Online Trading for Latest Guide for Beginners

Online trading has been around us for more than two decades since the rise of technology in the late 90s of the previous century. Although the early signs of online trading platforms have emerged around the 1970s, the accessibility of these platforms in the form of desktop and mobile applications greatly increased trading volumes and liquidity and created a new profession, home day trader.

But the concept of online trading has a wide spectrum that ranges from professional proprietary institutional firms and web-based trading platforms that are accessible by any individual.

In this guide, we break down the benefits of online trading, explain the differences between each platform and suggest the best CFD brokers in order to help you get started.

-

-

How to Start Online Trading in 3 Quick Steps:

[three-steps id=”195072″]Online trading might be a lucrative business, however, it is also risky and complicated. First, you’ll have to learn the markets, get the right equipment (you might need a second computer screen and a strong computer), find a set of sites and trading platforms to get data and information and find a reliable broker.

Obviously, there are plenty of ways to start online trading. These include online stock trading, options trading, futures trading, cryptocurrency trading, forex trading, bonds trading, and ETFs trading. Each one of these markets has distinctive demands and its own set of dynamics and there’s another way that combines the above markets and products and enables you to start trading with a minimal capital due to a concept called margin trading – The Contract for Difference (CFDs) market.

CFDs are basically a form of agreement between two parties who speculate on the price of certain security without owning and delivering the asset. The CFD market has grown exponentially in the past two decades and has gained the necessary regulatory framework in order to maintain a functioning industry. We have included a step-by-step demonstration that shows you how to start trading online with a top CFD broker.

Step 1: Open an Online Trading Account

First, you will have to choose a CFD broker that is regulated and authorized to operate in your country. You must note that every broker has different markets, products, terms of trading, trading platforms, and trading tools. When looking for a broker, you can create a demo account to test the upsides and downsides of each broker. Below, we have collected some of the best CFD brokers to help you get started trading online.

1. eToro - Best Online Trading Platform for Beginners

eToro is the best online trading platform out there for beginners. In this regard, there are few brokers that can compete with eToro. The broker offers an extremely easy-to-use social trading platform, meaning you can connect with other members of the community and even use the CopyTrader tool which allows you to copy trades of other traders. With this tool, you don't even have to be a trading expert but look for a top-performing trader and copy the trades executed on his/her account. The eToro platform is web-based and is completely unique. If you are a newbie to trading, you will find this platform useful and user friendly.

In addition, eToro is available in most countries (including in the US for cryptocurrency trading) and regulated by several financial authorities. those include the Cyprus Securities & Exchange Commission (CySEC), the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

Our Rating

- eToro offers a user-friendly and well-designed web-based trading platform suitable for beginners and experienced traders

- eToro is regulated by CySEC, FCA, and ASIC

- eToro offers the CopyTrader tool that lets you copy trades of other traders

- eToro does not offer a desktop-based trading platform

- Forex and CFD trading is not available for residents in the United States

CFDs are complex financial instruments and 75% of retail investor accounts lose money when trading CFDs.2. Plus500 - Competitive Spreads for Online Trading

Plus500 has been around since 2008, offering online trading services in more than 50 countries. The Plus500 trading platform is simple and easy to use, allowing traders to trade CFDs through more than 2,000 financial instruments in the following markets: indices, currency pairs (forex), stocks, ETFs, commodities, options, and cryptocurrencies.

One of the reasons why Plus500 is amongst the most popular trading platforms in the market is the variety of products and their regulatory status. In an industry that is prone to scam sites, Plus500 is highly regulated and is a public company listed on the London Stock Exchange. The broker is regulated by the Australian Securities and Investments Commission (ASIC) in Australia, the Financial Conduct Authority (FCA) in the United Kingdom, and the Cyprus Securities and Exchange Commission (CySEC) in Europe.

Our Rating

- Plus500 offers more than 2,000 financial instruments to trade on its platform

- Its trading platform is intuitive and easy-to-use

- Plus500 has low capital requirements

- Plus500 charges an inactivity fee

- Phone support is not available

80.5% of retail CFD accounts lose money.Step 2: Learn How the Online Trading Market Works

What is Online Trading?

In simple terms, online trading is trading in the financial markets through an electronic trading platform over the internet network. While traditional trading has taken place on the floors of exchanges, the integration of technology in financial markets has created the electronic trading method which ultimately functions similarly to buyers and sellers on exchanges. For instance, the Level 2 screen which is available on most exchanges allows users to get a full picture of the market, providing the buyers and sellers of the market including the offered prices and quantities.

Source: http://monstertrading.weebly.com/ How the Online Trading Market Works

Trading online is an act of buying and selling securities via the internet. It can be done through a brokerage firm with multiple channels that allow the user to execute market orders: a telephone, a web-based platform, a desktop-based platform, or a mobile application. Online trading is the same as any other type of trading but takes place in a virtual sphere. Nevertheless, a trader must take into consideration the motives and interests of other participants in the market, though it is not a face-to-face market.

Online trading refers to various markets such as stocks, ETFs, options, currency pairs, cryptocurrencies, futures, commodities, bonds, etc. Online trading occurs through a network of computers transacting one with the other, therefore, the reliability of networks and computing systems becomes a necessity for the existence and development of online trading applications.

Step 3: Choose a Trading Strategy/Broker Type

Throughout the evolution of online trading since the mid-90s, market orders and trading styles have become popular terms and much more defined.

Here are the four types of trading style to apply on the online trading market:

Day Trading – Day trading is a trading method that involves around buying and selling securities with the principle rule of thumb of closing all positions by the end of the trading day.

Scalping – Scalping refers to a trading method in which a trader profit from small price gaps in the market. Scalping is usually done in timeframes of seconds or minutes.

Swing Trading – Swing trading is a trading method in which a trader attempts to make a profit in a position held for 2-5 trading days.

Position Trading – Position trading refers to a trading technique in which a trader/investor holds a position for a long period of time. By definition, a position trader makes less than 10 trades per year.

Technical and Fundamental Analysis

Technical and fundamental analysis are the two main techniques of analysis for any financial security. While technical analysis aims to predict future price movements by clear patterns and previous price action, fundamental analysis helps traders to get a better indication of a security based on economic data and market news. These two techniques, or at least one of them, is mandatory for every trader.

Types of online trading brokers

Market Maker – A market maker broker literally makes an independent market. It is usually a brokerage firm that buys and sells securities on its own account, at the same prices of the exchange.

ECN Broker – An Electronic Communication Network (ECN) broker is a type of broker that functions as a bridge between the trader and the market. While these brokers are more transparent and reliable, they often charge higher trading fees.

STP Brokers – A Straight Through Processing (STP) brokers transfer clients’ orders directly to their liquidity provider. An STP broker is a No-Dealing Desk broker but unlike an ECN broker that sends orders to the members of the electronic network, an STP broker channels all orders to external liquidity providers.

Step 4: Placing a Trade on Online Trading Placing

Making a trade on an online trading platform may be complicated but in this section, we’ll go through each step to help you get started. As we mentioned, the eToro’s trading platform is intuitive and user friendly, hence, it is quite to place an order directly to the market.

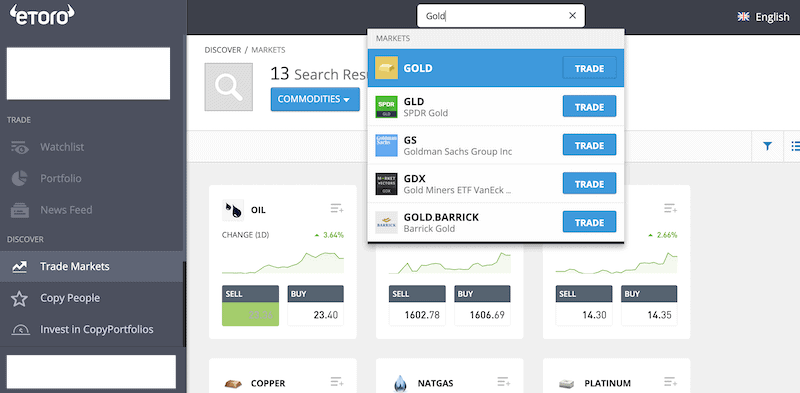

Once you have completed the registration process and transfer funds into your account, log in to eToro’s trading platform and search for one of the instruments you wish to trade on (for demonstration, we have chosen gold).

eToro immediately transfers you to the instrument page. On this page, you will be able to connect with other traders, see posts and relevant news, and analyze the asset using charts and stats.

Whenever you are ready to place your first order click on the ‘Trade’ button, set the amount of the trade, and click the ‘Open Trade’ button.

Conclusion

Nowadays, it is almost impossible to not come across an online trading broker, platform, or a friend that has traded through the online trading market. Some people are gifted with instincts that enable them to make consistent profits, basic income, or even a hobby. Believe it or not, trading can be fun. The adrenaline, excitement, and competitiveness of online trading will be something you wouldn’t want to miss.

Having said that, it’s not a secret that you might lose your capital which can end up in big disappointment and occasionally even tragedy. We highly suggest that you start small, and always be responsible with the money you risk.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

Is online trading safe?

Generally speaking, online trading is safe. Yet, you must find a regulated and secure online trading platforms such as eToro or Plus500. These brokers are regulated and make sure your funds are safe in segregated accounts and users will be compensated in the event of default.

What are the benefits of online trading?

Online trading enables you to access real-time information and speculate on price movements in certain markets without owning the security. The great advantage of online trading is that it gives you the flexibility in their everyday lives, meaning you won’t have to be attached to one location and one working place.

How can I join online trading?

There are plenty of ways to start trading online. Some brokers require a high initial deposit, a narrow selection of instruments, and a long registration process. Therefore, we have concluded that the most efficient way to get started is through a CFD broker like eToro.

How much money do I need to start trading?

High capital is not a must. While you might have to deposit a large initial capital in order to start trading stocks and futures through an exchange, CFD brokers offer margin trading, meaning you can trade on borrowed capital. For instance, eToro maintains an initial deposit of $200, and a leverage ratio of up to 1:30.

See Our Full Range Of Trading Resources – Traders A-Z

Tom Chen

View all posts by Tom ChenTom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up