M1Finance Review 2020 – Is It Any Good?

The development and increased popularity of online investing platforms and robo-advisors has enabled many people, who were previously locked out by exorbitant costs of traditional brokerages, to access the market.

Today, you can find robo-advisors and investment platforms that charge 0 fees or commission.

In this M1 Finance review, we look at a hybrid robo-investing platform that gives you control over your investments. And yes, it is free. Read on to find if it works for you.

-

-

What is M1 Finance?

Founded in April 2015, M1 Finance is a hybrid between a traditional brokerage and a robo-advisor. It is based in Chicago. The company was founded by the current CEO, Brian Barnes who claims that frustration with the status quo and the belief that he could create a better finance company using a different approach motivated him to start a better platform. And maybe he did, M1Finance is probably the most versatile robo-advisor in our list of 7 Best Robo Advisors.

As a hybrid, M1 Finance allows for both robo-directed and self-managed investing unlike other services. This makes it perfect for investors who want to be hands-off but still have a say in their investment. With its short time in operation, the company has over 25,000 accounts and it holds over $100 million in client assets.

The platform stands out from other robo-advisors because it lets you create and customize your own portfolio, after which your account will be managed by the automated service. It provides automated account management including dividend reinvestment and automatic rebalancing. The company decided to go free and make money in the back end in December 2017. A strategy to draw more people to the platform according to the CEO.

M1 Finance Pros- No fees or commissions

- No initial minimum deposit – the platform allows you to open the account with no money and only start investing when funds reach $100. Retirement accounts require $500 at least.

- Possible to customize and diversify your portfolio

- Beginner friendly – the platform offers custom portfolios that make it easy for entry-level investors

- The platform offers fractional shares, this helps avoid cash drag

- Automatic rebalancing

- M1Borrow enables you to borrow up to 35% of your account balance at low interest

PeerStreet Cons- No tax loss harvesting – the platform does not offer tax loss harvesting, which is common in other robo-advisors. However, the platforms use strategies to minimize investors’ tax liability

- The platform is not for active traders

- The platform does not offer mutual funds, only stocks and ETFs

- The platform does not recognize your outside holdings; therefore, your portfolio is balanced based on your M1Finance investments only.

M1 Finance App - Best Investing App

Our Rating

- No Fees or Commissions

- No Initial Minimum Deposit

- Beginner Friendly

- Automatic Rebalancing

All investments carry risk - Capital at risk.How M1 Finance works

M1Finance gives you complete control over the investment process in your portfolio, unlike other robo-advisors. The platform uses ‘Pies’ as the basis of investing, the pies allow you to represent your holdings as slices, all you need to do is assign percentages, fund it and you have your stocks portfolio.

During the registration process, the platform offers you a preconfigured pie suggestion with selected investment categories. Each pie can hold as many as a hundred slices with each slice representing an investment such as an ETF, a stock or even another pie. With the custom investment, you have unlimited choices. The platform allows you to add any ETF or stock that trade on the NASDAQ or the New York Stock Exchange.

After setting your pie and funding the account, the platform automatically buys the investments in the set proportions, also when you add funds into your account. When you buy, it buys the most underweight asset and when you sell it automatically sells the most overweight asset.

This way, you can invest in five stocks (For example FAANG stocks, Facebook, Apple, Amazon, Netflix & Google) and allocate each a percentage of the funds you want to spend on each, let’s say 20% each, or you can change the allocation to be 35% in two stocks and 10% in the other three.

You can also create pies on market sector basis and you can create an unlimited number of pies in your M1 Finance, which may lead to over-diversification.The process of investing with M1Finance Pies

- Create your pie – you can choose from one of the platform’s pre-configured expert pies, create your own by choosing investments or customize an expert pie by adding or deleting slices.

- Add funds – M1Finance will automatically buy shares when you add money into your account. The investments are bought according to the percentages you set in the pie, for example, if you set the Amazon slice at 10% and you fund your account with $1000, $100 will be used to buy Amazon shares.

- Delete or add slices – you can modify your pie at any time you wish. To sell, just remove the slice you want to sell and add a new one if you want to buy. M1Finance also rebalances your pie if it shifts from the original allocations over time.

You can also set up automatic contributions and the platform will obtain funds from your linked bank account.

Getting started with M1 Finance

Like other platforms, you need to create an account before you can access the platform. The first step requires you to enter your email address and set a password for your account. The next step is creating a pie by choosing at least three investments that interest you. The pie is saved in case you might want to add it to your portfolio later.

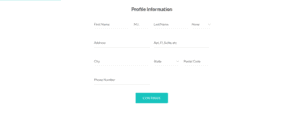

The next step requires you to add your personal information including name, address, city, state, postal code and phone number. You will be required to fill in your country of citizenship, date of birth, serial security number and employment status.

In the financial profile section, you will be required to fill in your income, net worth, liquid net worth, investing experience, risk tolerance and time horizon. You can then add your bank or choose to skip this step and add it later. You can now start building your portfolio. You will be later required to upload copies of a utility bill and driver’s license.

Types of accounts available on M1 Finance

- Individual brokerage accounts – these are taxable accounts for general investments

- Joint brokerage accounts – a shared account eg, with a spouse, or relative

- Retirement – M1Finance offers retirement planning accounts including SEP IRAs, Roth and traditional IRAs

- Trust – these are accounts set up on another individual’s or group’s behalf.

M1 Finance features

M1 Borrow

This is a feature on M1 Finance that enables you to borrow against the value of your portfolio for any purpose. The feature enables you to borrow up to 35% of your account balance at a 4.25% interest rate instantly without going through credit checks, additional paperwork and if you meet the qualifications, your request cannot be denied.

To qualify for M1Borrow, you must hold a taxable account with at least $10,000 balance. Individual retirement accounts do not qualify. Your portfolio must also be diversified. Account holders do not have to enroll for the service for when their account surpasses $10,000, they are instantly given an accessible line of credit, which they can choose to keep in the M1 account or transfer to the bank account. You are only charged for what you use.

There is also no set payment schedule. You can pay back the money whenever you see fit. However, the outstanding balance realizes interest every month. People using this service must be aware of the risks involved including:

- Interest rate rise - If Federal Funds interest rates rise your M1Borrow rate rises too.

- Maintenance calls – if your portfolio value falls below 30% of your account value. Your account will be frozen and you will have to either sell part of your portfolio or deposit additional money to make up for the maintenance call.

- Magnified losses – if the line of credit is used to increase your M1 portfolio investments, any losses in the portfolio will be magnified.

The platform a 0.25% discount for members of its M1 Plus membership. For example, the current interest rate is 4.25%, M1 Plus members are able to borrow at 4.00%

M1 Spend

This is an FDIC-insured checking account that is integrated into the M1 Finance app. It has two levels, the basic M1 Spend (free) and the premium M1 Plus. The basic M1 Spend is included in all accounts to enable borrowing, spending or investing.

It is an all in one money management tool. The M1 Spend comes with an account and routing number to enable users pay bills, receive paychecks or pay with debit card.

Users can also opt into the premium M1 Plus option that costs $125 per year. The M1 Spend feature will be available for use later this year.

Automation

The platform allows users to set up automatic investments and reinvestments once you fund your pies, the system takes over, invests, and rebalances your portfolio automatically to your desired preferences. The platform also uses tax-efficient investing strategies to help reduce the amount owed on taxes.

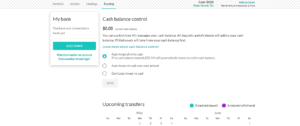

On the platform’s ‘Funding’ section, you can control how M1 Finance manages your cash balance (dividends and all deposits). You can choose to automatically invest your entire balance once it reaches $10 or set an amount or turn the auto-invest off.

Fractional shares

Some brokerages only allow whole share investing, this makes it hard to diversify small accounts. M1 Finance, however, offers fractional shares investing whereby you don’t have to deposit additional money to buy a whole share. The platform purchases stocks and bonds in the exact proportions that you initially set.

M1 Finance splits every share into 1/100,000th of a share which makes it possible for you to trade in the exact amounts based on your set targets. One advantage of this is, your money won’t sit idle in the account without being invested. You can invest as low as $0.01 in any security, however, the minimum exchange fee for selling a security is $0.02.

Portfolio rebalancing

Rebalancing your portfolio is a tedious and time-consuming process, in fact, this is the reason most people join robo-advisors. M1 Finance offers automatic balancing so that once you put click a button, it does the rest for you. This way, your portfolio will stay on course with your plan.

However, M1 will not initiate rebalancing without your instruction. You will have to initiate it if you want your investment to match your target portfolio. When you add funds or make new trades, the platform’s algorithm will identify the most underweight slices and put funds into those first. When selling, the platform will remove money from the overweight slices first, this way; your portfolio will stay on course.

Tax minimization

The platform does not offer the widely used tax loss harvesting (LTH), instead, they offer a feature called ‘tax minimization’ that enables you to trade in the most tax-favorable way. When selling an investment, the priority will be in the order:

- Losses that offset future gains

- Lots that result in long term gains

- Lots that result in short term gains

While the strategy will minimize your taxes, it is unlikely it will have the same consistent benefits offered by tax loss harvesting.

Is M1 Finance right for you?

Many people may benefit from using this platform for their investments. The platform is great for those who may just be getting started and experienced investors who want to experience automated investing but still want more control over their portfolios. The platform is great for long-term investors, semi-experienced and DIY investors. However, it is not for frequent or day traders as it only trades once a day.

M1 Finance Review: Verdict

M1 Finance is one of the most interesting automated investment platforms with a nice value proposition. The fact that it is free and allows fractional share trading makes it suitable for beginners and investors with small accounts.

You choose your own investments but you leave the tedious tasks such as rebalancing and manual trades to the platform. Experienced traders may find this feature useful, especially those looking to for a hands-free experience. The platform offers more than just passive investing. Other platforms may have to adopt the concept in the future. Give it a try.

M1 Finance App - Best Investing App

Our Rating

- No Fees or Commissions

- No Initial Minimum Deposit

- Beginner Friendly

- Automatic Rebalancing

All investments carry risk - Capital at risk.FAQs

Does M1 Finance automatically rebalance portfolios?

Yes, but you have to initiate the rebalancing of the portfolio. But when new funds are added, the platforms algorithm will put them into the most underweight slices first.

What is the minimum deposit?

M1 Finance requires a minimum account balance of $100 to start investing. However, deposits can be made in any amounts until that amount is reached. IRAs require at least $500 initial investment.

Is M1 Finance regulated?

Yes, M1 is a registered broker/dealer with FINRA and is a member of SIPC.

What are the fees charged by M1 Finance?

The platform is free to use. It does not charge any fees, commissions or mark-ups on trades

When does M1 Finance trade?

To keep the platform’s management spending low, the platforms only trades once a day. The trading window begins at 9 AM CT every day that the NYSE is open and runs until all orders are complete. All changes made before 9 AM CT are executed the same day during that window.

what happens when a stock you own is delisted?

The platform only supports actively traded securities due to the nature of the trading algorithm. you will be contacted to remove it from your portfolio.

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up