Blooom Review 2020 – Is it a Good for Your 401k?

For most employees, contributing to their workplace retirement plan is the main  way that they invest for the future, and for most of them, it is the largest asset they have. However, managing a retirement plan can be a complicated task for most people, meaning most are mismanaged or completely neglected while others are overrun by hidden charges. If you are one of the people who don’t understand how to invest in or manage a 401k plan, it may be time for you to get a low-cost robo-advisor.

way that they invest for the future, and for most of them, it is the largest asset they have. However, managing a retirement plan can be a complicated task for most people, meaning most are mismanaged or completely neglected while others are overrun by hidden charges. If you are one of the people who don’t understand how to invest in or manage a 401k plan, it may be time for you to get a low-cost robo-advisor.

In this Blooom review, we look at a robo-advisor that deals specifically with employer-sponsored retirement plans.

-

-

What is Blooom?

Blooom is a robo-advisor or robo investing service that helps you manage your employer plan without changing where it is held. The company was founded by three friends, Chris Costello, Kevin Conard and Randy Aufderheide in 2013. It is headquartered in Leawood, Kansas. The company deals with employer-sponsored retirement plans including 401(k), TSP, 403(b), 401(a) and 457.

Blooom is a robo-advisor to help you manage your employer-sponsored retirement plan. Most plan administrators only make changes that you request for in your plans, therefore, if you are not monitoring it yourself, no one is.Have a look at our list of best robo-advisors here

The company is a registered investment advisory, which means it is legally required to act in your best interests. Therefore, unlike other investment brokers, the company will make unbiased investment recommendations. The platform’s only source of revenue is the $10 per month fee. They do not earn from their investment recommendations.

Blooom claims to be managing more than $3 billion in assets and still growing, and that it has saved $978 million in projected hidden fees by their clients by retirement. Their clients are people between 18 years and 81 years with account balances from $500 to the largest being above $2.9 million. Blooom claims that they have been able to reduce hidden fees for over 79% 401ks that they manage.

Blooom Pros- Low cost for big portfolios – the platform charges a flat fee of $10 per month for all accounts. This is great for people with large account balances.

- Blooom is a fiduciary and therefore legally required to act in your best interests

- You can cancel the service at any time. The platform has no long term management contracts

- Access to a human advisor through the platform’s online chat and email

- Automatic account rebalancing

- There are no account minimums

- Free portfolio analysis

- The platform works with all employer-sponsored 401k plans

Blooom Cons- The $10 per month may be too expensive for small portfolios

- The service is limited to employer-sponsored retirement plans only, no IRAs or taxable accounts

- The company does not customer service phone support, communication is only through email and online chat

- The algorithm does not consider outside investments that you may have.

How does Blooom Work?

Blooom works with any employer-sponsored retirement plan as long as you have online access. Also, the plan remains at your company and therefore there is no need to transfer the account to Blooom, the employer won’t even know you signed up. Most companies just let you know that there is a plan, they will match your contributions, and they hand you the credentials. Often without giving you any advice on how you will manage your investments. That’s where Blooom comes in.

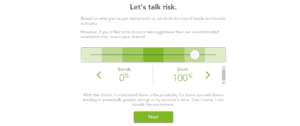

With the information you provide when signing up, such as age, investment horizon and retirement age, Blooom recommends allocations for your portfolio. Mostly aggressive if you are younger and it grows more conservative as your age increases. This way, you will be taking on more risk in your early days when you have more years to earn and lead towards stable income as you approach retirement. It is not unusual to get a 100% stock recommendation if you are young. However, you can change your portfolio if you do not like their recommendation.

According to the statistics Blooom provides on their website, 38% of their clients were too conservative before they started using the service, meaning they were not able to realize the full potential of their investment unless their accounts were optimized. 13% were too aggressive with their portfolios, this means their accounts would be too unstable when they approach retirement. Which could mean lost funds.

Whenever possible, Blooom will try to get you into low cost investments that will help you reach your goals. Once Blooom allocates the funds on your behalf, it will rebalance your account every 90 days to ensure your investment stays on course with your targets. Although you can adjust your stock to bond ratio at any time.

Getting Started with Blooom

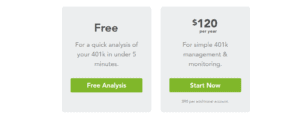

Blooom offers a free personalized analysis of your account in just a few minutes. To create an account, the platform will require your name, date of birth and the expected retirement age.

The next step is to enter your login details, an active email address and setting a password. You will be asked if you have an employer-sponsored retirement account, if you are not sure, you will be asked to try and link your account, if you select no, you will be directed to the platform’s IRA advice page, where you can get personalized reports for $49.

The platform will ask you a few questions to determine your risk tolerance, questions will range from what you would do if your account balance fell 20% to your ideal vacation, extreme sports or just chilling in a beach chair? Great way to determine risk appetite I guess! Your bond to stocks ratio determined by your answers will be displayed on a slider that you can adjust to your liking.

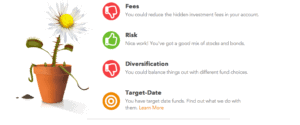

The next step is linking your retirement account to Blooom. Search for your retirement plan provider, enter the credentials and Blooom will securely connect to your account for the first free account analysis. The platform will review your existing portfolio and suggest areas where you can improve on, either bonds to stocks ratio, diversification or hidden fees.

Blooom will then recommend a diversified portfolio using the investments available in your retirement plan. Blooom seems to favor stocks for those with more than 20 years before their expected retirement date. This is because they are more likely to provide superior returns over time, however, you can change to include bonds depending on your risk appetite.

You will then decide to hire Blooom to manage your accounts or not.

The free analysis of your account takes about five minutes. It will see what investments you are invested in, uncover hidden fees and recommend a portfolio that is likely to achieve your goals. If you decide to pay for Blooom’s services, you enjoy all the free services in addition to rebalancing of your portfolio, suspicious activity alerts, expert advice from Blooom advisors and minimization of funds.

Blooom Features

Account rebalancing – when you sign up for the service, that will be your first account rebalance, your portfolio will be rearranged completely to march your target portfolio or one that is likely to help you achieve your goals. From there, rebalancing will occur after 90 days or when investment options are changed. Readjustments will be made to help you stay on track for retirement.

Suspicious activity alerts – Blooom monitors your account to keep ‘sneaky’ people out. If there are any withdrawals or loans, the platform will alert you via text message. However, you must enable this feature in your account.

Investment selection – Blooom helps you pick the best investments available in your 401k plan that are in line with your goals, age and risk appetite. Users closer to retirement will have more bonds recommended in their portfolio while younger employees will have more stocks. You just need to set your preferences and Blooom will diversify and manage your portfolio for you.

Reducing hidden fees – according to the statistics Blooom has provided on its website, it saves its users a median amount of $106 in year one. It does this by analyzing all your available investment options and uncovering all hidden management fees you have been paying. It reduces your fees by:- Removing managed accounts – Blooom will shift you away from arrangements where the retirement plan works with investment brokers that manage your accounts for a fee. You will be shifted to a more cost-effective option

- Uncovering hidden investment management fees – these are fees that may be buried in certain investment funds and charged in such a way that you may not notice them.

- Steering you clear of Target Date Funds – these often carry a high fee charged annually, however, they are still increasing in popularity despite that.

Ask a financial advisor – Blooom offers their users the opportunity to ask their financial advisors questions regarding their financial matters, not just about their retirement plans. The advantage is that this does not come with an additional fee, just the $10 per month. Advisors are available through an online chat or via email.

Security – in addition to monitoring your account for suspicious activity, Blooom also provides 256-bit encryption technology to ensure your data remains private. They also use third-party verification to ensure that you are the one requesting the change.Blooom Investment Process

These are the main steps that Blooom takes to invest:

- Blooom’s algorithm makes a personalized investment recommendation based on your risk tolerance, age, retirement date and goals

- The platform’s algorithm goes through the available investments in your retirement account and classifies them in one of the 14-asset classes.it then decides which of these are a perfect fit for your portfolio.

- The algorithm then picks the best investment options in each specific class. Blooom will tend to favor low-cost index funds but if they are not available in your plan, it will settle on actively managed funds according to past performance, expenses and management experience

- A Blooom advisor double checks the results according to your profile and approves the recommended portfolio which is then implemented on your behalf.

Blooom uses an algorithm to handle most of the heavy lifting in establishment and portfolio maintenance. The portfolio may be subjected to review by licensed advisors just to ensure everything is working as planned. By using the platform’s services you are giving them the authority to manage your account on your behalf, however, they are only allowed to manage your investments and they cannot take money out of your retirement account. You can also bypass Blooom by going directly through your plan administrator.

What are Blooom’s Fees?

Blooom charges a flat fee of $10 per month for any account size. Depending on your account balance, this may be either expensive or extremely reasonable. The more the account balance, the better the deal it will be for you. It may not be that bad of a deal because you will have access to human advisors who you can consult on other financial matters.

Another distinctive feature is that the platform does not withdraw money from your account to pay the monthly fee, instead, they charge your credit card for the service. Users can cancel at any moment without penalties.

Blooom Review: Verdict

Blooom stands out in the now crowded field of robo-advisors by focusing on the employer-sponsored retirement plans only, and by that, they provide essential services that are mostly overlooked by other platforms. It is an excellent solution for those with no idea what is happening with their retirement plans or don’t know how it works.

Even if you do not use their services, the free analysis may be worth it. Blooom will optimize your plan for you for a flat $10 per month with no hidden fees or additional charges. It may be worth trying out, after all, there are no other robo-advisors in this specific field.

FAQs

Is Blooom a robo-advisor or just an investment advisory that makes recommendations that you should invest in?

It is a robo-advisor. The platform will handle all investment management for you. Your work will be funding your account and paying the monthly fee.

Does Blooom manage IRAs?

No, the platform only deals with employer-sponsored retirement plans.

Do I have to move my account to Blooom?

No, You don’t have to transfer your account or create a new one as long as you have online access.

Does Blooom initiate withdrawals from my account?

No, Blooom only manages the account for you and cannot initiate a loan or withdrawal from your account.

Can I approve changes before they are implemented?

No, Blooom does not run each change by you. By using their services, you have signed offon the allocation and Blooom can place trades on your behalf. As a fiduciary, it is legally required to act in your best interests.

What are the hidden fees associated with Blooom?

The platform charges a flat fee of $10 per month. However, your investments may have internal expenses, the platform seeks the most cost-effective funds.

Are there human advisors managing my 401k?

The platform uses algorithms for most of the heavy lifting. However, there are advisors and account coordinators who audit and perform quality assurance to ensure every task is completed accurately.

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up