How to Buy Bitcoin With Credit Card in 2021

If you want to buy bitcoin, you can always take advantage of the traditional payment methods such as credit card, debit card, PayPal, and bank transfer (ACH) to buy bitcoin on a crypto exchange.

However, a vast majority of cryptocurrency traders/investors now prefer to use their credit cards to purchase bitcoin. This is mainly because they don’t want to link their bank accounts to crypto exchange platforms.

Read on to know more about the best crypto exchange platforms that make it possible for you to buy bitcoin using a credit card. We have their key features and also listed their pros and cons.

-

-

eToro wallet

Our Rating

- Highly regulated BTC wallet

- #1 cryptocurrency platform

- Accepts Paypal

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.How To Buy Bitcoin Using Credit Card in 3 Quick Steps

Follow these easy steps to buy bitcoin using your credit card.

[three-steps id=”192513″]Where To Buy Bitcoin Using A Credit Card

Purchasing bitcoin using credit cards is one of the most convenient and accessible methods to buy Bitcoin. However, this increased comfort can also include some significant disadvantages, as most digital currency exchanges will charge you, on average, 4% for card purchases. In case you want to save money, you should consider using a bank account since the fees can be slightly lower than paying using your card through a typical trading platform.

The following are some of the best crypto exchange platforms we suggest that you take into account if you want to purchase Bitcoin using a credit card:

1. eToro - Best Bitcoin Exchange & Wallet for 2021

eToro is a famous exchange platform to purchase bitcoin with the help of a credit card. It also offers a secure bitcoin wallet for sending and trading funds.

Started in 2006, eToro has gained fame over time due to its efficient services and highly advanced trading platform. It currently boasts more than 10 million clients around the world. The online brokerage recently entered the U.S market, offering various trading and investing options from digital currencies to forex and commodity CFDs.

If you already own BTC, you can exchange it against other cryptocurrencies such as ETH, LTC, BCH and many more. eToro is also licensed and regulated by CySEC, ASIC, and FCA, making it one of the most trusted crypto exchange platforms.

It will only take you a few minutes to create an account and also gain access to their free demo account. You also only need to deposit a minimum amount of $50 to start trading. Additionally, you can copy the trade strategies of the top traders on eToro and duplicate them on your account. By doing this, you can easily have a higher chance of getting gains instead of losses.

Our Rating

- Free stock and ETF trading in the European Union

- Simple trading experience

- Availability of social and copy trading

- High withdrawal fee

CFDs are complex financial instruments and 75% of retail investor accounts lose money when trading CFDs.2. Coinbase - Best Bitcoin Exchange for Low Rates

Coinbase is known as one of the most beginner-friendly and easily accessible platforms.

With a Mastercard or VISA credit card, you can buy bitcoin in small quantities and withdraw via a bank account, PayPal, or wire transfer. Also, Coinbase doesn’t charge any deposit fee so you only have to pay for the transfer fees that your bank may charge.

You also don’t have to worry about the safety of your funds as Coinbase is extremely serious about its clients’ safety and keeps under 2% of client finances online and the rest of them in the offline storage facility.

If you prefer to trade using your mobile phone, you can use its robust mobile trading app that is available on both Android and iOS.

our rating

- Good reputation

- User-friendly interface

- Secure platform

- Slow bank transfers

- Slow customer support team

How To Buy Bitcoin on eToro Using Credit Card

Below is a step-by-step tutorial that will guide you on how you can use your credit card to purchase bitcoin on eToro.

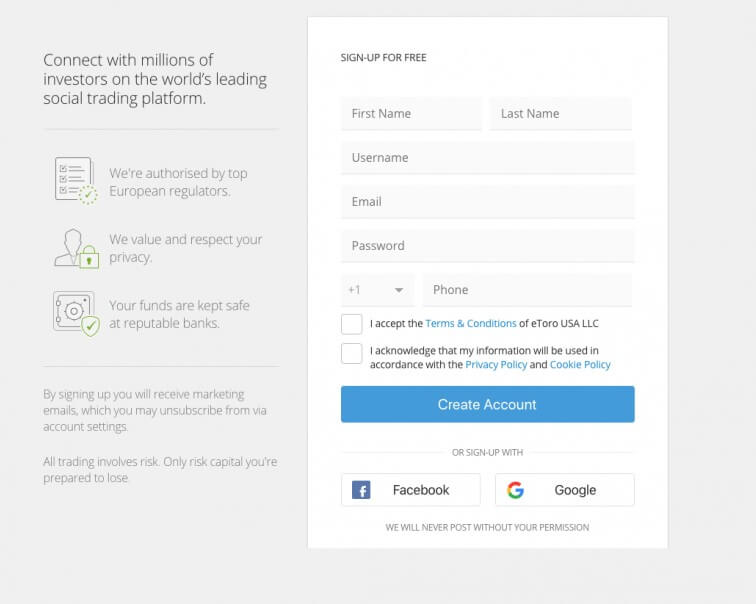

Step 1: Create an account on eToro.

Enter personal information like name, username, email address, password and phone number. You can also sign up to eToro using your Google or Facebook account.

Step 2: Verify your account.

You then have to verify the email address used to create the eToro account. After clicking on the link, enter your credentials to sign in to your eToro account. If you have used your Google or Facebook account to sign up, you won’t have to verify your account via email. You’ll also need to provide a government-issued ID as your proof of identity as well as your electricity bill or phone bill as your proof of address.

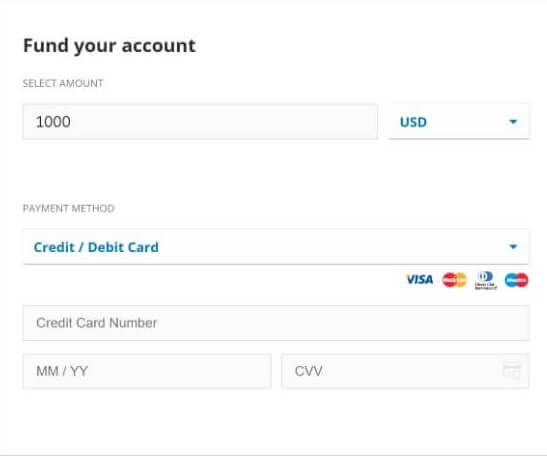

Step 3: Deposit funds.

Be sure to complete your profile to remove the deposit limit on your account. Click or tap on the “Complete Profile” button and follow the next steps. After the completion of your profile, you are now ready to make deposits. Click on the “Deposit Funds” button, enter the amount you want to deposit and choose the credit card payment option.

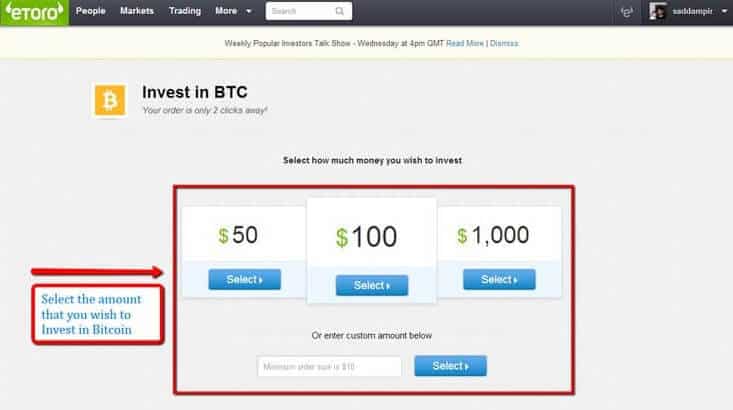

Step 4: Buy BTC.

After selecting Bitcoin from the list of cryptocurrencies available on the eToro platform, click on the “Buy” option, enter the amount of BTC you would like to purchase, then click on the “Open Trade” button to make the purchase.

[/su_list]

Can I Buy Bitcoin with Credit Card without verification?

Due to the increased popularity of cryptocurrencies, the number of exchange sites has increased significantly. However, there are only a few sites that can allow you to purchase bitcoin with a credit card without going a verification process.

Here are popular sites to buy bitcoins without ID verification.

- Changelly – This is a secure exchange trading platform where you can purchase bitcoin at market rate. It has advanced features that are rare to find in other sites. You do not need an account to start purchasing BTC. All you need to do is to configure the trade you would like to make, pay via your credit card and the site will give send the BTC to your bitcoin wallet address.

- Shapeshift – Founded in 2013, Shapeshift is a direct crypto-to-crypto exchange platform. It is popular because of its user-friendly interface. To start purchasing bitcoin, you will need to enter your bitcoin wallet address, the amount of BTC you want to buy then pay via your credit card. You will not be required to sign up or provide your email address.

Can I Buy Bitcoin with Credit Card Instantly?

Yes, it is possible to buy bitcoin with credit card instantly. Some exchange sites do not require its users to comply with the ID verification process.

Here are the best crypto exchange platforms that will allow you to bitcoin with credit card instantly.

- CoinSwitch – This site offers an easier way to purchase bitcoins with a credit card at the best available rate. The process of buying BTC is straightforward. It will only take you three steps. Just enter the BTC amount, paste your bitcoin wallet address and pay through your credit card.

- Coingate – This is an online marketplace that features a payment processor. Since it is a Bitcoin Payment Processor (BPP), the process of buying BTC is seamless and does not involve any deductions except the processing fee.

Why Should You Buy Bitcoin?

- Speculations are going around in the cryptocurrency market that the price of the BTC will increase again after the 2020 BTC halving. When the BTC halving happens, the BTC supply will reduce significantly in a move that’s expected to drive the Bitcoin value up.

- Bitcoin is the primary currency of the cryptocurrency universe. The prices of altcoins also depend on BTC’s price.

- BTC is considered to be a long-term investment. It has been displaying a positive trend early on and optimists believe its value is bound to hit $1 million per BTC a few years from now.

- There is a limited supply of Bitcoins all over the world. It means that the demand for it will keep on rising over time.

Bitcoin Predictions

According to a recent Bloomberg crypto report, the price of Bitcoin can retest the $14,000 support this 2021 and has the possibility of breaking the $20,000 all-time high price it got in 2017.

With a weak dollar and global uncertainties looming large, more and more investors are also speculated to be pushed towards BTC as they will see it as a store of value instead of a risk asset.

Conclusion

Purchasing bitcoin using your credit card is incredibly easy. You also have a lot of crypto exchange platforms to choose from.

To easily pick a highly secure and easy to use exchange platform, visit the official websites of our recommended platforms above, compare the services they offer as well as the fees they charge then choose the one that suits your needs most.

eToro wallet

Our Rating

- Highly regulated BTC wallet

- #1 cryptocurrency platform

- Accepts Paypal

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.Glossary Of Cryptocurrency Terms

FAQs

Can I buy bitcoin anonymously?

Yes, however, if you want to use the crypto exchanges mentioned above, you cannot buy bitcoin anonymously. This is because everyone is required to pass some sort of identity verification before making a purchase.

What types of credit cards are acceptable to buy bitcoin?

You may purchase bitcoin using Mastercard, VISA and American Express credit cards.

Is it safe to purchase bitcoin using my credit card?

Yes, it’s safe to do so. All the exchanges mentioned above are entirely secure cryptocurrency exchanges.

How much fees are charged while purchasing bitcoin using a credit card?

Every crypto exchange has its rates. For Coinbase, the fee is 1.5%, while for Coinmama, it’s 6%.

What are the benefits of purchasing bitcoin using a credit card?

Using your credit card to buy bitcoin is one of the easiest and fastest ways to purchase BTC. It also doesn’t require cryptocurrency traders to link their bank account to their chosen crypto exchange.

See Our Full Range Of Cryptocurrency Resources – Cryptocurrency A-Z

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up