Ethereum Trading | How to Trade Ethereum for Beginners

Cryptocurrencies have entered the market with a bang since the foundation of bitcoin in 2009. The technology behind digital assets and the notion of replacing the traditional nonfunctioning monetary system have created a new financial market that appears to remain relevant in the upcoming years. Following bitcoin, Ethereum is the most popular and used crypto coin in the crypto market with a market cap of 14.5B at the time of writing.

Ethereum has been gathering a lot of interest amongst traders due to its high volatility and increasing demand in various applications. Yet, if you are still confused about how to Ethereum market works and how to get started, this guide will help you get a clear picture.

In this guide, we will explain what is Eteherum, how the Ethereum market works, and how to get started trading Ethereum in the easiest way. Keep on reading to find out more.

-

-

How to Trade Ethereum in 3 Quick Steps:

[three-steps id=”193627″]Trading Ethereum can be done through a cryptocurrency exchange or a CFD broker. While cryptocurrency exchanges such as Binance, Kraken, and Coinbase enable you to “physically” trade a digital asset, these exchanges also require a complicated sign-up process and charge high commissions.

Yet, before you start trading, you must choose a reliable and highly regulated CFD broker to make sure you get a solid market execution and your funds are protected. Simply follow the steps below to find a well-reputed broker and start trading. Consequently, the best option to trade Ethereum is via a CFD broker such as eToro and Plus500. These brokers basically allow you to speculate on the price of Ethereum through a derivative market without having to own and store the crypto coin.

Step 1: Open an Ethereum Trading Account

The first step you will have to take is to decide the trading platform in which you would like to trade Ethereum. Cryptocurrency exchanges can be divided into two categories: fiat to crypt exchanges or crypto to crypto exchanges. Regardless of the type of cryptocurrency exchange, these exchanges are mostly unregulated, require a long verification process, and usually charge high trading and financing fees.

Therefore, you might want to consider another option. Different from cryptocurrency exchanges where you will have to pay high fees and the user interface is not suitable for day trading, CFD brokers allow you to trade cryptocurrencies on an advanced trading platform with high-speed execution and no trading fees besides the buy and sell spread.

1. eToro - Best Ethereum Trading Platform for Beginners

eToro is a leading online trading platform for a selection of financial instruments including more than 15 cryptocurrencies. While most exchanges and CFD brokers are forbidden to offer services to US residents, eToro accepts customers from many countries including the United States. Furthermore, eToro's is a bit different than other online trading platforms as it offers a social trading platform where users can connect with other members and even copy other trades of other top-performing traders.

eToro is regulated by the Cyprus Securities & Exchange Commission (CySEC), the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

Our Rating

- eToro accepts customers from the United States

- A highly regulated brokers by CySEC, FCA, and ASIC

- eToro offers a selection of more than 15 crypto coins

- eToro charges an inactivity fee

- eToro offers a low leverage ratio of 1:2 for Ethereum contracts

75% of investors lose money when trading CFDs2. Plus500 - Competitive Spreads for Ethereum Trading

Plus500 is a popular and well-known CFD broker in the market. It offers Ethereum trading along with other cryptocurrencies through CFDs. The broker offers leverage of up to 30:1 on cryptocurrency via its user-friendly trading platform.

Plus500 is listed on the Main Market of the London Stock Exchange (LSE) under the symbol (LON: PLUS) . Plus 500 is authorised and regulated by the Finacial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC) in Australia, and the Cyprus Securities and Exchange Commission (CySEC) in Europe.

OUR RATING

- Plus500 offers competitive spreads for the ETH/USD pair

- The CFD broker maintains advanced proprietary trading platforms

- Plus500 offers more than 15 cryptocurrency pairs including the Crypto 10 Index

- Plus500 charges inactivity fees

- Not available in the United States

CFDs are complex financial instruments and 80.5% of retail investor accounts lose money when trading CFDs.Step 2: Learn How the Ethereum Market Works

What is Ethereum?

Ethereum is a digital currency that runs on the blockchain network. While Ethereum is the open-source centralized blockchain network, Ether is the cryptocurrency of the Ethereum network. Ethereum currency can be traded similarly to any other currency and can be used as a payment method on solely on the Ethereum blockchain network. Eventually, ETH is the currency behind the Ethereum Network and all transactions can be made only with Ether.

Although Ethereum can be used as a technology that runs smart contracts and create a decentralized ledger, it is also a tradable asset and can be traded similarly to any other security.

How the Ethereum Market Works

In terms of trading, Ethereum is being traded on two major trading platforms: Cryptocurrency exchanges (including spot and futures contracts) and the secondary (derivative) market of Contract for Difference. As Ethereum prices vary depending on the exchange, it is highly recommended that you follow the Ethereum price index. Furthermore, the cryptocurrency market is in its early stage of developments and understanding the contract size of Ethereum might be a bit confusing. Each exchange has a different pricing method and you mind yourself getting lost with the unclear information.

The CFD market, on the other hand, provides clear contract specifications through intuitive trading platforms. Moreover, most of the CFD brokers have knowledgeable customer service support, unlike cryptocurrency exchanges.

It is important to note that the cryptocurrency market is open 24/7 across several online exchanges worldwide, meaning the market is always open for trading. So, if you are planning to day trade, you must set time limits of closing your positions at a specified time of the day.

What drives Ethereum prices?

Ethereum is not a usual currency nor a commodity. The second most popular cryptocurrency in the world has different factors that influence its price. Those include:

- DApps Development

- Regulatory Approval

- Cost of Mining

- Decentralized Finance (DeFi) Growth

- Acceptance and Adoption by financial institutions and the media

- ICO (Initial Coin Offering) Growth

- Day traders and trading robots

Step 3: Choose an Ethereum Trading Strategy

Ethereum is a tradable asset just like any other commodity, currency pair or stock. That means you can trade Ethereum with the same principles that apply to any other financial security. As a matter of fact, cryptocurrency traders report that technical analysis works effectively on Bitcoin, Ethereum and other cryptocurrencies as it does with stock trading. Let’s find out the main strategies and tips to follow when trading Ethereum.

Technical Analysis

In simple terms, technical analysis is the study of market trends and patterns in order to identify trading opportunities in the market. Like any other security, technical analysis can be applied to Ethereum. While Ethereum has not yet reached a point of clear trading patterns, some of the most basic technical analysis indicators can help you identify entry and exit points.

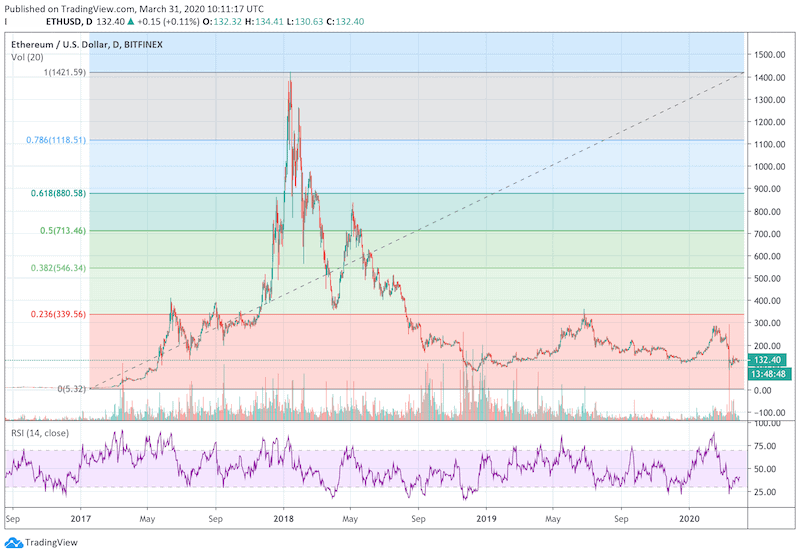

Support and resistance levels are one of the key indicators used by technical analysts to detect entry and exit levels. You can either find reliable sites/analysts providing support and resistance levels for Ethereum or learn how to draw Fibonacci retracement levels. Other popular indicators, which appear to be used by Ethereum’s traders, include the Relative Strength Index (RSI) which identifies the overdemand and oversupply of an asset, the Moving Average (MA), MACD, and Bollinger Bands.

Here are some of the main trading strategies to help you identify a market trend or range-bound trend:

Fibonacci Retracement and Relative Strength Index (RSI)

In the Ethereum daily chart below, we have inserted Fibonacci retracement levels from the highest level to the lowest level. As you can see, Fibonacci retracement levels provide effective entry and exit levels and allow you to get a better visualization of the market. The RSI helps you to identify a change in market trends.

Support and Resistance Levels

Support and Resistance levels are among the most effective ways to analyze security. These levels usually being used in a range-bound market in consolidation where a trader sells the security at the resistance level and buys the security at the support level. In case the price of Ethereum breaks one of the levels, then a market trend is expected.

Fundamental Analysis – Market News

Ethereum is covered constantly in mainstream media. The public has shown great interest in the adoption of Bitcoin, Ethereum and other cryptocurrencies. If you are planning to trade Ethereum, you might have to follow some top crypto news sites and track the cost of mining Ethereum.

Step 4: Open an Ethereum Trade

Unfortunately, cryptocurrency exchanges require new users to complete a long registration process before you get access to the platform. In the past few years, crypto exchanges were subjected to multiple hacking events and as a result, the sign-up process is a long procedure.

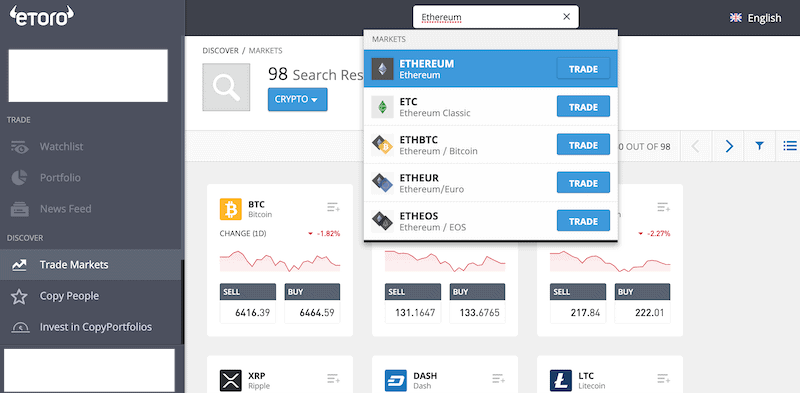

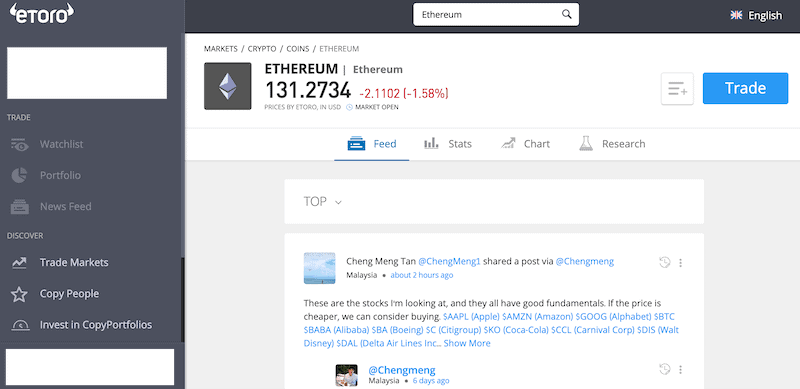

Trading Eteherum through the CFD market is easier. First, complete the registration process on eToro’s homepage and fund your account. Once the funds have reached their destination, log in to eToro’s social trading dashboard and search for Ethereum (there’s a search box at the top of the platform).

Then, you will be transferred to Ethereum’s trading page where you can connect with other traders in the community, find stats and charts and a new research tool that allows you to get helpful information about Ethereum. Once you are ready to place an order, click on the ‘Trade’ button, set the amount of the trade, the leverage ratio, and click on the ‘Open Trade’ button.

Conclusion

Ethereum was initially released on 30 July 2015 by the Ethereum foundation and after almost five years, it appears that Ethereum is here to stay. In the past two years, Ethereum has shown a lot of extreme price movements and high volatility. Furthermore, Ethereum is a liquid asset, meaning you won’t get stuck with wide spreads.

Having said that, the cryptocurrency market is still subjected to market manipulation and lots of trading robots trying to take advantage of the lack of regulation. Therefore, it’s advisable that you spend some time and effort to learn the Ethereum market, the best trading hours, and the strategies that are most suitable to your trading style and personality.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

What are the trading hours for Ethereum?

Basically, the cryptocurrency market never closes and runs 24 hours a day, 7 days a week. Therefore, trading Ethereum is available anytime though the highest volatility occurs during the overlap of the trading hours in Asia and North America.

What is the total supply of Ethereum coins?

At the time of writing, Ethereum’s total supply is more than 107 million ETH. Unlike Bitcoin, Ethereum has no supply limit.

What is the ticker symbol of Ethereum?

Ethereum’s ticker symbol is ETH. The most popular ETH pair is ETH/USD.

How much money do I need to start trading Ethereum?

There’s no need to risk a large amount of money. Nowadays, most CFD brokers enable you to leverage your position, meaning you can deposit a relatively low amount of money. For example, eToro requires an initial deposit of $200 but allows you to use a leverage ratio of 1:2.

See Our Full Range Of Trading Resources – Traders A-Z

Tom Chen

View all posts by Tom ChenTom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up