Wealthfront Review 2020 – Best US Robo Advisor?

Online automated investing and financial planning platforms have been gaining popularity over the past couple of years amid digitalization and increasing use of smartphones for banking and financial activities.  These platforms offer services such as robo investing, saving and retirement planning. Actually, these platforms help users in making the best use of their hard-earned money; they help in setting and achieving long-term goals.

These platforms offer services such as robo investing, saving and retirement planning. Actually, these platforms help users in making the best use of their hard-earned money; they help in setting and achieving long-term goals.

Automated investment service is among their best features. With the help of robo advisors, these platforms are investing investor’s money in various asset classes to generate above-average returns with low risk. They claim to stand taller in front of economic uncertainties and market meltdowns – which is quite often in stock and forex markets.

All these aspects have dramatically increased people’s confidence in these platforms. Consequently, financial planning and automated investment platforms have been attracting billions of dollars every year. However, choosing the right platform is necessary when it comes to generating high returns and making the right plan for financial success

To help you with that – we review Wealthfront – which is one of the most popular robo advisor and financial planning platform. The platform also offers other features such as saving and cash accounts.

-

-

What is Wealthfront?

The platform is established by Chief Investment Officer Burton Malkiel who was a senior economist at Princeton University and author of “A Random Walk Down Wall Street. It is offering automated investments in 11 different asset classes according to the requirements of investors. The platform is known for offering the best tax harvesting services. Indeed, it offers daily tax-loss harvesting on all taxable accounts.

Established in 2011, Wealthfront is an online automated investing and financial planning platform for people who are familiar with running their daily lives through their smartphones.The company’s methodology includes giving investors a streamlined questionnaire to identify risk tolerance, then employing exchange-traded funds in up to 11 asset classes.

The platform has clearly highlighted its investment strategy on the website. Their fee structure is straightforward and transparent. Besides from robo advisory service, Wealthfront offers financial planning for buying a home, retirement planning and borrowing. The investors don’t need to create an account to use these financial advisory services. It permits investors to links bank and brokerage accounts with the Wealthfront to create a complete financial profile.

After reviewing all the information related to cash balance and other assets, the platform suggests you how much you need to achieve your goals. In addition, the platform also offers a saving account to the investor; the investor will get a decent interest rate by holding funds.

What are Pros and Cons of Wealthfront?

Wealthfront Pros:

✅Diversified portfolios

✅Strong investment strategy

✅Low ETF expense ratios

✅Daily tax-loss harvesting

✅Direct indexing on accounts over $100,000

✅Automatic rebalancing

Wealthfront Cons:

❌ No investment advice

❌ Limited investor education

❌ No fractional shares

❌ No large-balance discounts

How Wealthfront Works?

Wealthfront is very clear about the investment strategy and other services. Its software-only solution puts your money in different assets according to risk tolerance potential. The platform believes in passive investing. This means that the platform will build a globally diversified portfolio for you. They seek to achieve maximum retunes for investors by sticking to a few key principles. Below are the best features that make the investment through this platform attractive:

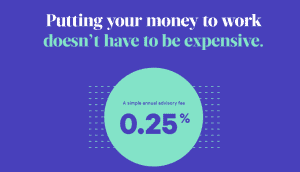

- Direct annual Fee: Instead of fees compounding that increase gradually, the platform charge a 0.25% annual advisory fee on what you invest.

- Lowering your taxes: Taxes always play a big role in maximizing or minimizing returns. The platform seeks to reduce taxes. Its software executes trades strategically to lower your tax obligation, so you can reinvest the savings.

- Managing your risk: The platform gauges your investment potential and risk potential to offer you a portfolio according to your financial condition.

Wealthfront allows investors to make investments that are tied to your goal. They allow you to invest for retirement, college or Invest for everything else. The platform uses Modern Portfolio Theory (MPT) by combining a mix of asset classes such as a low-cost ETF. Its investment strategy is based on five steps:

- Identify a diverse set of asset classes

- Select the most appropriate ETFs to represent each asset class

- Apply Modern Portfolio Theory to construct asset allocations that maximize the expected net-of-fee, after-tax real return for each level of portfolio risk

- Determine your risk tolerance to select the allocation that is most appropriate for you

- Monitor and periodically rebalance your portfolio taking advantage of dividend reinvestment.

What is the Account Creation and Investment Process?

Robo advisors and financial planners always require a lot of information for the account opening process. The information helps platforms in understanding the investment nature of the client. It takes up to a few minutes to complete the account creation process. The account creation process is composed of three stages. The platform suggests investors reach the support center if they feel difficulties in account opening. The minimum investment requirement is $5000.

Clicking on the “invest now” or “open an account,” is the first step of account opening process. You can easily find these tabs by visiting the homepage of its website. Once you click on these tabs, the platform will show a questioner – where the platform will ask you to answer a series of questions. These answers help Wealthfront in building a portfolio for you. In the case you don’t have a suitable answer for questions, you can leave them; the platform allows you to change it later if needed. Once you are done with the questioner, the platform will present you with a recommended portfolio and risk score on “investment plan” page.

The investment plan page will show the recommendations that the platform seeks to buy for you after reviewing your profile.

Please take your time and explore this investment plan page.The investor is required to closely review all the suggestions related to the recommended portfolio. You are also required to review the risk score that the platform has provided to you. If you are comfortable with the investment suggestions, the platform will then ask you to click on “open an account.” The platform will then ask you about the funding options. Once you selected the funding option, the platform would then ask you to choose the account type that is most suitable to you. During the application process, the platform will ask you to enter the following basic information:

- Name and date of birth

- Address

- Mobile number

- Employment information

- SSN

- Financial goals

- Employment information

- Risk tolerance.

Once you have created the account, you are eligible to add more information if something is missing in Wealthfront questioner. Although you are required to choose the type of account you want during the application process, you can also add new accounts for different financial goals. The platform allows you to use the dashboard to track your financial activities and monitor your returns.

What Types of Accounts Wealthfront Offers?

The platform offers various types of accounts to investors in order to generate returns according to the investor’s goals. They offer following types to accounts to investors:

Retirement Account

The platform permits investors to select from various types of retirement accounts. These accounts include:

- Traditional and Roth IRA: Investors with higher income are likely to benefit from Traditional IRA – which works like a tax-deferred account. On the flip side, if you expect to be in a higher tax bracket later in life, paying taxes on your contributions now might be the better choice.

- SEP IRA: This is quite similar to traditional IRAs. This type of account is best for small business owners and self-employed individuals. The benefit of using a SEP IRA is the higher contribution limit.

- 401(k) Rollover: This account allows investors to combine multiple 401(k) accounts with different providers. Combining these accounts would not only reduce the fee, but it will also allow you to easily track your progress against your savings goals.

- Investment Account: The platform allows investors to create a simple investment account which will help in generating better returns and low taxes.

General long-term investing (regular taxable brokerage accounts)

The platform has created several types of general investing accounts. These accounts are created to generate returns from investment in 11 asset classes. These are regular account; the platform uses its specified strategy and your preferences for investing in different assets. Following are the types of general long-term investing accounts:

- Individual and joint non-retirement accounts: Wealthfront permit investors to create individual or joint account according to your requirement.

- Trusts: An account in which a trust company (acting as an authorized custodian) holds funds.

High-interest Cash Accounts

The platform has recently created a cash account. The platform is offering APY on this account in the range of 2.29% to 2.51%. This account works like a saving account in a bank. This account is insured by FDIC up to $1 million. The minimum opening deposit requirement is $1. They offer the following types of high-interest cash accounts:

- Individual

- Joint (specifically, joint tenants with rights of survivorship, or JTWROS)

- Trust.

What are the Best Features of Wealthfront?

Besides automated investing, Wealthfront offers several other enticing features. These features include financial planning, tax harvesting, college savings, line of credit and interest rates. Below is a brief explanation about these features:

Financial planning

Wealthfront offers a free Path tool that helps users in finding ways and suggestions to achieve their financial goals such as buying a house, college, retirement, and general savings goals. The platform doesn’t require the investor to create an account to use this tool. The path tool is available both on phone and desktop.

For instance, if you want to use its retirement planning feature, this tool requires you to add a bank account and other spending details. Besides that, the platform uses government data to analyze the spending and saving patterns. They also use other data such as the value of currency, inflation, purchasing power, and other factors to make recommendations for retirement-plan.

Its home-planning tool helps in setting goals for home planning after closely reviewing the financial situation of the user. They will provide you home prices with mortgage rates. Its tool tells you how much you need to save over time to reach your goal.

Wealthfront also offers travel planning. The travel-planning tool helps investors figure out how much time they can afford to take off and how much they can spend on travel.

Line of credit

Wealthfront permit customers to borrow money from this platform. However, they have some restrictions on borrowing. You must have $100,000 in your account or asset portfolio. They allow you to borrow up to 30% of that value. The platform has set annual interest rates between 4.7% and 5.95%.

College savings

Wealthfront’s Path tool permits students and parents to make planning for college savings. They help in estimating college costs and developing a monthly savings plan. They allow parents to link their 529 college-savings accounts to Wealthfront.

Tax Harvesting

Tax-Loss Harvesting is one of the most popular features of this platform. It is an integral part of its Passive investment strategy. The platform takes benefit of movements in the markets to capture investment losses. This results in a lower tax. This feature is automatically enabled for all taxable investment accounts.

What is the Fee Structure of Wealthfront?

Wealthfront does not charge any fee related to account opening and depositing funds into Wealthfront account. The withdrawal is also free. The platform also does not pass in trading and other commissions. The annual advisory fee is 0.25% on all assets under management. The platform deducts this fee on a monthly basis. For instance, if you have a balance of $100K, the monthly fee would stand around $20.55.

The only other fee you incur is the expense ratio embedded in the ETFs and mutual funds you will own.What Countries are Accepted on Wealthfront?

Wealthfront only accepts clients from the United States. They do not permit investors from Europe and other parts of the world to use this platform. This is due to regulatory restrictions. The clients must have a U.S. social security number, a permanent U.S. residential address, and currently, reside in the U.S due to financial regulations. However, they accept clients from all U.S. states. Below is the list of few states that are accepted on this platform:

[one_fourth]- Alabama

- Alaska

- Arizona

- California

- Colorado

- Delaware

- Hawaii

- Idaho

- Utah

- Virginia

- Wisconsin

- Wyoming

- Illinois

- Kansas

- Louisiana

- Mississippi

- Missouri

- Nevada

- North Dakota

- Ohio

- Oklahoma

- Rhode Island

- Tennessee

- Texas

Is Wealthfront Customer Support Good?

Customer support is one of the main features that every platform seeks to improve. This is because clients always like to speak with the management before investing their money. In the case of Wealthfront, they only allow clients to contact the support team through email. They often respond to phone calls. The live chat feature is also missing. Investors can get a lot of information from the FAQ segment.

Wealthfront Review 2019: Verdict

Wealthfront appears like a good platform for investors who have big capital. The minimum investment requirement for its basic account is $5000. This robo advisor offer premium services. The investment strategy appears safe. This is due to their focus on modern portfolio theory and passive investing. They closely evaluate your investment criteria with the help of questioner. The portfolio diversification along with tax harvesting is enhancing investor’s returns. Its financial planning feature also appears strong. The platform helps in enhancing user’s goals such as mortgages and buying home.

FAQ:

Who may open an account on Wealthfront?

Anyone who is 18 years old is eligible to create an account on this platform. In addition, the user should be a U.S. resident with a U.S. social security number and a permanent U.S. residential address.

Can investors open multiple accounts?

Yes, the platform allows the investor to open multiple accounts. The investor can open an account using a nickname.

Where Wealthfront hold investors money?

They hold investor’s assets in a brokerage account at Wealthfront Brokerage Corporation. It uses IRA Services Trust Company (IRASTC) as a custodian for all IRA accounts.

Do they support Custodial/UGMA accounts?

They do not allow users to make Custodial/UGMA accounts. However, the platform claims to offer this service in the future.

How does the investor fund his account?

The platform offers multi-methods for depositing funds. These methods include Deposit Cash (ACH bank transfers), Transfer / Rollover, Check (529 accounts only) and direct transfer.

Are there exit fees?

No, the platform does not charge any exit fee. You can close your account anytime you want.

Siraj Sarwar

Based in Saudi Arabia, Siraj has a strong understanding of and passion for accounting and finance. He has worked for international clients for many years on several projects related to the stock market, equity research and other business, accounting and finance related projects. Siraj is a published financial analyst on the world's leading websites including SeekingAlpha, TheStreet, MSN, and others.View all posts by Siraj SarwarWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up