Savings Bond Wizard – How to Calculate What Your Bonds are Worth

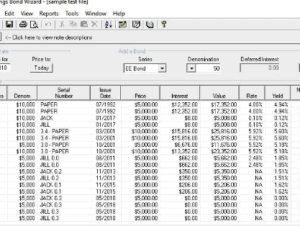

The Savings Bond Wizard was a useful tool offered by the Treasury Direct website that allowed you to calculate how much your bonds were worth. This was handy, as attempting to figure out the current market value of EE and I Bonds is challenging when you have multiple yields and maturities to take into account.

Unfortunately, the Saving Bond Wizard is no longer available at the Treasury website. Instead, it’s been replaced by a new bond calculator. Although the calculator yields the same result, it’s slightly less user-friendly than its predecessor.

In this article, we explain the ins and outs of how the new bond calculator works, what it allows you to do, and how you can calculate the current value of your savings bond portfolio.

Featured Bonds Broker 2020 The overarching benefit of using the Wizard was that you could easily import new bond holdings. After all, each savings bond is likely to come with its own characteristics. For example, you’d need to enter the bond serial number, face value, issue date, coupon rate, and more. Although the Savings Bond Wizard is no longer supported, the good news is that you can export your portfolio data and import it into the new calculator. With the Savings Bond Wizard dating back to the mid-1990s, it’s likely that you have heaps of data stored within the program. Thankfully, there is no requirement to input each and every entry into the new calculator, as you can simply export this via a single file. Here’s what you need to do. And that’s it, you’ve just exported up to 15 years worth of bond records via a single click. So now that you’ve exported your historical bond records, you will now need to upload it into the new calculator. Now that you’ve imported your historical records into the new calculator, you won’t be able to use the old Wizard again. As such, you’ll need to get used to manually entering every new bond purchase that you make. Below we have listed a step-by-step guide on how you can add newly purchased savings bonds into the calculator. You will need to repeat this process manually for each bond that you buy. Your first port of call will be to head over to the Treasury Direct website and log into your account. You should be able to see the ‘Bond Calculator’ button; click it. Much like the old Savings Bonds Wizard, you will need to enter the specific details of the bond you want to add to your portfolio. Make sure the information matches the bond like-for-like or the calculator will give you incorrect figures. There are four values in particular that you need to enter, which includes: There are a couple of glitches on the new savings bond calculator with respect to denominations. For example, let’s say that you want to enter two $10,000 EE Bonds, which are collectively worth $20,000. You will need to repeat the process four times ($5,000 x 4) to get to the $20,000 EE Bond value. Once you do, the calculator will correctly show you the current market value just across four bonds instead of two. Secondly, there is also a glitch when entering I Bonds. The bond calculator doesn’t recognize that the rules surrounding I Bond purchase limits have recently changed. While you could previously only purchase $5,000 per year, this has since been upped to $10,000. As such, you’ll need to enter your investment in multiples, so if you want to enter a $10,000 I Bond, you’ll need to repeat the transaction twice so that it reflects 2 x $5,000 bonds. When you have finished adding your newly purchased bonds into the calculator, you will need to save your bond portfolio. If you don’t, you will need to repeat the above steps again. Unfortunately, the calculator once again presents a glitch; if you’re using Google Chrome or Microsoft Edge, the file won’t be compatible with your device. Instead, you’ll need to consider using one of the following browsers: You also need to give your file a suitable name, because it will save as ‘Calculated Value of Your Paper Savings Bond(s)’. Instead, consider calling it something like ‘Bond Calculator April 2020’. The next time you wish to add more bonds to your savings calculator, you will need to upload the file that you saved in step 3. To do this, you will need to find the file and open it on your device. You will then see the same portfolio layout as you saw when you exported your data from the old Savings Bonds Wizard via the .htm file. Only this time, when you click on the ‘Return to Savings Bond Calculator’ button, you’ll instantly be able to view your portfolio via the Treasury Direct website. Then, you can simply add new bonds as and when you see fit. When you proceed to download your updated file, be sure to give it a new name. As the name suggests, the savings bond calculator lets you know the exact market value of your savings bonds portfolio. Unlike a stocks and shares portfolio, the value of your savings bonds can only go northwards. This because savings bonds come with positive coupon rate, but there is no secondary market to sell them. As such, unlike other types of bonds, there is no running yield in play. Although at first glance you might think that it’s easy to calculate an asset with a pre-determined rate of interest, things start to get complicated when you have multiple coupon rates and maturity dates. Much like the old Savings Bond Wizard, the new calculator available at the Treasury Bond website is only suitable for EE Bonds and I Bonds. As such, you won’t be able to enter Treasury bonds or privately-issued savings bonds. Not sure what savings bond types you actually have? Check out the below. Series EE Bonds, or simply ‘EE Bonds’, were first launched in the 1980s. They always come with a maturity date of 30 years and the interest rate remains fixed for the duration of the term. The specific interest rate is determined on each issue, which typically occurs twice per year. When the EE bonds mature or you decide to cash them out, you will need to pay Federal tax on your gains. You won’t, however, need to pay state or local taxes. Series I Bonds were first launched in 1998. Unlike its EE counterpart, I Bonds come with both a fixed and variable rate of interest. The variable interest on the I Bond will move every May and November, depending on inflation levels. The overarching concept is to give bondholders fixed income and purchasing protection against rising inflation. Much like EE Bonds, there is no secondary marketplace for I Bonds. In summary, it is a shame that the old Savings Bond Wizard is no longer available. Although the original calculator was somewhat basic, it was super-easy to use and it came bug-free. On the contrary, the new calculator available at the Treasury Direct website is glitchy, to say the least. As we discussed earlier, it still doesn’t recognize that the $5,000 purchase limit of I Bonds has since been increased to $10,000. As such, you need to make two $5,000 entries to represent your $10,000 I Bond investment. Despite this, the new savings bond calculator is reasonably easy to use. As long as you are not using a Google Chrome or Microsoft Edge browser, you’ll be able to save your bond entries every time you make an addition. Featured Bonds Broker 2020 No, the Savings Bond Wizard is no longer available. Instead, it’s been replaced by the Treasury’s new savings bond calculator. Much like the original Savings Bond Wizard, the new calculator only supports EE Series Bonds and I Series Bonds. If you need to calculate other bond types you will need to use a third-party provider. Among a number of other bugs on the Treasury Direct website, the new savings bond calculator has not been updated to reflect I Bond limit increase. More specially, it still thinks that I Bond investments are capped at $5,000 annually. As such, to reflect the $10,000 increase, you’ll need to make two $5,000 entries. An additional glitch when using the new savings bond calculator is with regards to the $10,000 EE Bonds. For some reason, the system automatically changes it to a $5,000 denominated bond, so you’ll need to make two entries. A further problem with the new savings bond calculator is that it does not support all browsers. If you’re using Google Chrome or Microsoft Edge, it’s not compatible with the calculator. You’ll need to down an alternative browser. There is no reason why using a third-party program to replicate the old Savings Bond Wizard should be a problem as long as you are not required to enter the specific serial number. Instead, you’ll simply need to enter key details like the yield, issue date, and bond type. Kane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications. WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site. Copyright © 2025 | Learnbonds.com

What was the Savings Bond Wizard?

Exporting Your Data From the Savings Bond Wizard

Import Your File into the new Savings Bond Calculator

Adding Bonds into the new Savings Bond Calculator

Step 1: Visit the Treasury Direct Website

Step 2: Enter Bond Values

Step 3: Save Your Bond Portfolio File

Step 4: Updating Your Downloadable File

What Does the Savings Bond Calculator do?

What Bonds Will the Savings Bond Calculator Accept?

EE Bonds

I Bonds

Conclusion

FAQs

Is the Savings Bond Wizard still available on the Treasury Direct website?

What bonds can I add to the new savings bond calculator?

Why can’t I add my $10,000 I Bond into the new bond calculator?

Why can’t I add a $10,000 EE Bond into the new savings bond calculator?

Why can’t I save my portfolio in the new savings bond calculator?

Should I use a third-party Savings Bond Wizard program?

Kane Pepi