US and UK consumer confidence dipped back down to its joint-lowest level in May since the global financial crisis in 2009. Despite shops reopening after the loosening of lockdown restrictions and foot traffic increasing, broader indexes of economic activity are still stalled.

US data is released on Tuesday bt the published by The Conference Board, while UK data is published by GfK on Friday.

“It will be interesting to see if consumer confidence is starting to recover at all as lockdowns start to ease, albeit very carefully, and financial markets recover their poise or whether concerns over unemployment, income and the COVID-19 outbreak still prevail,” said AJ Bell investment director Russ Mould.

GfK, a polling firm, said UK’s consumer confidence index – published every two weeks – slipped to -34 in the May 1-14 period from -33 during the second half of April. In the US, results are not much different with a slip from 118.9 to 86.9, the lowest mark since May 2014, according to the Conference Board’s last survey on consumer confidence among US shoppers.

“Consumer confidence remains battered and bruised despite efforts at loosening the COVID-19 restrictions,” GfK’s client strategy director Joe Staton said.

Data from location tracking and cellphone apps companies Unacast and SafeGraph showed a continued slow rise in visits to retail stores last week. Data on around 55,000 small businesses from time management firm Homebase showed a few more firms open and more workers return on the job.

The latest numbers reflect the gradual lift of coronavirus-related restrictions across the US and the UK. However, analysts warn against the need for a measured response. Especially among small businesses and consumers until it is clear the virus is under control.

Some small businesses and entrepreneurs have been able to reopen with limited capacity. Continued restrictions or other regulations still apply to keep the virus in check.

As the number of the unemployed continues to rise, the US and UK governments have introduced emergency relief payouts to households.

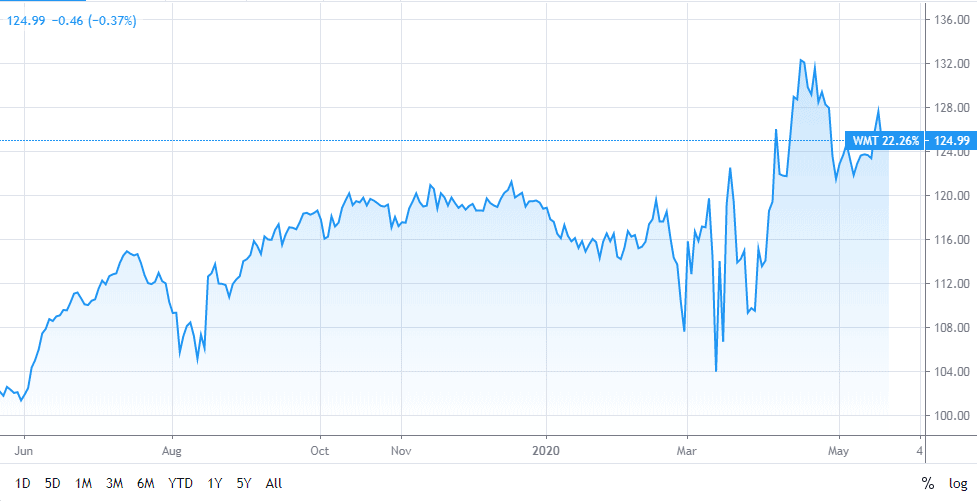

Major retailers like Walmart Inc. have welcomed the stimulus before the start of their second quarter. Walmart is one of the few retailers who reported higher first-quarter earnings and share price from increased traffic and consumer spending amid the pandemic.

Foot traffic is only just starting to increase and estimated activity moved up faster in the midwest and south. However, consumer confidence and industrial activity measures from Goldman Sachs remain unchanged.

As the current degree of uncertainty and anxiety translates itself into weaker consumer confidence, investors are turning towards gold and government bonds to get conservative investment returns. If you want to trade gold, we offer a list of brokers for gold as well as ETF brokers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account