How to Buy Facebook Stocks Online in 2025

Social media giant Facebook is now one of the largest companies on the NASDAQ. This means that there are numerous online brokers to buy its stocks from.

Although the company is yet to pay any dividends, the blue-chip stock has proven popular with investors in recent years. Much of this is down to the platform’s number of monthly active users (MAUs), which now stands at more than 2.6 billion.

In this article, we explain the basics of how to buy Facebook stock, alongside the best two brokers.

-

-

Where to Buy Facebook Stock

With a market capitalization that now stands in the hundreds of billions of dollars, virtually every stock broker in the online space gives you access to Facebook shares. This can make it a challenge to find a platform that meets your needs, so we’ve narrowed our list of recommended stock trading sites down to just two. All of our pre-vetted brokers are heavily regulated.

1. Plus500 – CFD Broker to Trade Facebook Stock

While you might be looking to buy and hold Facebook stocks for a number of years, someone else likes to engage in short-term trading. This means that you will look to make small, but regular profits by buying and selling stocks on a more frequent basis. If this sounds like you, it might be worth checking out Plus500. The UK-based broker hosts more than 2,000 stock CFDs, including that of Facebook.

By trading CFDs, you won't actually own the underlying asset, meaning there is no entitlement to dividends. However, Facebook is yet to distribute dividends, so you're not missing out. Crucially, by trading Facebook CFD stocks at Plus500, you will be able to apply leverages of upto 5:1. You will also have the ability to go 'short' on Facebook. This allows you to profit in the event Facebook stocks go down in value.

Plus500 does not charge trading commissions on any of its 2,000+ stock CFDs. Instead, it's only the spread that you pay. You can open an account by meeting a $100 minimum deposit, which you can do via a debit/credit card, bank account, or Paypal. Plus500 is also highly regulated in several jurisdictions including the UK, Australia, Singapore, and Cyprus.

Our Rating

- Fast order execution

- No commissions

- Tight spreads

- Stocks only available via CFDs

- Its educational resources are sparse

76.4% of retail investor accounts lose money when trading CFDs. Sponsored ad.2. Stash Invest – Best USA Broker With Low Deposits

Stash Invest is the ultimate online stock broker for inexperienced traders and low capital investors in the US. As such, the platform makes the Facebook stock trading process super-easy. To get started, you will be required to open an account and verify your identity. After that, you'll be asked to link your US checking account.

Unfortunately, you won't be able to use a debit or credit card at the broker, which is a bit disappointing.

Stash Invest allows you to deposit from just $5, making the platform attractive to beginners and individuals with relatively low capital. Similarly, Stash Invest is a proponent of micro-investing. This means that you can buy stocks like Facebook from just 1 cent. So, a $5 deposit would allow you to diversify across 500 different companies!

Stash Invest lists a total of 1,800 US stocks, so you've got plenty of investment diversification opportunities. Stash, however, does not give you access to international markets, as everything is US-based. When it comes to pricing, Stash Invest employs a monthly subscription service. If you only want to buy Facebook stocks and hold them for a number of years, you'll only pay just $1 per month.

Our Rating

- $5 minimum deposit

- Allows fractional stock purchases

- Monthly fee from just $1

- Limited number of shares hosted

- No access to international stock exchanges

Sponsored ad.How to Buy Facebook Stock

Note: If you don’t have an account, you’ll quickly need to open one before you can buy Facebook stock. On top of uploading a copy of your ID, you’ll then need to deposit some funds. End-to-end, it should take no more than 10 minutes.Step 1: Search for Facebook Stock

Enter ‘Facebook’ into the search box at the top of the screen. When you see the search result as displayed below, click on it.

Step 2: Click on ‘Trade’

Click on the blue ‘Trade’ button to go straight to the Facebook trading page.

Step 3: Set-Up Order and Buy Facebook Stock

Set the trade parameters for your Facebook stock.

This lets the platform know exactly what you want to do with your Facebook investment, such as:

- Amount: This is the amount in dollars that you want to invest, and not the number of shares. As you can see from the screenshot above, we are buying $500 worth.

- Set Rate: Leave this set as a market order to get the next available price on Facebook stocks.

- Stop Loss: By default, the stop-loss option is switched off. If you want to exit the trade at a certain price, this will reduce your losses in the event Facebook stock goes down in value.

- Take Profit: Much like a stop-loss, a take-profit order allows you to close your trade at a certain price, but when you are in profit.

Finally, click on ‘Buy’ to complete your commission-free Facebook stock order.

Why Do People Invest in Facebook?

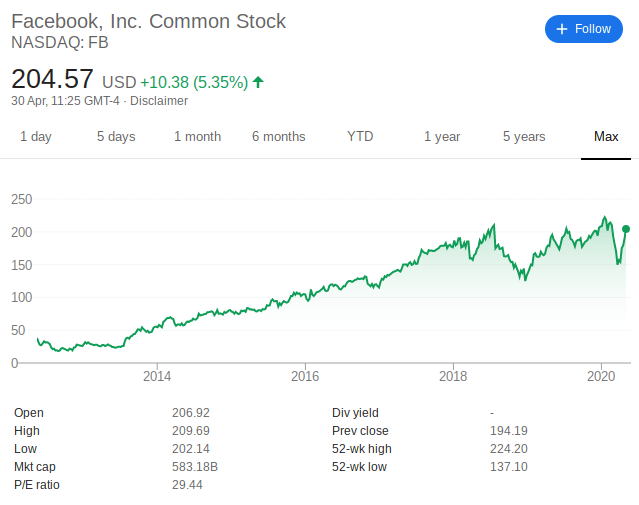

Unlike fellow social media giant Twitter, Facebook stock has been bullish since its initial public offering (IPO). Priced at just $38 per share during its NASDAQ launch in 2012, Facebook is sitting comfortably above the $200 mark as of Q2 2020.

More than 2.6 Billion Monthly Active Users

As of early 2020, Facebook now boasts 2.6 billion monthly active users (MAUs). This figure represents a year-on-year increase of 11%. The daily average users (DAU) on the other hand stood at 1.73 billion as of Q2 2020.

Acquisitions Continue to Grow

Much to the delight of shareholders, Facebook has engaged in a huge diversification strategy in recent years. This ensures that the company does not rely exclusively on the revenues it generates from Facebook advertising. Major acquisitions include Instagram and Whatsapp – which collectively boast hundreds of millions of active users.

We should also note that Facebook has acquired dozens of other technology companies and by the end of 2019, Facebook was holding a surplus of $50 billion in cash reserves. This means that the company is well-armed to continue its long-term acquisition plan.

About Facebook Stock

Company and Stock history

It’s been nothing short of a remarkable story for Facebook since its inception in 2004. The social media giant has since attracted 2.6 billion users globally – with 1.73 billion of those logging in to their account at least once a day.

In terms of the company’s journey as a PLC, Facebook first went public in 2013. Opting for the tech-orientated NASDAQ exchange, Facebook shares were originally marked-up at $38 per share. This placed the company value at just over $16 billion. Fast forward to Q2 2020 and these shares are worth just over $200. This translates to a market capitalization of over $583 billion – subsequently making it the fourth-largest company on the NASDAQ. To put these numbers into perspective, a $5,000 investment in Facebook during its 2020 IPO would now be worth over $21,000.

Interestingly, although the social media giant has been growing non-stop since its inception, Facebook is yet to pay a single cent in dividends.

FAQ

What is Facebook’s all-time high stock price?

Facebook stocks last hit their all-time high price as recently as January 2020. Amounting to $224 per share, this isn’t too far away from its Q2 2020 price of $204. This is very impressive when you consider the wider impact that the coronavirus has had on the markets.

Does Facebook pay dividends?

No, much like its fellow social media counterpart Twitter, Facebook is yet to pay any dividends. Instead, the company has rewarded investors with a post-IPO stock increase of more than 400%.

Who is Facebook’s biggest shareholder?

Still do this day, founder Mark Zuckerberg is still Facebook’s largest shareholder – by a country mile. At the time of writing, this stands at just under 30%, which is worth tens of billions of dollars!

How much were Facebook stocks originally?

When Facebook went public in 2012, it originally priced its shares at $38.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com