How to Buy Twitter Stocks Online in 2021

One of the most hyped stock market IPOs of the past decade was that of Twitter in 2013. Initially priced at $26 per share, the IPO gave the social media giant a market value of just over $14 billion dollars. More than seven years after its IPO, Twitter stocks are still trading in and around the $23-$30 range.

If you think that this represents a good buy, here we discuss the easiest, cheapest, and most convenient way of making an investment. We give you three broker options to choose from, alongside a handy step-by-step guide that will allow you to complete your Twitter stock purchase in minutes.

-

-

How to Buy Twitter Stock in 3 Quick Steps

Don’t have time to read our guide in full? Below you’ll see three quick steps that you need to follow to buy the Twitter stock right now.

[three-steps id=”199998″]Where to Buy Twitter Stock

As a multi-billion dollar company listed on the New York Stock Exchange, it makes sense that you can buy Twitter from hundreds of stock trading platforms. This does, however, make it difficult to know which stock broker to open an account with. To help you get started, we discuss our top three picks of 2021. Not only does each broker allow you to open an account and deposit funds in minutes, but their stock trading fees are super-competitive.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

Detailed provider overview

1. eToro – Best Stock Broker for Worldwide Customers

eToro is an online stock and CFD broker that has since attracted more than 12 million users from over 150 countries. The overarching selling point of the platform is that you can buy, sell, and trade over 800 stocks in a commission-free manner. As such, the only fee that you will need to pay when buying Twitter stocks is the spread. This makes eToro one of the most cost-effective stock trading sites in the space. What we also like about eToro is that it takes less than 10 minutes to get started.

Once you have opened an account and uploaded a copy of your passport or driver's license, you can then instantly deposit funds with a debit/credit card or e-wallet. After that, simply head over to the stock trading page, enter the number of Twitter stocks you wish to buy, and confirm the order. You will need to deposit a minimum of $200 at eToro, although you can place stock trades from just $25 per order.

There are no deposit fees to contend with, although a $5 withdrawal charge does apply. If you're interested in buying other blue-chip stocks, eToro offers a copy trading feature. This allows you to automate your portfolio picks by following other users at the site. Finally, eToro takes its regulatory responsibilities seriously, with licenses from the FCA, CySEC, and ASIC.

Our Rating

- Catered to newbie traders

- 0% commission on ETFs and stocks

- Supports heaps of everyday payment methods

- Minimum withdrawal of $50

- High spreads

- MT4/5 not available

75% of investors lose money when trading CFDs2. Plus500 – Trade Twitter Stock through CFDs

An alternative angle that might be worth considering is buying Twitter stock in the form of CFDs. This means that you will not take direct ownership of the underlying shares. As such, you are not entitled to any dividends. With that said, although Twitter has been a public company since 2013, it is yet to pay a single cent in dividends, so you're not missing out. If you do decide to take the CFD option, our top-rated platform Plus500 gives you to option of applying leverage.

This is capped at 5:1 on Twitter stocks, so a $500 investment would allow you to trade with $2,500. Plus500 also allows you to short sell Twitter. In Layman's terms, this means that you can profit in the event Twitter stocks go down in value. An additional benefit of going the stock CFD route with Plus500 is that you will get to trade Twitter shares in a low-cost environment.

This is because the platform is not required to purchase the Twitter stocks on your behalf, as you are merely speculating on the CFDs. In terms of funding your Plus500 account, the broker requires an initial deposit of $100 or more, which you can do via a debit/credit card, Paypal, or bank account. Plus500 is heavily regulated, with licenses in the UK, Australia, Cyprus, and Singapore.

Our Rating

- Fast order execution

- No commissions

- Tight spreads

- Stocks only available via CFDs

- Its educational resources are sparse

80.5% of retail investor accounts lose money when trading CFDs3. Stash Invest – Best USA Broker With Low Deposits

If you're looking to buy stock online with a US-based stockbroker, it might be worth considering the merits of Stash Invest. The trading platform targets its services to the newbie investor, so it's perfect if you've never previously bought or sold shares. Firstly, the account opening process couldn't be easier. Simply enter some basic information - including that of your social security number.

You will then need to link your US checking account. Once you do, you can easily deposit funds into Stash at the click of a button. With that said, the platform does not support e-wallets or debit/credit cards. You will, however, be able to get started with a deposit of just $5, which is great if you want to start off with really small amounts. In terms of fees, Stash Invest employs a monthly subscription model.

This starts at just $1 per month, which gives you access to more than 1,800 US stocks and ETFs. The most expensive plan costs $9, although this is only worthwhile if you are looking to set up a retirement account through Stash. It is worth noting that there is no requirement to purchase full shares at Stash. Instead, you can invest from just 1 cent per company - which is great for diversification purposes.

Our Rating

- $5 minimum deposit

- Allows fractional stock purchases

- Monthly fee from just $1

- Limited number of shares hosted

- No access to international stock exchanges

How to Buy Twitter Stock from eToro

We are now going to give you a full run-through of how to buy Twitter stock with our top-rated broker – eToro. As noted earlier, the broker allows you to buy stocks commission-free, and you can easily deposit funds with a debit/credit card, e-wallet, or bank account. You’ll need to do this prior to following the steps below.

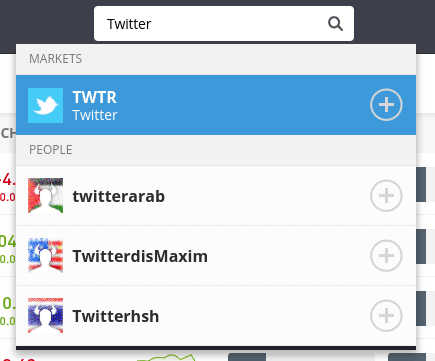

Note: If you want to use a different online broker to buy Twitter stock, the steps below remain largely the same.Step 1: Search for Twitter Stock

To go straight to the Twitter trading page at eToro, enter the company into the search box at the top of the screen. When Twitter pops up, click it.

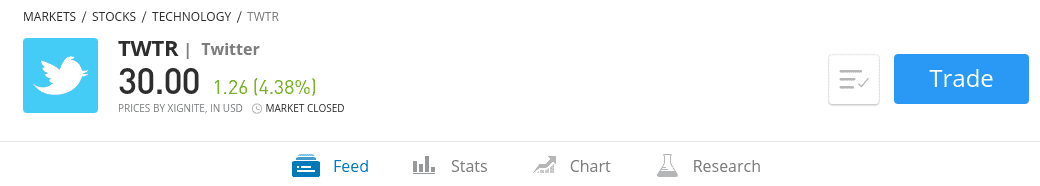

Step 2: Click on ‘Trade’

Unless you want to read some mark stats on Twitter first, click on the ‘Trade’ button to make your purchase now.

Step 3: Set-Up Order and Buy Twitter Stock

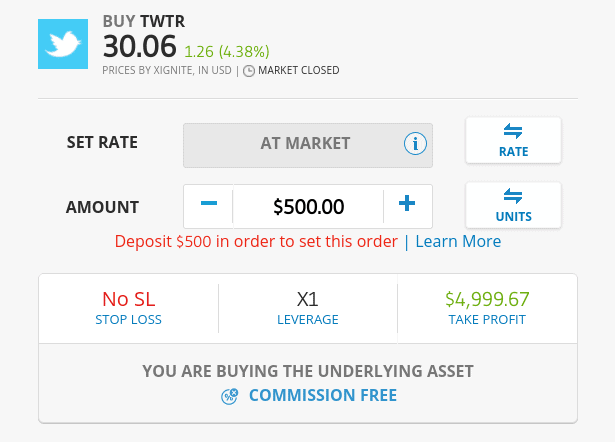

As is the case with all online brokers, eToro will ask you to fill out an order form. This is so the broker knows the type of trade that you wish the place.

These include:

- Amount: Enter the amount of Twitter stock that you wish to buy in US dollars. As you can see from the example above, we are buying $500 worth.

- Set Rate: Leave this set as a market order if you are planning to hold on to your Twitter stocks long term. In doing so, eToro will give you the next available market price.

- Stop Loss: This allows you to exit your Twitter trade if the stock goes down by a certain amount.

- Take Profit: This allows you to lock in your profits when Twitter stocks hit a certain profit target.

Finally, click on ‘Buy’ to complete your Twitter stock order.

Why Invest in Twitter?

Twitter stocks failed to live to the mass hype created in 2013 when the social media company went public. In fact, the stock last hit all-time highs in December of the same year, subsequently leaving early backers feeling somewhat disappointed.

With that said, there are still a number of reasons to feel bullish on Twitter, which we have outlined below.

More than 330 Active Monthly Users

There is no getting away from the fact that Twitter has an unprecedented global reach. As of late 2019, the number of active monthly users stood at a remarkable 330 million. This is even more impressive when you consider that Twitter is banned in China, a market with over 1.4 billion consumers. Crucially, this 9-figure reach paves the way for a number of revenue streams. At the forefront of this is the multi-billion dollar global advertising space.

Stocks Still Well Below Previous All-Time Highs

Twitter last hit its all-time high stock price in late 2013, where its shares were priced at just over $63. The company has, however, been on a downward spiral ever since. Was the social media giant overvalued during its IPO? Potentially, but, with Twitter still a relatively new company, there’s no reason to believe that it won’t one day recover its previous heights. As such, at a Q2 2021 price range of $23-$30, you can arguably buy Twitter stocks at a huge discount.

145 Millin Monetizable Daily Active Users (mDAUs)

Not to be confused with the more aggressive ‘monthly active users’ figure, the monetizable daily active users (mDAUs) is what social media companies like Twitter and Facebook are primarily interested in. In the case of Twitter, this now stands at 145 million. For those unaware, this means that Twitter believes it has 145 active users that it can profit from in the form of ad revenue.

No More Political Ads

Much like Facebook, Twitter has been embroiled in several backlashes against its previous support for political-based ads. This became prevalent in the lead up to the 2016 US Elections, with Twitter heavily criticized for its failure to keep the platform non-political. Although such advertisements generated over $3 million in ad revenues for the company in 2018, Twitter has since decided that it no longer wants to facilitate political agendas. Sure, this will result in a small loss of income for the firm, but it could help Twitter become a more trusted platform.

About Twitter Stock

Company and Stock history

Launched in 2006, Twitter is an online social media platform with a global presence. In fact, apart from China, Iran, and North Korea, the platform is used in virtually every corner of the world. The platform works by posting ‘Tweets’, which can then be shared, liked, and commented on by other users of the site. As per late 2019, Twitter is home to more than 330 million active monthly users.

Of this figure, 145 million are believed to be mDAUs, meaning the platform has the capacity to profit from the users via ad revenues. In terms of the company’s stock market presence, Twitter went public in 2013. The much anticipated IPO valued the company at just over $14 billion, with each share priced at $26. After the IPO, Twitter stocks sky-rocketed for the remainder of the year, reaching an all-time high of $63 in December 2013.

Since then, the company has failed to live to its market expectations. The overarching reason for this is that Twitter is yet to fully capitalize on its 9-figure customer base. While at the very least the company is now reporting profits, the numbers are nothing to write home about. As a result of this, Twitter is currently positioned in and around the $23-$30 range.

As is often the case with large-scale tech companies that were publicly-launched within the past decade, Twitter is yet to pay a single cent in dividends. It remains to be seen when, or even if, Twitter will ever reward investors with dividend distributions, not least because management’s main focus is to increase its net operating income. As such, you will only make money if Twitter stocks increase in value.

Should I Buy Twitter Stock?

Although Twitter stocks have been a major disappointment for those that backed the company during its 2013 IPO, many from within the industry argue that shares can be purchased at a discount. At its current range of $23-$30 per stock, this represents a decline of about 50% from its prior all-time high.

Ordinally, this would rightly so be a major concern for shareholders. However, it is important to remember that Twitter is still in its infancy. Add in the fact that the social media giant is home to more than 330 million active monthly users, and 145 million mDAUs, it is not unthinkable that the company will one day return to its former glory.

If you do think that the future is bright for Twitter, you can easily buy stocks in minutes with our top-rated broker eToro.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQ

Do I need to buy whole Twitter stocks?

No, you can invest as little as you wish with platforms like Stash Invest, which allows you to buy stocks from just 1 cents!

Does Twitter pay dividends?

No, although the company has been listed on the NYSE since 2013, it is yet to pay a single cent in dividends.

Who owns Twitter?

Twitter is a public limited company (PLC), meaning that it is owned by shareholders. Shareholders with the largest stake in the company at present include Vanguard Group, Morgan Stanley, and BlackRock..

What is Twitter’s all-time high stock price?

Twitter last hit a new all-time high in late 2013, where its stocks were priced at just over $63. Since then, its shares have been on a downward trajectory.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com