such as your house or car. These can be repossessed if you miss payments.

Cash Advance

Cash AdvanceA Cash Advance is a short-term loan that has steep interest rates and fees.

Credit Rating

Credit RatingYour Credit Rating is how likely you are to fulfill your loan payments and how risky you are as a borrower.

Fixed Interest Rate

Fixed Interest RateFixed Interest Rate is when the interest rate of your loan will not change over the period you are paying off you loan.

Interest

InterestThe Interest is a percentage based on the amount of your loan that you pay back to the lender for using their money

Default

DefaultIf you default on your loan it means you are unable to keep up with your payments and no longer pay back your loan.

Late Fee

Late FeeIf you miss a payment the lender will charge you for being late, this is known as a late fee.

Unsecured Personal Loan

Unsecured Personal LoanAn Unsecured Personal Loan is when you have a loan based solely on your creditworthliness without using collateral.

Secured Loan

Secured LoanA Secured Loan is when you put collateral such as your house or car up against the amount you're borrowing.

Prime Rate

Prime RateThis is the Interest Rate used by banks for borrowers with good credit scores.

Principal

PrincipalThe Principal amount the borrower owes the lender, not including any interest or fees.

Variable Rate

Variable RateA Variable Rate is when the interest rate of you loan will change with inflation. Sometimes this will lower your interest rate, but other times it will increase.

Installment Loan

Installment LoanAn Installment Loan is a loan that is paid back bi-weekly or monthly over the period in which the loan is borrowed for.

Bridge Loan

Bridge LoanA Bridge Loan is a short term loand that can last from 2 weeks up to 3 years dependant on lender.

AAA Credit

AAA CreditHaving an AAA Credit Rating is the highest rating you can have.

Guarantor

GuarantorA Guarantor co-signs on a loan stating the borrower is able to make the payments, but if they miss any or default the Guarantor will have to pay.

LIBOR

LIBORLIBOR is the London Inter-Bank Offered Rate which is the benchmarker for the interest rates in London. It is an average of the estimates interest rates given by different banks based on what they feel would be the best interest rate for future loans.

Home Equity Loans

Home Equity LoansHome Equity Loans is where you borrow the equity from your property and pay it back with interest and fees over an agreed time period with the lender.

Debt Consolidation

Debt ConsolidationDebt Consolidation is when you take out one loans to pay off all others. This leads to one monthly payment, usually with a lower interest rate.

Student Loan

Student LoanIf you obtain a Student Loan to pay your way through College then you loan is held with the Department for Education U.K.

Student Grants

Student GrantsFinancial Aid in the form of grants is funding available to post-secondary education students throughout the United Kingdom and you are not required to pay grant

FAQ

What is the highest APR that I should pay on my debt consolidation loan?

While you should make every effort to ensure that you obtain the lowest APR rate possible, the main factor to consider is that your new interest rate is lower than what you are currently paying. Otherwise, it means that you will be worse off by taking out a debt consolidation loan.

What is the largest amount I can borrow with a debt consolidation loan?

The largest amount that you will be able to borrow will depend on a number of factors. This includes the specific lender, as well as your current credit score.

Should I still proceed with a debt consolidation loan if the loan size is less than what I owe in total?

You should rethink your plans to take a debt consolidation loan out if the loan size is smaller than what you owe. In doing so, you will still have multiple debts outstanding, some of which are likely to come with adverse interest rates. Instead, try to find a specialist debt consolidation lender that is happy to lend you the full amount.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up