Best Personal Loan Providers & Sites in 2021

Whether you’re looking to raise funds to purchase a new car, pay off some debts, or for some home improvements – a personal loan is one of the most cost-effective ways of borrowing money. However, with thousands of personal loan providers in the market, attempting to find the best deal for your individual needs is no easy feat. Ultimately, the underlying loan terms that you are able to get will be dependent on your credit profile. In other words, the better your credit score is, the lower your APR rates will be.

With that being said, we have created the ultimate guide to the best personal loans. Within it, we’ll cover everything that you need to know – such as what a personal loan is, how they work, and what you need to look out for before signing on the dotted line. To conclude, we will present three of the best personal loan providers currently active in the UK market.

-

-

Ocean Finance

Our Rating

- Get the borrowed cash in just 15 min

- No hard inquiry on your credit rating

- Apply with less than ideal credit rating

- No fees charged

Note: You need to ensure that you have the financial means to make your repayments on time each and every month. Failure to do so will not only result in financial penalties, but it will also have a detrimental impact on your credit score.

Note: You need to ensure that you have the financial means to make your repayments on time each and every month. Failure to do so will not only result in financial penalties, but it will also have a detrimental impact on your credit score.Pros and cons of personal loans

The Pros

- Can be much cheaper than obtaining a credit card

- Most personal loans applications can be completed online in less than a day

- Comparison sites allow you to find the best personal loan deals

- Personal loans available for credit profiles of all shapes and sizes

- Borrow a small or large amount depending on what you require

The Cons

- Interest rates will be high if your credit score is poor

Best 3 personal loan providers: Reviewer’s choice

Reviewers Choice

Ocean Finance RatingAvailable Loan Amount£100 - £10,000Available Term Length5 YearsRepresentative APR49.9% APRAdmiral loansRatingAvailable Loan Amount£1000 - £25,000Available Term Length5 yearsRepresentative APR14.5% APRSainsbury’s BankRatingAvailable Loan Amount£1,000 - £40,000Available Term Length5 yearsRepresentative APR2.9% to 24.9% APR.

RatingAvailable Loan Amount£100 - £10,000Available Term Length5 YearsRepresentative APR49.9% APRAdmiral loansRatingAvailable Loan Amount£1000 - £25,000Available Term Length5 yearsRepresentative APR14.5% APRSainsbury’s BankRatingAvailable Loan Amount£1,000 - £40,000Available Term Length5 yearsRepresentative APR2.9% to 24.9% APR.Best 3 personal loan providers

So now that you have a firm understanding of what a personal loan is, who they are suitable for, and how much it is likely to cost you, you are now ready to begin the application process. Take note, there are literally thousands of personal loan providers now active in the UK market, so knowing which provider to go with can be challenging.

To help you along the way, we have listed the top three personal loan providers that are worth a closer look. Before we do, check out the following criteria that we used to rank the best providers.

Criteria used to rank the best personal loan providers

- Lenders with the most competitive interest rates

- How much the lender is able to offer

- What credit score you need to obtain the personal loan

- What loan terms are available

- What the late payment and missed payment process is

1. Ocean Finance – Best if your credit is less than ideal

If you're in the market for a personal loan, but your credit score isn't too healthy, then it might be worth seeing what Ocean Finance can find for you. In a nutshell, the platform is a comparison-style loan website that seeks to match you with the best lenders in the market - based on your individual credit profile.

The way it works is you enter your loan requirements into the search tool, and then Ocean Finance will provide you with a list of lenders that are able to offer you a loan. Take note, although Ocean Finance has an array of lenders within its network, most of these lenders are more suited to credit profiles outside of the good - excellent threshold. As such, the rates of interest on offer will be higher than what you can get elsewhere. However, if you are looking for a lender with more flexibility in who it approves, then Ocean Finance is an excellent source.

Our Rating

- Access personal loans of between £100 and £10,000

- Soft-credit enquiry - applying won't hurt your credit score

- Perfect for those with bad credit

- Maximum loan limits only available to individuals with stellar credit

- Ocean Finance is not a direct lender but a loans brker

2. Admiral – Very competitive APR rates for loans of less than £25,000

If you are currently in possession of an excellent credit profile, and you are looking for a loan size of less than £25,000 - then it might be worth checking out Admiral. Unlike the Ocean Finance platform, the UK institution is a direct lender, meaning that you will deal with Admiral - and only Admiral. In terms of the rates on offer, you can obtain a personal loan of £25,000 for just 3.9% APR, which is super competitive. Take note, the maximum loan term available is 5 years, so if you plan to borrow the funds over a longer period of time, Admiral might not be suited.

On top of having a very healthy credit profile, you also need to ensure that you are a permanent resident of England, Wales, or Scotland, and be aged between 18 and 74. You will also need to ensure that you have a minimum annual income of £10,000 - although this can either come in the form of employment or a pension. You can complete the entire application process online, and as long as Admiral is able to verify your information automatically, you should receive an instant decision.

Our Rating

- Extended loan repayment periods of up to 72 months

- Best rate of 3.9% APR on loans of £25,000

- Access persnal loans of up to £25,000

- Not available for individuals with tainted credit scores

- No guranatee you will get the maximum loan limit

3. Sainsbury's Bank – Best APR rates for loans of £25,000 or more

If you are in the market for an even bigger loan, then you might be best off checking out the rates currently being offered by Sainsbury's Bank. The UK supermarket giant can facilitate personal loans of up to £40,000, although this is a major financial commitment, so be sure that you have the means to make your repayments on time each and every month. Nevertheless, if you were to take the full £40,000, Sainsbury's Bank offers a top APR rate of just 6.7% if you take the loan out over 5 years.

If you need slightly longer, you can borrow the money for a maximum of 7 years, although this does come with a higher APR rate of 7.7% at best. The APR rate that you get is fixed, so your monthly payments will always remain the same. Furthermore, Sainsbury's Bank also offers a two month repayment holiday, meaning that you won't need to start repaying your loan until two months after you receive the funds.

Our Rating

- Access personal loans of up to £40,000

- Enjoy extended loan repayment periods of up to 7 years

- Perfect for individuals with a stellar credit score

- One might consider their 6.7% APR expensive

What is a personal loan?

First and foremost, let’s make sure that we know what a personal loan actually is. In its most basic form, a personal loan is simply a loan that is taken out for a fixed period of time, at a fixed rate of interest. Often referred to as an instalment loan, a personal loan allows you to repay the funds back in instalments over a number of months. As such, they allow you to make large purchases that you would otherwise have been unable to pay for upfront.

In return for lending you the money, the underlying financial institution will charge you a rate of interest. As we will discuss in more detail further down, the amount of interest that you pay will depend on a number of factors – such as your credit score, your income, your current relationship with debt, how much you need to borrow, and for how long.

Here’s a quick example of how a personal loan works.

- You need to raise £10,000 to pay for some home improvements

- As you don’t have the money in your bank you decide to take out a personal loan

- You find a provider that is willing to lend you the money at an interest rate of 5% APR

- You decide that you want to pay the money back over the course of 6 years

- As such, you will make 72 equal payments of £161.05 over the 6 year period

- At the end of the loan term, you will have paid the entire £10,000 back – plus interest

- The total interest on the loan would have cost you £1,595.55

As you can see from the above example – taking out a personal loan comes with both its pros and cons. On the one hand, you were able to make a large purchase of £10,000 even though you didn’t have the funds at the time. Moreover, you could repay the loan over 6 years, meaning that your monthly payments amounted to just £161.05. However, in return for lending you the funds, the financial institution charged you a total of £1,595.55 in interest over the 6 years.

Am I suitable for a personal loan?

In a nutshell – unless your credit is completely dampened, most UK consumers will be eligible for a personal loan of some sort. The reason for this is that lenders will base your loan terms on your financial profile. For example, if you have a ‘good’ or ‘excellent’ credit score, not only will you benefit from super-high approval rates, but you will also benefit from some of the lowest APR rates in the market.

Note: As we will discuss further down, APR stands for ‘annual percentage rate of charge’. In its most basic form, the APR dictates how much interest you will pay over the course of a year. The better your credit score, the lower your APR will be.On the contrary, if you have a ‘poor’ or ‘very poor’ credit score, then you will be limited in who you can borrow funds from. By this, we mean that you might need to use a specialist bad credit lender that is willing to lend funds to those with a less than ideal credit profile. However, this comes at a cost, as you will likely pay a much higher rate of interest in comparison to those with a healthy credit score.

Personal loans: Secured vs Unsecured

It is important to note that there are actually two main types of personal loan options out there for you – secured and unsecured. It is crucial that you understand how the two terms differ, as it will dictate whether or not you need to put your personal assets up as collateral in order to obtain the loan.

Here’s a quick breakdown of what you need to know.

- Unsecured Loan: An unsecured loan is simply a personal loan that does not require you to put any of your assets up as security. This is the safest type of loan type out there, not least because you will not face the risk of losing your assets in the event of default. As long as your credit score is not too damaged, you should have no issues obtaining an unsecured loan.

- Secured Loan: At the other end of the spectrum, a secured loan will require you to put up an asset as collateral in order to obtain the loan. For example, the lender might ask that you put your house or car up as security before releasing the funds. If you do – and you end up defaulting on the loan, then the lender will have the legal remit to seize the asset from you to cover the outstanding balance.

How much do personal loans cost?

As we briefly noted earlier, the cost of your personal loan will be based on the amount of APR that you pay. However, it is also important to note that other costs might come in to play – such as an origination fee. Moreover, if you end up missing a payment, this is likely to come at a financial cost, too.

With that being said, here are some of the main costs that you need to make considerations for when taking out a personal loan.

APR – Interest

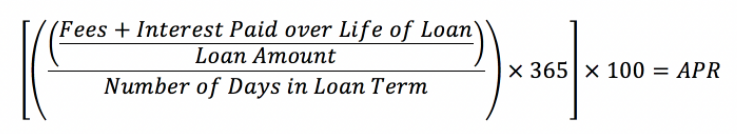

In the vast majority of cases, your personal loan will come with an APR rate. This is the amount of interest that you will end up paying each year. Even if your personal loan is based on a term of less than 12 months, the APR rate will still be expressed as an annual cost, albeit, the specific amount that you pay will be smaller. Attempting to understand how the APR rate is calculated is no easy feat, which is why lenders are required to break this down for you in Layman Terms so that you have an understanding of how much the loan agreement is actually costing you.

As you’ll see from the above image, the APR rate takes into account the interest paid over the life of the loan, the number of days in the loan term, and of course – the loan amount. It is also important that you assess whether the APR is fixed or variable. While in the vast majority of cases the interest rate will be fixed, some lenders offer a variable rate. If this do, this means that the interest rate can change at any time.

Origination Fee

The second cost that you need to look out for when taking out a personal loan is that of the origination fee. For those unaware, this is a fee charged by the respective lender for arranging the loan. The origination fee is paid in addition to the amount that you receive, and can range from just 0.5%, up to a whopping 5%. Much like in the case of your APR rate, the size of the origination fee is often determined by your underlying credit profile. As such, the better your credit score, the less you will pay.

Here’s an example of how the origination fee works in practice.

- You take out a loan for £5,000 to pay for a new car

- The loan comes with an origination fee of 3%, which amounts to £150b

- As such, when the lender transfers the loan funds across, the £150 will be deducted

- This means that you will receive £,4850, even though the size of the loan is £5,000

As you can see from the above example, you will be required to pay back £5,000 + your APR rate, even though you will only receive £4,850. This is why you should try to stick with lenders that either charge a very small origination fee, or no origination fee at all.

Missed payment and late payment fees

If you are taking out a personal loan, then it is hoped that you are doing so because you are confident you will always make your repayments on time. However, life can often throw unexpected events our way and thus – there might come a time where you fall behind on your loan. If you do, not only can this lead to financial penalties, but it is also likely to have a negative impact on your credit score. As such, you need to make some considerations regarding the fees charged by the lender if you miss a payment.

In this sense, there are two types of consequences that you need to assess – a late payment and a missed payment. Although some consumers think that the two are the same, they are not. Here’s the difference between the two:

- Late Payment: A late payment is a term used to describe a payment that is slightly late. For example, let’s say that your monthly repayment date is the 5th, whereby you are required to pay £200 off your balance. However, due to unforeseen circumstances, there wasn’t enough money in your bank account to cover the payment. In order to rectify the problem, you call the lender on the 7th to make a payment with your debit card. As the payment was made just 2 days after the scheduled payment date, this is simply a late payment, as opposed to a missed payment.Whether or not the lender charges you a fee for a late payment will vary from lender-to-lender. Essentially, some do and some don’t. If the payment is late, as opposed to missed, then in the vast majority of cases this will not be reported to the main three credit rating bureaus. As such, it probably won’t hurt your credit score.

- Missed Payment: On the contrary, a missed payment is much more severe than a late payment. There is no hard and fast rule as to the specific time period that turns a late payment into a missed payment, although the industry average is around 30 days. In other words, if you fail to settle your late payment before your next repayment date, then this is likely to turn into a missed payment. You can be all-but-certain that the lender will charge you a missed payment fee. The amount will be added to your outstanding balance, meaning that the fee will have interest applied to it. The missed payment will also be reported to the main three credit rating agencies. This will have a negative impact on your credit score, and future lenders that you borrow funds from will be able to see this. As such, it will impact your ability to obtain credit at competitive APR rates.

Ocean Finance

Our Rating

- Get the borrowed cash in just 15 min

- No hard inquiry on your credit rating

- Apply with less than ideal credit rating

- No fees charged

Glossary of emergency loans

Credit ScoreA credit score shows your creditworthiness. It's primarily based on how much money you owe to loan or credit card companies, if you have ever missed payments or if you have ever defaulted on a loan.

Guaranteed ApprovalGuaranteed Approval is when, no matter how bad, your credit score its, your loan application will not get declined.

Credit LimitA Credit Limit is the highest amont of credit a lender will lend to the borrower.

CollateralCollateral is when you put up an item against your loan such as your house or car. These can be repossessed if you miss payments.

Cash AdvanceA Cash Advance is a short-term loan that has steep interest rates and fees.

Credit RatingYour Credit Rating is how likely you are to fulfill your loan payments and how risky you are as a borrower.

Fixed Interest RateFixed Interest Rate is when the interest rate of your loan will not change over the period you are paying off you loan.

InterestThe Interest is a percentage based on the amount of your loan that you pay back to the lender for using their money

DefaultIf you default on your loan it means you are unable to keep up with your payments and no longer pay back your loan.

Late FeeIf you miss a payment the lender will charge you for being late, this is known as a late fee.

Unsecured Personal LoanAn Unsecured Personal Loan is when you have a loan based solely on your creditworthliness without using collateral.

Secured LoanA Secured Loan is when you put collateral such as your house or car up against the amount you're borrowing.

Prime RateThis is the Interest Rate used by banks for borrowers with good credit scores.

PrincipalThe Principal amount the borrower owes the lender, not including any interest or fees.

Variable RateA Variable Rate is when the interest rate of you loan will change with inflation. Sometimes this will lower your interest rate, but other times it will increase.

Installment LoanAn Installment Loan is a loan that is paid back bi-weekly or monthly over the period in which the loan is borrowed for.

Bridge LoanA Bridge Loan is a short term loand that can last from 2 weeks up to 3 years dependant on lender.

AAA CreditHaving an AAA Credit Rating is the highest rating you can have.

GuarantorA Guarantor co-signs on a loan stating the borrower is able to make the payments, but if they miss any or default the Guarantor will have to pay.

LIBORLIBOR is the London Inter-Bank Offered Rate which is the benchmarker for the interest rates in London. It is an average of the estimates interest rates given by different banks based on what they feel would be the best interest rate for future loans.

Home Equity LoansHome Equity Loans is where you borrow the equity from your property and pay it back with interest and fees over an agreed time period with the lender.

Debt ConsolidationDebt Consolidation is when you take out one loans to pay off all others. This leads to one monthly payment, usually with a lower interest rate.

Student LoanIf you obtain a Student Loan to pay your way through College then you loan is held with the Department for Education U.K.

Student GrantsFinancial Aid in the form of grants is funding available to post-secondary education students throughout the United Kingdom and you are not required to pay grant

FAQ

Can I get a personal loan if I have really bad credit?

Due to the sheer size of the online lending space, there are now personal loans for all credit profiles. If your credit is really bad, then it’s likely that you will need to use a specialist lender. As a result, the underlying APR rate is likely to be much higher in comparison to somebody with a healthy credit score.

What are the benefits of a personal loan?

The main benefit of taking out a personal loan is that you get to make a large purchase upfront even if you don’t have the required funds yourself. You then get to spread your repayments over many months or years, which can make personal loans an affordable option.

Why does the APR rate increase when I borrow the funds for longer

The personal loan space is all about risk. As such, the longer that you have to repay the money you borrowed, the more chance there is that you will one day default. This means that lenders need to increase the APR rates on longer loans as a means to counter the risks of non-payment.

How long does it take to apply for a personal loan?

As lenders are now able to verify your personal information electronically with third-party sources, some loan applications can be approved within 15 minutes. However, if the lender requires more information from you – or they need you to provide supporting documentation, it can take longer.

Should I opt of a secured personal loan or an unsecured personal loan?

If you have the required credit profile to take out an unsecured loan, then this is the option that you should go with. This is because a secured loan will require you to put up an asset as collateral, which the lender can then legally take if you default on your loan. On the other hand, a secured loan in the form of a homeowner loan will often come with much higher lending limits, longer loan terms, and a much more favourable APR rate.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up

Reviewers Choice

Reviewers Choice