Swift Money Loan Review 2021 – Fast Funds in 10 Minutes!

Financial emergencies often arise when we least expect, and at times, accessing credit facilities is not as easy as it may sound. Short term loan providers like Swift Money seek to rescue applicants out of such situations. But are they lenders for you?

Financial emergencies often arise when we least expect, and at times, accessing credit facilities is not as easy as it may sound. Short term loan providers like Swift Money seek to rescue applicants out of such situations. But are they lenders for you?

Before signing up for one of these loans, it would be wise to find out all you can about the provider. To help you along, we have carried out a thorough analysis of the platform’s features and services.

Read on to find out all you need to know about Swift Money and make the right decision.

-

- 1. Select the amount you want, between £100 and £1,000.

- 2. Next, click on “Apply Now” to start the actual application process.

- 3. Next, enter your personal details starting with your name, email address, home phone, mobile phone, date of birth, marital status and number of dependents if any.

- 4. Provide your address details and then proceed to the employment details section.

- 5. The final section of the application form requires information about your finance details.

-

- 1. Select the amount you want, between £100 and £1,000.

- 2. Next, click on “Apply Now” to start the actual application process.

- 3. Next, enter your personal details starting with your name, email address, home phone, mobile phone, date of birth, marital status and number of dependents if any.

- 4. Provide your address details and then proceed to the employment details section.

- 5. The final section of the application form requires information about your finance details.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.What is Swift Money?

Swift Money is a trading name of Swift Money Limited, a credit brokering service provider. It is authorized and regulated by the Financial Conduct Authority (FCA). They have their head offices in Bolton, Lancashire and offer services all over the UK.

Swift Money is a trading name of Swift Money Limited, a credit brokering service provider. It is authorized and regulated by the Financial Conduct Authority (FCA). They have their head offices in Bolton, Lancashire and offer services all over the UK.The service is registered in England and Wales and was launched in 2011. They claim to have processed more than a million applications since inception and boast high acceptance rates.

Swift Money offers loan brokerage services, providing a platform for connecting with various lenders. They have a brief and concise application process and have a great reputation for high acceptance and fast funding.Pros and Cons of a Swift Money Loan

Pros

- High acceptance rates because they work with multiple lenders

- Single-page loan application form

- They do not require any paperwork or extensive information

- Applicants can access funds in as few as 10 minutes

Cons

- They are not a direct lender and will therefore share your information with third-party service providers

- Rates and fees on the platform vary from lender to lender

- You might have to complete an application form on the lender’s site as well

How does a Swift Money loan work?

As mentioned above, Swift Money is not a direct lender, but a credit brokering service. Therefore, when you make an application on the site, they share the details with their lending and broker partners. These ones will then weigh your details against their requirements and make a decision on whether or not to offer funding.

While Swift Money does not charge any fees for the service, they receive a commission from lending partners when an introduction is successful. The approval process takes place by means of what the platform refers to as auto decisioning. This refers to the capacity to make a lending decision without the need for human interaction.

Rather, the lending partners’ platforms make use of advanced algorithms to assess applications and approve or decline them.

Online loan application

The lender does not have any physical stores and therefore, the entire application process takes place online. Applying for a loan on the platform is easy and straightforward as the application form is compact and not complicated. The least amount you can apply for is £100 and the maximum is £1,000 and the typical repayment period is 1 month.

In fact, it is one of few platforms that make use of a single-page loan application form. They do not require any extensive information or paperwork. And this greatly cuts down the approval time.

Once you go through the form and enter all of the required details, they forward the application to more than 20 payday lenders in the UK. As soon as a lender reaches a decision, you will get an email confirming the outcome of the application.

In case you are successful, you will get forwarded to the lender’s website. Note that Swift Money does not have any control over whether or not you get accepted. In certain cases, the lender who accepts your application may require you to fill out another application on their site.

After approval and successful redirect to the lender’s website, you will get access to the loan agreement. You will need to check for this important document in your email inbox as the agreement gets automatically triggered as soon as a lender verifies and accepts your application.

All the details of the loan including the amount, the loan term and the repayment amounts and due dates are clearly outlined on this agreement. So take your time to go through it, reading carefully through all the details.

If you find it satisfactory, you will simply need to sign it electronically so as to finalize your application. Once you sign the electronic agreement, the lender will process your funds so as to dispatch.

Fast funds disbursement option

Note that if you happen to be in a rush to receive the funds, you can select “Faster Payment Services.” These services are available on some lenders’ sites but in certain cases, charges might apply. But if you choose this option, you might get the funds in your account in as few as 10 minutes.

However, the amount of time it takes to access your funds could be a lot longer depending on your bank as well as the lender who approved the application. But in most cases, it will take at most 3 working days.

In case at some point during the repayment period you feel that you may have a problem paying back the borrowed amount, the lender advises that you contact the support team immediately.

Repayment

They will attempt to work out an alternative repayment option or a different set of terms for you. The idea is to help you avoid missing the due date completely, which could attract fees and additional interests.

Not every lender will charge a late repayment fee, but those that do can only charge a maximum of £15, which is the legally accepted amount. During the delay period, you will also incur interests on the outstanding amount.

Additionally, failure to notify a lender of financial challenges and then missing the due date could lead to having your details sent to debt recovery agencies. Lenders do not take this action lightly and only pursue it as a last resort. This too could lead to incurring additional charges.

They would also need to report your poor repayment habits to credit agencies and this will negatively affect your credit score. Before they pursue any of these options though, they will try to reach you via phone and letter so as to recover their funds.

What loan products does Swift Money offer?

Swift Money specializes in providing the best payday loans. These are short term financing options that typically require repayment by the next payday. They may not be as high in amount as other types of loans but they are infamous for their high interest rates.

Some lenders offer longer terms and more flexible repayment requirements than the usual. So take the time to go through the loan agreement form to find out if the terms are suitable.

Swift Money Account Creation and Borrowing Process

As noted above, creating an account and borrowing from this platform is rather simple. To get started, visit the platform’s official website.

In case you wish to get an idea of how much you will need to pay back before going through the application process, start by using the online loan calculator on the home page.

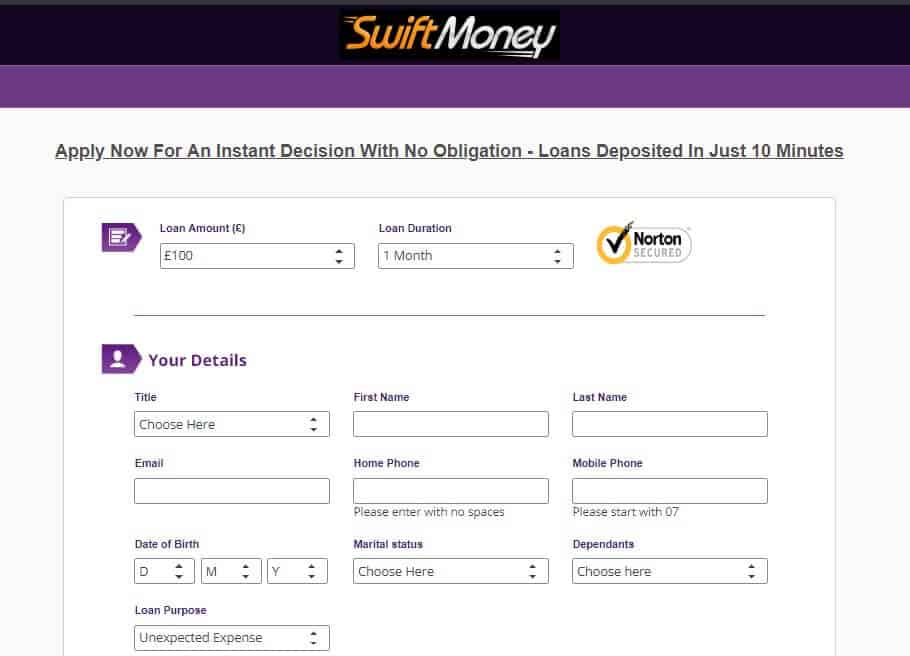

1. Select the amount you want, between £100 and £1,000.

This will give you the approximate amount you will need to repay in a span of 30 days.

2. Next, click on “Apply Now” to start the actual application process.

Fill in the required details starting with the loan amount and selecting a duration in case you want a longer period than the default 1 month.

3. Next, enter your personal details starting with your name, email address, home phone, mobile phone, date of birth, marital status and number of dependents if any.

You will also need to indicate the purpose for which you are taking out the loan.

4. Provide your address details and then proceed to the employment details section.

Here you will need to indicate your employment status, the industry in which you work, how you get paid and your work phone number. You will also need to fill in the length of employment, your monthly income, how often you get paid, your next pay date and the one after that. Complete this section by entering the name of your employer.

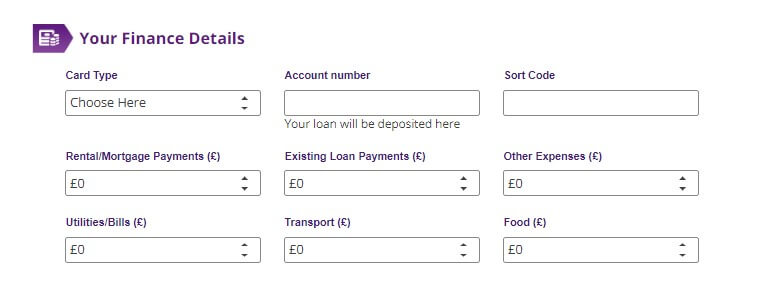

5. The final section of the application form requires information about your finance details.

Start by entering your card type, account number and sort code. Provide details regarding your expenses such as mortgage or rent, existing loans, utilities, food and transport.

After going through the terms and conditions and the privacy policy, click “Apply Now” and wait for a lender’s response in a matter of minutes.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Swift Money Loan

Qualifying for a loan on Swift Money is not at all complicated; here are the requirements you need to meet:

- Be a UK resident

- At least 18 years old

- Have a regular income

- Have a bank account

- Have a valid debit card

Information Borrowers Need to Provide to Get Swift Money Loan

In order to access a loan facility from one of the lenders on Swift Money, here are some of the details you will need to provide:

- Phone number

- Name

- Marital status

- Number of dependents

- Postcode

- Employment details including status, length at employment, monthly income and how you get paid among other things

- Finance details including your account number and sort code, type of card and monthly expenses

What are Swift Money loan borrowing costs?

Borrowing costs on Swift Money differ significantly from one lender to another. Here is a look at some of the rates you might expect:

- Late payment fees – £1 to £15

- Interest rate – capped at 0.8% daily

- Average APR charged by the lenders over 30 days – 1,255.66%

Representative Example:

- Loan amount – £250

- Loan period – 30 days

- Total repayment – £310

- Interest rate p.a. fixed – 292.25%

- Interest amount – £60

- Representative APR – 1,255.66%

Swift Money Customer Support

Swift Money gets a high rating on various platforms online, with users hailing the fast and easy application process. There are also positive comments about its communication and services. However, it would be good to keep in mind that when you take out a loan from the platform, you will actually have to deal with the lender’s customer support and not the broker’s.

Therefore, before signing up for any loan, take a moment to see what customers think of the lender’s customer support team.

Is it safe to borrow from Swift Money?

The lender is regulated and authorized under the FCA. And the platform makes use of advanced encryption protocol to secure your data. However, as brokers they have to share your information with third-party lenders and this might pose a degree of risk.

Swift Money Review Verdict

Swift Money is a reliable credit brokerage service provider with a high acceptance rate. This has to do with the fact that they work with multiple lenders, which increases the chances of borrowers getting a good fit.

They make use of a simple and concise application process, and since their lending partners make use of auto decisioning, they approve loans fast. If you are in a rush for accessing funds, you might find them ideal.

However, you need to look out so you do not end up settling for less than ideal terms and services from one of their lending partners. Note too that their loan limits are pretty low and the rates are considerably high.

Overall, they are a good choice of platform for when you are in a tight situation financially with no other way out.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.Glossary of loaning terms

Credit Score

Credit ScoreA credit score shows your creditworthiness. It's primarily based on how much money you owe to loan or credit card companies, if you have ever missed payments or if you have ever defaulted on a loan.

Guaranteed Approval

Guaranteed ApprovalGuaranteed Approval is when, no matter how bad, your credit score its, your loan application will not get declined.

Credit Limit

Credit LimitA Credit Limit is the highest amont of credit a lender will lend to the borrower.

Collateral

CollateralCollateral is when you put up an item against your loan such as your house or car. These can be repossessed if you miss payments.

Cash Advance

Cash AdvanceA Cash Advance is a short-term loan that has steep interest rates and fees.

Credit Rating

Credit RatingYour Credit Rating is how likely you are to fulfill your loan payments and how risky you are as a borrower.

Fixed Interest Rate

Fixed Interest RateFixed Interest Rate is when the interest rate of your loan will not change over the period you are paying off you loan.

Interest

InterestThe Interest is a percentage based on the amount of your loan that you pay back to the lender for using their money

Default

DefaultIf you default on your loan it means you are unable to keep up with your payments and no longer pay back your loan.

Late Fee

Late FeeIf you miss a payment the lender will charge you for being late, this is known as a late fee.

Unsecured Personal Loan

Unsecured Personal LoanAn Unsecured Personal Loan is when you have a loan based solely on your creditworthliness without using collateral.

Secured Loan

Secured LoanA Secured Loan is when you put collateral such as your house or car up against the amount you're borrowing.

Prime Rate

Prime RateThis is the Interest Rate used by banks for borrowers with good credit scores.

Principal

PrincipalThe Principal amount the borrower owes the lender, not including any interest or fees.

Variable Rate

Variable RateA Variable Rate is when the interest rate of you loan will change with inflation. Sometimes this will lower your interest rate, but other times it will increase.

Installment Loan

Installment LoanAn Installment Loan is a loan that is paid back bi-weekly or monthly over the period in which the loan is borrowed for.

Bridge Loan

Bridge LoanA Bridge Loan is a short term loand that can last from 2 weeks up to 3 years dependant on lender.

AAA Credit

AAA CreditHaving an AAA Credit Rating is the highest rating you can have.

Guarantor

GuarantorA Guarantor co-signs on a loan stating the borrower is able to make the payments, but if they miss any or default the Guarantor will have to pay.

LIBOR

LIBORLIBOR is the London Inter-Bank Offered Rate which is the benchmarker for the interest rates in London. It is an average of the estimates interest rates given by different banks based on what they feel would be the best interest rate for future loans.

Home Equity Loans

Home Equity LoansHome Equity Loans is where you borrow the equity from your property and pay it back with interest and fees over an agreed time period with the lender.

Debt Consolidation

Debt ConsolidationDebt Consolidation is when you take out one loans to pay off all others. This leads to one monthly payment, usually with a lower interest rate.

Student Loan

Student LoanIf you obtain a Student Loan to pay your way through College then you loan is held with the Department for Education U.K.

Student Grants

Student GrantsFinancial Aid in the form of grants is funding available to post-secondary education students throughout the United Kingdom and you are not required to pay grant

FAQ

If I have bad credit, can I qualify for a loan?

Yes. Most lenders on the platform will weigh both your credit history and current financial status and could approve you based on affordability.

When will I get funding?

You might get funding in 15 minutes, but it could also take up to 3 days depending on your bank and the lender in question.

How will the lender deposit the money?

The lender will deposit the money directly into your bank account.

What does auto decisioning mean?

This is a loan approval process that does not require human intervention as it makes use of advanced algorithms.

What happens if I cannot make a repayment on time?

You will need to get in touch with the lender before your due date so as to make alternative arrangements. Otherwise, you might face hefty penalties or get reported.

What other store services does Swift Money offer?

Swift Money does not offer any other store services.

UK Payday Loan Reviews- A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up