Zero-coupon Bonds – Invest in Zero-coupon Bonds Today!

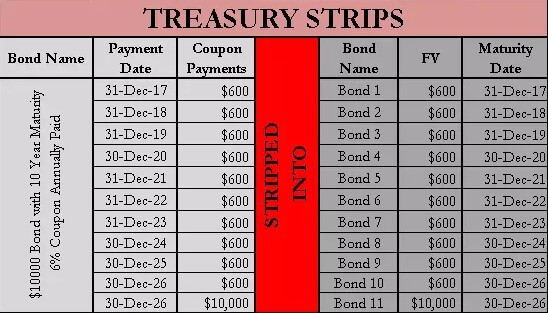

Zero-coupon bonds, also known as zeros, are special types of debt securities that do not pay periodic interest payments. Instead, the bonds are sold at a deep discount and the principal amount is paid at maturity. These bonds are issued by the government through the Treasury, municipalities and corporations. Zeros are considered to be a low-risk investment option compared to stocks.

There are different types of zero-coupon bonds. Some are issued as zero-coupon debt securities from the beginning while others are created after financial institutions buy regular bonds, strip the coupons and resale them as zero-coupon bonds. Since they offer the entire principal amount at maturity, their prices fluctuate more than regular bonds do.

Read on to find out how zero-coupon bonds work, its types, how to calculate its price and yield at maturity and many more.

-

-

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

What is a Zero-Coupon Bond?

A zero-coupon bond is an instrument that corporations and governments use to raise capital. When you purchase this type of bond, you become a lender to the issuer. On top of getting back the original amount you invested, you will earn interest payments that are paid semi-annually until the bond matures.

However, there are certain bonds that do not pay the occasional interest payments. They are known as zero-coupon bonds and are sold at a deep discount from the face value. At the end of the maturity period, you will get the whole principal amount. Your returns are the difference between the purchase price and the face value. For instance, you can get a zero-coupon bond with a par value of $20,000, 20 years maturity and 5.5 % yield sold as low as $6,000. This means you will invest the $6,000 and get $20,000 after 20 years. The difference between the two amounts represents your earnings, which is also the compounded interest.

According to the IRS, an imputed interest which is also referred to as phantom interest is subject to income tax. So even though you will not earn periodic interest payments like in regular bonds, you will still have to pay income tax on the phantom interest which accrues each year. Nonetheless, there are various ways you can avoid paying taxes. For instance, you can buy a zero-coupon municipal bond, use a tax-exempt retirement account or choose a bond that has a tax-free status.

What are the pros and cons of investing in zero-coupon bonds?

Pros

- A secure form of investment

- Low minimum capital required

- Subjected to only capital gain tax

- Solid long-term returns

- Traded in the secondary market

Cons

- Riskier than regular bonds

- Long wait to get paid

- Affected by interest rates in the market

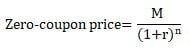

How to calculate the zero-coupon price

M= face value of the bond

r= requested rate of interest

n=numbers of years until maturity

Assume a bond with a $25, 000 face value matures in three years and comes with a 6% return. This is the amount you should expect to pay.

The longer the maturity period, the lesser amount you will be required to pay and vice versa. This also means that you will earn more. In most cases, the zero-coupon bond maturity periods are long term with a minimum period of 10 years. These bonds are a good option for long-range goals like buying a house.

Types of Zero-coupon bonds

Separate Trading of Registered Interest and Principal Securities (STRIPS)

These are fixed-income securities sold at a discount price from the face value and do not offer interest payments. They are fixed-income securities which means you will be given the full amount when the bond matures.

STRIPS started in the US in the 1960s by investment dealers. Initially, the STRIPS were made by physically detaching the paper coupon from bearer bonds and selling them separately. This method had a lot of disadvantages. For instance, if the coupon was lost or stolen, the investors could not receive payments, so this is the reason why STRIPS in electronic book-entry form became popular.

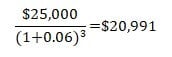

As the acronym suggests, STRIPS are types of bonds where the interest payment is removed and sold separately. However, the principal amount is paid out in full at maturity. The STRIPS are not sold by the US government directly to investors like other debt securities. Instead, they are created when banks and other financial institutions buy regular bonds and strip the interest payments. The stripped interest payments are sold as separate securities even with different CUSIP numbers. Although STRIPS have been disassembled and sold by other entities, they are still backed by the US government.

Bonds created for each interest payment is referred to as coupon STRIPS. On the other hand, principal STRIPS is the claim to reimburse the principal from the initial bond. The principal and coupon STRIPS are considered zero-coupon bonds because they do not pay coupon payments. They are offered at a discount but mature at the face value.

Furthermore, STRIPS are also made from Treasury Inflation-Protected Securities (TIPS) that pay floating interest rate instead of the conventional coupon rate. Since STRIPS do not involve interest payments, their duration corresponds to the maturity. A stripped fixed-rate or inflation-adjusted bond must have a par value of not less than $100 and should only increase by $100. If a bank can get the principal STRIP and all other associated coupon STRIPS, it can reconstruct a STRIP into whole securities.

Taxation of STRIPS

In terms of taxation, zero-coupon STRIPS are taxed differently from most bonds. Bond types that involve interest payments are required to report the interest paid to investors for taxation purposes. Since STRIPS do not involve any kind of interest, they are exempted from local and state taxes. The Original Issue Discount (OID) applies because STRIPS are issued at a discount but matures at face value. However, the OID may be ignored if it is less than a nominal de minimus amount until maturity when it is reported as a capital gain.

The cost basis will increase for each year the STRIPS is held. If a bond is sold at a price different from the cost basis, capital gain or loss could be generated. However, the entire discount is regarded as interest income if the bond is held to maturity. In addition, if you choose to buy STRIPS associated with TIPS, you are required to report inflationary adjustments.

STRIPS issuers should report the phantom interest on form 1099-OID. It is important to note that this figure cannot be obtained at par value. In fact, it must be recalculated, especially when the STRIPS were bought at a discount in the secondary market or at a premium. Most of the tax rules used in these calculations are stipulated in the IRS Pub 550.

The most significant advantage of STRIPS is that you will always be paid the precise principal amount at maturity. This is a great investment option if you need a definite amount of money to start a project. However, if you wish to dispose of your STRIPS before maturity, you will get reduced returns. This is because they are sparsely traded on the secondary market, and sometimes they don’t exist at all. Nonetheless, like other types of bonds, STRIPS can get either gain or lose capital if they are sold before maturity. It is good to know that you may still be required to pay taxes on the accrued OID interest if you sell your STRIPS before maturity.

STRIPS are appropriate for a wide range of investors. Most retail investors and institutions such as banks and insurance companies buy these securities because of the assured cash flow at maturity. If you want to avoid the phantom tax issue, you can purchase STRIPS inside IRAs and tax-deferred retirement plans and this is because they can grow to maturity without any tax issues.

Zero-coupon municipal bonds

Many people are looking for the best ways to save for retirement years and even though there are various options to consider, none can match the security and the value offered by the zero-coupon municipal bond.

The two main types of zero-coupon municipal bonds are stripped municipal bonds and convertible zero-coupon. Stripped municipal bonds are conventional bonds where the coupon payments have been stripped off and reinvented into zero-coupon bonds. On the other hand, convertible zero-coupon municipal bonds are sold like traditional coupon bonds and start paying interest after like 10 to 15 years.

These bonds are purchased at a deep discount and are exempted from most taxes. Unlike other debt securities, zero-coupon municipal bonds do not pay periodic interest payments. Instead, interest accumulates over the life of the bond. The profit you will get is the difference between the buying price and the face value at maturity.

The good part is that the compounded interest is exempted from most taxes and in some states it is excused from income taxes. If you are not looking for immediate income, zero-coupon municipal bonds are a great way to accumulate retirement funds.

Also, buying zero-coupon municipal bonds is the small initial investment required. In most cases, they are sold in the denominations of $5,000 face value. Since they are zero coupons, they are sold at a significant discount. This means that the purchase price is must lower even though you will get the whole amount at maturity.

Another major benefit is the tax-exempt compounding. The accumulation of interest payments during the life of the bond is known as compounding, which means you earn interest on interest. The interest income you could have received periodically is compounded semi-annually during the life of the bond.

Factors to consider before buying zero-coupon municipal bonds

There are various factors to consider before deciding that buying zero-coupon municipal bonds is the right investment option for you. The first thing you need to consider is the quality of the issuer. Since you will not earn any return until the maturity of the bond, it is crucial to consider the quality of the issuer. To be absolutely sure that you will get the whole amount, you should consider an issuer who is covered by reputable municipal bonds insurance companies such as Build America Mutual Assurance Co.

Price volatility is another critical factor to consider. This is because bonds that sell at a deep discount are more likely to be affected by market interest rates. If you choose to liquidate your bond before maturity, you can get a principal amount that is less or more than purchase price based on the market conditions.

Zero-coupon corporate bonds

These are bonds offered by corporations in the zero-coupon style, although they are considered to offer higher interest payments than government bonds, they come with a lot of risks. For instance, there is a high likelihood for the issuer to default paying the agreed principal amount.

It can be very devastating to invest your hard-earned money only to be told that the issuer has gone bankrupt. If the insurer defaults, you can lose the interest or even the amount you invested. The only way to avoid this situation is to choose a corporation that is insured by a reputable insurance company.

The difference between zero-coupon bonds and regular bonds

The only difference between a zero-coupon bond and a regular bond is the system of paying interests, also known as coupons.

In a regular bond, you will be paid interest semi-annually and still get the principal amount when the bond matures. There are no periodic interest payments in zero-coupon bonds. Instead, you will be given the face value at maturity.

Difference for investors

Investors who invest in long-term zero-coupon bonds gain the difference between the buying price and the principal amount at maturity. This amount can be sizeable, especially if you purchase the bonds at deep discounts. In the long-run, the discount can lead to a higher return if you hold the bond to maturity.

Because of the shape of the yield curve, a zero-coupon bond will always have a higher return than a regular bond with of similar maturity period. On a normal yield curve, long-term bonds show to have higher returns than bonds with shorter maturities.

The absence of periodic payments does not mean zero-coupon bonds are bad investments. In fact, they usually offer lucrative returns. Since the interest payments given in regular bonds reduce the wait time and the risk, you should expect the returns to be reduced.

Difference for speculators

Zero-coupon bonds are considered to be more volatile than regular bonds. As a result, speculators purchase them to profit from anticipated price movements. If all factors remain constant, the price of a zero-coupon bond is likely to increase if interest rates fall. Since the government backs Treasury bonds, they respond strongly to any changes in the market interest rate. Consequently, zero-coupon bonds are preferred for speculating changes in interest rate, which can be profitable if there is interest fall.

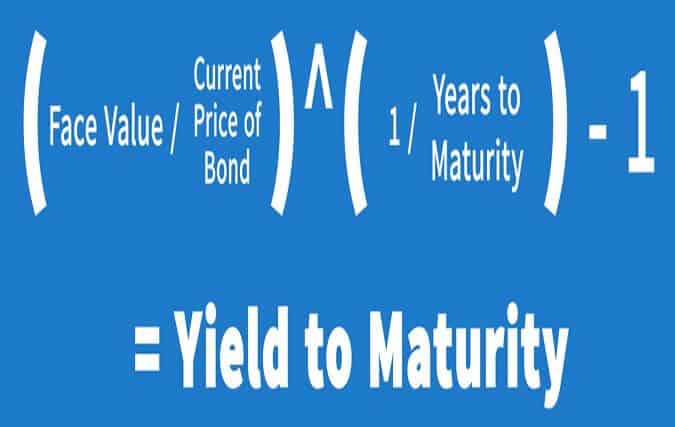

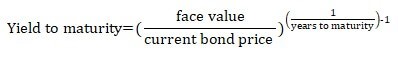

How to calculate yield to maturity of a zero-coupon bond

Because zero-coupon bonds do not involve periodic interest payments, the process and formula of calculating yield to maturity are different from regular bonds.

Assume a zero-coupon bond has a face value of $1,000 with two years to maturity. If the bond is currently valued at $925, then

Face value: $1000

Current bond price: $925

Years to maturity: 2 yearsYield to maturity = 3.98%

The interest rate figures at each point during the life of the bond are used in most time-value money formulas. This means that the zero-coupon bond yields are easier to calculate since there are no interest payments made, the yield to maturity is regarded to be the normal rate of return.

It is worth noting that the yield to maturity may change from one year to the other depending on the overall bond prices in the market. For instance, if investors decide to hold bonds due to uncertain economic times, the denominator in the yield maturity formula can spike, which can cause the yield to reduce. Zero-coupon bonds yield to maturity is also referred to as the spot rate.

In most cases, the minimum maturity period of zero-coupon bonds is ten years. The lack of recurring interest payments is a deterrent to some investors. However, these securities can be an excellent option for long-term financial goals. If you get a good discount, you will only need to invest a small amount of money and leap big after several years.

Zero-coupon bonds are designed to lock you into an assured reinvestment rate. This arrangement can be advantageous when interest rates in the market are favorable and when placed in tax-exempted retirement accounts. You can choose to buy zero-coupon municipal bonds to avoid paying taxes on imputed interest. These bonds are exempted from most taxes, especially if you live in specific states.

The value of zero-coupon bonds is based on the current price compared to the par value because they do not involve coupon payments. As a result, when there are interest rates changes, prices rise faster compared to regular bonds and this means that zero-coupon bonds, especially STRIPS, can be a reliable hedge for stock portfolios.

Conclusion

If you are looking for a way to invest your money, you can choose zero-coupon bonds. They are sold at a discounted price, and the principal amount is given at maturity.

Although Treasury zero-coupon bonds have a low-interest rate than municipal and corporate bonds, they are more secure because the US government backs them. However, if you are looking for a zero-coupon bond with the highest interest rate, you should consider corporate zero-coupon bonds. For zero-coupon municipal bonds, the longer you hold them, the higher the interest rate. They are also considered to be the best zero-coupon because they are exempted from most taxes.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

FAQs

What are zero-coupon bonds in simple words?

Zero-coupon bonds are debt security that does not pay interest. Instead, they are sold at a massive discount, and the value accretes during the life of the bond. After the maturity period matures, you will receive the whole principal amount. The interest rate in the market determines the accretion rate of interest. They are issued by corporations, the Treasury and local governments.

Which is the best zero-coupon bond?

Before deciding on which is the best zero-coupon bond is, there are certain factors you should consider. STRIPS are considered to be safer because the government backs them. However, they have fewer returns compared to other zero-coupon bonds. Although zero-coupon corporate bands have better returns, they are riskier because of the likelihood to default. Zero-coupon municipal bonds are popular because the returns are exempted from the phantom interest.

Which is better between zero-coupon bonds and regular bonds?

Zero-coupon bonds are a better option because of two main reasons. First, they are a great option to save up for an obvious need, like a child’s university education. You will only need to buy the bonds at a discount and wait for it to mature to get its full amount. The second reason is that they are a good option for anticipating interest rate changes. For instance, STRIPS are very liquid and volatile and therefore, a great vehicle to use in the interest rate market.

Should a retired person take a laddered zero-coupon bond?

A laddered zero-coupon bond may not be favorable to a retired person. This is because most retired people need constant income. Regular bonds can be a great option because of the periodic interest payments.

How does a zero-coupon bond differ from other types of bonds?

The only difference between zero-coupon bonds and other types of bonds is the system of paying interest rates. In a regular bond, interest is paid twice a year throughout the life of the bond. In addition, the whole principal amount is paid at maturity. However, zero-coupon bonds do not pay the occasion interest payments. Instead, they are sold at a discount, and the interest rates compound during the life of the bond.

See Our Full Range Of Bonds Resources – Bonds A-Z

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up