By Benjamin Streed

October 22, 2012

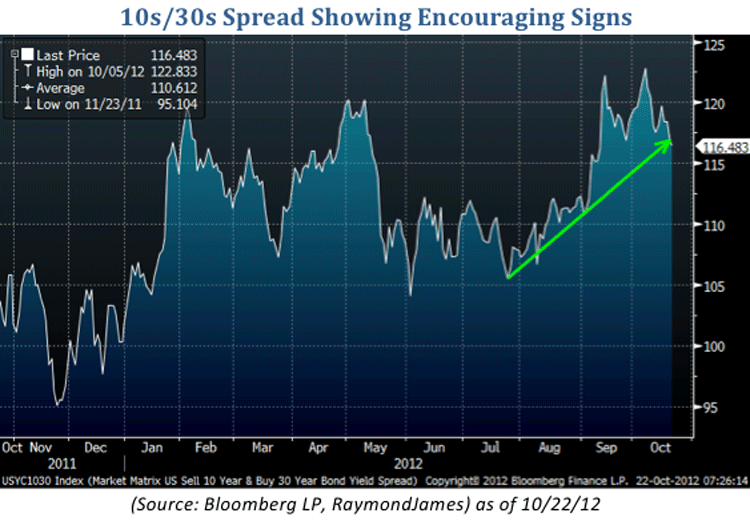

Treasury yields across the curve finished significantly higher last week after generally positive earnings releases and several economic releases, including retail sales, the consumer price index (CPI), industrial production and housing starts provided encouraging signs for the domestic economy. Highlighting the importance of market expectations, last week’s initial jobless claims figure had little impact on yields as the market was anticipating a figure as high as 390k since the prior reading was uncharacteristically low. Overseas, Moody’s kept Spain’s debt rating as investment-grade citing a reduction in the risk of the country being locked out of the international capital markets thanks to the European Central Bank’s (ECB) willingness to purchase its debt. Although, this does not fix the situation in that country it is helping to alleviate some concerns that the European Union will be unable to resolve its seemingly endless debt crisis. The rise in yields was relatively stable over the course of the week with Friday being the only day in which yields actually declined; the benchmark 10-yr Treasury note was up nearly 11bp to yield 1.76% as of the close on Friday while the longer-dated 30-yr bond was up 10bp to yield 2.93%. Interestingly, the difference in yields between the 10-yr and 30-yr securities, known as the 10s/30s spread, now sits at nearly 117bp. Many market participants view a larger spread as an encouraging sign for the economy, as investors in longer-dated maturities tend to demand higher yields should they feel that the economy is due to expand over the course of the debt’s lifetime. The 10s/30s spread is near its highest levels all year and is now only 6bp from the high of 122bp set just two short weeks ago. On a similar note, the 5s/10s climbed back up to over 100bp in the last 3 months, after having been as low as 83bp in June, which shows continued signs that investors are betting on some good news moving forward.

On Wednesday we’ll get yet another rate decision from the Federal Open Market Committee (FOMC) amidst a heavy week for Treasury issuance that will see $35 billion of 2-yr notes on Tuesday followed by $35 billion of 5-yr securities on Wednesday and $29 billion of 7-yr debt on Thursday. Should the FOMC release provide any surprises or run contradictory to the yields seen in the two auctions leading up to the statement, there could be some yield volatility in the shorter-end of the curve this week. For the sake of context, the 10-yr yield at 1.76% is the highest weekly closing level since the week ending September 14th, which you may have guessed was the last time the FOMC met. Additionally, should the Fed provide encouraging language in its statement that confirms some of the recent economic releases there could be further upside potential for Treasury yields from their current levels. Wednesday’s release is the first of two remaining releases scheduled for 2012 and will be the final announcement before voters take to the polls for the Presidential election on November 6th. According to a recent Bloomberg article, many market participants are expecting the Fed will announce in December that it will continue to purchase longer-term Treasuries while abandoning the “selling” portion of its plans, to help keep longer-dated rates low through its timeframe of 2015.

Disclaimer:

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section ofinvestinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account