Satsuma Loans Review 2021 | Read This Before Applying

Are you stuck in a financial rut with seemingly no way out? Satsuma Loans could be your way out. But before you rush into signing up on one of its loan offerings, take a moment to find out everything you can about the platform and its services.

Are you stuck in a financial rut with seemingly no way out? Satsuma Loans could be your way out. But before you rush into signing up on one of its loan offerings, take a moment to find out everything you can about the platform and its services.

To save you the hassle of digging up information online, we have undertaken a comprehensive review of the lender. In our thorough analysis, we have covered everything including the highlights, downsides and other important details.

Read on to make an informed decision on whether or not to take out a loan with them.

-

- 1. To get started, go to the site and use the SmartCheck online calculator to select an amount.

- 2. Select the loan amount and borrowing period and the purpose for which you are taking out the loan.

- 3. Enter your name, date of birth, marital status and number of dependents, address, residential status and how long you have been at the residence.

- 4. After you enter your contact details (email address and phone number, proceed to the next step by clicking “Next: Your Finances.”

- 5. After submitting all details, click “Apply” and then wait for a response from the lender.

-

- 1. To get started, go to the site and use the SmartCheck online calculator to select an amount.

- 2. Select the loan amount and borrowing period and the purpose for which you are taking out the loan.

- 3. Enter your name, date of birth, marital status and number of dependents, address, residential status and how long you have been at the residence.

- 4. After you enter your contact details (email address and phone number, proceed to the next step by clicking “Next: Your Finances.”

- 5. After submitting all details, click “Apply” and then wait for a response from the lender.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.What is Satsuma Loans?

Though Satsuma Loans is a relatively new player on the scene, its roots go back at least two centuries. It is a trading name of parent company Provident Personal Credit Limited, which is among the oldest lenders in the UK.

Though Satsuma Loans is a relatively new player on the scene, its roots go back at least two centuries. It is a trading name of parent company Provident Personal Credit Limited, which is among the oldest lenders in the UK.The lender is authorized and regulated by the Financial Conduct Authority (FCA) and has its head office in Bradford.

They pitch themselves as a friendlier alternative to the traditional payday loan. And they make use of a new and vibrant model to try and differentiate themselves from the competition.

Satsuma Loans has a long history of lending courtesy of its parent company. It offers an alternative to payday loans in form of short term installment loans. These are small loans repayable in a maximum of one year and can be repaid weekly or monthly. There are no hidden or extra charges from this transparent lender.Pros and Cons of a Satsuma Loans Loan

Pros

- Regulated entity under the FCA

- Operates on a no-fee model and thus does not charge late payment or prepayment fees

- Offers a longer-term alternative to payday loans with friendlier terms

- You can access funds within an hour if you time your application well

- You can make weekly repayments on any day you choose

- Mobile app makes it easy to access your account and transact

- You can use SmartCheck to confirm eligibility and loan amount before borrowing

Cons

- Borrowing costs are relatively high

- Applicants must submit to a credit check which will affect score

- You cannot qualify for a loan if you have an active bankruptcy

How does a Satsuma Loans loan work?

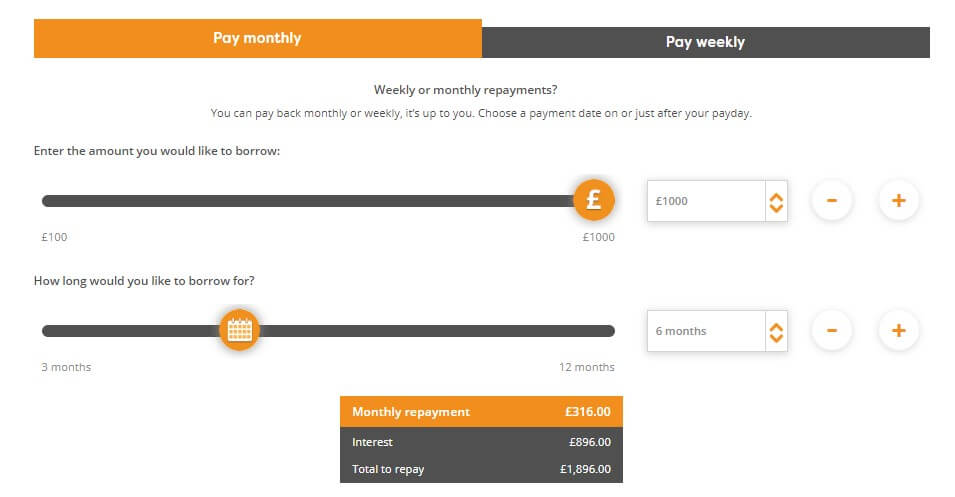

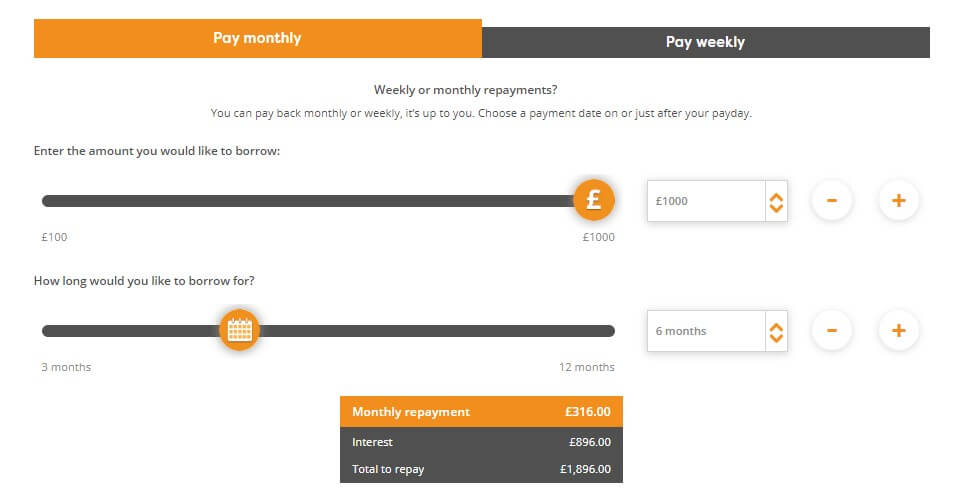

Satsuma Loans works on a relatively simple premise. They offer short term installment loans ranging from £100 and £1,000. You can borrow this amount over a span of 13 weeks and 52 weeks. And the maximum APR payable is 1,575%.

A major differentiating factor between this and other lenders is that they do not use the monthly repayment schedule. If you want to, you can make weekly payments. And best of all, you can choose any day of the week to make your payments.

Fees and costs

They claim to be a friendly service provider, and true to this, they do not charge any arrangement fees for loan application. Neither do they charge any fees for early repayments, missed payments or late payments.

When you apply for your first loan, they will require lots of details. The aim of collecting these details is to check whether or not you will have the ability to repay the loan. In addition to your details, they will also want you to submit to a credit check.

With this information at hand, they are able to determine affordability as well as creditworthiness and make a fair decision. This means that even if you have been declined by other lenders, you might still qualify for funding from Satsuma. They are objective and weigh multiple factors before approval or rejection of any application.

Before you go through the application process therefore, it would be great to use SmartCheck. This is an automated system using which you can check your eligibility, know your chances of getting approved and even check the amount you can qualify for.

Credit check

The importance of going through this check is to make sure the application does not impact your credit score negatively and you get declined. SmartCheck does a soft search and this gives the lender an idea of your creditworthiness without leaving a footprint. And you get your results in as short as 60 seconds.

Note that in the actual application, you will need to go through affordability, identity, fraud and money laundering checks. Only then can you qualify for one of their loans.

If you are in urgent need of funds, you might want to make your application and get approval between 6:00 AM and 11:00 PM. This is really generous as it gives you lots of time to get your application in and even verify details if need be. In case you manage to work within the said timeframe, you will be able to access funding within an hour of approval.

After they approve your application, you will get an email with the loan agreement. But you can also find it on the lender’s mobile app. The app provides an easy way to keep track of the loan and repayments. You can also use it to check your eligibility for future loans.

The team also makes it a practice to update borrowers with regular alerts and messages relevant to their account and loan.

Repayment

Once you get the funds, you need to choose a repayment plan. Choose a day of the week on which you want to make your payments and they will then set up a Continuous Payment Authority (CPA).

As with most other short term loans, the earlier you pay the funds back, the better. You get to cut down on the interests payable and end up paying a lower amount overall. So if you ever find yourself in a position, you can pay extra and reduce the outstanding balance. But before you do this, you will need to call their customer support center.

If at any point you have a hard time keeping up with payments, just contact the customer support team. Note that the lender does not charge any fees for missed payments or late payments. You will only need to pay back the original amount indicated on the agreement.

Satsuma LoansAccount Creation and Borrowing Process

Creating an account and borrowing from the platform is not at all complicated.

1. To get started, go to the site and use the SmartCheck online calculator to select an amount.

You can choose to make repayments on a weekly or monthly basis. Once you submit these details, the site will automatically calculate the loan terms and give you the total cost of borrowing upfront. At this point, you are free to proceed with the application or play around with the amount and loan term to get the perfect fit for your circumstances.

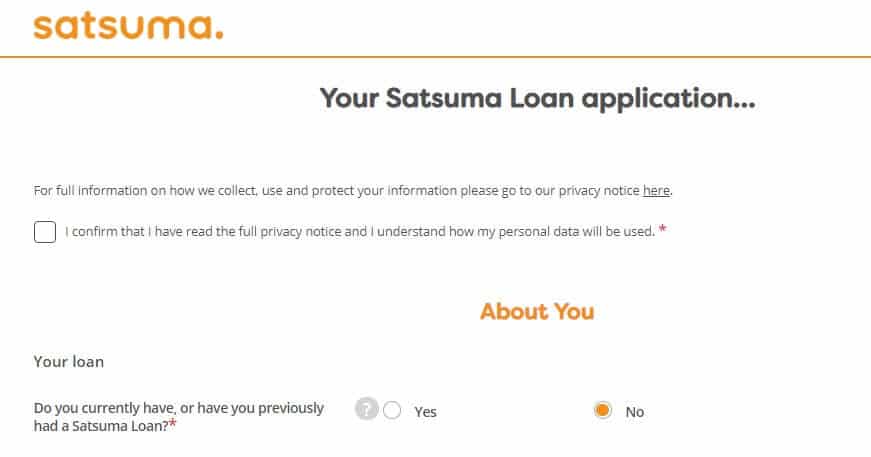

If you decide to proceed with the application, you will need to fill a short application form. First, you need to fill out information about yourself.

Confirm whether you have a Satsuma loan and select if you will make repayments weekly or monthly.

2. Select the loan amount and borrowing period and the purpose for which you are taking out the loan.

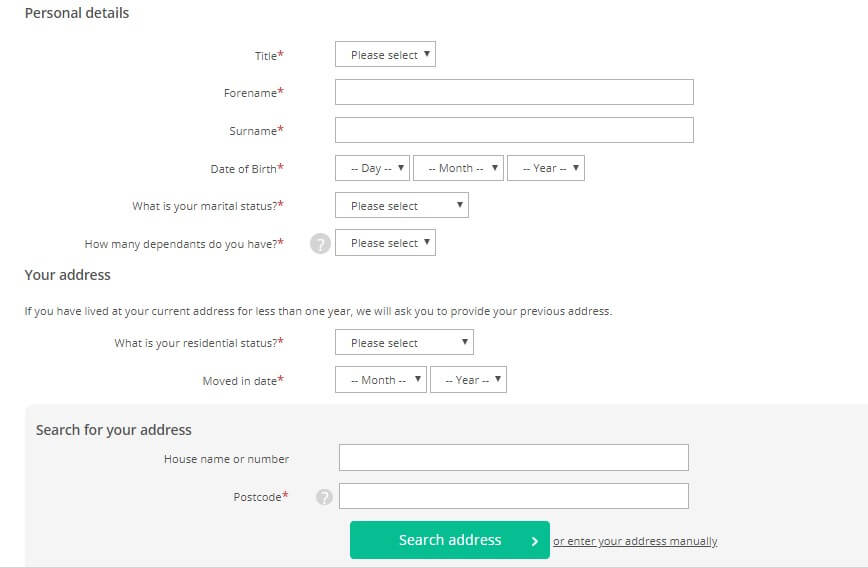

3. Enter your name, date of birth, marital status and number of dependents, address, residential status and how long you have been at the residence.

4. After you enter your contact details (email address and phone number, proceed to the next step by clicking “Next: Your Finances.”

Under this section, you will need to enter your employment information, income details, monthly outgoings, employer details and other relevant information.

Other details you will need to submit include your bank account information and credit card information.

5. After submitting all details, click “Apply” and then wait for a response from the lender.

If they approve within the aforementioned timeframe, then you will likely get the funds within an hour.

The lender will set up a CPA for repayment to automate the process.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Satsuma Loans Loan

Before you start applying for a loan from Satsuma, here are some of the conditions you need to meet:

- Be between ages 18 and 74

- Be a UK resident

- Have a mobile phone

- Agree to a credit check

- Have an email address

- Not be bankrupt

Information Borrowers Need to Provide to Get Satsuma Loans Loan

You will need to provide a number of details about yourself when applying for a loan from Satsuma. Take a look at what you need:

- A valid email address

- A valid mobile number

- Your bank account information

- Debit card details

- Details about your regular income

- Regular expenses

- Information about your home address for the past 3 years

What are Satsuma Loans loan borrowing costs?

Before borrowing from Satsuma, you might need to acquaint yourself with their fees and borrowing costs. Take a look:

- Arrangement fees – nil

- Late payment fees – nil

- Early payment fees – nil

- Maximum APR – 1,575%

- Representative APR – 535%

Representative Example:

- Loan amount – £480

- Repayment period – 9 months

- Repayments – monthly

- Repayment amounts – £106.56

- Interest rate – 133.1% per annum (fixed)

- Total amount payable – £959.04

Satsuma Loans Customer Support

Satsuma has a high rating online from various platforms. On the site known as Reviews, it gets a 4.7 rating out of 5 on the basis of 2,880 reviews. Among the reasons for the high rating are comments about an excellent, understanding customer service team. Notably, most of the complaints concern high rates, and not customer service.

Is it safe to borrow from Satsuma Loans?

Satsuma Loans offers a considerable measure of safety for its borrowers. To begin with, the lender is authorized and regulated by the FCA. They therefore have to adhere to stringent operational requirements and exercise responsible lending.

Furthermore, the site makes use of advanced encryption to protect the sensitive information that users upload to the site. However, it is always advisable to exercise caution when submitting information online. Avoid using a public computer as these are more prone to hacking and cybersecurity risks.

Satsuma Loans Review Verdict

A comprehensive look at Satsuma Loans proves that it is a reliable lender with lots of strengths. To start with, it offers transparency into its fees and costs. Borrowers can confirm eligibility before going through the application process. Their mobile app makes it easy to manage your account conveniently from a handheld device.

Since they do not base approvals on creditworthiness in isolation, it is possible for bad creditors who have been declined elsewhere to access funding here. The only challenge you may have to content with has to do with high rates.

A major downside to the service is the fact that loans are small compared to those of other short term lenders.

But if you ever find yourself in a tricky spot financially, they might be a great last resort.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.Glossary of loaning terms

Credit Score

Credit ScoreA credit score shows your creditworthiness. It's primarily based on how much money you owe to loan or credit card companies, if you have ever missed payments or if you have ever defaulted on a loan.

Guaranteed Approval

Guaranteed ApprovalGuaranteed Approval is when, no matter how bad, your credit score its, your loan application will not get declined.

Credit Limit

Credit LimitA Credit Limit is the highest amont of credit a lender will lend to the borrower.

Collateral

CollateralCollateral is when you put up an item against your loan such as your house or car. These can be repossessed if you miss payments.

Cash Advance

Cash AdvanceA Cash Advance is a short-term loan that has steep interest rates and fees.

Credit Rating

Credit RatingYour Credit Rating is how likely you are to fulfill your loan payments and how risky you are as a borrower.

Fixed Interest Rate

Fixed Interest RateFixed Interest Rate is when the interest rate of your loan will not change over the period you are paying off you loan.

Interest

InterestThe Interest is a percentage based on the amount of your loan that you pay back to the lender for using their money

Default

DefaultIf you default on your loan it means you are unable to keep up with your payments and no longer pay back your loan.

Late Fee

Late FeeIf you miss a payment the lender will charge you for being late, this is known as a late fee.

Unsecured Personal Loan

Unsecured Personal LoanAn Unsecured Personal Loan is when you have a loan based solely on your creditworthliness without using collateral.

Secured Loan

Secured LoanA Secured Loan is when you put collateral such as your house or car up against the amount you're borrowing.

Prime Rate

Prime RateThis is the Interest Rate used by banks for borrowers with good credit scores.

Principal

PrincipalThe Principal amount the borrower owes the lender, not including any interest or fees.

Variable Rate

Variable RateA Variable Rate is when the interest rate of you loan will change with inflation. Sometimes this will lower your interest rate, but other times it will increase.

Installment Loan

Installment LoanAn Installment Loan is a loan that is paid back bi-weekly or monthly over the period in which the loan is borrowed for.

Bridge Loan

Bridge LoanA Bridge Loan is a short term loand that can last from 2 weeks up to 3 years dependant on lender.

AAA Credit

AAA CreditHaving an AAA Credit Rating is the highest rating you can have.

Guarantor

GuarantorA Guarantor co-signs on a loan stating the borrower is able to make the payments, but if they miss any or default the Guarantor will have to pay.

LIBOR

LIBORLIBOR is the London Inter-Bank Offered Rate which is the benchmarker for the interest rates in London. It is an average of the estimates interest rates given by different banks based on what they feel would be the best interest rate for future loans.

Home Equity Loans

Home Equity LoansHome Equity Loans is where you borrow the equity from your property and pay it back with interest and fees over an agreed time period with the lender.

Debt Consolidation

Debt ConsolidationDebt Consolidation is when you take out one loans to pay off all others. This leads to one monthly payment, usually with a lower interest rate.

Student Loan

Student LoanIf you obtain a Student Loan to pay your way through College then you loan is held with the Department for Education U.K.

Student Grants

Student GrantsFinancial Aid in the form of grants is funding available to post-secondary education students throughout the United Kingdom and you are not required to pay grant

FAQ

Will borrowing from Satsuma affect my credit score?

Yes. You can check your eligibility without affecting your score, but the moment you make an application, the lender will perform a hard credit check which will affect your score.

Do I have to make weekly repayments if I take out a loan?

No. All borrowers have the option of choosing between weekly and monthly repayments. Choose the most suitable option based on your payday to ensure that you make timely payments on the due date.

Do I automatically qualify for subsequent loans after a first successful application and timely repayments?

No. Every loan application will be assessed independently. Of course, if you made timely repayments on previous loans, this contributes to your likelihood of qualifying. But the lender will also assess your affordability based on current circumstances.

How does Satsuma decide whether or not to approve my loan?

The lender uses a combination of credit scoring and affordability to check whether you can manage to repay a loan. They will look at such aspects as income, outgoings, dependents, marital status and address to determine this.

What does credit scoring entail?

Credit scoring involves contacting one or more credit agencies to see your credit report. The report contains your personal credit history, information from other creditors and payment history on mortgages, credit card accounts and bills.

What loan products does Satsuma Loans offer?

Satsuma Loans offers short-term installment loans as an alternative to payday loans

UK Payday Loan Reviews- A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up