Betterment Review 2022 – Leading Robo Advisor

Robo advisors are attracting billions of dollars of investment every year amid higher than average returns and lower fees.  They have been giving investment opportunity to investors who don’t have skills and time to evaluate investment opportunities in stock markets. These platforms also offer tax efficient investment approach that results in higher returns. The investors are only required to fill up the questioner which helps robo advisors in understanding investment criteria and risk tolerance.

They have been giving investment opportunity to investors who don’t have skills and time to evaluate investment opportunities in stock markets. These platforms also offer tax efficient investment approach that results in higher returns. The investors are only required to fill up the questioner which helps robo advisors in understanding investment criteria and risk tolerance.

These platforms mostly use algorithm techniques and modern portfolio theory to create an asset portfolio that suits your requirement. However, the rate of success entirely depends on what robo advisor you are using. This is because each platform has a different investment strategy and potential returns along with other retirement and tax features.

To help you with that – we review Betterment – which is the most popular platform for investors who like hassle-free investing.

-

-

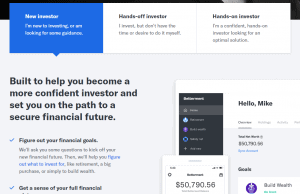

What is Betterment?

Betterment is an online robo advisor that focuses on helping people in making better returns on investment. They use portfolio-based investment options to simplify investing. It focuses on an algorithm based investing instead of human management. The platform particularly invests money in ETF-based portfolio. The tax-efficiency and automatic diversification are among the best features.

Founded in 2008, Betterment claims that it is built for people who like to receive above-average returns with low risk. It has more than $15 billion of assets under management.They are using algorithm techniques according to the investor’s financial position, risk tolerance, and goals. They also charge a lower fee when compared to a human financial advisor. They charge only 0.25% annual fees to investors. The platform claims that its services suite to all types of investors. They offer an equal investment opportunity for new, hands-on and hand-off investors.

The platform also works with users in making the right financial planning. Their experts guide investor regarding retirement, buying a home and achieving any other goal.

- Planning for retirement: They advise investors and users on how much they need to save and what types of accounts they need to invest in and what is the optimal risk level.

- Buying a home: If you set a goal of buying a home, the platform will create a slightly conservative portfolio to achieve that goal in a short to medium-term.

- Having a baby: The platform also permits investors to invest for their child.

- Switching jobs: The platform permits investors to roll over 401(k)s and IRAs to reduce the fee and make the most of your money.

- Receive an inheritance: The experts from betterment are in a position to suggest you how to invest the money you received an inheritance.

- The market uncertainties: The platform has built a model that factor in market downturns. It has also put guardrails in place to help prevent you from making decisions in the heat of the moment.

- How and what to save: Sometimes investors don’t have a particular reason to save. In this case, the platform will guide you to save money to grow wealth.

What are the Pros and Cons of Betterment?

Betterment Pros:

✅Diversification

✅Automatic rebalancing

✅Dividend Reinvestment

✅Portfolios customization

✅Competitive fees

Betterment Cons:

❌ No DIY investment tools

❌ Lack of educational resources

❌ No live chat

How Does Betterment Work?

Betterment has created a simple and user-friendly platform. They are seeking to generate above-average returns by investing in ETFs according to investment criteria set by the investor. They employ various investment and tax efficiency strategies to improve returns and reduce risk.

During the registration process, the platform will ask you to answer a few questions. These questions include where are you currently standing in your financial life and what are you investing for, what are your goals?

- Building a portfolio: After reviewing the questioner and your goals, the platform will set a portfolio that meets your investment criteria and goals.

- Then, they put magic to work: Once the platform sets a portfolio for you, they will manage your portfolio with tax-smart technology.

Betterment claims that they have constantly generated better returns than private investor since 2004, thanks to portfolio strategies. Its portfolio strategies also include the following factors:

- Socially Responsible Investing: The platform increases its investment in stocks of companies that meet certain environmental, social and governance criteria.

- Goldman Sachs Smart Beta: Diversified portfolio strategy that uses certain factors that attempt to outperform a conventional market-cap strategy

- BlackRock Target Income: 100% bond portfolio with different income yields. This helps insulate against the ups and downs of the stock market.

What are Betterment Account Creation and Investment process?

It always takes a longer time for creating an investment account on robo advisors compared to brokerage accounts. However, Betterment has created the process simple and easy.

The investors need to visit the website to create an account with the help of email and password. Once you click on the ‘Get Started’ tab, the platform will ask you to enter an email address. The platform will then ask you to enter other basic information such as age and annual income and projected year for retirement. The investors need additional information such as a social security number.

The investors are then required to select the goal. For instance, these goals include saving for retirement, buying a home, emergency savings or college? From there, they’ll use an algorithm to help determine what level of aggressiveness you should have in your portfolio.

The platform will present a short questionnaire – which helps them in accessing the overall financial goals, external accounts and level of risk tolerance. Indeed, they will get a complete overview of your finances before developing a portfolio that makes sense.

After answering all the questions, they will suggest a portfolio to investors. The investors should closely review the portfolio before moving forward. Once you approved the suggested portfolio, the platform will ask you to link the bank account to deposit funds.

What Types of Accounts Betterment Offers?

Betterment has developed various types of accounts for investors in order to fulfill investor’s needs more specifically. Below are the types of accounts you can choose on this platform:

Personal Investing Account

This account is developed to help investors in outperforming average market returns. The account creation process is the same for this account. The platform will ask you a few questions before creating a portfolio for you. It uses the algorithm and other strategies in creating a portfolio that suits your requirements. Betterment also manages a portfolio with automated tools such as expert advice, rebalancing and tax efficient features.

The platform permits investors to create multiple personal investing accounts. The investors are eligible to create a joint account.- Open multiple accounts: The platform permit investors to create multiple accounts to attain multiple goals. They do not charge an extra fee for opening a new account.

- Select from multiple portfolio strategies: Betterment permit investors to select from one of its four strategies. They also permit investors to customize the desired risk level. You can select one portfolio strategy for each account.

- Keep taxes in check: The account holders don’t need to worry about taxes. The platform automates advanced tax-saving strategies, like asset location and tax loss harvesting.

Rollover

Rollover is perfect for those who worked for multi-employers. When you have more than one 401(k), you are liable to pay more fees. Betterment allows investors to reduce 401(k) fees that are draining your savings. Below are the best features of Betterment Rollover account:

- Low and transparent fees

- Licensed experts:

- Diversified portfolio

- Tax-smart services.

The platform claims that they do everything they can to help make rolling over easy. The investor can transfer IRA at Betterment as little as 60 seconds.

IRA

The platform claims to generate 15% higher returns for investors over thirty years when compared to average returns. This is due to its tax-related strategies. The platform offers Roth, traditional, and SEP IRAs to users for retirement savings. They give you a retirement plan and tell you how much you need to save each year to reach the goal.

Smart Saver

Smart Saver is a type of savings account. The platform offers 2.14% annual yield on holding money in this account. Betterment invests that money in short-duration bond funds. They also use 80% of the money in U.S. Treasuries and 20% in low-volatility corporate bonds. In addition, they also offer tax advantages on smart saver account. All these activities help investors in generating returns from holding cash in a smart saver account.

What are the Best Features of Betterment?

Besides robo advisory service, the platform offers several other enticing features to investors. Below are the few features that are worth considering:

Financial Advice Packages

In addition to robo-advising, the platform permits users to communicate with a certified financial planner in order to get a financial plan for big life events, such as changing jobs, buying a home, having a baby, or planning for retirement. Their financial planners have strong experience in their respective industries and they also use algorithm techniques to create the best plan.

Tax Loss Harvesting

This is one of the best and most famous features of Betterment. Tax loss harvesting is when you sell investments at a loss, strategically, to offset the taxes you’ll pay on the gains you make from selling shares that have increased in value. This is a tricky task and could result in losses if you don’t do it correctly. Betterment offer strong tax harvesting feature. They do this automatically for investors. They also sell and buy assets at the perfect time to reduce your tax impact as much as possible.

Flexible Portfolios

Betterment offers more control on a portfolio to experienced investors through the flexible portfolio. The investor will have the potential to make changes to increase the weight of the individual asset class. Although they allow you to increase investments on certain assets, the platform will also let you know about the possible outcome of that change. The flexible portfolio comes with features such as tax-loss harvesting and tax coordination.

The investor can use this portfolio with all account types — including Traditional IRAs and Roth. The minimum investment requirement stands around $100,000 or more to use this feature.Automatic Rebalancing

Automatic rebalancing is an innovative feature that many Forex robots offer. The investor doesn’t always need to monitor market activities to make changes in the portfolio. Betterment offers automatic rebalancing feature. This feature makes changes in the portfolio according to the market activities. When you do this manually, you have to pay additional fees and commissions on buying selling of assets. You will also pay higher taxes. However, in the case of Betterment, they don’t charge any fee for automatic rebalancing.

What is the Fee Structure of Betterment?

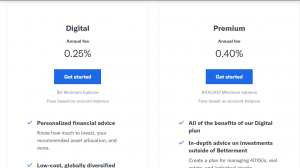

Betterment is crystal clear about the fee structure. They do not charge any account opening and withdrawal fee. Their auto-rebalancing feature is also free of cost. They offer this feature on both accounts. These accounts are digital and premium. The fee is different for both accounts. The annual fee for digital account stands at 0.25% with no minimum investment requirement. The fee for a premium account is 0.40% with the minimum investment requirement of $100,000. They also charge users for offering human financial planning service. Below are the fees related to planning packages:

- Getting Started – $149

- Financial Checkup – $199

- College Planning – $199

- Marriage Planning – $299

- Retirement Planning – $399.

What Countries are Accepted on Betterment?

The platform does not accept clients from Europe and other parts of the world. They only accept clients from the United States. You must be a U.S. resident or U.S. citizen with a valid social security number. They permit investors from all over the United States. Below are the few states that are accepted on this platform.

[one_fourth]- Alabama

- Alaska

- Arizona

- California

- Colorado

- Delaware

- Hawaii

- Idaho

- Utah

- Virginia

- Wisconsin

- Wyoming

- Illinois

- Kansas

- Louisiana

- Mississippi

- Missouri

- Nevada

- North Dakota

- Ohio

- Oklahoma

- Rhode Island

- Tennessee

- Texas

Is Betterment Customer Support Good?

Customer support plays a huge role when it comes to robo advisors. Betterment does not offer instant chat feature. The clients have to contact the support team through email and phone call. They do not offer round-the-clock support. The support team is mostly available to answer questions 7 days a week. Betterment has also set up a strong FAQ segment. If you want to speak to an actual human, you’ll need to contact the support team during business hours – 9am-6pm M-F, and 11am-6pm Sat-Sun.

Is Betterment Safe?

Yes, Betterment is safe. This is because of its compliance with regulatory policies. This platform operates through two legal entities—Betterment Securities, which is the SEC-registered broker-dealer regulated by FINRA. It also operates through Betterment, LLC, which is an SEC-registered investment advisor. The investor’s money is also insured through its Securities’ membership in SIPC. The insure investors funds up to $500,000.

Betterment Review 2022 – Verdict

Betterment is one of the most famous robo advisors. It has an extensive history in this emerging industry. The platform has more than $15 billion of assets under management. This is a well-established platform with strong recognition regarding financial planning and automated investing. It offers various types of portfolios to investors. The investors are eligible to select any portfolio according to his investment criteria. Indeed, its flexible portfolio permits investors to increase or decrease the weight of an asset. On the other hand, it offers premium services to investors who have a higher balance in the account. Its retirement accounts and products offer 15% higher returns compared to other market players.

FAQ:

How does investor move money to Betterment?

The investors can easily move money to Betterment. There are two ways: • By transferring investments from an account at a different firm • You can also do this by linking a bank account

What methods of deposit do they accept?

Betterment only permits an investor to deposit funds through electronic transfers to Betterment account. They do not accept personal checks. It does not accept deposit through credit cards. Online payment service companies such as PayPal is also not accepted for depositing funds.

What is the withdrawal method?

The platform allows investors to withdraw funds from Betterment account any time with no additional fee. The funds could take a few days to reach your account. Generally, it takes 3 to 5 days.

How does Betterment calculate the earnings percentage?

Betterment calculates returns in two ways: The investors can find earnings performance under the “$ VALUES PERFORMANCE” sub-tab. This considers the timing and size of cash flows into and out of the account. The investor can find the time-weighted return under the “% RETURN PERFORMANCE” sub-tab. This reflects the returns of your portfolio ignoring size and timing of cash flows.

Where Investor can find Betterment’s Federal tax ID number (FEIN)?

The platform has set Federal tax ID number (FEIN) on your tax forms in the top left-hand corner. The investor can easily download tax forms.

Does Betterment offer a referral program?

Yes, Betterment offers a referral program. The investors can earn free time on their entire Betterment account by inviting family and friends to Betterment.

Siraj Sarwar

Based in Saudi Arabia, Siraj has a strong understanding of and passion for accounting and finance. He has worked for international clients for many years on several projects related to the stock market, equity research and other business, accounting and finance related projects. Siraj is a published financial analyst on the world's leading websites including SeekingAlpha, TheStreet, MSN, and others.View all posts by Siraj SarwarWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up