How to Buy Apple Stock For Beginners in 2021

Apple PLC is a trillion-dollar blue-chip company that is listed on the NASDAQ exchange. It forms part of the ‘Big Four’ US tech stocks alongside Google, Amazon, and Microsoft.

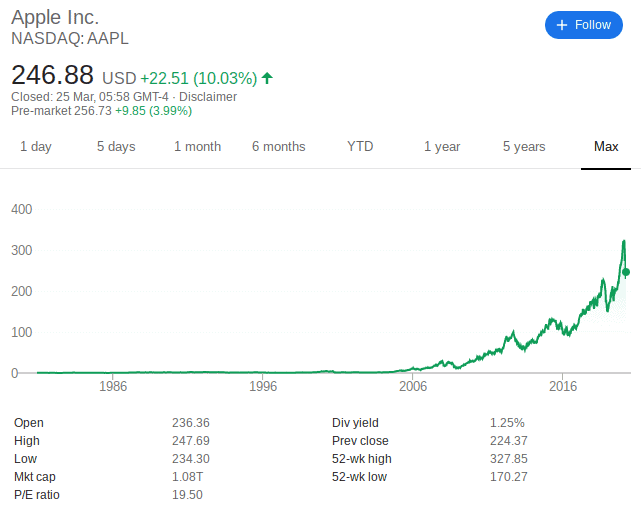

Had you bought Apple stock back in the mid-1980s, you would have paid a mere $0.50 per share. And today? Well, with all-time highs standing at a remarkable $324, this illustrates a total increase of 64,000%.

Thinking about buying Apple stock today? In this article, not only do we give you a step-by-step overview of how you can get your hands on Apple shares, but we explore whether or not this is the best time to invest in Apple Stocks.

-

-

3 Quick Steps to Buy Apple Stock

Follow these 3 steps to buy an Apple stock right now!

[three-steps id=”189672″]Where to Buy Apple Stock

In order to buy Apple stock online or via your mobile phone, you will need to use a third-party stock trading platform. Online brokers typically allow you to buy fractional shares, and you’ll have access to multiple payment options.

With hundreds of online stockbrokers now allowing you to invest in Apple at the click of a button, knowing which platform to sign up with is no easy feat. To help you get started, we have reviewed our top three picks below:

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

Detailed Provider Review

1. eToro – Best Stock Broker for Worldwide Customers

eToro is a multi-purpose brokerage firm that offers a wide range of asset classes. On top of forex, CFDs, and cryptocurrencies, eToro lists thousands of stocks. It takes a few minutes to open an account and verify your identity, plus the platform supports multiple payment methods. These include debit/credit cards, e-wallets like Paypal and Skrill, and even local bank transfers.

As such, buying Apple stock has never been easier. One of the stand out selling points of using eToro to buy Apple shares is that it does not charge a trade commission. You do, however, need to keep an eye out for the spread, especially if you are purchasing stocks outside the market hours. If you're looking to purchase assets other than just Apple shares, it might be worth exploring the platform's Copy Trading feature.

This allows you to copy the trades of more experienced traders on the site. eToro is also a notable option for its strong commitment to regulation. Most importantly, the platform holds operating licenses from the UK's FCA and CySEC in Cyprus. This ensures that your funds are held in segregated bank accounts.

Our Rating

- Newbie traders get to earn while learning by taking advantage of the copy/social trading feature

- 0% trading commission on ETFs and stocks

- Supports heaps of everyday payment methods

- Minimum withdrawal of $50

- Charges relatively high spreads

- MT4/MT5 trading platforms aren't available

75% of investors lose money when trading CFDs.2. Plus500 – Trade Apple Stock CFD with a highly regulated broker

Plus500 is an international leader in the forex and CFD space. Launched in 2008, the platform is regulated by a number of leading tier-one licensing bodies, including the FCA, ASIC, and MAS. Take note, Plus500 does not give you access to the actual Apple stock. Instead, you will be making an investment via a CFD (Contract-for-Difference).

This means that you will not own the underlying asset, so you won't be entitled to dividends. CFDs allow you to speculate on the future price of the asset at variable but competitive spreads, and you'll also have the option of going short. CFDs also make it easier when it comes to selling your Apple stock. Plus500 allows you to get started with a minimum deposit of $100, and supported payment/withdrawal options include a debit/credit card, Paypal, or bank wire.

Much like eToro, Plus500 does not charge any trading commissions, but you still have to contend with the trading spreads. The platform has a proprietary trading platform and, therefore, doesn't support the conventional MT4/MT5 traders. On top of Apple stock, you'll have access to 2000+ other CFD instruments, such as indices, metals, energies, cryptocurrencies, and forex.

Our Rating

- Fast order execution

- Highly intuitive user platform

- Tight spreads

- Stocks only available via CFDs

- Its educational resources are limited

80.5% of retail CFD accounts lose money.3. Stash Invest – Best USA Broker With Low Deposits

Stash Invest is a US-based broker that offers hundreds of equities via its user-friendly trading app. Launched in 2015, the broker allows you to get started with a deposit of just $5. Stash Invest allows you to purchase 'fractional' shares, so there is no need to buy whole Apple stock.

This is celebrated by investors who wish to start off with really small capital, especially when you consider that the Apple stock has hit an all-time high of $324. When it comes to funding your Stash account, you'll need to link it to your US checking account. As and when Apple distributes dividends, this will be paid directly into your Stash cash account. You can then re-invest the cash or withdraw it out.

Stash Invest is also known for its low account management fees. These start at just $1 per month, you'll get to choose from three account types. On the flip side, Stash Invest only gives you access to the US stock markets. As such, you'll need to use a broker like eToro or Plus500 if you want to buy shares from international stock exchanges.

Our Rating

- $5 minimum deposit

- Allows fractional stock purchases

- Monthly fee from just $1

- Limited number of shares hosted

- No access to international stock exchanges

How to Buy Apple Stock from eToro

Looking to buy Apple stock right now from eToro? Follow the quick-fire step-by-step guide outlined below.

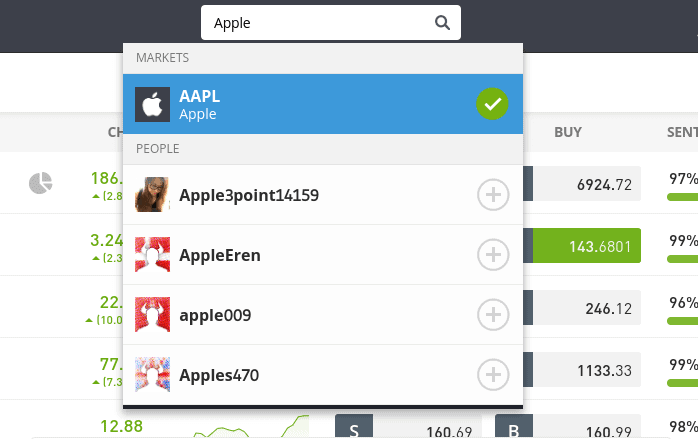

Note: You will first need to open an account with eToro, upload your ID, and deposit some funds. You can then proceed to buy Apple stock in a matter of minutes!Step 1: Search for Apple (AAPL) Stock

Step 2: Click on ‘Trade’

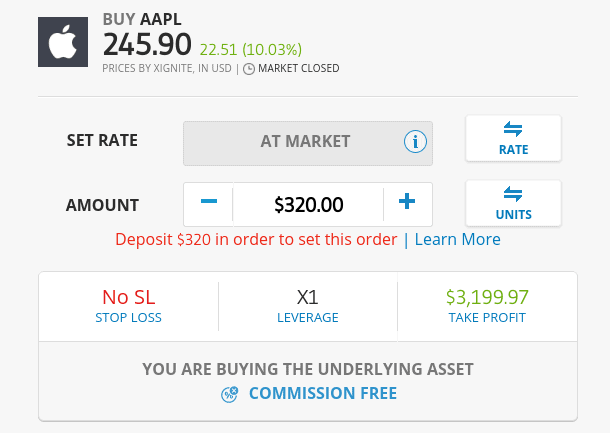

Step 3: Set-Up Order and Buy Apple Stock

To complete your order, enter the following details:

- Amount: This is the amount that you wish to invest in Apple. Don’t forget, you are not required to buy whole shares, so you can buy as little or as much as you like.

- Set Rate: This is the price that your order will be executed at. If you want to target an entry price, go for a limit order. If you’re happy to take the next available price, select a market order.

- Stop Loss: Enter a stop-loss trigger price. This is the price that your shares will be sold automatically if the markets move against you.

- Take Profit: Enter a take-profit price if you have a particular target in mind. If not, leave it blank.

Finally, click on ‘Buy’ to complete your order!

Why Invest in Apple?

Jst like Casino Utan Svensk Licens, Apple recently hit the market capitalization of $1 trillion dollars. Here are more reasons why we believe you should invest in Apple stocks:

Note: Never purchase shares in Apple – or any company for that matter, without doing your own research. The positive investment notes listed below are subjective, so there’s no guarantee that Apple stock will increase in value. In fact, you could just as easily lose money.Huge Cash reserve levels of Over $200 Billion

In 2019, Apple was believed to maintain between $200-$250 billion in cash reserves. This not only ensures that Apple has more than enough to protect itself and its interests from turbulent economic challenges, but it also opens the door to future expansion.

Dividend-Paying Company

Passive income-driven investors would also be glad to note that Apple pays dividends. These payments have been fairly consistent, and excluding specials, are paid out four times per year. This allows you to combine the fruits of capital gains and fixed-income through a single investment.

Globally Recognized Brand That is Trusted by Consumers

Apple-branded products are also heavily sought after by consumers locally and internationally. On top of its core iPhone range, Apple has had major successes in other segments of its portfolio, such as its watch, desktop and laptop devices, video content subscription, and the iTunes network – all of which have achieved tremendous success.

Ongoing Buyback Scheme

Analysts that are bullish on Apple stock will also point towards its ongoing buyback scheme. This is where companies use excess cash reserves to purchase its own shares. What this means for you as an investor is that when fewer shares are in circulation, the value of your holdings goes up. Taking into account Apple’s $200 billion-plus war chest, there is no reason to believe that its buyback efforts will slow down any time soon.

About Apple Stock

Company and Stock history

Apple was founded way back in 1976 by Steve Jobs, Ronald Wayne, and Steve Wozniak. The start-up initially focused on building personal computers, has since expanded into dozens of other tech-related products. This includes its hallmark iPhone series, Apple Mac desktop and laptop devices, iOS operating system, iPods, iTunes library, Apple watch, and more.

The company went public in 1980, on the NASDAQ exchange and had you bought a single share of Apple during its IPO, you would have paid a mere $0.50 (based on multiple stock-splits). Fast forward to February 2021 and Apple hit all-time highs of $324. The company was on an upward trajectory at the time until the global Coronovirus pandemic resulted in a sudden market sell-off. Apple was not alone in losing a surplus of 30% in value in just a few weeks.

Apple Stock

Apple is one of the ‘Big Four’ tech-stocks alongside Microsoft, Facebook, and Google. It is important to remember that tech stocks are often the first-in-line when the wider markets go through a period of bearishness. This is why you are best advised to mitigate the risks of your Apple investment by diversifying into other industries. Nevertheless, the stock itself is often regarded as high-grade equity.

Apple is, however, not immune to macroeconomic events, especially when it comes to China. This is because the vast bulk of Apple products are manufactured in the Far East. So, geographical and political events like the recent US-China Trade War, or the global pandemic of COV-19, have had significant impacts on Apple’s supply chain and stock price.

There are also growing pressures on Apple to take a more ethical approach when it comes to honouring its tax obligations. Time and time again Apple has been criticized for its failure to ‘pay its fair share’, with the European Union going as far as ordering the tech firm to pay up $14 billion in tax arrears.

Should I Buy Apple Stock?

Not only does Apple company have cash reserves in excess of $200 billion, but the tech giant has also rewarded investors with the ongoing share buybacks. This plus the company’s consistent dividend distribution are enough proof of why investors remain bullish on the company. As of Nov 5, 2021, analysts are forecasting a 12 month price target of $125.60 per share (an upside of 9.26%) for Apple stock.

Apple is still heavily reliant on its Chinese supply chain for the vast majority of its products, and market rival Samsung is closing the gap in the smartphone arms race. As such, make sure you consider the risks before you proceed to buy Apple stock.Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQ

How much were Apple stock originally?

When the company first went public in 1980, shares were priced at $22. However, when you factor in the multiple share splits that Apple has engaged in since its IPO, this amounts to an original stock price of about $0.50.

How much cash is Apple hoarding?

Apple’s cash reserves float between $200-$250 billion, which is huge.

Does Apple pay dividends?

Yes, Apple now distributes dividends, which it does four times per year. With that said, it wasn’t until 2012 that it became a dividend-paying company.

Do I need to buy whole Apple shares?

This depends on the broker you sign up with. Traditional brokers typically force you to purchase whole shares, which might be out of reach for some of you. The good news is that heaps of brokers now allow you to buy fractions shares in Apple, so be sure to check this prior to joining a new platform.

What stock exchange are Apple stock listed on?

Apple stock are listed on the NASDAQ exchange in New York, which is the second-largest exchange in the world.

Why does Apple buy its own shares?

Known as a ‘buyback scheme’, Apple uses its excess cash reserves to purchase its own shares. In doing so, it reduces the number of shares in circulation, which results in a higher stock price.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up