Plum App Review 2021 – How Good is it?

Today, there are plenty of new automatic saving apps coming from the  FinTech scene. Most, if not all, are intelligent and can understand your spending habits just by linking them to your bank accounts and credit cards. The apps then suggest how you can minimize your spending and save more, better yet, some can put a certain amount aside and save it for you. But why would anyone need automatic saving?

FinTech scene. Most, if not all, are intelligent and can understand your spending habits just by linking them to your bank accounts and credit cards. The apps then suggest how you can minimize your spending and save more, better yet, some can put a certain amount aside and save it for you. But why would anyone need automatic saving?

In this Plum Savings review, we examine the Facebook chatbot designed to help you spend less and save money.

-

-

What is Plum Savings?

Plum is a smart savings software that was founded in 2016 by Victor Trokoudes and Alex Michael. Co-founder and CEO, Victor, says that the idea stemmed from a personal challenge between him and the Alex to see who would save faster and smarter. Victor saved what was left over in his current account while Alex wrote a program that would analyze his transactions and calculate how much he needed until the end of the month. He ended up saving more than Victor. The two then set out to help other people save smart by putting aside small amounts rather than committing to a specific amount.

More robo-advisors are coming up with creative ways to help you take control of your spending and save more. While automation is the main feature in most, some are making it easy to interact with you and understand your saving and spending patterns better. Here is our list of best robo-advisors here

The service is specifically for those that struggle to put away money every month for their savings. A report published by The Independent claims that one in four adults in the UK has no savings, which is scary if you think about it. That is 25%! The solution Plum offers is by helping people take control of their finances and save without having to notice or to change their lifestyle. According to the CEO, they have an overarching mission to help people be better off.

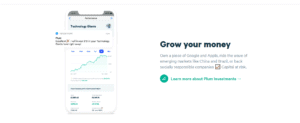

Plum launched its investment tool in 2018 that enables users to invest in tech companies like Amazon or they can choose to invest in socially responsible companies.

Plum Pros- The platform is free to register and use making it suitable for beginners

- You can save money easily and automatically, you may not even notice it

- You can withdraw your money at any time by using a simple command to the Facebook bot and your money will be deposited to your bank account within 24 hours

- You can invest and earn returns through the Plum’s investment deal with the peer-to-peer lender Ratesetter. However, you must aware of the risks associated with p2p lending

- Savings algorithm prevents savings from taking you into overdraft

Plum Cons- Plum does not offer an interest rate on the money you save unless you choose to invest it

- The platform’s customer support team can only be contacted during working hours

- The money takes up to 24 hours to be deposited to your bank account

- The service relies on other services usability, such as Facebook Messenger, MangoPay

- Your capital is at risk whether you are investing in funds or investing in peer to peer loans through Ratesetter.

How Plum Works

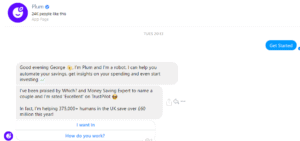

How the platform works depends on the platform you are using. If you are an Apple user, you can download the Plum iOS app from the App Store and start managing your finances. Android and other users have to access the service through Facebook Messenger, as it does not have a standalone app available yet. This may put off some people, especially after the much-publicized Facebook data privacy problems. Plum claims that even Facebook will not have access to your account details. Plum does not store your login details, instead, they are passed directly to Yodlee, its data partner.

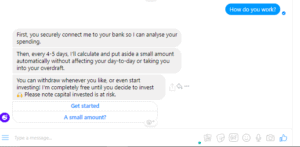

Plum works by connecting to your bank and fetching your transactions for the last 90 to 365 days and analyzing them. This includes your regular income, rent, daily spend and available balance to suggest an affordable amount that you can save. Every 4 to 5 days, the service will calculate and put aside automatically an amount that won’t affect your day to day or take you into overdraft. The amount is unique to you as it is calculated according to your income and spending patterns, however, you can change the amount to save more or less by adjusting the saver mood.

The money is moved out of your account by direct debit via Plum’s partners GoCardless. Plum aims to save between five to seven times a month so it can adjust to your spending every month. If you have less income this month, Plum will reduce the savings drastically and might even not save. But what if you move a huge amount to your account? Maybe for a purchase? Will Plum assume it is for saving? Well, their algorithm is intelligent and can adapt and behave differently in each scenario. In this case, it will not assume the money is for saving unless it stays there for an extended period of time.

Here are a few scenarios on how Plum behaves

- Less balance towards the end of the month – Plum will reduce your savings to the point of not saving at all

- Your payment is delayed or late – It will reduce the amount it saves until you get paid

- You moved a huge amount to your account for an expensive purchase – Plum will not assume that the money can be saved from, unless it lays there for an extended period

- You want to spend more, for example when you are on a holiday – it will adjust to your spending as soon as you start spending – you can also withdraw some of your savings to spend

Saving is completely free until you decide to invest.

Getting started with Plum

There are four ways to sign up to Plum, three through messenger and using the iOS app. You can go the Plum’s Facebook page and click the signup button, you can sign up on the platforms web page or you can find Plum directly on Facebook Messenger by searching @withplum and click ‘getting started’.

The signup process has two steps. The first one requires you to fill in your personal details including name, age, and address. The next step is connecting your bank account. The platform will collect your details and forward them to Yodlee for linking.

Investing with Plum

Your savings with Plum do not earn interest, if you want to grow, you can start investing by just typing ‘invest’ into Plum and it will explain how investing works and provide you with seven options with different risk levels and returns. You can choose to invest in one or all options starting with as little as £1.

Plum gives you opportunities to invest in funds. They are dived into two according to the risk levels and returns, basic funds and advanced funds.

Plum basic funds

These provide a starting point for investors and give you the stability of bonds and potential gains of stocks. They are well diversified to minimize your risk and make your earnings stable despite, market movements. They are managed by Vanguard. The basic funds comprise of:

- Conservative Fund – this has a risk level of 3/7. They are composed of 80% bonds and 20% shares. The underlying fund is the ‘Vanguard LifeStrategy 20% Equity Fund’ provided by Vanguard. The average annual return is 4.9%.

- Balanced Fund – this has a risk level of 4/7. It is composed of 60% shares and 40% bonds. Its average annual return is 8.7%.

- Growth Fund - it carries a risk of 4/7. The growth fund invests in a portfolio of assets with approximately 80% shares and 20% bonds. The growth fund offers an average annual return of 10.5%.

Plum Advanced Funds

Unlike the basic funds, the advanced funds are made up almost exclusively of stocks. This means they hold more risk as the market is more volatile than in bonds. However, it gives you an opportunity to invest in themes that matter to you. The advanced fund is made up of the following:

- Tech Fund – this holds a 6/7 risk and is made up of stocks almost exclusively. It invests in global tech companies such as Apple, Oracle, Facebook, Alphabet, and Microsoft. The fund is managed by Legal and General Invest Management who charge a 0.32% fee to manage the fund. the average annual return is 23%.

- Ethical Fund – the ethical fund holds a 5/7 risk level. It consists of UK companies selected for making a positive contribution to society. It invests in companies such as Bellway and Fever Tree. The fund is managed by Standard Life Investments and is charged 0.90% fees. It has an average 11.7% return per year.

- Emerging Markets Fund – it carries a 6/7 risk level. It invests in stocks from a broad range of markets including India, China, or Taiwan. It was founded in 2017 and is managed by Vanguard at a cost of 0.80% fee. It has an average annual return of 5%.

Peer to peer investment

Plum lets you invest in peer-to-peer lending through one of the biggest p2p lender in the UK, Ratesetter. Keep in mind that peer to peer lending depends on the borrowers to pay back their loans and by investing you are putting your capital at risk. However, Ratesetter has a provision fund that reimburses the investors if the loans go into default, but repayment is not guaranteed as the fund can be depleted and the Financial Services Compensation Scheme does not cover the investments.

You will have your own RateSetter account, but all your interactions will go through Plum.

Plum Features

Free automatic saving – probably the feature that stands out the most. Plum analyses your transactions, incomings and outgoings, identifies your spending patterns, income and bills, and uses that information to calculate what amount you can save daily without hurting your lifestyle. The platform also puts aside the amount into your Plum savings account every 4-5 days via direct deposit.

Investing - Plum allows you to invest your savings into different options including Basic Funds, Advanced Funds and Peer to peer lending via RateSetter.

Security – the platform does not store or access your bank login details and it is only allowed read-only access to your transactional data. The platform also uses symmetric cryptography to store sensitive data and uses 256-bit encryption to communicate between the browser and the servers. Plum’s servers run on Amazon’s cloud.

Save on bills - Plum analyses your bills and notices if you are being overcharged on bills or financial products including mortgages and overdrafts. It also finds a cheaper alternative and helps you switch in a few clicks.

Spending insights – Plum lets you set daily or weekly balance updates to help you keep an eye on where your money goes without having to wade through bank statements.

Human customer support – you can reach Plum’s human support team by simply typing ‘chat to human’ in the Plum messenger if you need help with your account. However, this is only possible during office hours, 9-5 weekdays and 10-3 on Saturdays.

How much does Plum cost?

If you only want to connect Plum to your bank account, get daily spending insights and save automatically, then Plum is free. There are no registration fees and you get unlimited deposits and withdrawals.

If you want to go beyond your automatic savings and grow your money, there will be fees associated with investing. Plum charges £1 per month for access to investments. The first month is free and it includes as many funds as you would like to add. The £1 fee is charged only if you have a positive balance in investments. You will also be charged 0.15% of the value of the fund as Fund Management Fees by the funds’ administrator, Gaudi Regulated Services LTD. This is charged monthly. The fund providers also charge between 0.22% and 0.9%.

Plum Review: Verdict

Plum is an excellent option for those who struggle to save. The platform is also very easy to use and suitable for beginners. It enables you to save automatically, for free and adapts to your account balance such that you might not even notice it. If you are looking to invest, you can definitely get better value investments elsewhere but it is still a good starting point for inexperienced investors. You may have to add more money into your investments each month or the fees will eat into your returns.

Plum is worth signing up for, especially for saving even if you are not investing.

FAQs

Is Plum available outside of the UK?

No, you require a UK postcode and bank account to register

Can I use Plum without a Facebook account?

Yes, You sign up using Facebook Messenger or by downloading the iOS app from the App Store

Can Plum guarantee that you will not be taken into overdraft?

Yes, the algorithm used by the platform has safeguards designed to avoid getting you into overdraft. If you entered into your overdraft and you think its Plum’s fault, contact them and they will cover your overdraft fees.

Are their tax implications for investing?

The Stocks and shares ISA funds and cash are exempt from UK income tax and capital gains tax. For investments via GIA and Ratesetter, you have to pay all the relevant taxes on the returns earned.

How is Plum Regulated?

Plum is not independently registered with the FCA. It, therefore, connects different financial products from regulated partners and payment institutions. It is also registered with the FCA as an appointed representative of two of its partners.

Where are my funds held?

When it sets aside money from your account. It is moved to a protected bank account provided by MangoPay which is an ‘Authorized Electronic Money Provider’. The account is not protected by the FSCS but it is subject to European regulation.

Do I get my own bank account and sort code?

No, but you can view, top up or withdraw by chatting to Plum on messenger.

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up