Bingo Loans Loan Review 2021 – All Credit Histories Considered!

Finding the right short-term lender to get you out of a financial rut can be a tricky process. There are lots of quality and sub-par lenders out there, each one offering different terms.

Finding the right short-term lender to get you out of a financial rut can be a tricky process. There are lots of quality and sub-par lenders out there, each one offering different terms.

Bingo Loans is one such lender, but is it the right lender for you? We have undertaken a comprehensive review of the platform to let you know everything you need to know.

So before signing up for a loan on the site, take a few moments to find out how it works and if there are any benefits and downsides to borrowing from them.

-

-

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.Bingo Loans functions as both a direct lender and a matching service connecting borrowers to its partner lenders. It assesses all applications and either services them or hands them over when it cannot meet borrower needs. Most applicants can find a match but the rates are unpredictable as they vary from one lender to the next.

*Subject to lender requirements and approval.Bingo Loans functions as both a direct lender and a matching service connecting borrowers to its partner lenders. It assesses all applications and either services them or hands them over when it cannot meet borrower needs. Most applicants can find a match but the rates are unpredictable as they vary from one lender to the next.What is Bingo Loans?

Bingo Loans describes itself as “a short-term loan direct lender and broker, giving you the best of both worlds.”

The lender allows you to find the right loan either from its own platform or from third-party lenders. It makes use of a loan comparison algorithm to match borrowers and lenders.

Bingo operates under The Money Hive Limited and has the authorization and regulatory oversight of the Financial Conduct Authority (FCA). It is also registered on the Financial Services Register.

The company is registered in England and Wales with its head offices in Manchester.

Pros and Cons of a Bingo Loans Loan

Pros

- Uses advanced technology to find the right loan for every applicant

- Works as both a direct lender and a matching service to third-party lenders

- Offers transparency into its rating system

- Reports to credit agencies and can therefore help to improve your rating

- Allows borrowers to cancel loans for up to 14 days after receiving funds

- Fast loan approval and funding within one business day

Cons

- The rates may vary from figures shown on the site if you get your loan from a third party

- Bingo Loans may have to share your information with third parties to match you to a lender

- Since they check your credit, applying for a loan from the platform may affect your rating

How does a Bingo Loans loan work?

Bingo Loans uses advanced technology to offer a fast and efficient loan application process. Typically, the lender will offer you financing as a direct lender without discrimination. They accept all credit histories, and the entire process takes place online.

With a focus on convenience and speed, they allow applicants to access an online calculator to confirm loan terms prior to application. And whenever they are unable to meet your request, they refer you to an alternative lender.

If you happen to be matched to one of the provider’s partner lenders, you will have your application transferred to their site. Once you complete the process, you will have the funds deposited directly to your account.

At no point will you need to make a phone call as you can complete all required steps online. But if at any point you have queries regarding the application, you can contact customer support. In case you have been transferred to a third-party lender, the provider will put you in touch with the relevant person(s).

Fees and cost

They do not charge fees for the matching service though they may receive a commission from the partner lenders. Loan amounts on the platform vary from as little as £50 to a maximum of £1,500. The loan terms, on the other hand, vary from one month all the way to 12 months.

In some cases, you can get your loan as soon as the same day or the next business day. It all depends on the time when you submit the application and when approval takes place.

Given that the lender has a wide network of partners to work with, it also claims to offer high acceptance rates. This has to do with the fact that there will nearly always be a lender who is glad to meet your requirements and give you the terms you want.

Though the typical wait period is 24 hours, you might have to wait longer if your bank does not accept accelerated payments. The maximum wait period is approximately 3 days.

Credit check

The site offers services to everyone even borrowers with a bad credit rating or no credit at all. In fact, it claims that there is no such thing as “bad credit.” Thanks to their flexible approach they finance all borrowers and seek to help you improve your rating.

When you apply for a loan for the first time on the site, the provider may carry out a credit check and referencing. During the eligibility assessment process, they may use data from credit reference agencies and credit checks to determine your creditworthiness.

Through these comprehensive checks, they ascertain borrower identity and are able to prevent fraudulent applications. In case you provide any information that is untrue or inaccurate, it is considered a breach of terms. As such, it may lead to the instigation of criminal procedures.

You have the right to cancel any loan which the lender has approved for up to 14 days after you receive the funds. In order to make a cancelation, you need to contact the lender directly, whether this is Bingo Loans or any third party on the platform.

Doing so will require written notification of phone call to the company. Note though that you will need to pay the full credit amount as well as the interests that have accrued since approval. You need to do this immediately and no later than 30 days after you give the withdrawal notice.

What are payday loans?

A payday loan is a type of short-term loan whose term typically lasts until your next payday. Given the short term of the loan and the high risks that are typically associated with this type of loan, interest rates are also high.

The payday loan is usually a portion of a borrower’s next paycheck and also goes by the name cash advance loan. To complete an application for this loan on Bingo, you would therefore need a pay stub from your employer to show your income level.

Your loan principal will then be calculated as a percentage of this short-term income and your credit history will also come into play.

Bingo Loans Account Creation and Borrowing Process

Creating an account on Bingo and applying for your first loan is a simple process.

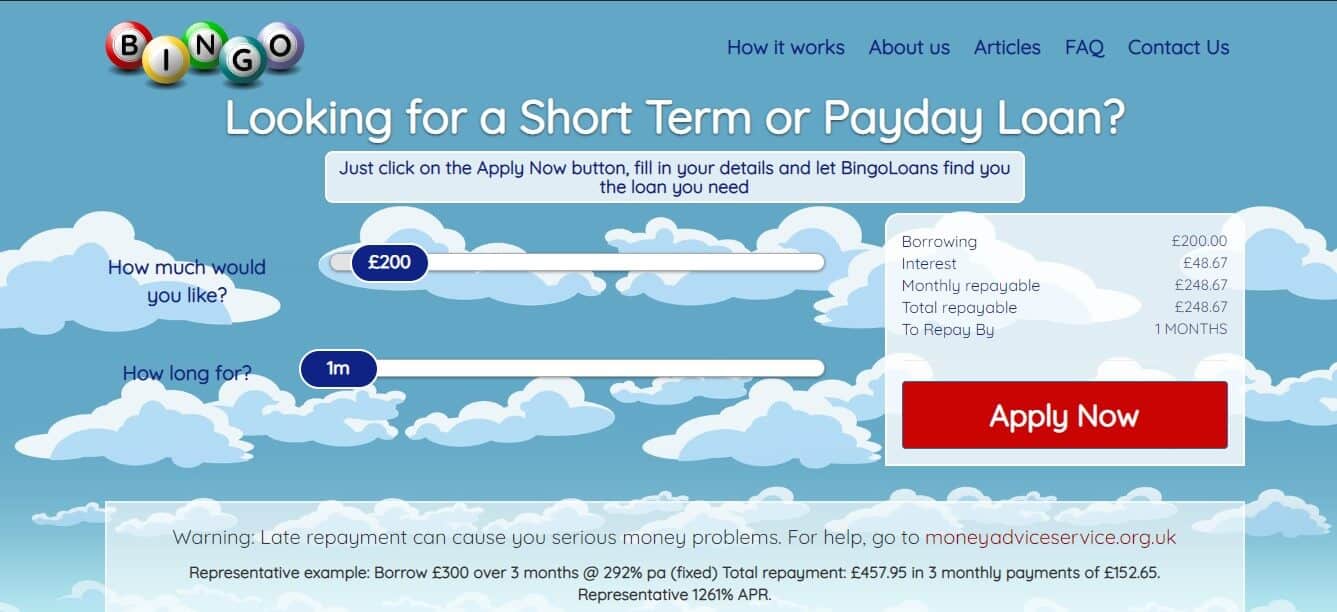

1.Simply visit the official Bingo Loans website and on the home page, select the amount you want and your preferred loan term.

The site will automatically calculate the interest rate applicable for this loan as well as how much you will need to pay every month (if it takes longer than 1 month).

2. If you find the terms satisfactory, proceed to the next step by clicking “Apply Now.”

3. Next, you will need to enter your personal details so as to complete the application.

These include personal details, income information, expenses and your bank account information.

Bingo Loans may review your application or send it to a panel of other lenders who will review and send you the decision. In case one of them approves your application, you will be redirected to their site to complete the process by electronically signing the agreement.

In case you complete the application before 3pm on a weekday, you might get funds on the same day. But if it is after 3pm or on a weekend, you will get funds on the next business day.

Your repayment date will depend on when you complete the application as well as when you receive funds. All the repayment details will be available on the agreement.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Bingo Loans Loan

Here are some of the qualifications you need to meet so as to qualify for a loan on the site:

- Be over 18 years of age

- Be a resident of the UK

- Have an active bank account

- Have an active debit card

- Be in permanent employment or be a recipient of various allowances

- Meet the site’s credit and affordability criteria

- Provide accurate financial and personal information

Information Borrowers Need to Provide to Get Bingo Loans Loan

When applying for a loan on the platform, here is the information you will need to supply:

- Email address

- Personal information

- Employment details

- Financial information

- Bank account details

What are Bingo Loans loan borrowing costs?

Bingo is clear about its borrowing rates and costs. Take a look at some of the fees you will need to pay:

- Fixed APR 292% from Bingo Loans but may vary by lender

- Origination fees – depend on lender

- Late payment fees – vary by lender

Representative Example:

- Borrowed amount – £300

- Repayment period – 3 months

- Interest amount – £156.52

- Monthly repayment amount – £152.17

- Total amount repayable – £456.52

- Representative APR – 1,261%

Note however that rates may vary significantly from the above-shown figures if you end up getting a loan from one of the third-party lenders.

Bingo Loans Customer Support

There is very little information online about Bingo Loans or its support team. You might want to find out firsthand by contacting them before applying for a loan. They are accessible on phone and via email and the contacts are available on the website.

Is it safe to borrow from Bingo Loans?

Bingo Loans is a regulated service provider and there appears to be no safety concerns about borrowing from the platform.

The website adheres to standard encryption protocols ensuring the safety of user information.

Additionally, as a matching service, they work with reputable lenders in the UK. But always carry out a background check and read reviews on third-party lenders before accepting a loan from them.

Bingo Loans Review Verdict

Bingo Loans is a reputable, regulated financier working both as a direct lender and as a matching service. They ensure that everyone can get access to a loan by providing access to alternative lenders when they cannot offer services directly.

Though their rates are within the average charged by short-term lenders, you can never be too sure of applicable rates until you identify your lender. They perform credit checks and report to credit agencies and may thus affect your rating for better or for worse depending on your repayment.

All in all, it is a solid choice when you need cash urgently and have no other way out. but always make sure you read the fine print before signing any loan agreement from Bingo or any of its partner lenders.

Try Our Recommended UK Payday Loan Provider 2020:

- Get an Instant Quote

- Apply within 2 Minutes

- Friendly Support Service

- FCA Regulated

*Subject to lender requirements and approval.

*Subject to lender requirements and approval.Glossary of loaning Terms

Credit Score

Credit ScoreA credit score shows your creditworthiness. It's primarily based on how much money you owe to loan or credit card companies, if you have ever missed payments or if you have ever defaulted on a loan.

Guaranteed Approval

Guaranteed ApprovalGuaranteed Approval is when, no matter how bad, your credit score its, your loan application will not get declined.

Credit Limit

Credit LimitA Credit Limit is the highest amont of credit a lender will lend to the borrower.

Collateral

CollateralCollateral is when you put up an item against your loan such as your house or car. These can be repossessed if you miss payments.

Cash Advance

Cash AdvanceA Cash Advance is a short-term loan that has steep interest rates and fees.

Credit Rating

Credit RatingYour Credit Rating is how likely you are to fulfill your loan payments and how risky you are as a borrower.

Fixed Interest Rate

Fixed Interest RateFixed Interest Rate is when the interest rate of your loan will not change over the period you are paying off you loan.

Interest

InterestThe Interest is a percentage based on the amount of your loan that you pay back to the lender for using their money

Default

DefaultIf you default on your loan it means you are unable to keep up with your payments and no longer pay back your loan.

Late Fee

Late FeeIf you miss a payment the lender will charge you for being late, this is known as a late fee.

Unsecured Personal Loan

Unsecured Personal LoanAn Unsecured Personal Loan is when you have a loan based solely on your creditworthliness without using collateral.

Secured Loan

Secured LoanA Secured Loan is when you put collateral such as your house or car up against the amount you're borrowing.

Prime Rate

Prime RateThis is the Interest Rate used by banks for borrowers with good credit scores.

Principal

PrincipalThe Principal amount the borrower owes the lender, not including any interest or fees.

Variable Rate

Variable RateA Variable Rate is when the interest rate of you loan will change with inflation. Sometimes this will lower your interest rate, but other times it will increase.

Installment Loan

Installment LoanAn Installment Loan is a loan that is paid back bi-weekly or monthly over the period in which the loan is borrowed for.

Bridge Loan

Bridge LoanA Bridge Loan is a short term loand that can last from 2 weeks up to 3 years dependant on lender.

AAA Credit

AAA CreditHaving an AAA Credit Rating is the highest rating you can have.

Guarantor

GuarantorA Guarantor co-signs on a loan stating the borrower is able to make the payments, but if they miss any or default the Guarantor will have to pay.

LIBOR

LIBORLIBOR is the London Inter-Bank Offered Rate which is the benchmarker for the interest rates in London. It is an average of the estimates interest rates given by different banks based on what they feel would be the best interest rate for future loans.

Home Equity Loans

Home Equity LoansHome Equity Loans is where you borrow the equity from your property and pay it back with interest and fees over an agreed time period with the lender.

Debt Consolidation

Debt ConsolidationDebt Consolidation is when you take out one loans to pay off all others. This leads to one monthly payment, usually with a lower interest rate.

Student Loan

Student LoanIf you obtain a Student Loan to pay your way through College then you loan is held with the Department for Education U.K.

Student Grants

Student GrantsFinancial Aid in the form of grants is funding available to post-secondary education students throughout the United Kingdom and you are not required to pay grant

FAQ

Can I make a repayment before my loan due date?

Most of the lenders on the platform accept prepayments. But always confirm to avoid prepayment fees.

Will I have to go through the same application process for subsequent loans or do I automatically qualify?

Simply because you qualified for a loan does not mean you will qualify the next time you apply. Therefore, you may get approval for subsequent or get rejected. Every lender will base their decision on your financial position at the time of application.

Do I need to submit any supporting documentation when applying for a loan?

If you get approval for a loan with Bingo Loans, you will need to provide a picture ID and your latest bank statement (scan, photo or PDF) showing 30 days transactions.

If I am working with a debt management company, do I need to reveal that when applying?

Yes. You may need to ask the debt management company to contact Bingo Loans in writing indicating their authorization to work on your behalf.

What happens if I can’t make repayment on due date?

Make sure you contact your lender before the due date to discuss alternative options. Failure to do so may lead to late payment fees and you might get reported to debt collection.

What loan products does Bingo Loans offer?

Bingo specializes in offering payday loans as a direct lender. But if you need any other kind of loan, you may still apply on the platform. Acting as brokers, they will match you to their partner lenders at no fee.

UK Payday Loan Reviews- A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up