Moneybox App Review 2021 – Best UK Savings App?

A wave of financial innovation is redefining how people –

In this Moneybox review, we look at the features of an investing app that is making it simple and easy for everyone to start.

Find our list of the best robo-advisors here

-

-

What is Moneybox?

Moneybox is a mobile savings and investment app that aims at helping cash strapped millennials build wealth by rounding up their everyday card purchases and investing the collections in tracker funds. The company was founded in July 2015 by entrepreneurs Charlie Mortimer and Ben Stanway. The app was later launched in August 2016 and it is one of the fastest growing FinTech apps in the UK.

Check out some more of the best investment apps for the UK here!

The company claims to have over 150,000 users since its launch. For as little as £1, the platform’s tracker funds will enable you invest in companies like Netflix, Amazon and so on. Also, the whole investment process does not require your constant input. Everything happens automatically. All you need to do is set up your account and spend. The platform will take money out of your account or credit card and invest it automatically, and hopefully, you will get a better return than a savings account.

However, the round-ups alone may not change your world, and may even be outstripped by the fees charged by the app in monthly and annual fees, that’s why the platform allows you to deposit lump sums monthly or weekly yourself. According to Ben Stanway, the co-founder of the app, their preliminary tests in 2016 showed that users were making an average of 30 purchases a week, with an average round-up amount of 28p, which adds up to £8.40 per week just from spare change.

Moneybox Pros- The app is simple and easy to use, making it simple for individuals with no investing experience

- The platform makes it possible to set a preferred risk level

- The platform is regulated by the Financial Conduct Authority

- Easy getting started and investing processes

- The platform has a robot driven chat function to guide users and help with any difficulties that may arise.

- Easy to use for beginners who have never saved or found it difficult to do so. The roundups are automatic and you may even forget about the app

Moneybox Cons- The app is only available to UK residents

- The platform is expensive for investors with small account balances. The platform charges £1 per month (waived for the first 3 months), a 0.45% platform fees and fund provider fees. The fees may be higher than your monthly profits if you have a small balance

- Your capital is at risk and you may get less than you initially invested

How does Moneybox Work?

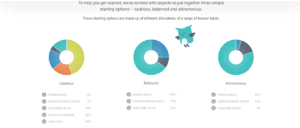

How Moneybox works after you download it to your Android or IOS device is pretty straightforward as it takes you through every step. The platform requires you to choose your risk appetite, between conservative for those aiming at a modest growth whilst minimizing risk, balanced for moderate risk and growth, adventurous for investors whose high priority is more growth, and hence the higher risk. The funds will be invested in tracker funds, just like in other robo-advisors, but your portfolio will not be rebalanced automatically.

The platform has a £1 minimum initial deposit after which you can add funds manually or choose automatic weekly or monthly deposits. However, the feature that stands out for the Moneybox app is the roundup function. This as the name suggests, it rounds up your daily transactions to the nearest pound and collecting the difference to be used in your investment account.

For instance, if you make a £5.50 purchase using your debit or credit card, the Moneybox round up function will show the transaction as $6 on your statement and it will put the 50p aside for investment. This may be a negligible amount but the same transaction being carried out every day for a year would amount to over £180. You can allow your purchases to be automatically rounded up every 48 hours or you can manually view all your purchases on the app and decide which one to round up or ignore.

The roundups build up in your account for a week before being transferred to your GIA, ISA or your child’s Junior ISA account for investment. The weekly roundups go between three tracking funds with the amount going into each decided by your risk appetite. If you are in the cautious approach, your funds will be invested in less risky options such as cash funds, if you are in the balanced option, your funds will be invested equally and in adventurous, most of your funds will be invested in property and global shares.

Your investments are traded the next day after your request to sell. This means the value may have increased or decreased in value by the time the process is completed. The platform allows you to withdraw all or some of your money at any time as long as the amount has fully settled. That is about two weeks after the funds are collected to your account for investment. If you are withdrawing some of your money, you must leave a minimum of £5 in your account. If it is not possible, you have to make a full withdrawal. The withdrawal process can take up to two weeks and you are only allowed to have one request at a time.

The app, however, does not provide any financial or investment advice to its users. Leaving how they invest their money entirely up to them. Users are also supposed to monitor their own investments and adjust or rebalance their accounts.

Getting Started with Moneybox

To open an account on Moneybox you must be at least 18 years old and be a UK tax resident. If you plan to open the Stocks and Shares ISA, you will be required to fill in your National Insurance Number; however, it is not required for opening a GIA.

The first step is to download the Moneybox app for IOS or Android as the platform’s services are only available on mobile apps. You can also enter your mobile phone number on the Moneybox website and they will send you a download link. Install the app, enter your active email address, set a password for your account, and proceed to provide your personal information as prompted by the platform’s cartoon trio.

The next step is deciding how you will be funding your account. The platform gives you three options, roundups, weekly deposits or one-off deposits. To be able to use the round-ups function, you will need to enter your online banking, credit or debit card details. Adding your online banking details is easy, but if you use a digital key, mobile generated password or a two-step verification method, you may have to reset the online banking set up, if you not possible, you can choose to use the manual round-ups collection method.

Next, the platform will require you to choose how you would like your money to be invested, in other words, how much risk you are willing to take to grow your investment. Moneybox gives you three options to start from. Cautious, the safest but slow growth, Balanced, for more risk but more growth and adventurous, the option that holds the maximum growth but also the highest risk. The platform provides you with graphs to help you choose.

The last step is choosing where your money will be invested; you have to choose between a general investment account and a stock and shares ISA. Most people go for the ISA as it allows you to invest tax-free, however, it has an annual contribution limit. If you choose the ISA, you will be required to enter your National Insurance Number as the last step in creating your account.

The platform only allows a single profile per user. Either way you choose to fund your account, your savings will be collected once a week via direct debit and invested.

Moneybox App Features

In addition to the stock and shares ISA and GIA accounts, the platform also offers Lifetime and Junior ISAs.

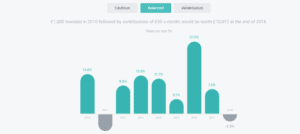

Lifetime ISA – This is a product designed by the government to help you save for your first home or save for your retirement. With this account, you can save up to £4,000 per year and you will get a 25% government bonus. This means, for every £4 you save, you will get £1 from the government for free, if you save the maximum £4000, you receive £1000. These bonuses can give you a real head start in your investments.

Any UK tax resident between the age of 18 and 39 can open a Lifetime ISA with Moneybox and can pay into it every year until you reach the age of 50. If you decide to withdraw funds from the LISA before the age of 60 for other reasons apart from buying your first home, you will pay a government charge of 25% therefore, you should only invest funds that you are sure you will not need in the near future. However, if you are terminally ill (less than 12 months to live), you can withdraw the funds free of the government charge.

The property must be your first, cost £450,000 or less and you must buy it at least 12 months after opening the LISA. Keep in mind that owning a property or a share of one through inheritance counts as owning a property.

Junior ISA – Moneybox offers a Junior Stocks and Shares ISA. Junior ISAs are efficient ways to save and invest for children below the age of 18 as they are free from any income and capital gains taxes. This account works almost the same way as the standard Stocks and Shares ISA. The only difference is you are saving for your child’s future.

You link a card to collect the roundups and they will be invested in more than six thousand companies via tracker funds just like in a standard account. You also get the three investment categories, Cautious, balanced and adventurous it is also subject to the same fees.

The money contributed in the account belongs to the child and is considered a gift, therefore it cannot be repaid or withdrawn if you change your mind. You can only cancel the junior ISA within 30 days, if there are any shortfalls, they will be deducted from the original contribution, if there is a profit, you will receive your original contribution.

The Junior ISA will automatically convert into an adult Stocks and Shares ISA when the child reaches 18. He will then take full control of the account.

Moneybox Pension – This new product allows you to transfer an existing pension account to the Moneybox pension account. This gives you two investment choices, the Fidelity World Index Fund or the Blackrock Lifepath fund. Currently, Moneybox pension is not offering drawdown services, bank account contributions and your employer cannot pay into the pension. It is only available as a service to accumulate and view your old pensions.

Socially Responsible Investing – Moneybox partners with Old Mutual to offer investors the Old Mutual World ESG Index Fund exclusively. The fund contains companies that pass MSCI ESG research and analytics. ESG stands for Environmental, Social and Governance. Each investment allocation, Cautious, balanced and adventurous include an option to make it socially responsible, older investors can choose to change all their existing investments to SRI or just the future investments by changing the settings allocation on the app.

Security – The platform uses a 256-bit TLS encryption on all information collected. If your phone is lost or stolen, you can contact the customer support team who will suspend your account to protect your investments.

The platform is authorized and regulated by the FCA and covered under the Financial Services Compensation Scheme, in the case it goes down, your investments may be covered up to £85,000 of financial loss.What are Moneybox App’s Fees?

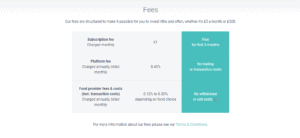

Moneybox charges two types of fees, the £1 per month that covers all transactions and investment costs. This is charged by selling down your largest holding at each end month, and the Platform fee, 0.45% of your investments per year. It is also charged monthly in the same manner. In addition to those two charges, the fund providers also charge 0.12% to 0.30% per year.

Moneybox App Review: Verdict

Moneybox is an easy way to get started if you are a new investor, it provides seamless saving and investing and it is very easy to set up. The roundup feature enables you to invest without having to save large sums of money and if you are a frequent spender, you might not even notice it. However, the platform’s fees make it an expensive choice and they may eat into your returns. Therefore, if you want to invest large sums, you may want to look for another platform with lower fees and probably higher returns.

Nevertheless, Moneybox is an interesting platform for new investors, if the advantages interest you, you should definitely give it a try.

FAQs

Is Moneybox regulated?

Yes, it is registered, authorized and regulated by the Financial Conduct Authority (FCA) and is therefore subject to the rules and controls set by the authority.

Are gains from Moneybox investments taxable?

Yes, any income from Moneybox investments is taxable, tax depends on your personal tax rate and bracket, consult your tax professional for more information.

is Moneybox available outside the UK?

Currently, the service is only available in the UK.

Does Moneybox give financial and Investment advice

No, the platform leaves it up to you to decide how you will invest your money, you are also required to monitor your own investments.

Can I close my account?

You can close your Moneybox account from within the app by going to the settings section of the app. But first, you must withdraw or transfer all the funds out. You cannot delete a Junior ISA from the app, for that, contact the customer support team.

What are the investment limits?

According to the Moneybox website, there is no limit for the GIA accounts but the maximum investment is £20,000 per week. For an ISA, there is a £20,000 limit for the 2018/19 tax year.

How are the fees deducted from my account?

The £1 and the 0.45% platform charges are taken from the value of your investments by selling down the largest holding you have monthly.

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up