An oversubscribed funding round led by EV Growth and Quona Capital helped Indonesian P2P lending platform KoinWorks raises S$16.5 million recently. The recent investment shows confidence in the P2P lending sector’s future growth.

KoinWorks receives a great response

The recent Series B funding round was supervised by OJK and brought about IDR 170 billion (approx. S$16.5 million) to the P2P lending platform. Apart from Quona Capital and EV Growth, existing investors also participated in the fundraising. KoinWorks will use the newly acquired funds to expand its teams and partnerships. It will also work on developing its technology and systems and help in bringing more financial inclusion to the country.

The company, established in 2016, provides a platform for lenders and borrowers. Its target audience is small and medium-sized enterprise, which have historically been underbanked or unbanked. KoinWorks uses machine learning to help borrowers get lower interest loans but provide good returns to the lenders. They provide both business financing and invoice financing services to the customers.

Changing the Indonesian financial landscape

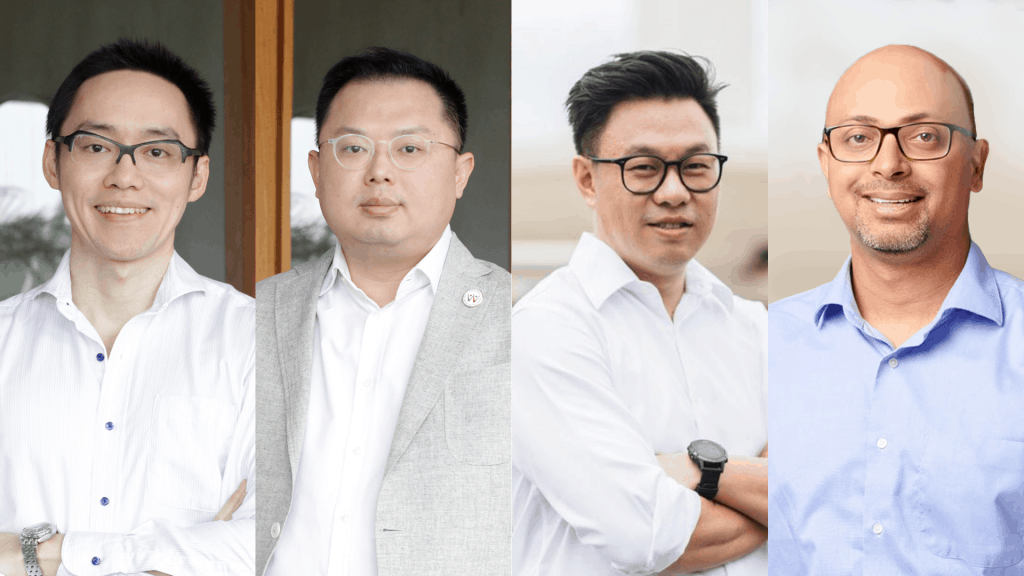

According to co-founder and executive chairman Willy Arifin, KoinWorks helps in democratizing finance in Indonesia and helps in spreading financial inclusion. He said that the platform has the largest retail investor base in the country with over 300,000 users. The oversubscription in Series B funding shows that investors are ready to bring more liquidity to the platform that existing investors are ready to share. He noted that it doesn’t reflect the “true appetite” of investors.

Their co-founder and CEO Benedicto Haryono noted that the company had served a huge chunk of the retailer market in Indonesia. The company’s growth is being supported by factors like increased awareness about early investments. Interestingly, over 60% of investor-lenders on the platform are millennials, and more than 70% users on the platform made their investment using KoinWorks.

EV Growth partner Willson Cuaca said that KoinWorks is a unique fintech company in Indonesia that fills the gaps between convenience and access in providing loans and investment products. He noted that the investors are impressed with the rapid growth of the company. EV Growth is a joint venture between Sinar Mas Digital Ventures (SMDV), East Ventures, and YJ Capital Inc.

Quona Capital co-founder and partner Ganesh Rengaswamy said that KoinWorks’ platform had had a dramatic impact on Indonesian businesses, especially because of their responsible lending practices. He said that their role in catalyzing the growth of small and medium enterprises in the country could not be overlooked.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account