How to Buy Standard Life Shares UK in 2022 – A Beginner’s Guide

Standard Life (also known as Standard Life Aberdeen PLC) is one of the largest investment companies in the UK, with over £550 billion in assets under management. As a public company listed on the LSE and a key constituent of the UK’s FTSE 100 Index, Standard Life is one of the most well-known financial companies in the UK.

We review some popular brokers and also cover the basics on how you can buy Standard Life shares right now.

-

-

Where To Buy Standard Life Shares

When it comes to buying Standard Life Shares, there are many different stock brokers to choose from, all with different fees, tools and payment methods. Therefore, finding the a broker for you can sometimes be a little tricky.

To help you out, we’ve reviewed a popular broker for UK customers. Check them out below.

Plus500

Plus500 is a UK-based broker that specializes in CFD trading, so while you can’t buy Standard Life shares in the traditional sense on this platform, you can trade share CFDs with leverage. Plus500 offers over 2,000 financial instruments in total, including a good number of shares, all as CFDs.

One of the reasons this broker is so popular is due to its extremely low fees. There’s no commission to pay on share trading, and Plus500’s spreads are among the tightest in the space. You don’t have to pay any fees on deposits or withdrawals, either.

Plus500 offers its own proprietary trading platform, which is available both on desktop and as a trading app. This broker requires a fairly low minimum deposit of £100 and accepts a range of payment methods, including PayPal. Thanks to its FCA licece, you can trade shares CFDs with confidence on Plus500.

Our Rating

80.5% of retail investor accounts lose money when trading CFDs with this provider. Sponsored ad.Why Do People Buy Standard Life Shares?

Standard Life is one of the oldest and most well-respected investment companies in the UK, with a web of associates and joint-ventures in the insurance sector across the UK, India and China. Since its merger with Aberdeen, Standard Life’s position in the UK market has been reinforced.

Deciding which shares or stocks to buy can be a difficult decision that must be supported by personal research.

1. A leader in Asset Management in the UK

Aberdeen Standard, the asset management arm of Standard Life, is the third largest UK asset manager in terms of assets under management. With over £550bn in assets generating a stream of fee income, Standard Life’s asset management business is steady and profitable.

Despite the loss of the Scottish Widows contract, fund inflows remain strong. In addition, Standard Life owns 20% of Phoenix, another large UK asset manager, and 27% of HDFC Asset Management, one of the leading asset managers in India.

2. Strong financial position

The coronavirus crisis has sparked many bankruptcies and forced many companies to cut costs and engage in mass layoffs to slow their cash burn. Meanwhile, Standard Life’s healthy cash flows from operations, large cash balance and comfortable net cash (cash on hand higher than debt) position put it in a comfortable place to ride out the crisis.

3. Excellent track record of returning money to shareholders

Over the past 5 years, the average dividend yield on Standard Life shares was 6.3%.

Standard Life has also frequently carried out share buybacks. In fact, between 2018 and 2019, Standard Life returned almost £2 billion to shareholders via a mix of buybacks & dividends.

Interested in buying other shares? Check out our guides on how to buy Amazon shares, Netflix shares and Tesla shares.About Standard Life Shares

Company History & Business Model

Founded in 1825, Standard Life is one of the UK’s oldest and most famous investment companies, with over £550 billion in assets under management.

Standard Life Aberdeen (formerly known simply as “Standard Life”) is the product of the merger between Standard Life PLC and Aberdeen Asset Management in 2017. The new company is headquartered in Scotland, listed on the London Stock Exchange, and employs around 6,000 people worldwide.

It operates primarily in two segments: Asset Management & Platforms and Insurance (via associates & joint-ventures).

The Asset Management & Platforms segment offers active asset management for institutional and retail clients, as well as advisory and platform services for investment advisors in the UK. Standard Life primarily derives its revenues from fees on assets under management and platform fees (for investment advisors).

Most of the revenues of the Asset Management division come from management fees (a flat percentage of assets managed charged every year), with a small sliver derived from performance fees (when the investment gains of the clients exceed a certain threshold). In addition, Standard Life derives revenues from fees on the use of its fund platforms, where investment advisors can manage their client’s portfolios. With over £1.6 billion in fee-based revenues in 2019, the Asset Management & Platforms division drives the bulk of Standard Life’s top- and bottom-lines.

Standard Life’s second division, Insurance Associates & Joint Ventures, consists primarily of significant equity stakes or JVs with insurance companies in India (HDFC Life), the UK (Phoenix) and China (HASL). These businesses offer pension, insurance and savings products to customers in these key markets. In 2019, with approximately £190 million in profits before tax, these associates and joint-ventures contributed to a third of Standard Life’s profits before tax.

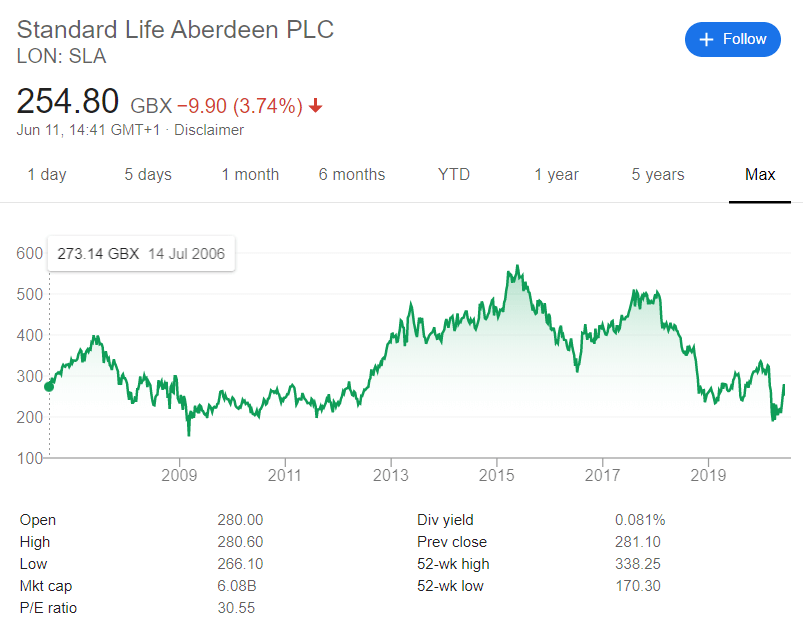

Standard Life Share Price and Performance

Standard Life Aberdeen is listed on the London Stock Exchange (LSE) under the SLA.L ticker.

Since the beginning of the coronavirus crisis, Standard Life shares have lost over 20%, hit by concerns over the company’s near-term outlook. Indeed, Standard Life has suffered from higher-than-usual outflows of assets under management, lowering its management fees earning potential.

Nonetheless, the main outflow for the year 2019 (£25 billion) concerned the loss of a large client, the Scottish Widows fund, which had been expected since 2018.

At the time of writing, the analyst consensus was overwhelmingly “Buy”, with the next 12 months price targets between 260p and 518p (average of 380p).

How To Buy Standard Life Shares

Step 1: Search for Standard Life (SLA.L) shares

Using the search function on the platform, look for “Standard Life” or its ticker “SLA.L”. You may find not only the company but also trader profiles in the search results: the ability to browse other traders is a key dimension of the social trading system.

Step 2: Select “Trade” to get started

Using your own money directly or via a free demo account for free paper trading, choose “Trade” to open the trading window. There, you will find the trading options including amount traded, buy or sell, leverage and special order types.

Step 3: Choose how much to invest and the options you want

One you’re in the trading window, your first decision is whether to buy or sell Standard Life shares, and how much. You can specify either a set number of shares (or fractions of shares), or a specific dollar amount.

Then, choose your order type. Default orders are at market, but you can specify limits and special order types like stop-loss or take-profit, useful to limit your downside or cash in without being behind your screen.

If you buy Standard Life shares without leverage, your trade will be executed directly (i.e. you will own the underlying shares). If however you short-sell Standard Life shares or use leverage for your trade, then your order will be executed as a CFD trade.

Take a minute before closing your trade to review the exposure (in dollar amount and percentage of your equity) of the trade. Make sure to also consider the fees (shown at the bottom) for a CFD trade. Once you have reviewed the risk and are comfortable with your decision, you are ready to buy Standard Life shares!

Simply click “Open Trade” to get started!

Conclusion

Standard Life is one of the largest and most reputable investment companies in the UK, with steady cash flows from its Asset Management business and a strong financial position.

FAQs

Where is Standard Life Aberdeen listed?

Standard Life Aberdeen is based in Scotland and listed on the London Stock Exchange.

What’s the difference between Standard Life and Standard Life Aberdeen?

In short, they’re the same. In 2017, Standard Life PLC merged with Aberdeen Asset Management to form Standard Life Aberdeen, a leader in Asset Management in the UK.

What business is Standard Life in?

Standard Life primarily derives its revenues from fees on the £550+ billion it manages. It also offers platforms to allow investment advisors to manage their clients’ money, and receives income from its investments in associates and joint-ventures in the insurance & asset management business.

Can I buy fractional shares of Standard Life?

Many of the brokers reviewed in this article allow you to buy or short fractional shares of Standard Life, mainly via CFDs.

Does Standard Life pay a dividend?

Historically, Standard Life has maintained a dividend yield above 6%.

A-Z of Shares

Alan Draper Lewis

View all posts by Alan Draper LewisAlan is a content writer and editor who has experience covering a wide range of topics, from finance to gambling.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com