Best Binary Options Brokers in 2021

Ever thought of investing in binary options? Trading in binary options can be exciting but at the same time, risky. While there are many brokers and trading platforms, there only a selected few let you trade in binary options, and of the providers that do allow binary options trading, many are governed by lax regulators. In addition to the legislative issues around Binary Options, there are several other considerations to keep in mind, which we explore through this article.

We have selected three of the best binary options brokers on the market for you to explore, with a framework of factors to consider before signing up. For those who are not familiar with Binary Options we also explain how to sign up and start trading with our number one provider.

The Best Brokers for Trading Binary Options

We’ve written detailed reviews of the top binary options brokers below, but if you’re in a rush, here’s a quick list of the best brokers of 2021.

Nadex – Best binary options broker for beginners

- Pocket Option – Top provider for experienced traders

-

-

What criterion have we chosen to compare providers

There are multiple criteria that aspiring traders should consider before choosing a binary options broker. We’ll cut the clutter and rank the top three binary options brokers on the below-mentioned criteria.

- Regulation

- Payouts

- Bonus

- Trading platform

- Coverage of different assets

Top binary option brokers

Looking at our selected criterion, we’ve identified the top three binary options brokers. We’ve listed the features as well as the pros and cons of going for these brokers. You can go through the details mentioned against the brokers for more insights.

Note: Please check your eligibility as some brokers don’t allow US-based investors on their platform.1. Nadex - Best Binary Options Trading Provider For Beginners

We rate Nadex as our preferred provider if binary options. Nadex is regulated by the CFTC (Commodity Futures Trading Commission). Being US registered adds credibility to Nadex. The platform allows a 100% payout. Nadex requires a minimum balance of $250 and charges a $1 trading fee per contract on entry and exit before expiry. If the trade expires in the money, there is a $1 settlement charge. There is no settlement charge if the trade expires out of the money. The platform lets you enter into a contract with major US and global stock index futures, forex, commodities, and events markets.

To deposit money, you can use your checking account, debit card, bank transfer, wire transfer, or could even drop a physical cheque. For withdrawals, you can go for wire transfer, bank transfer, or debit card. Nadex lets you trade with a demo account so you can familiarize yourself with the platform and binary options in general.

In regards to platform functionality, Nadex is comparable with the market, not a slick as some of the bigger names in trading, but certainly suitable for beginners.

There are, however, a few cons with the Nadex account. The minimum initial balance of $250 might be prohibitive for some investors. Nadex allows trading on only a handful of assets. You cannot trade in individual stocks but only in stock index futures. Also, Nadex does not offer a bonus like most other binary options brokers. It also charges a $25 fee for every withdrawal using the wire transfer. The platform allows very restrictive trading on weekends.

Our Rating

- Regulated by the CTFC

- Suitable for Beginners

- Minimum Balance $250

- $25 Charge Per Withdrawal

Disclaimer: Transacting in Forex, CFDs and virtual currencies is subject to various risks, such as price volatility, and is therefore not suitable for everyone. Your capital is at risk.2. Pocket Option Best Platform for Experienced Traders

Pocket Option lets you invest in binary options on its platform from as low as $1. You can use cards, e-payments, wire transfers, and cryptocurrencies to make deposits in your trading account. However, the minimum transaction value is $500 for wire transfers. For all other payment modes, the minimum amount is $1. Pocket Option also provides an initial bonus when you deposit money. The bonus varies from 20% to 50%. It lets you invest in a variety of assets like stocks, commodities, currencies, and cryptocurrencies. The platform also allows social trading and lets you copy trades of some of the successful traders on the platform. It also organizes tournaments on its platform where you can participate and earn rewards. Pocket Option does not charge any commission on deposit and withdrawal. It offers a payout ratio of up to 128%. The trading platform looks good for beginners as well as seasoned investors and allows US citizens.

Pocket Option is registered in the Republic of the Marshall Islands and is regulated by FMRRC (Financial Market Relations Regulation Center), which is an independent body.

- High Initial Bonus

- Allows Options on Stocks and Cryptocurrencies

- Regulated by An Independent Body

Transacting in Forex, CFDs and virtual currencies is subject to various risks, such as price volatility, and is therefore not suitable for everyone. Your capital is at riskWhat to Consider When Choosing a Binary Options Trading Platform

Having described our top three binary options traders, there is bound to be some idiosyncrasy in individual likes and dislikes. Some investors might want to give a higher weightage to a particular feature while it may not be important for others. But there are some aspects that you should consider before deciding on your binary options broker. We’ve listed some of the essential features that you should check in your binary options broker.- Regulations: Is the binary options broker registered by a reputed regulator?

The internet is full of stories over binary options scams. While your broker’s regulation is anyways amongst the essential aspect you should watch out, it’s especially true for binary options and online Casino Utan Svensk Licens. Now, only watching for the broker’s regulation is not enough. You also need to be sure about the credentials of the regulatory body. Several of binary options brokers are regulated either by independent bodies or by regulators who themselves lack credence. Please note, regulations come handy when things go wrong, or you have some sort of issue with your broker.

- Does the broker support investors from your country?

Multiple brokers provide binary options. However, you also need to check whether the broker supports investors from your region. Many brokers don’t allow US citizens to trade on their platform.

- Trading and other fees

Let’s get things straight. There are no free lunches. Every trading platform has a cost. It’s essential to know the fees that your binary options broker charges. The fees can be related to your trades and spreads. Also, some platforms charge a fee for deposit and withdrawal. Some binary options brokers provide their fee structure transparently on the website itself. If you are not able to find the fee structure on the site, be sure to check with the customer care before opening the account.

- Coverage

There can be binary options on practically every underlying asset. However, your broker might have limited options on its platform. For instance, some platforms let you trade in bitcoins while others don’t. Similarly, some brokers have options on individual stocks on their platform, while others only have an option on stock index futures. Be sure to check the coverage of your binary options trader before opening the account. The broker should ideally have most, if not all, of the assets that you intend to trade into.

- Deposit and withdrawal methods

Binary options brokers provide several deposit and withdrawal methods. Some platforms even let you deposit cryptocurrencies. Be sure to check the deposit and withdrawal methods so that you can deposit money in your preferred way. Also, some brokers that give initial bonus set a withdrawal restriction.

- Trading platform

Most binary options brokers provide a free demo account. You can use the facility to familiarize yourself with the trading platform. While all brokers try and make a user-friendly platform, you should check if the trading platform confirms your choices.

- Bonus

Most binary options brokers provide you a bonus. These can be of several types, but the welcome bonus and risk-free trades are most prevalent. In a welcome bonus, the broker credits a bonus amount, which is typically a percentage of your initial deposit. In a risk-free trade, a binary options broker would allow you a few trades wherein you get to keep the profits but the loss if any would be borne by the broker. However, it’s important to note that options are anyways a risky and leveraged proposition. By taking a bonus, you are increasing the leverage. Leverage is always a double-edged sword. While it would magnify your gains, it would also amplify your losses in a losing trade. However, if your risk appetite is high, do take advantage of higher bonuses.

Getting started with Binary Options

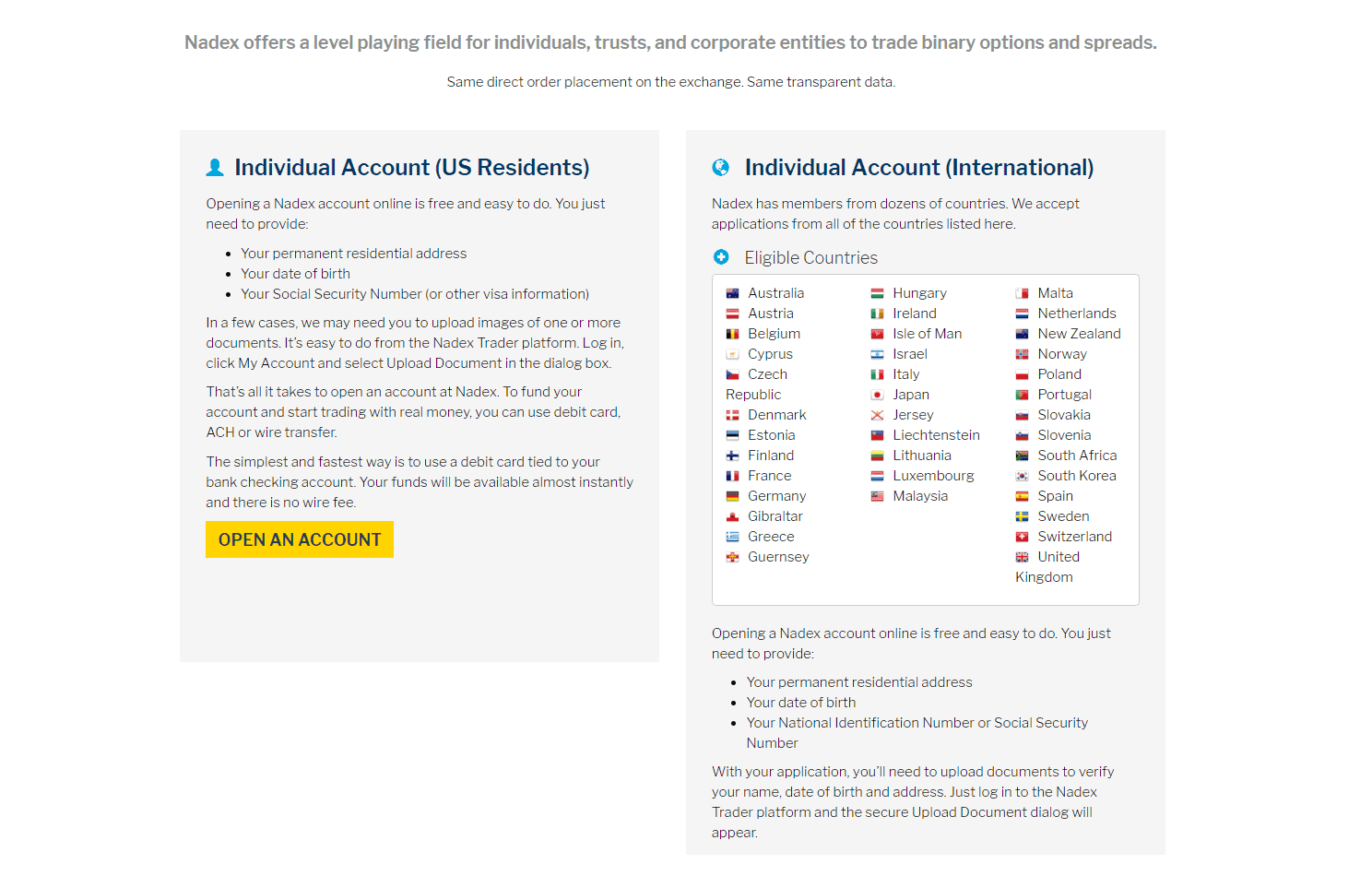

First of all, you need to open an account, we have used Nadex for this walkthrough. You can open your account online easily. The required documents are the date of birth proof, Social Security Number, and the permanent residence proof. The chart below depicts the account opening process. Once you are done with the account opening formalities and have transferred funds, you are ready to trade.

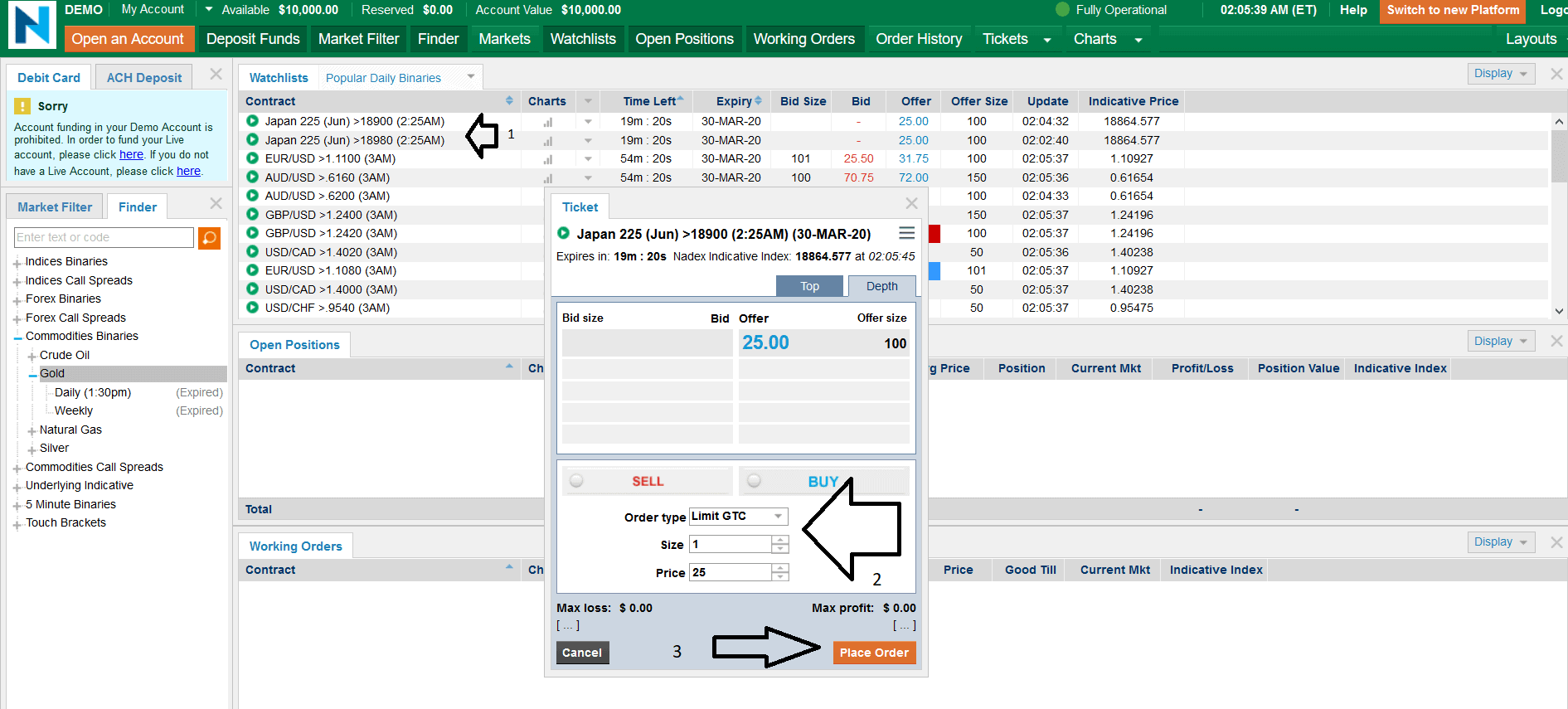

How to trade Binary Options using Nadex

Firstly, you need to log into your account and ensure that funds are available to trade. Second, you need to figure out which market and asset class you are interested in. You need to decide which particular asset you want to trade. You can go long as well as short, depending on your analysis, meaning that your binary option is a prediction of the outcome of the price movement in either direction – price rise or price fall. There are often multiple binary options on the same underlying tradable item. They differ on the strike price (the point at which a trader can buy or sell depending on whether it’s a call or a put option) as well as the expiration. You will need to decide in what direction you expect the underlying security to move and in what time frame. Once you are decided on these two metrics, we get to the third step, which is placing the order.

While placing the order, there are two options. You can either go for a market order or a limit order. In a market order, the trade is executed immediately at the current market price. In a limit order, you specify the rate at which you want the order to be executed. The trade would get executed only when the market price reaches the limit price set by you. The trade will not get executed if the market price does not reach the limit price that you set. You also need to enter the size of your order, which is the number of options that you wish to transact. The Nadex platform informs you of the maximum possible loss as well as profit before you execute the order.

Once the trade is executed, we get to the fourth step, which is monitoring your trade. Remember, you can close your trade before the expiration time. You can either book profits or cut your losses if the trade does not go in the way you expected. You may also leave the trade until the expiry.

Am I Eligible to Join a Trading Platform?

Binary options traders can allow their services to limited nationalities, which is based on their regulations. Be sure to check your eligibility with the broker if it is not explicitly mentioned on their website. Every trading platform would also a mandatory KYC (know your client) process that would require you to verify your credentials like identity, address, and bank details with the broker.

What types of options are there?

We can classify options into several categories. Firstly, options can be American options or European options. The American option can be exercised at any time before expiry. However, European options can be exercised only at expiration.

Then we can classify options as call and put options. The buyer of a call option has a right to buy the underlying at a fixed price. The fixed price is called the strike price. It’s important to note that a call buyer has limited downside but unlimited upside. The buyer of a call option is betting that the underlying asset will appreciate. The payoff is opposite for a call option seller, and he has a limited upside equaling the option premium. However, theoretically, a call option seller has an unlimited downside.

As for the put option, a buyer has a right to sell the underlying at a fixed price. Like a call buyer, a put buyer also has a limited downside equal to the premium paid. A put buyer expects the price of the underlying to go down. However, he stands to lose if the underlying asset appreciates. The put option sellers’ maximum theoretical downside is the strike price minus the premium received. While a call sellers’ maximum theoretical loss is unlimited, a put seller’s maximum loss is limited. It’s because theoretically, while an asset’s price can rise to any level, it cannot fall below zero.

Summary

Trading in any leveraged asset is riskier than unleveraged trade. You should have a proper understanding of your risk appetite before giving binary options a shot. Trading can be fun and profitable but at the same time stressful.

OptionsOptions are derivative contracts. The buyer of options has a right but not the obligation to execute the contract. Each option has an underlying, expiration date, strike price, and premium. Options are a leveraged play on the underlying asset. An option buyer can bet on the movement in the underlying asset by limiting his loss.

UnderlyingEvery option contract has underlying security on which the contract is based. The movement in underlying security’s price impacts the price movement of the option. The underlying can be any security like shares, index, commodity, or forex.

Expiration dateUnlike shares that theoretically trade perpetually, options have an expiration date. The option contract is valid only until the expiration date. The expiration date can extend into years. However, generally, the liquidity is higher in options that expire in the running month. The distinguishing feature between normal options and binary options is that binary options can have an expiration time of only a few seconds on initiation.

Strike priceEvery option has a strike price, which is also known as the exercise price. A call option buyer has a right to buy the underlying security at the strike price. Similarly, a put option buyer has a right to sell the security at the strike price. The strike price also impacts the option’s premium and its moneyness.

Option moneynessOption moneyness depends on the underlying’s current price and the option’s strike price. An option can be out of the money (OTM), in the money (ITM), or at the money (ATM).

In the money optionA call option is in the money when the security’s spot price is above the strike price. A put option is in the money when the security’s spot price is below the strike price.

Out of the money optionA call option is out of the money when the security’s spot price is below the strike price. A put option is out of the money when the security’s current price is above the strike price.

At the money optionAn option is at the money when the strike price and the underlying’s spot prices are equal. At the money, options have no intrinsic value, but they have a time value.

Option’s intrinsic valueFor in the money options, the intrinsic value is the difference between the strike price and the underlying’s spot price. However, out of the money options and at the money options don’t have any intrinsic value. That, however, does not means that the trade at zero. They still have a time value.

Time valueTime value is perhaps the most important thing to understand in an option. We can define time value as the option premium minus the intrinsic value. The time value gradually decays and eventually falls to zero at expiration. Options that have higher time to expiration have a higher time value. The vice versa also holds.

Option premiumOptions premium is the price that the option buyer pays to enter the contract. In simple terms, it is the current market price of the option. For an option buyer, the option premium is the theoretical maximum loss. However, for an option seller, the premium is the maximum possible profit from the trade.

CFDCFD (contracts for difference) are derivative products based on the underlying’s price movement. As the name suggests, CFD is based on the change in an asset’s price and not the underlying’s total value. You can go long as well as short CFD.

Naked optionsWhen you enter into an options trade without owning the underlying, it is referred to as a naked option. It’s worth noting that some investors use options to hedge their portfolios. For instance, if you hold a stock in your portfolio, you may buy a put on the same stock. This would hedge your losses in case the stock price falls.

Option trading strategiesThere are several option trading strategies. You may use a combination of different options or use them with the underlying asset to build the desired payouts.

FAQ’s

What are binary options

Binary options are a type of investment that is based upon a prediction of the future price of a security. The Binary aspect of the option is that upon a given timeframe the conditions of the bet need to be met, which results in either a correct or incorrect bet, but nowhere in between.

Which is the most preferred way to deposit funds in the trading platform

Some platforms have a fee for wire transfer, and it takes a longer time to realize funds. Usually, you get an instantaneous fund transfer from the debit and credit card. Also, most brokers don’t charge a fee for cards.

Is binary options trading for me?

Binary options trades are risky, and given the short time frame, fundamental investing principles don’t apply. You should get yourself well versed in some technical trading concepts. Also, it’s better first to open a free demo account and try your hand at binary option trading.

What is the most important thing to consider in a binary options broker?

The regulation is the most important thing that you need to consider while choosing your binary options broker.

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up